COMEX Gold: a Mild Pullback

rhboskres

Publish date: Tue, 07 Sep 2021, 10:27 AM

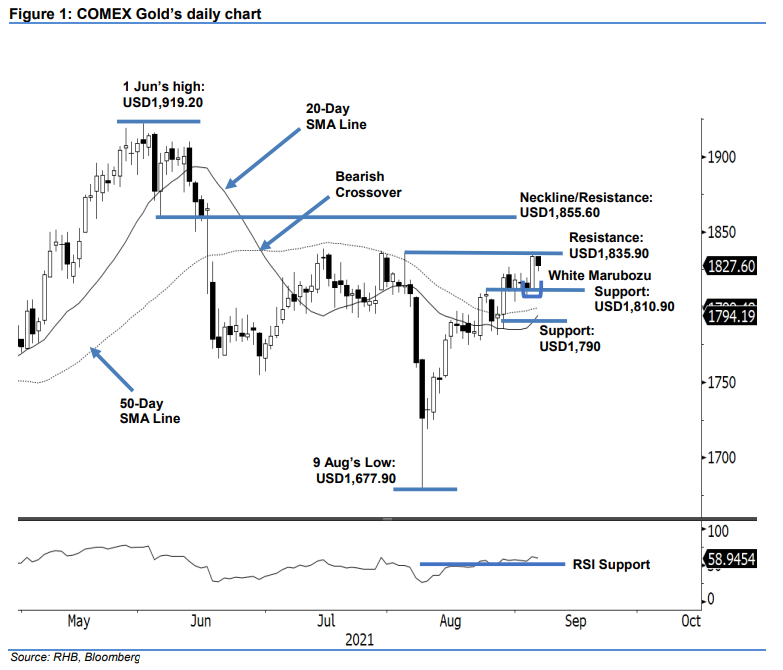

Maintain long positions. As the US underwent its Labour Day holiday, the COMEX Gold saw a light trading session, retreating USD6.10 – it last traded at USD1,827.60 as of writing. The commodity opened at USD1,833.50 and moved lower to test the USD1,823.60 session low. The current session will continue trading until the settlement. As mentioned during a previous note, volatility has picked up pace since last Friday, and the bullish momentum is likely to see a follow-through that tests the USD1,835.90 immediate resistance. Breaching the threshold will see the yellow metal reclaim July’s high. If this happens, the COMEX Gold may climb higher to test the neckline at USD1,855.60. Meanwhile, a Bullish Crossover of the 20- and 50-day SMA lines will enhance the technical setup, supporting its rally higher. However, falling below the 20-day SMA line may put an end to the recent bullish movement. As the upside movement is still intact, we keep to our positive trading bias.

Traders are recommended to hold on to the long positions initiated at USD1,778.20, or the closing level of 13 Aug. For trading-risk management, the trailing stop is marked at USD1,790, ie just below the 20-day SMA line.

The first support is established at USD1,810.90 – 3 Sep’s low – and followed by the USD1,790 whole number. The nearest resistance is seen at USD1,835.90 – 4 Aug’s high – and followed by USD1,855.60, ie 4 Jun’s low.

Source: RHB Securities Research - 7 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024