Hang Seng Index Futures: Pending a Breakout

rhboskres

Publish date: Tue, 07 Sep 2021, 10:29 AM

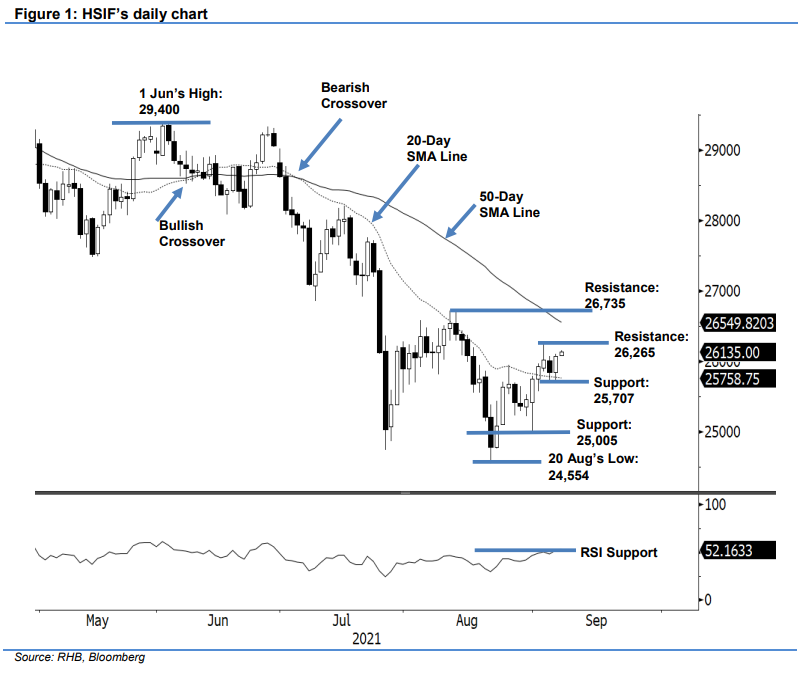

Maintain long positions. The HSIF climbed above the 26,000-pt level, advancing 235 pts to settle the day session at 26,079 pts. The index began Monday’s session at 25,819 pts. Despite a weak opening, it managed to establish its day low at 25,707 pts before reversing upwards to test the 26,111-pt intraday high before the close. The bullish momentum was witnessed during the day session, further extending during the evening sesson. This lifted the HSIF 56 pts higher, and it last traded at 26,135 pts. With the bulls back in the driving seat, the index may attempt to break past the 26,265-pt immediate resistance. If this happens, the HSIF may accelerate towards the 50-day SMA line. Conversely, breaching below 25,707 pts, or a drop below the 20-day SMA line, we may see sentiment being dented and observe further downside corrections. Pending a meaningful breakout, we stick to our positive trading bias.

Traders should keep the long positions initiated at 25,638 pts, ie the closing level of 24 Aug’s day session. To control the downside risks, the stop-loss threshold is revised higher to 25,638 pts – the breakeven level.

The immediate support is changed to 25,707 pts – 6 Sep’s low – and followed by 25,005 pts, ie 31 Aug’s low. The nearest resistance is pegged at 26,265 pts – 2 Sep’s high – and followed by 26,735 pts, or 12 Aug’s high.

Source: RHB Securities Research - 7 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024