E-Mini Dow: Falling Below the Immediate Support

rhboskres

Publish date: Wed, 08 Sep 2021, 07:02 PM

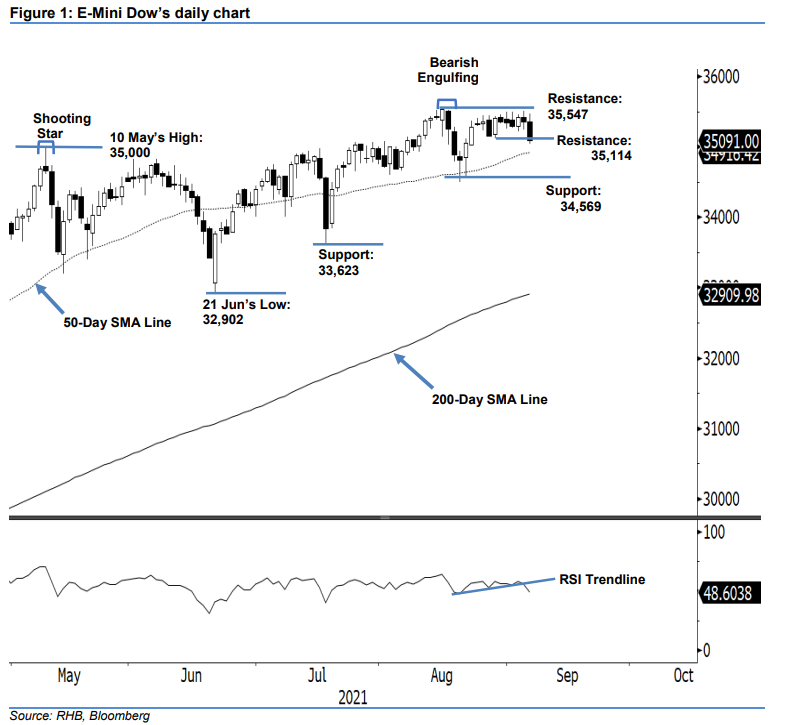

Stop-loss mark triggered; initiate short positions. The E-Mini Dow reversed its direction southwards yesterday as it fell 262 pts to settle at 35,091 pts. It also breached below the recent sideways consolidation zone. The index began at 35,352 pts, and oscillated between 35,476 pts and 35,038 pts in a downwards direction – it fell sharply during the US trading session before the close. The long black candlestick breaching the immediate support – forming a “lower low” pattern – signals that the E-Mini Dow will fall further below the 50-day SMA line and then the 34,569-pt support level. Similarly, the weakening RSI below the 50% mark suggests that negative momentum has emerged. Since the stop-loss level is breached, we shift to a negative trading bias.

We closed out the long positions initiated at 35,314 pts, or the closing level of 24 Aug, after triggering the 35,114- pt stop-loss mark. Conversely, we initiate short positions at the closing level of 7 Sep, ie 35,091 pts. For risk-management purposes, the initial stop-loss threshold can be placed above 35,547 pts.

The nearest support is revised to 34,569 pts – 20 Aug’s low – and followed by 33,623 pts, or 19 Jul’s low. The resistance levels are lowered to 35,114 pts – 27 Aug’s low – and 35,547 pts, which was 16 Aug’s high.

Source: RHB Securities Research - 8 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024