FCPO- Bullish Momentum Accelerating

rhboskres

Publish date: Wed, 08 Sep 2021, 05:29 PM

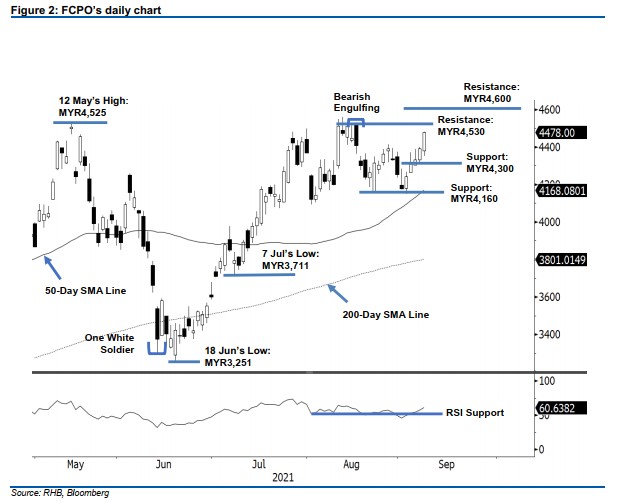

Maintain long positions. After breaching the MYR4,350 level, the FCPO cruised higher, surging MYR88 to settle at MYR4,478. Yesterday, the commodity began stronger at MYR4,380. After touching the MYR4,353 day low, it progressed higher towards the MYR4,480 day high and closed at MYR4,478. As the RSI has strengthened to the 60% level, the commodity is travelling higher on strong momentum to test the MYR4,530 level. Meanwhile, observe that the latest session’s trading range ie the difference between the day’s high and day’s low is getting wider. While expecting another follow through of positive price action to test the upside, we do not discount the possibility of the momentum flipping due to profit taking. However, we believe the MYR 4,300 level will provide strong support. As of now, we are keeping to our positive trading bias.

We recommend traders shift to long positions, initiated at MYR4,390, or the closing level of 7 Sep. To mitigate downside risks, the stop-loss threshold is raised to MYR4,300.

The first support is revised higher to the round number of MYR4,300, and followed by MYR4,160, or the low of 23 Aug. The nearest resistance is eyed at MYR4,530 – the high 17 Aug. The higher hurdle is projected at MYR4,600.

Source: RHB Securities Research - 8 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024