FKLI- Strong Reversal In Progress

rhboskres

Publish date: Wed, 08 Sep 2021, 05:34 PM

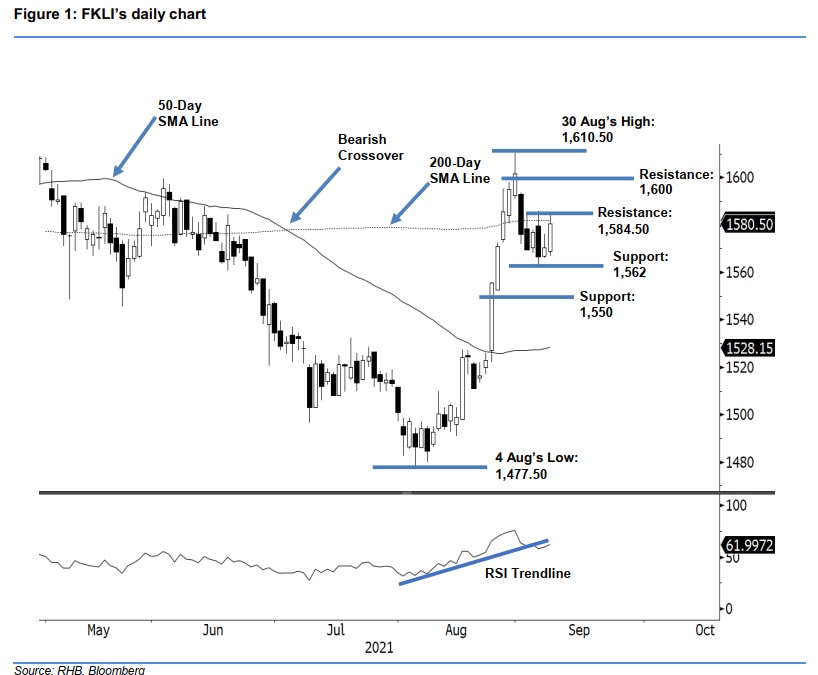

Maintain short positions. Following a mild rebound on Tuesday, the FKLI saw the bullish momentum extend yesterday, advancing 10 pts to settle at 1,580.50 pts. On Wednesday morning, the index began at 1,569 pts and moved sideways for most of the session. At the eleventh hour, the index jumped on strong buying interest, touching the 1,584-pt day high before the close. The latest session has affirmed the “higher low” bullish pattern – the index is poised to cross the 200-day SMA line. If the momentum extends in the upcoming sessions, the FKLI may breach the 1,584.50- pt immediate resistance and travel towards the 1,600-pt level. On the other hand, falling below the 1,562-pt immediate support will see negative momentum build up again. As of now, we maintain our negative trading bias until the stoploss is breached.

Traders should stick with their short positions initiated at 1,569.50 pts, or the close of 2 Sep. To control trading risks, the stop-loss threshold is set at 1,587 pts.

The immediate support is revised higher to 1,562 pts, followed by the second support at 1,550 pts. Towards the upside, the nearest resistance remains at 1,584.50 pts, the high of 2 Sep, followed by the 1,600-pt psychological level.

Source: RHB Securities Research - 8 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024