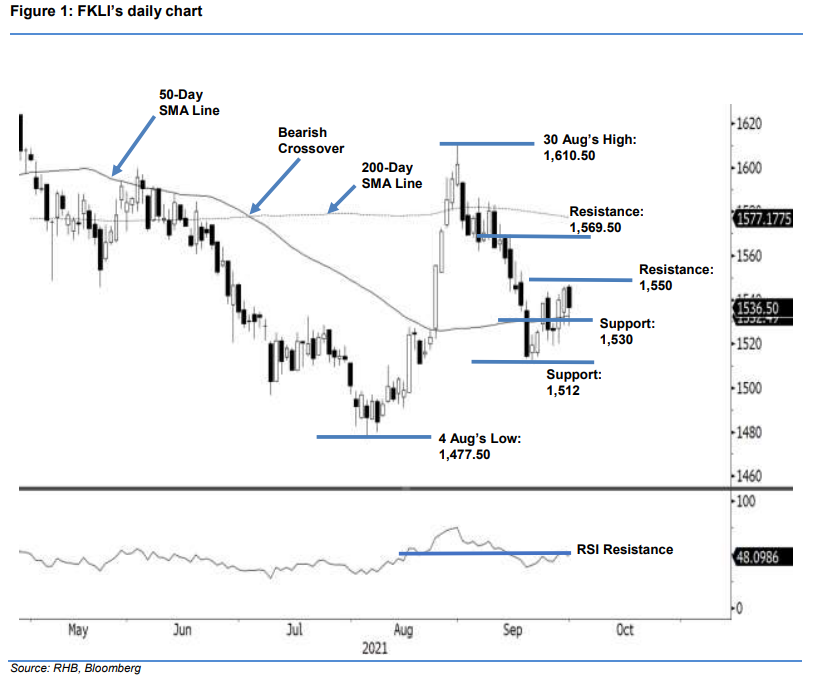

FKLI: Testing The 50-Day SMA Line

rhboskres

Publish date: Fri, 01 Oct 2021, 08:38 AM

Maintain long positions. The FKLI saw strong profit taking on the last trading session of September, falling 8.50 pts to settle at 1,536.50 pts – still above the 50-day SMA line. Yesterday, the Sep futures contract index initially opened stronger at 1,546 pts. The bears were eager to take profit in the early session, with the index reversing to touch the day’s low of 1,528 pts, before bouncing off to close at 1,536.50 pts. Although the index remains on track above the 50- day SMA line, the momentum indicator RSI is rounding downwards, suggesting a mild correction in the immediate session. However, we expect the moving average line to provide strong downside support. As long as the index continues to trade above the stop-loss threshold, we keep to our positive trading bias.

Traders are advised to retain their long positions, initiated at 1,538.50 pts, or the closing level of 23 Sep. To safeguard downside risks, the stop-loss revised to 1,525 pts.

The immediate support is kept at 1,530 pts, followed by 1,512 pts, or the low of 21 Sep. Towards the upside, the immediate resistance is pegged at 1,550 pts, followed by the next resistance of 1,569.50 pts ie the high of 14 Sep.

Source: RHB Securities Research - 30 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024