Hang Seng Index Futures: Negative Momentum Picking Up Pace

rhboskres

Publish date: Tue, 05 Oct 2021, 08:41 AM

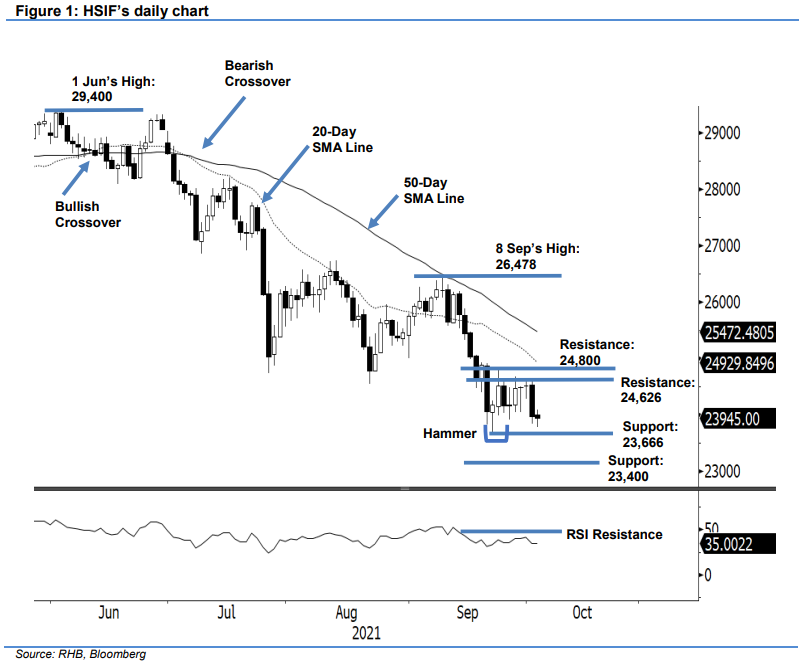

Maintain short positions. The HSIF’s October futures contracts experienced a sharp correction yesterday, plunging 550 pts to settle the day session at 23,974 pts – falling below the 24,000-pt threshold. On the first trading session of the week, the index gapped lower to open at 24,325 pts. Amidst the risk-off sentiment, it plummeted to the 23,836-pt day low before closing at 23,974 pts. During the evening session, the HSIF tracked the weakness of its US peers, correcting 29 pts and last traded at 23,945 pts. Breaching the Hammer’s low at 23,666 pts will open the door for a deeper correction. The lower support is projected at 23,400 pts. The downward movement may continue until the index forms a candlestick with long lower shadow or it establishes an interim base with a bullish reversal pattern. Since the bears are still at the wheel, we keep to our bearish trading bias.

Traders are advised to hold on to the short positions initiated at 25,646 pts, ie the close of 9 Sep’s day session. For trading-risk management, the trailing-stop threshold is placed at 24,800 pts.

The immediate support is revised to 23,666 pts – 21 Sep’s low – and followed by the 23,400-pt round figure. Conversely, the nearest resistance is revised to 24,626 pts – 4 Oct’s high – and followed by the 24,800-pt whole number.

Source: RHB Securities Research - 5 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024