(RICHE HO) Ni Hsin Resources Berhad

RicheHo

Publish date: Sat, 26 Dec 2015, 11:00 AM

Ni Hsin Resources Berhad

Ni Hsin Group is a leading manufacturer of Premium Stainless Steel Multi-ply Cookware in Asia.

Its core business can be divided into 3 segments:

- Stainless Steel Cookware

- Stainless Steel Convex Mirrors

- Clad Metals

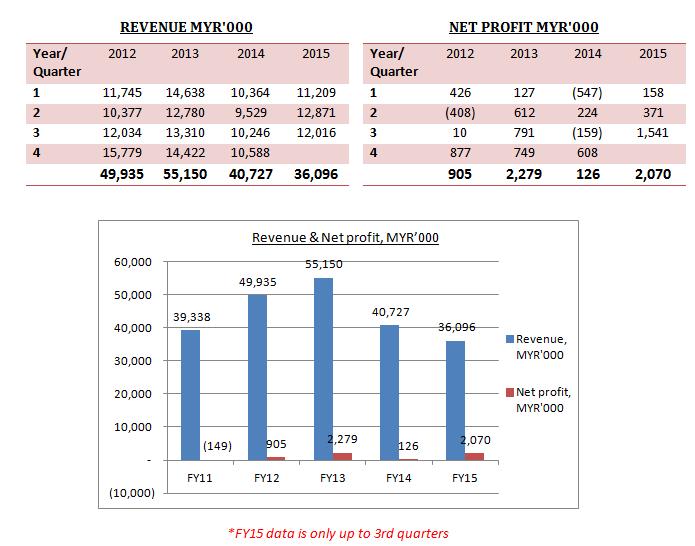

Financial Performance

In FY14, NIHSIN revenue had dropped by MYR15m compared to FY13. It is because its sales to its key export markets had declined sharply.

Let’s have a look into its business segment profit margin.

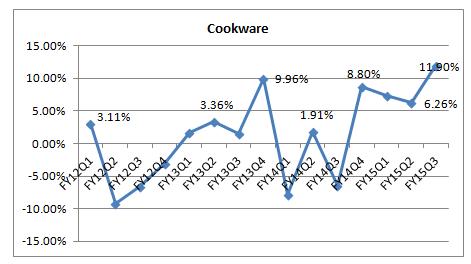

Cookware is the main contribution to NIHSIN revenue. It experienced an improvement in sales of premium cookware to Japan which is the Group's major export market. Cookware segment had achieved the highest profit margin, 11.90%, over the past 15 quarters due to weakening of MYR against other currency.

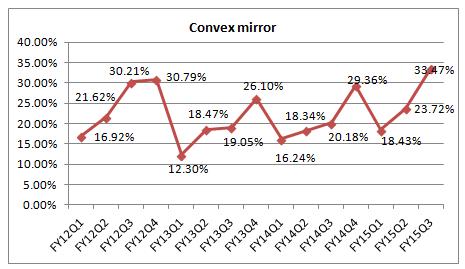

Convex mirror contributed the lowest portion to NIHSIN revenue. Its revenue contributed from this segment had dropped compared to preceding quarter.

Having said so, its average profit margin over the past 15 quarters is up to 20%! It achieved the highest 33.47% in the latest quarter! It is also contributed by the weakening of MYR.

Perhaps, the group should focus more on this segment to boost its sales?

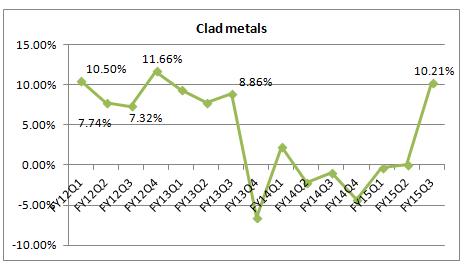

As we can see from above, clad metals division had delivered losses from FY14Q2 to FY15Q2. However, on FY15Q3, NIHSIN profit had suddenly pop up to 10.21%! It doesn’t explain the sharp increase in profit margin. However, I believe a big part of it is also because of weakening of MYR.

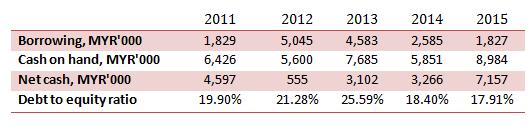

Financial Strength

Even though NIHSIN is considered as a penny stock, it is always in a cash positive position over the past 4 years. Its borrowing had been reduced since FY12, from MYR5m to current MYR1.8m, while its cash on hand increased.

Besides, NIHSIN debt to equity ratio in FY15 is also the lowest over the past 4 years, which is only 17.91%! In short, NIHSIN financial strength is healthy.

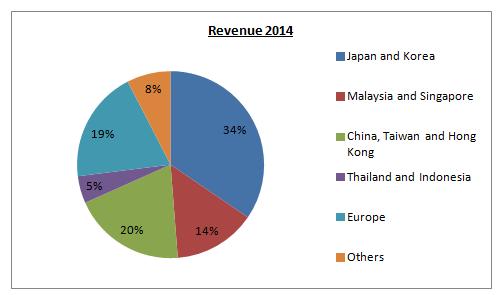

NIHSIN exported 86% of its products to oversea, while the rest 14% revenue is from Malaysia and Singapore. Even though Japan and Korea are the two main contributions for the revenue, NIHSIN largest exposure is in USD.

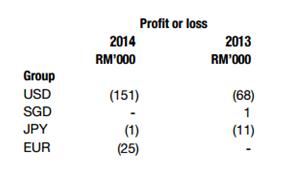

Based on currency sensitivity analysis, weakening of MYR against USD, JPY and EUR by 10% will increase NIHSIN profit by MYR177k. In other words, NIHSIN is a beneficiary of weakening of MYR.

However, additional of MYR354k per year (20%) is not too significant for the Group as one quarter is only approximately MYR90k.

Do take note that this currency sensitivity analysis is based on year 2014. As for now, it might vary.

Memorandum of Understanding

On December 2015, NIHSIN had signed a memorandum of understanding (“MOU”) with Helios Photovoltaic Sdn Bhd (“HELIOS”) to start discussions on a possible stake in HELIOS's business and growth.

Under the MOU, NIHSIN and HELIOS have jointly agreed to commence discussions and negotiations exclusively on the structures and terms of the proposal which may involve the acquisition of HELIOS in its entirety by NIHSIN, or such other mode of investment as agreed upon.

FYI, HELIOS is involved in the conception, development, construction and operations of photovoltaic systems. It is a loss making company. HELIOS made losses of MYR1.93m for the financial year ended Mar 31, 2014.

This acquisition will diversify NIHSIN into the solar energy industry.

On March 2015, NIHSIN entered into a Heads of Agreement (“HOA”) with HELIOS for the proposed acquisition of entire issued and paid-up capital of HELIOS.

However, on May 2015, the HOA had lapsed and ceased to have force or effect. Both parties have no intention to pursue any further negotiations with each other. It is because HELIOS is not willing to bear the corporate exercise expenses upon NIHSIN’s request.

Shareholders’ agreement

On November 2015, NIHSIN had entered into shareholders agreement with MyAngkasa Holdings Sdn Bhd (“MHSB”) with the intention of venturing into marketing and distribution of multi-ply stainless steel cookware under a new brand named “Pentoli” through a new company to be set up.

The products under the "Pentoli" brand include pots, pans, woks and pressure cookers.

NIHSIN will have a 70% stake and MHSB 30% in the joint venture company. They are eyeing MYR10m sales for the company by the end of 2016.

According to NIHSIN management, this joint venture will provide NIHSIN with the opportunity to leverage on the customer network of MHSB and help widen its reach to other markets.

Under the shareholders agreement, NISHIN will be responsible for managing the business operations and to manufacture and supply premium multiply stainless steel cookware and related products to the new company. MHSB will make available its customer network, including its online shopping portal, for the marketing and distribution of the new company's products.

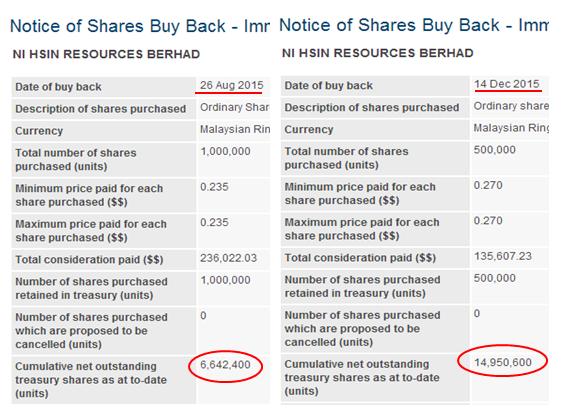

Shares buyback

Since the release of its FY15Q2 quarter result on 19th August, NIHSIN had been bought back its own shares very frequently. It started its first shares buyback on 26th August. After 16 rounds of accumulation, NISHIN cumulative net outstanding treasury shares had been increased from 5.64m to 14.95m!

In total, it had bought back 9.31m shares in less than 4 months time! FYI, NIHSIN share price during end of August is the lowest in year 2015. From end of August to end of October, the average price for NIHSIN is MYR0.26/0.27.

I believe the management thinks that its share price of less than MYR0.30 is a value buy and they are looking good in NIHSIN prospect. As a result, NIHSIN had first achieved net profit above million in FY15Q3, which is also the highest over the past 15 quarters. NIHSIN’s huge and frequent shares buyback had reflected its confidence in the Group business prospect.

Technical Chart

In term of technical analysis, NIHSIN is very bullish in short term, with an increase in volume as well.

It recently had breakout from the level of 0.29 and currently 0.29 had become its new support line. A bull engulfing candle had been formed after it stands strong on its support line. It is very likely to continue go up and test the level 0.34.

Conclusion

As at 21th December, NIHSIN closed at MYR0.305. Based on its share price, NIHSIN had a PE of 26.30.

Let’s have a brief calculation on its shares price based on its future earnings. MYR is still expected to remain weak in year 2016. So, we assume NIHSIN is able to deliver MYR4m in a financial year, its earnings per share is approximately 1.70 cent. With an estimated PE of 12, NIHSIN is actually only worth MYR0.21.

However, it doesn’t take the future contribution from its new JV company, which distributed “Pentoli” branded cookware, into account yet. It definitely needs time to proof that whether this JV will be success or not, due to NIHSIN doesn’t have a pretty track record in its financial performance.

Besides, NIHSIN is currently in a cash positive position, with net cash of MYR7m, it definitely has a probability to declare dividend. FYI, its number of shares is 230.96m. For every 1 cent dividend per share, it only costs NIHSIN MYR2.31m.

Other than that, do take note that, NIHSIN currently is fully depends on the catalyst of weakening of MYR. What if one day MYR slowly recover to its previous level? Is NIHSIN still able to deliver a good result? It is another question.

Having said so, in term of technical analysis, NIHSIN is still very bullish.

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

I will send you one or two samples of my report, for your reference.

Wish you a Merry Christmas and Happy New Year :)

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

http://klse.i3investor.com/blogs/JTYeo/86568.jsp According to this article, jt yeo say nishin is going to bankrupt soon

2015-12-26 21:58

Jt Yeo is BULLSHITTing ... see another article which checking NIhsin for bankruptcy with Altman Z-score ... Nihsin scored 7.59 that meant far away from bankruptcy pls use your head to think and no your ass.

2015-12-27 12:06

10 years ago in 2005, you bought 1 share of Nihsin which is selling for RM0.34. You went coma, wake up today. You asked 'Does Nishin still exist?" Yes. "No bankrupt?" Alive & well. "How does my 1 share perform?"

As you remember you bought RM0.34 a share in 2005. Since then they make money most of the year, lose money a few years. They made RM0.13 per share in total, they give you dividend of RM0.064, 18.8% of your cost. Niceee.

But unfortunately Nihsin is selling at RM0.305 now. Although the dividend reduce your cost to RM0.276, well you say at least I still make money if I sell now. Oh wow not bad I make 10.5% return for the past 10 years. Or about 1.05% a year.

Maybe not so great compare to fixed deposits. If you take into the account of CPI and decreasing of purchasing power due to inflation by average of 3.25% a year, hm well at least I am not bankrupt!

2015-12-28 15:06

Riche ho is independent write's.which him luck&all the best.i still accumulate nihsin at current level.im looking 40cents to sell.

2015-12-28 19:37

klsefighter

Riche Ho Thks for the info ... Good writing ....give you a LIKE

2015-12-26 17:48