(RICHE HO) Latitude Tree Holdings Berhad - Earnings Recovery in FY17

RicheHo

Publish date: Sun, 19 Feb 2017, 12:00 PM

Latitude Tree Holdings Berhad (“LATITUD”)

Background

LATITUD’s history can be traced back to year 1988 when it started as a manufacturer of chairs for dining sets. Over the past 28 years, LATITUD had grown into a complete high end dining and bedroom sets manufacturer.

As to date, through its subsidiaries, the Group was mainly involved in the manufacturing and sale of wooden furniture and components particularly rubber-wood furniture for both the domestic and export markets. About 60% of its raw materials were rubber-wood-based with the remaining being oak, pine wood and other wood-based materials.

LATITUD had positioned itself as one of the largest rubber-wood furniture manufacturers and exporters in Malaysia and Vietnam. It owned three factories in Malaysia, two factories in Vietnam and one factory in Thailand.

Financial Highlights

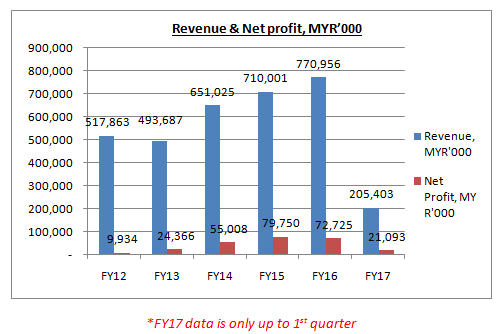

Overall, LATITUD’s financial result had been improving 5 years consecutively since FY12. Its revenue increased from MYR518m in FY11 to MYR771m in FY16, which equivalent to a compound annual growth rate (“CAGR”) of 10%. In term of net profit, it had achieved more than 6 folds improvement in 5 years time, surged from MYR10m in FY12 to MYR73m in FY16, which equivalent to CAGR of 64%.

The significant improvement in FY14 and FY15 was mainly contributed by LATITUD’s newly subsidiaries. In year 2013, LATITUD had acquired all the subsidiaries of Latitude Tree International Group for MYR117m, in order to increase its effective interest in those subsidiaries. As a result of acquisition, LATITUD had accounted the subsidiaries’ financial result in FY14 onwards.

In FY15, LATITUD had delivered net profit of MYR80m, which was a new high record in the Group’s history. Its excellent result was mainly contributed by the factors below:

- lower material costs and improved productivity/efficiency

- higher orders received of better margin products

- strengthening of US Dollar against Ringgit Malaysia

In FY16, LATITUD’s net profit had dropped by 9% despite its revenue went up by 9%.

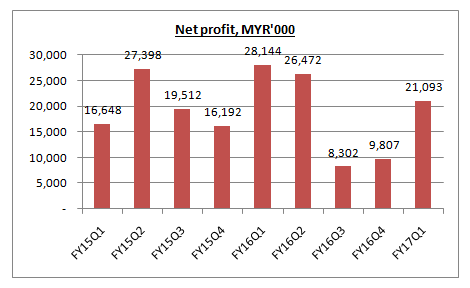

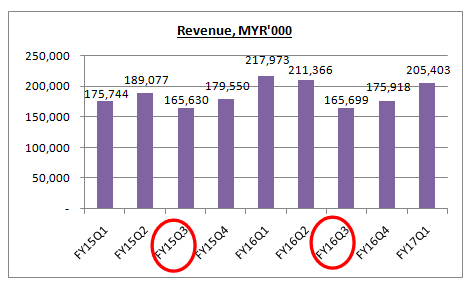

After breakdown into quarters for comparison purpose, LATITUD’s net profit in FY16 was mainly dragged down by performance in 3rd and 4th quarter.

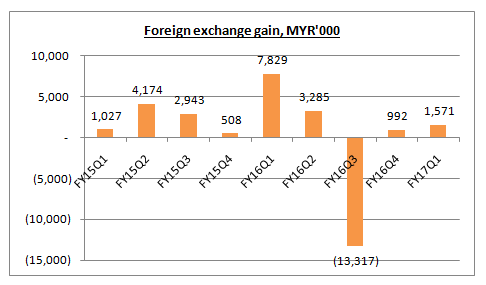

In FY16Q3 (Jan 16 to Mar 16), USD/MYR had dropped sharply from 4.40 to 3.90 in three months time. Being a beneficiary of strengthening of USD against MYR, LATITUD had incurred a huge foreign exchange loss amounting to MYR13.3m. Its actual profit supposed to be MYR21.6m in FY16Q3 once excluded the foreign exchange loss.

In FY16Q4, LATITUD’s earnings were compressed by higher tax expenses. There was nothing wrong with its sales and operating margin. Commonly, LATITUD paid MYR2-5m tax expenses in a particular quarter. However, it paid approximately MYR10m tax expense in FY16Q4. With that, the Group registered a lower net profit of MYR9.8m in FY16Q4.

In FY17, with no significant foreign exchange loss and special events incurred, LATITUD’s earnings recovered back to the level of MYR20m once again.

FYI, LATITUD’s operation was seasonal in nature whereby the revenue for the Jan to Mar (Q3) was slightly lower due to long festive holidays and also lower demand in the United States which normally slowed down after Christmas and New Year.

Financial Strength

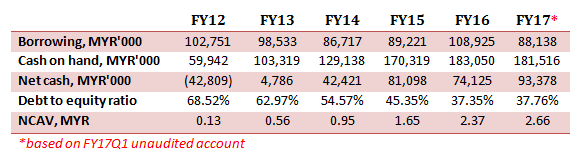

Overall, LATITUD had been strengthening its financial from year to year. As to date, its net cash on hand stood at MYR93.4m, which equivalent to 96 cent per share.

In term of debt to equity ratio, it had dropped continuously from 69% in FY12 to current 38%. In addition with its positive net current asset value of MYR2.66 per share, there was no issue on its liquidity and financial strength.

Strengthening of USD/MYR

The United States region was LATITUD’s core market all the while, accounted approximately 93% of the Group’s FY16 revenue. To be precisely, in FY16, approximately 97% and 84% of the Group’s sales and costs were denominated in foreign currencies.

LATITUD incurred exceptional high foreign exchange loss in FY16Q3 due to the sharp drop of USD/MYR in the quarter. However, most of its losses were unrealized due to change in value of its assets. In other words, it was paper loss which did not involve any cash transaction.

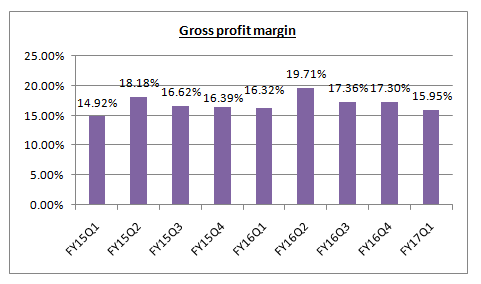

As for its gross profit, it was commonly in the range of 16-18% over the past two years. 1% changes in gross margin would affect LATITUD’s profit by MYR1.5-2.0m.

Once again, its weak net profit in FY16Q3 and FY16Q4 was not affected by its sales performance or gross margin.

Expansion Plan

In line with its expansion plans, LATITUD planned to increase and explore other export markets with high growth potential such as Australia, Japan, China and Middle East countries in future.

Currently, the Group was focusing on its stability of raw materials supply and fluctuation of raw materials cost. In order to further reduce the processing cost of downstream furniture plants and cater raw materials requirement, LATITUD had constructed an additional saw mill plant in Kuala Terengganu. The mill plant had completed and commenced in FY16Q3.

Besides, LATITUD was in the pipe line to install a new high-end production line and design center, to cater for production of small quantity high value products. It would enhance the design and development of new products and expedite the delivery of new product prototype at Vietnam plants

Once the installation of the production line completed, it was expected to further improve LATITUD’s profitability in years to come.

Other than that, in order to reduce reliance of low-skilled labor and to improve production efficiency, LATITUD had allocated MYR24m to upgrade or automate existing production lines with advanced automation and state-of-the art technology machinery.

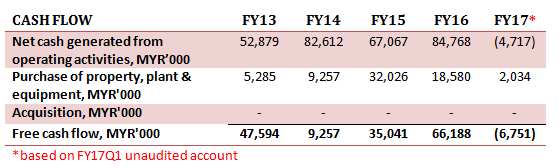

As extracted from LATITUD’s annual report and quarter report, it had invested approximately MYR50m capital expenditure in FY15 and FY16.

Overall, LATITUD was able to generate healthy cash flow in every year.

US New Home Sales

Since 93% of the Group’s revenue was derived from United State market, US new home sales was an important data for LATITUD.

As to date, sales of new single-family houses in US had dropped by 10% to 536,000 in Dec 2016 as compared to 598,000 in Nov 2016. It was the lowest figure since Feb 2016.

However, considering full 2016, new home sales went up 12.2%, the highest since year 2007. The pace of growth of existing home sales remained strong overall, on the back of new construction and the existing housing market with first time buyers expected to make up the biggest demographic of homebuyers.

FYI, new home sales account for about 10% of the US housing market.

LATITUD was expected to benefit from the strong growing US housing market in long run.

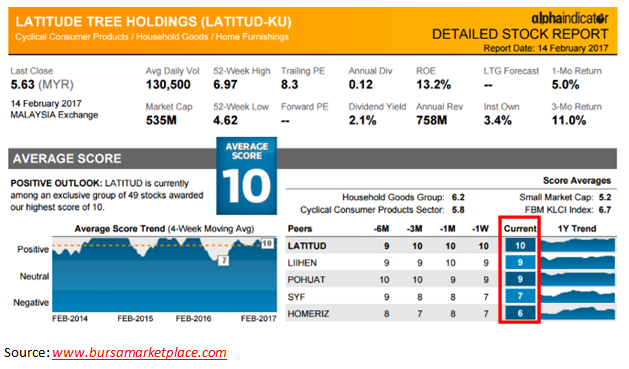

Analyst Concensus

Source: www.bursamarketplace.com

According to analyst report by Bursamarketplace.com, LATITUD was currently among an exclusive group of stocks awarded highest score of 10, higher than its peers LIIHEN, POHUAT, SYF and HOMERIZ.

Technical Chart

As at 14th Feb 2017, LATITUD closed at MYR5.63.

Technically, LATITUD had breakout from its major resistance level 5.60, supported by huge volume. It was likely to move up and test its subsequent resistance level 6.40 in short to mid term.

Previously, LATITUD had dropped from 8.00 to lowest 4.60 in year 2016 due to poor performance in FY16Q3 and FY16Q4. It was equivalent to a sharp drop of 42.5% in 9 nine months.

Currently, LATITUD’s earnings had started to recover back to normal level. Based on its previous share price movement before the huge drop, LATITUD was supposed to trade above the price level 6.40.

Conclusion

Let’s assume LATITUD will be able to deliver MYR80m profit in FY17. Based on its outstanding shares of 97.2m, its earnings per share will be 82.3 cent. With an estimated PE of 8-10, LATITUD will have an intrinsic value of MYR6.60-8.23.

The below was the comparison of its peer’s PE:

- LIIHEN – 8.0

- LATITUD – 8.3

- POHUAT – 8.8

- SYF – 10.1

- HOMERIZ – 10.8

With the expansion plan going forward, strengthening of USD/MYR and growth in US home sales, LATITUD was expected to deliver a better result in FY17.

Just for sharing!

For those who interested in my research, I am providing stock analysis report for a small fees. For more info, you may email me at richeho_92@hotmail.com

If you guys like my writing, kindly give me a like on my FB page as well.

https://www.facebook.com/rhresearch/

For any enquiry, you may contact me as well. Sharing is caring.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

You have missed out "investment" which is mainly unit trust to be included in cash on hand.Adding this will make Latitude cash on hand even higher.In 2016 ivestment is value at whopping rm42m.

2017-02-22 12:17

kakashit

郭台铭 Good timing!

2017-02-19 12:01