(RICHE HO) Benalec Holdings Berhad - Strong Earnings from Tanjung Piai & Pengerang MIP

RicheHo

Publish date: Sun, 08 Jan 2017, 02:26 PM

Benalec Holdings Berhad

Background

BENALEC was first incorporated in year 1978 as a contracting company specializing in civil engineering works. It was listed on the Main Market of Bursa Securities in year 2011.

Its name “BENALEC” was derived from combining the Malay word “BENA” (BINA = Construct) with “LEC” which were the initials of the late founder, Mr. Leaw Eng Chang.

As at today, BENALEC was a fully integrated marine construction solutions provider. The principal activity of the Group was in the provisioning of marine construction services with expertise primarily in land reclamation, dredging and beach nourishment, coastal and shore protection works, etc.

Apart from its portfolio of securing land reclamation contracts from third parties, BENALEC had been successfully undertaking its own projects, including land reclamation in Melaka, Port Kelang and Johor since year 2003.

Currently, its two main projects were land reclamation at Tanjung Piai and Pengerang.

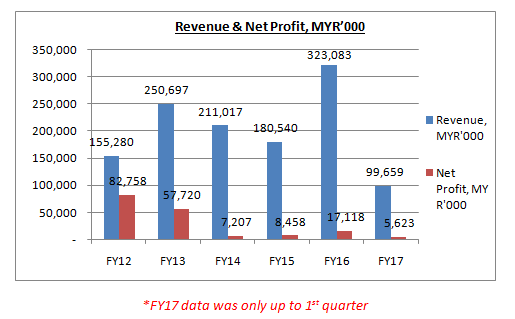

Financial Highlight

The business model of BENALEC was different as compared to others construction companies. Its land reclamation works were compensated either by way of CASH or LAND portion, or a combination of both.

Land portion was received in return as settlement for certain reclamation contracts and it was available for immediate sale. This settlement method represented an innovative solution ways in providing solutions to its customers. In other words, it was a win-win situation to BENALEC as it was able to enjoy the premium derived from the capital appreciation of the reclaimed land.

Due to uniqueness of this business model, BENALEC’s business can be divided into two main segments:

- Marine construction – disposal of land held for sale

- Marine construction – land reclamation services

Its nature of accounting will be different as others construction companies as well. As long as the compensated land was not sold and convert into cash, the revenue from land reclamation will not be recognized.

Do note that, the disposal of land was only recognized upon the issuance of land title by the local land office and the fulfillment of all conditions of the SPAs.

BENALEC’s FY16 revenue and net profit had improved significantly as compared to FY15, mainly attributed to sales of land in Melaka held by the Group.

The Melaka land sale and purchase agreements had signed and publicly announced few years ago. The income from recognition of disposal of land will be recognized, either sooner or later.

The disposal of land held for sale was the main contributor in FY16, which accounted 65% of the Group’s revenue.

Reclamation Concessions

![]()

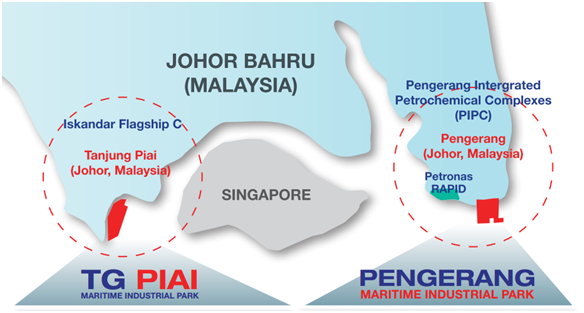

In Sep 2012, BENALEC had signed the development agreements on its two Johor land reclamation concessions in Pengerang and Tanjung Piai for the construction of an oil terminal.

The Tanjung Piai project spans 3,485 acres and the Pengerang project 1,760 acres.

While several other oil and gas hubs were being developed in Malaysia, BENALEC’s project was perceived to have the support of the Johor royal family.

Both Pengerang and Tanjung Piai to be developed into oil and gas industrial parks in line with the Malaysian Government’s and the State of Johor’s common objective of transforming Johor into a sustainable, world-class downstream oil and gas hub

BENALEC will bear the cost of major infrastructure works and assume all risks of constructing the two integrated petroleum and petrochemical hubs as well as logistics and maritime industrial parks (“MIP”) along the Pengerang, Kota Tinggi and Tanjung Piai, Pontian coast.

Do note that, Johor Sultan's son, Crown Prince Tunku Ismail Idris, was involved in the two reclamation projects, both carried out by BENALEC. BENALEC had the majority stake in the project, at 70%, the Johor royalty held the remaining stake, with Tunku Ismail owning 21% of the shares.

Tanjung Piai Project

Tanjung Piai Maritime Industrial Park (“MIP”) was a man-made island measuring 3,485 acres to be reclaimed off the south-western coast of Johor, known as Tanjung Piai. Featuring natural deepwater of up to 30 meters, Tanjung Piai MIP was able to handle the largest ships and vessels in the world.

It was strategically located at the confluence of Malacca Straits, Singapore Straits and Johor Straits. Tanjung Piai MIP was only 17km away from Jurong Island, one of the most important refining and petrochemical hubs in the world. In future, Tanjung Piai MIP was capable of accommodating all major oil and gas developments, from upstream, midstream to downstream.

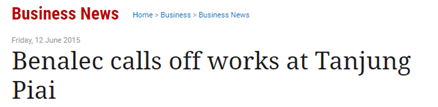

Back to year 2013, BENALEC had signed the term sheet with the State Secretary of Johor and 1My Strategic Oil Terminal (“1MY”) for the reclamation works and sale of approximately 1,000 acres of land off the coast of Tanjung Piai to construct and operate a crude oil and petroleum storage facility as well as a private jetty.

However, in Jun 2015, BENALEC’s agreement for the planned reclamation works at its Tanjung Piai had lapsed and it did not intend to pursue the matter any further after extended for four times.

As a result, BENALEC needs to continue look for other potential clients/buyers for the reclaimed land in Tanjung Piai.

In Jun 2016, BENALEC received the green light from the Department of Environment (“DOE”) for all three phases of its Tanjung Piai Integrated Petroleum and Petrochemical Hub and MIP project in Johor.

The first phase reclamation area of 1,080 acres was approved in Jan 2015. The second phase and third phase was for the balance area of 2,407 acres of the total reclamation area of 3,487 acres.

The approval encompassed the reclamation construction for all three phases of Tanjung Piai MIP, oil storage terminals and related marine facilities, which will be capable of accommodating vessels up to 350,000 deadweight tonnages.

The reclamation works for phase 1 had begun in Dec 2016 after the relevant approvals were secured. As stated in its Annual Report 2016, approximately MYR142m of development costs had been incurred for Tanjung Piai project as to date.

Currently, BENALEC had signed a memorandum of understanding (“MOU”) with a large international logistics company to jointly own and operate an oil storage terminal at the Tanjung Piai MIP development. This oil storage terminal will be the maiden development at Tanjung Piai MIP and will act as a catalyst to attract further investments and developments within the area.

The Group’s strategic expansion into the oil storage terminal business was aimed at diversifying its revenue streams and more importantly generate more stable recurring income.

Pengerang Project

BENALEC’s Pengerang venture was earmarked as a container port to complement the nearby PETRONAS’s Refinery and Petrochemical Integrated Development (“RAPID”) project.

Located close to the mega RAPID project, BENALEC’s Pengerang project was strategically positioned to benefit from “spillover” investments from RAPID, which was expected to commence operations in year 2019.

In Jan 2016, BENALEC had received the approval from DOE for the reclamation works on 1673 acres in Teluk Ramunia for the development of Pengerang MIP.

The reclamation works of Pengerang project must be carried out in two phases (1,180 acres and 493 acres) and included the construction of drainage channel, construction of jetty and development of land reclamation.

Currently, the Pengerang MIP had secured the development order and earthwork plan approvals.

Melaka Project & Prospect

BENALEC’s FY16 revenue was mainly derived from land reclamation project in Melaka. It was contributed by greater proportion of works carried out for one of the contracts in Melaka.

FYI, BENALEC had secured the land reclamation contract from Oriental Boon Siew in May 2014 to undertake coastal reclamation works in Melaka covering a total area of approximately 415 acres.

Revenue derived from land reclamation services to Oriental stood at MYR87.8m in FY16, which accounted approximately 84% of the Group’s land reclamation revenue. As to date, there was still MYR103.4m had yet to be recognized as revenue from this project.

Moving forward, BENALEC expected demand for land in Melaka to remain strong due to the rapid pace of developments taking place in Melaka. In year 2015, Melaka had attracted more than 15.7m tourists.

Besides, Melaka and Guangzhou were now linked via direct flights between the two cities. In Sep 2016, the maiden direct flight from Guangzhou touched down at the Malacca International Airport, marking a new milestone for the development of the state.

The increasing and steady inflow of tourists will provide a catalytic effect and spur economic activities in Melaka, particularly within the hospitality sector, and will add prominence to the state of Melaka. It was expected to enhance the value of the Group’s substantial land bank in the State.

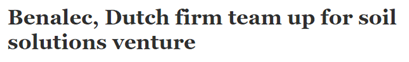

Joint Venture with CETEAU

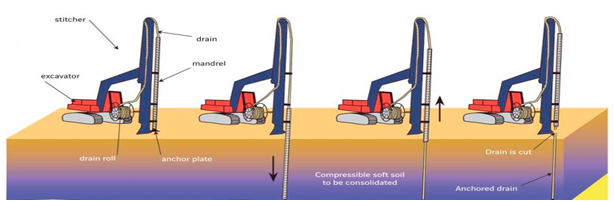

In Nov 2016, BENALEC and CeTeau Malaysia (“CETEAU”) had formed a joint-venture company to provide world-class soil improvement solutions using specialized geosynthetics engineering techniques.

CETEAU was based in the Netherlands and it was specialized in soft soil improvement using prefabricated vertical drain (“PVD”).

BENALEC holds 51% equity stake of the joint venture company named Benalec CeTeau Asia, while CETEAU holds the remaining 49%.

Under the joint venture, BENALEC will provide an integrated marine construction solution in the areas of land reclamation and coastal protection along with CETEAU’s specialist capabilities in the areas of advanced ground improvement technologies and specialized geosynthetic environmental techniques.

The joint venture company would also provide the supply and installation of PVD. The method was primarily applied to shorten the settlement period of soft, compressible clay/soil, which will in turn reduce the construction period of a project and reduce post-construction settlement. In other words, it was expected to improve BENALEC’s profit margin for each project.

The first PVD machine had delivered to BENALEC’s Tanjung Piai MIP project site in Dec, in order to commence installation of an estimated 200 million linear meters of PVD.

FYI, each PVD costs up to approximately MYR10m. According to management, currently BENALEC had ordered 4 PVD.

Additional Information

At the BENALEC’s AGM, Legal Counsel of the Group had briefed shareholders on all the outstanding legal cases. The legal cases were initiated by 2 ex-directors of BENALEC.

Legal Counsel informed that all the legal cases by the 2 ex-directors were thrown out by the courts as the legal actions were frivolous (insignificant).BENALEC was not liable to any of the cases.

As such, BENALEC's management will not have any legal matters as a distraction in the future. They can focus their full attention on the Group’s operations to enhance shareholders wealth creation.

In Budget 2017 which announced on Oct 2016, Prime Minister mentioned that GLC Companies will allocate special fund MYR3b to fund managers under Securities Commission to invest in potential small and mid-cap companies.

It was good news and catalyst for BENALEC as it might be one of the small-cap companies.

Technical Chart

As at 5th Jan 2017, BENALEC closed at MYR0.42.

BENALEC was in a downtrend over the past 2 years. Its share price had dropped from approximately MYR0.90 to current MYR0.42 in two years time, which equivalent to a drop of 53%.

Currently, BENALEC had successfully breakout from its downtrend line which indicated that its downtrend had come to an end. It had temporarily found its bottom at 0.36.

With the technical breakout supported by a huge volume, BENALEC was likely to touch its major resistance level 0.54 in short to mid term based on fibonacci retracement.

Conclusion

Both the current flagship Tanjung Piai MIP and Pengerang MIP developments represent the Group’s foray into Johor State’s fast growing Iskandar and PIPC regions.

It will be the main growth driver for the BENALEC over the next 10 to 15 years, which expected to provide the group with the springboard for enhancing its business sustainability and up-scaling its growth prospects.

Besides, BENALEC had signed sales and purchase agreement for its 160.54 acres of land in Melaka. It will generate sales revenue of in excess of MYR300m in FY17 and FY18. In addition, the land reclamation contract from Oriental amounting MYR103.4m had yet to be recognized as revenue.

In total, there will be approximately MYR400m revenue which can be recognized in FY17 and FY18. Other than that, its Tanjung Piai land reclamation project had started in Dec 2016. It will contribute positively to the Group in FY17.

Just for sharing!

Hey guys, I am writing stock analysis report to earn some pocket money. For more information, you may email me at richeho_92@hotmail.com

If you guys like my writing, kindly give me a like on my FB page.

https://www.facebook.com/rhresearch/

For any enquiry, you may contact me as well. Sharing is caring.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Discussions

Very informative. With such low share price as a result of very low expectations by investors, any change in sentiment will move the share price up further. I think this stock will likely be targeted by the recent Budget rm3b small cap fund- given the 30% equity involvement of the JB Royal family in the huge Tanjung Piai and Pengerang 5000+ acres of reclamation concession. Possible CNY rally speculators make may also make punts on penny stocks.

2017-01-08 16:28

stockraider

VERY GOOD INFORMATIVE WRITE UP.

THANKS!

2017-01-08 15:14