(RICHE HO) KRONO 亚洲 – FY16Q4盈利背后的隐忧

RicheHo

Publish date: Tue, 21 Feb 2017, 05:47 PM

KRONO 亚洲 – FY16Q4盈利背后的隐忧

KRONO是今日 (2/21) 股价上涨幅度最大的股票之一,上涨6仙收市在38仙,相等于约19%的涨幅。其股价走高主要源自于最新出炉的业绩。

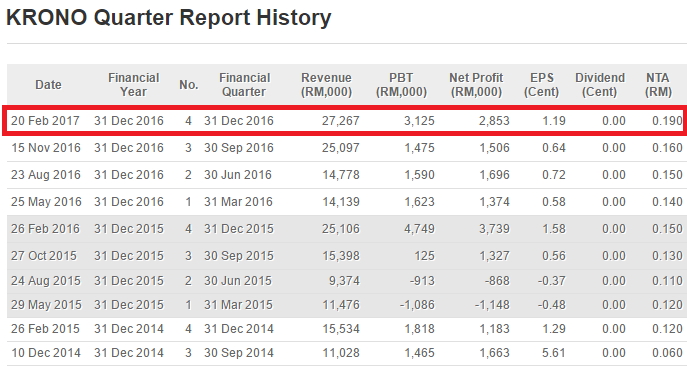

KRONO在昨日发布FY16Q4业绩,其盈利按年下滑24%,按季则增长89%,超出市场的预期。为何说超出市场预期呢?回顾去年10月,KRONO完成收购印度【QUANTUM】的80%股权,后者正式成为KRONO的独资子公司。因此,KRONO于FY16Q4开始纳入印度【QUANTUM 】的盈利贡献。

这项收购为KRONO在印度市场的EDM领域扩展铺路,同时也附带附带盈利保证。印度【QUANTUM】保证将在FY16和FY17分别贡献USD1m的税后盈利。以USD/MYR = 4.40计算,这子公司可为KRONO带来额外RM4.3m的盈利,相等于每个季度平均RM1.1m的盈利。翻看KRONO未完成收购前的近三个季度,其平均盈利为RM1.5m。因此,本专页早前估计KRONO的盈利大约在RM2.5m左右。RM2.8m的税后盈利可算是超出预期。

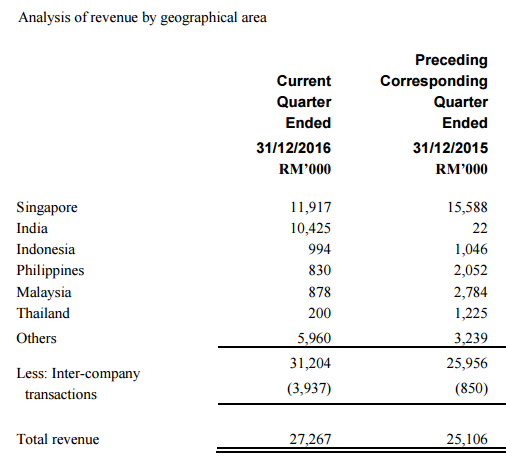

参考KRONO最新季度的营业额,新加坡依然是集团的最大贡献市场,但是收入却按年按季分别下滑了24%和42%。此外,KRONO的印尼、菲律宾和大马市场的贡献全都按年按季下滑。收入获得扶持主要归功于新子公司印度市场的贡献。整体来说,KRONO的业务似乎在东南亚国家面临困境,不是个好的迹象。

大家可以观察KRONO近两个季度的业绩表现。其FY16Q3营业额为RM25m,FY16Q4营业额为RM27m。但是为何其FY16Q3盈利只有RM1.5m,而FY16Q4却高达RM2.9m?为何差距如此大呢?

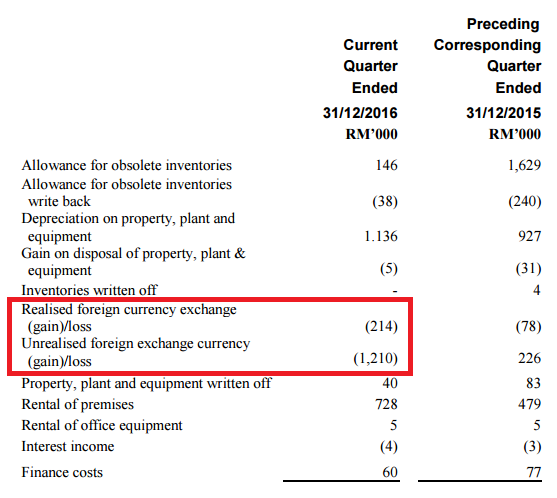

KRONO大部分的营收都是以美金计算。同时,收购印度【QUANTUM】后,它在印度拥有三个办事处。因此,美金兑马币走势对于KRONO的影响不小。KRONO在FY16Q4录得RM1.42m的显著外汇收益,是集团盈利暴涨的主要因素,而非来自核心业务的增长。值得一提,KRONO在这个季度之前的外汇收益都不明显。

若剔除这非核心收益后,KRONO的FY16Q4实际盈利只有RM1.43m,甚至还低于未收购完成的FY16Q2和FY16Q3盈利表现。

因此,本专页认为KRONO这个季度的表现有运气的成分,股价走高纯粹是市场对于KRONO的FY16Q4缺乏详细的了解。在下个业绩出炉前的3个月,预计市场对于它的期望更大,毕竟KRONO最新季度的每股盈利为1.19仙,为市场提供非常大的想象空间。从市场的角度去想,假设KRONO在未来3个季度交出相同的盈利,其一整年每股盈利将会是4.76仙。以标准10倍PE推算,它的潜在每股价值为RM0.475。

值得一提,本专页是KRONO的股东之一,受惠于市场盲目根据盈利推高股价。根据技术走势,相信KRONO有很大可能突破40仙大关。然而,在未来三个月内,相信将依据进行部分甚至是全部套利。

对于股票分析报告有兴趣的股友,可留下PM或私下询问。

#KRONO

纯属分享!

https://www.facebook.com/rhresearch/

info.rhresearch@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Not all companies can ensure profit can improve quarter to/on quarter. But if profit can improve year to year, it is very good already. Can take Padini as example. Besides, Krono new management haa been trying their very best and optimistic that Year 2017 will be better than Year 2016.

2017-02-21 21:51

未来展望

The QIS Acquisition in October 2016 marked the beginning of a new phase of growth for the Group. Going forward, the Group will focus on improving its sales mix, building on its managed services segment, and targeting viable merger and acquisition opportunities, with a view to expanding throughout the region and driving long-term value for shareholders.The Group will recognise full year contributions of revenue and profit from QSI for FY’17. Barring unforeseen circumstances,the Group expects its FY’17 performance to surpass that of FY’16.

2017-02-21 23:47

The NTA is increased from 0.16 to 0.19 which is very good and highest increment in Krono record after listing.

2017-02-22 11:27

KYY Golden Rule: You must make sure this year Krono makes more money than last year. then you go in.

2017-02-23 09:56

Jeffbkt

There is a 3 million expenses for the new share listing. Is it considered a one time cost

2017-02-21 21:10