(RICHE HO) Karyon Industries Berhad - Hidden Gem below 20 cent

RicheHo

Publish date: Tue, 24 Jan 2017, 04:02 PM

Karyon Industries Berhad

Background

KARYON’s history can be traced back to year 1990, where the founders ventured into the trading of polyvinyl chloride compound (“PVC”) compound. Later on, they decided to manufacture their own PVC compound, started with a second hand PVC compound production line, with a production capacity of 840 MT per annum only.

Initially, KARYON’s products can be generally classified under two industries, namely:

- Polymeric (Upstream)

- manufacture various types of PVC compound, stabilizers and lubricant

- compounded polymer raw materials for manufacturers who operated in polymer industry

- play a complementary role in arriving at polymer based products

- Oleochemical

- manufacture Palm Kernel Diethanolamide (“PKDE”)

- used in the manufacturing of washing detergent, cleaning liquid and toiletry products

In year 2014, due to weak performance, KARYON had shut down its oleochemical operation. Its factory plant which located at Shah Alam, Selangor was subsequently disposed in year 2016. (will be discuss below)

It was listed on Ace Market of Bursa Securities in Sep 2004 and subsequently transferred to Main Market in May 2014.

Financial Highlight

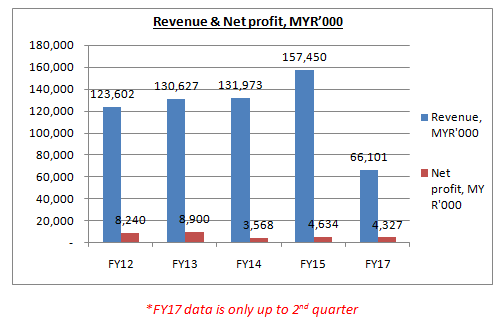

In Dec 2015, KARYON had changed its financial year from 31st Dec to 31st Mar. Hence, its FY15 audited financial statement consisted of 15 months (5 quarters), made up from Jan 2015 to Mar 2016.

Overall, KARYON’s financial performance over the past few years was considered average. Its revenue had increased slightly for 3 years consecutively, mainly contributed by higher sales volume of polymeric products.

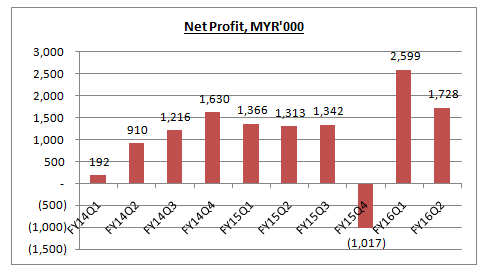

However, due to increase in cost of materials, one-time off expenses incurred for the transfer listing exercise and share of loss of a joint venture, KARYON’s net profit had dropped significantly in FY14 and FY15.

KARYON had incurred some non-operating items in recent years, as below:

- FY13 – One-off gain on disposal of a factory, MYR0.64m

- FY15 – Sales tax and penalty imposed by Jabatan Kastam Diraja Malaysia, MYR1.60m

In FY16, KARYON had an excellent profit in first two quarters, which was almost the same profit as in full FY15. It was mainly contributed from more orders received from customers and increase in production by 220 MT.

FYI, KARYON’s new production line had commenced partially in Jun 2016. As a result, its sales volume of polymeric products had increased by approximately 10% as compared to FY15.

Polymeric Division

PVC products constitute part of the polymer industry and play a complementary role in arriving at polymer based products.

KARYON compounds polymer raw materials for manufacturers operating in this industry. It is focusing on the upstream of PVC industry, producing various types of PVC compound and PVC color masterbatch.

Generally, compounding enables thermoplastic resins to effectively meet the heat strength and other requirements for polymer or plastic products.

The raw materials used for the production of compounds are derivatives of crude oil and natural gas. These building blocks of plastics are short-chain molecules called monomers. Monomers that are combined to create longer, more complex chains are known as polymers.

KARYON’s end applications of its products are as below:

- Wire and cable insulation

- Hoses – normal water hoses to chemical and oil resistant hoses

- Packaging purpose

- Cable

- PVC products

- Toys and food contact applications

Based on its previous record, KARYON’s major customers were from cable industry. Its main raw materials for the production of PVC compound were PVC resin, plasticizers and calcium carbonate. These three items constitute approximately 85% for the total raw material cost.

Over the years, KARYON had been refining its capabilities in polymeric manufacturing and contract manufacturing by adding value through formulating polymeric materials according to customers’ specifications and requirements.

As at today, it had emerged to become one of the largest PVC compound manufacturers in Malaysia.

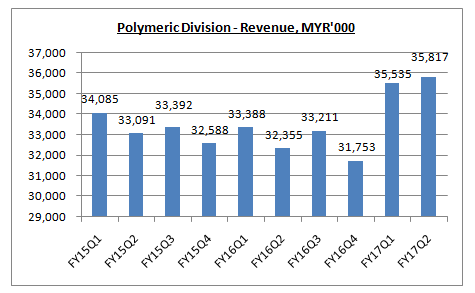

Over the past two years, KARYON’s revenue from polymeric division was consistently in the range of MYR32 – 34m, without any growth.

However, in FY17, KARYON had received more orders from customers. In order to cater the demands, it had increased its production by 220MT resulted from installation of a new production line.

KARYON had invested substantially in the expansion of its production capacity since FY16. By attaining mass production, it was expected to increase KARYON’s profitability and enhance the long term business prospects of the Group.

The new production line had commenced operation in Jun 2016.

As a result of expansion, KARYON’s profit margin had increased from 6-8% previously to 9%. In other words, KARYON’s cost of production had reduced by 2-3%.

Own Land & Factory Plant

In Mar 2015, KARYON had acquired a piece of land together with a factory erected thereon located in Johor Bahru for MYR8.39m.

Previously, KARYON had been in a tenancy agreement for a term of 3 years. It occupied the land and factory plant for an annual rental of approximately MYR198k for its warehousing and manufacturing operations.

Since the tenancy agreement will be expiring on Jun 2015, the acquisition enables KARYON to own the land and factory plant, which result in annual rental cost savings of approximately MYR198k.

Besides, the acquisition eliminates the risk of non-renewal of the tenancy agreement as there is no assurance it will be renewed.

Oleochemical Division – Cessation of Operation

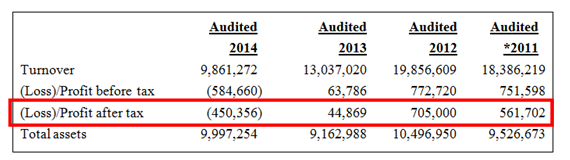

In Mar 2015, KARYON had ceased all operations of its wholly-owned subsidiary, Karyon (Malaysia) Sdn Bhd, in order to prevent incurring any further losses,

Karyon (Malaysia) was principally engaged in the manufacturing of foam boosters, concentrated detergent paste, washing detergent and toiletries.

It was not a major subsidiary of KARYON and it contributed only approximately 11% of KARYON’s unaudited consolidated total assets as at FY14. Karyon (Malaysia) had been in a loss making position since FY14.

The summary of financial performance of Karyon (Malaysia) was as below:

However, HARYON had only shut down its factory plant in Selangor. It did not go through deregistration of the subsidiary. Hence, it still needs to bear some unavoidable expenses such as audit fees, factory expenses, etc.

Disposal of Factory Plant

In order to cut down all unnecessary expenses by is oleochemical division, in Apr 2016, KARYON had proposed to dispose of the piece of leasehold land and its factory in Selangor for MYR5.62m.

The total net book value of the land and factory was approximately MYR1.78m. Upon completion, the profit arising from the disposal after deducting the estimated expenses was approximately MYR3.51m.

The disposal enables KARYON to unlock the value of the land and factory that do not contribute towards the core business of the Group. It would also discharge KARYON from the land’s future holding and maintenance costs.

It was more efficient to utilize the proceeds received from the disposal for KARYON’s working capital purposes rather than leaving the land and factory idle.

The disposal was completed on Oct 2016. KARYON will include the gain on disposal of MYR3.51m in its FY17Q3 result, which will be release on Feb 2017.

With the cessation of oleochemical’s business operation, KARYON fully focused on its core business – polymeric division.

Sales Tax Penalty Refund

In Dec 2016, the Finance Ministry had agreed to refund the sales tax penalty of MYR0.53m imposed on KARYON. The further appeal would not be considered by the Finance Ministry.

To recap, in Apr 2016, the Customs Department had notified KARYON to request for the additional payment of MYR1.06m in sales tax together with penalty of MYR0.53m due to different classification of product tariff code.

Subsequently, KARYON paid the sales tax and sales tax penalty on Apr 2016. As a result, KARYON had incurred loss of MYR1.02m in the same quarter.

In May 2016, KARYON made an appeal, and the following month, KARYON received a letter saying that the ministry would rescind the sales tax penalty making the full sales tax payment. However, there would be no refund for penalty or compound that had been paid.

That led to KARYON making another appeal, which resulted in the Finance Ministry agreeing to refund the tax penalty.

The refund was expected to boost KARYON’s FY16Q4 result.

Fire Incident

In Nov 2016, there was a fire incident occurred at a third party premise located adjacent to one of the manufacturing facilities of KARYON at Johor.

The fire incident had affected small area of the factory, causing some damages to the raw materials and finished products and disruption to two PVC production lines. The management had decided to temporarily cease the manufacturing operation in the factory pending some clean-up and repair works.

The manufacturing operation in the factory was expected to re-commence approximately 1 week. As to date, the management was unable to finalize the financial impact to KARYON, but they believes that the damages were adequately insured pending the insurance company’s assessment.

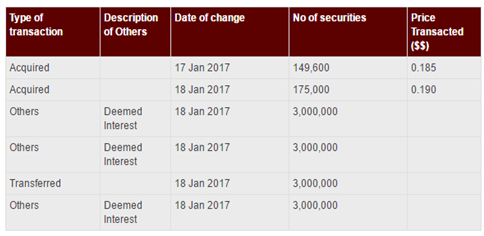

Changes in Substantial Shareholders

In Jan 2017, the chief executive officer of KARYON, Mr. Chua Ling Hong had acquired 324,600 shares worth MYR60,926 from open market. He was the son of the founder, Dr. Chua Kee Lam.

Besides, Dr. Chua had also transferred 3m shares to his son, Mr. Chua Ling Hong, which he is also deemed interested.

As to date, Mr. Chua Ling Hong owned 3.06% direct stake and 8.06% indirect stake in KARYON.

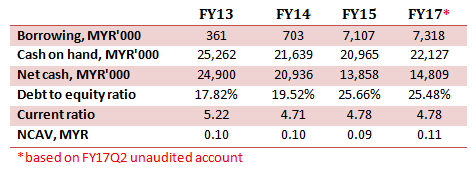

Financial Strength

As to date, KARYON as healthy financial company with net cash of MYR14.8m on hand. Besides, its debt to equity ratio was only 25%.

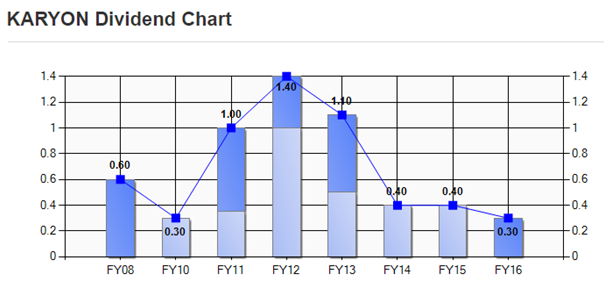

KARYON had been declaring dividends over the past 8 years.

Valuation

With the expansion of production capacity in polymeric division, KARYON’s financial performance was likely to improve in FY17. Its profit margin had improved from 6-8% previously to current 9%.

Let’s assume KARYON will be able to deliver MYR9m net profit in FY17. Based on its outstanding shares of 475.71m, its earnings per share will be 1.89 cent. With an estimated PE of 10-12, KARYON will have an instrinsic value of MYR0.19 – 0.23.

Do note that, KARYON's upcoming result will included the gain on disposal of MYR3.51m which will be release on Feb 2017.

Previously, KARYON delivered MYR8.9m net profit in FY13. During that time, its share price had surged from MYR0.15 to highest MYR0.35 in a year.

Perhaps, KARYON may be able to repeat the same history again?

Hey guys, I am providing stock analysis report for a small fees. For more info, you may email me at richeho_92@hotmail.com

If you guys like my writing, kindly give me a like on my FB page as well.

https://www.facebook.com/rhresearch/

For any enquiry, you may contact me as well. Sharing is caring.

Happy investing!

Cheers!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Lmao. This guy hentam 10x PE again. PE must be 10x? My ah gong say karyon china man company and he suggest me to put 5x PE wor.

2017-01-24 17:25

i don think one-off gain should be highlighted,since it wont repeated in future,not to said it is only RM3.5m.

so,it is meaningless to calculated PE by using one-off gain,cos it is not sustainable.

2017-01-24 17:58

Hi Sherlock, its accumulated latest two quarter profit is RM4.33m. So i assume Karyon will be able to deliver RM9m profit. It doesn't include the one-off gain RM3.5m+.

2017-01-24 18:31

Fire incident at Third Party premise, share price drop. Few week later strong buying interest into this counter... clever..

2017-01-24 19:04

becareful of richeHo, my friend lost over 20% of 200k following him past 2 months...

2017-01-25 12:09

well, i personally did not make any losses on TEKSENG. So, where come the losses? LOL

2017-01-25 12:28

If I may provide and impartial comment on TekSeng, it wasnt truly RicheHo fault as the Management of TekSeng behave unethically. Despite achieving record profit and delivering continuous dividend in the Q before, they closed down a production line and fired everyone under guise of redundancy. When media asked, they were not honest and forthcoming. A management of such a company that is so unethical deserve their shares to be sell down. Tekseng was an unfortunate incident that was beyond the control of many.

2017-01-25 12:36

New guru in making, though RicheHo is only 20+ (less than 24, I guess) & only 1-2 years investing experience.

2017-01-25 15:31

Lots of self proclaimed GURU in every where nowaday, good to see one is coming

2017-01-25 15:31

Really scary, with so little years of experience also want to be guru, OMG.

2017-01-25 20:21

At least ppl try la. Better than some only complain but contribute nothing.

2017-01-26 08:06

Sebastian Sted Power

good analysis

2017-01-24 16:20