Mycron 5087 : 4 Feb 2017

seihoi628

Publish date: Sat, 04 Feb 2017, 07:57 AM

MYCRON : 5087

MYCRON currently engaged in mid-stream steel cold rolled coil manufacturing and steel tube manufacturing business.

Let look into fundamental side before we proceed with technical analysis.

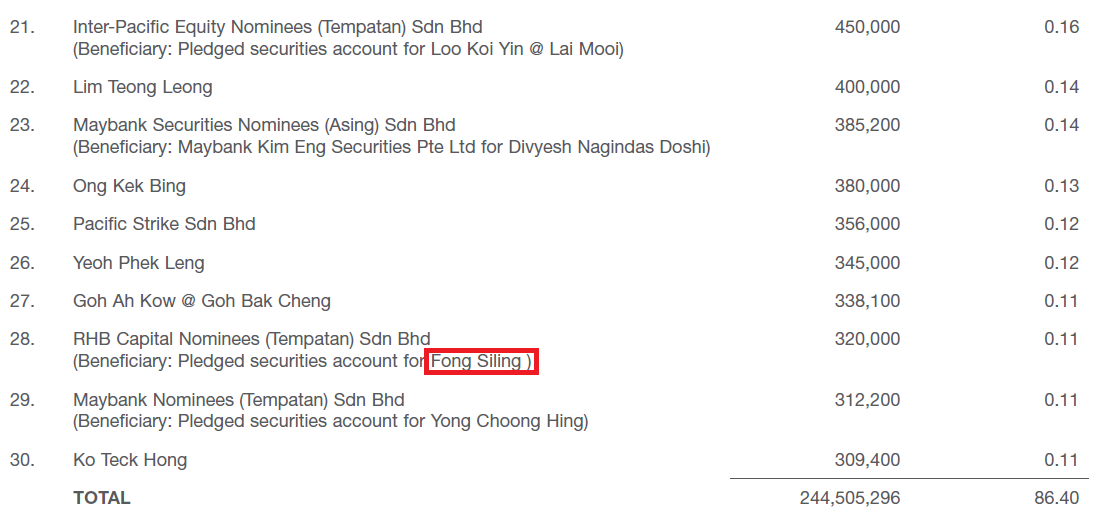

Based on the annual report Year 2016 which as at 30 Sept 2016, Fong Siling which people know him as "COLD EYE" own 320,000 shares will repesent 0.11% of the total shares issued.

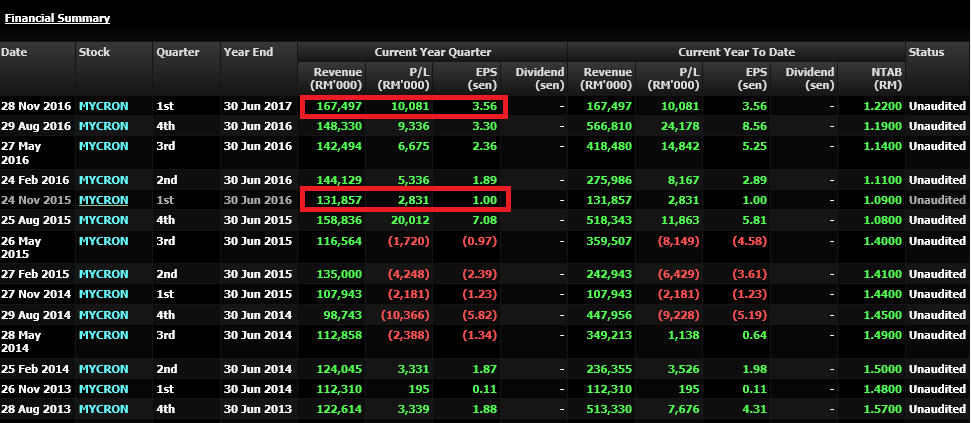

Now, let look at their quarterly result performance which shown as below :

We do notice if we compare 1st Quarter financial year end 30 Jun 2016 revenue : RM131,857,000 compare to 1st Quarter financial year end 30 Jun 2017 : RM 167,497,000 which represent revenue improve by 27.03%

Profit for 1st Quarter 2016 : RM2,831,000 , Profit for 1 st Quarter 2017 : RM10,081,000 which represent profit increase by 256.09%

Then, we look into current quarter compare to previous quarter to see is there grow in term of revenue and profit.

Previous quarter revenue RM148,330,000 and compare to current quarter result also show there is improvement of revenue by 12.92%.

Profit wise for previous quarter RM9,336,000 compare to current quareter which is RM10,081,000 show there is a improvement of 7.98%

On top of that, NTA for MYCRON is 1.22

Overall, if we compare both way, there is still a growth but it seem momentum is slowing down.

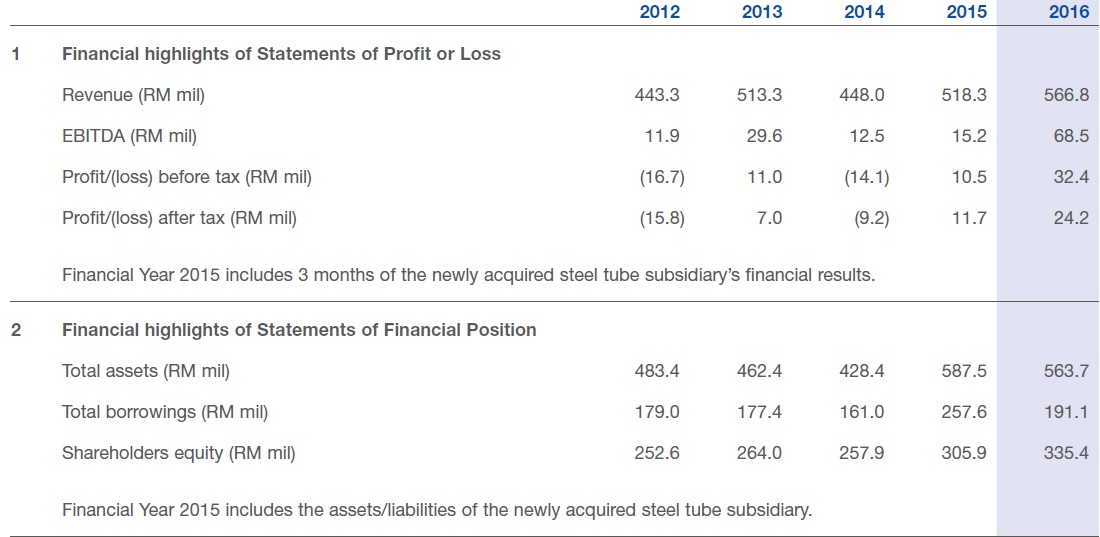

Now let look into financial earning.

If compare PAT (Profit After Tax) for year 2015 and 2016, obviously there is a improvement by 106.84%.

If compare Revenue for year 2015 and 2016, there is a improvement by 9.36%.

Sharesholders equity increase 9.64% and total borrowing reduce from RM257.6 million to RM191.1 million which show siginificant drop 25.82% which indicate a good sign as equity increase and debt reduce.

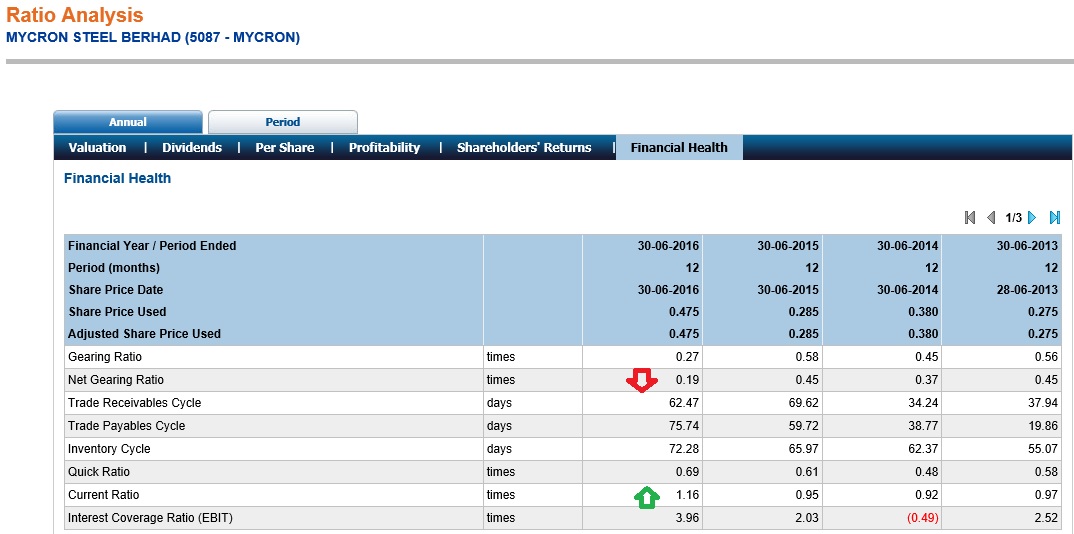

Above Financial Health obtain from Insage.

Sigifniciant improvement of net gearing ratio is a good sign showing management taking the appropriate step to put their debt at manageble level and current ratio also improving. Trade receivables from average 1 months drag till 2 months and this started since the implementation of GST. I guess it could be the current industry practice to make payment 2 months later.

Now, let look at technical chart

MyCRON SURGE UP with volume at the price level of 0.28. Then, we can see it do adopt Elliot Waves pattern as shown as above. Waves 3 is the longest and currently Waves 5 remain doubtful is it there is room to go up further or the end of Waves 5 is very much depend on investors sentiment toward this month end quarterly result earning. Currently, there is no clear direction from overall chart formation. However, we do notice a significant buying interest appear yesterday and this might be a sign of investors coming in betting on the coming quarter result.

Now let look at another chart that i plot with Fibonacci Retracement

From the chart, it clearly show that, it retrace from the peak 1.20 to to the low of 0.72 which represent the difference of 0.48. From the chart, it show multiple top at the level of 1.08 follow by Tripple Top at 1.10. So 1.08 - 1.10 is the resistance level. Then it has another resistance at 1.13. A Doji follow by a white candlestick with improvement of volume indicate current stage there is possibility of forming bullish reversal formation. So, upside there is approximately 9 - 15%. Downside risk is once break 0.94 then you may consider taking appropriate action.

Disclaimer: Above information obtain at the best available source of information. Any inaccurate information, writer should not held any responsibility due to investment losses arise from above article. It does not solicit buy or sell call on the stock, it merely for educational sharing purpose. Kindly consult your investment broker pertaining any investment decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Stock Time Machine

Discussions

Steel products whether CRC, rebar, steel pipe or wire rod, all has jumped 30% since september 2016. I guess there is another wave coming soon since you know that QR will be released in this Feb.

SSTEEL and CSCSTEL is a good buy since their prices never surge too much since 3 months ago.

http://www.100ppi.com/vane/detail-927.html

http://steelbenchmarker.com/files/history.pdf

2017-02-04 09:11

Recommended steel counters.

Long steel products - SSTEEL

Flat steel products - CSCSTEL and MYCRON

2017-02-04 09:19

John Lu

OTB ald give tp 1.58 mah

2017-02-04 08:05