Stock Time Machine - Mpay 7 Feb 2017

seihoi628

Publish date: Tue, 07 Feb 2017, 05:28 AM

Mpay : 0156

Mpay is a provider of end-to-end electronic payment (E- Payment) solutions for bank and financial institutions, merchants and card issuers which operating in Malaysia. The Company undertake merchant acquiring and own direct business relationship with the merchants by facilitating merchants' ability to accept credit, debit, loyalty and stored-value cards.

What attract the eyesball of investors about this counter when a person look at their recent quarterly results which show relatively poor performance. So, below is my 2 cent points of view why people are looking into it.

Mpay is involve into Fintech which involve with the payment system. One of synificant changes that we can feel is that banking system already change our credit card to Chip - Pin usage instead of those day we need to sign on a piece of money.

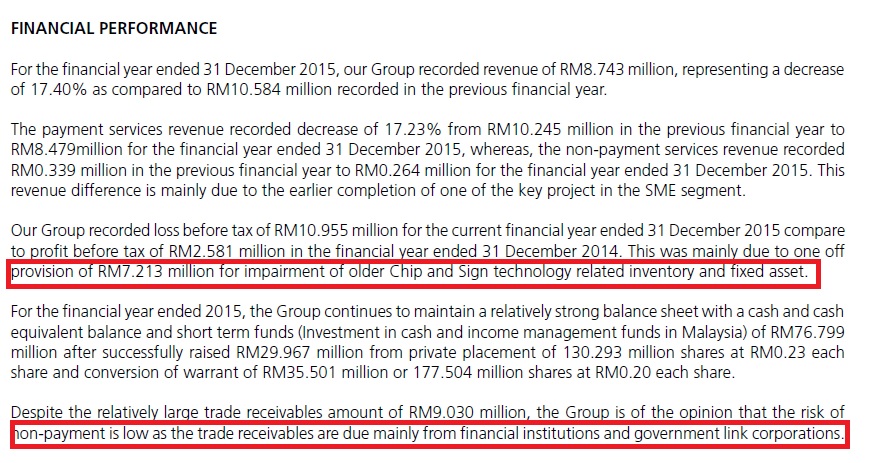

Let look at some financial figure

Above information was obtained from Mpay Annual Report 2015.

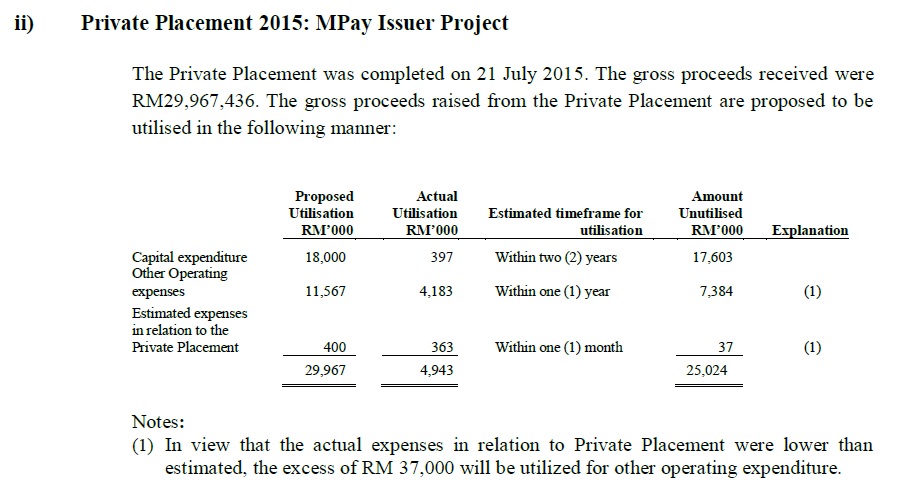

The private placement during the year 2015 will be utilise for the duration of 2 years which should be fully utilise or significantly utilise for the next 6 months time. Therefore, capital expenditure and operating expenses should be remain high and coming quarterly result may not look good.

The recent development is about P2P license obtain by Mpay.

The Securities Commission (SC) has appointed six parties to run peer-to-peer (P2P) financing platforms, making Malaysia the first country in Asean to regulate this segment of financial technology (fintech), which in turn provides new funding sources for small and medium enterprises (SMEs). The six, a mixture of local and foreign parties, are expected to be fully operational by next year. P2P financing allows investors to lend directly to individuals and businesses. In return, they receive an attractive yield – provided the borrower does not default.

The six registered operators are B2B FinPAL, Ethis Kapital, FundedByMe Malaysia, ManagePay Services,Modalku Ventures and Peoplender. They are expected to be fully operational in 2017. This makes Malaysia the first country in the ASEAN region to regulate P2P financing.

Some interesting news can be read if you click on below linkage :

http://www.thestar.com.my/business/business-news/2016/11/04/sc-issues-p2p-licences/

http://fintechnews.sg/6528/malaysia/malaysia-sc-announces-6-peer-peer-financing-operators/

Some news coverage on P2P peer which will be operating soon in Malaysia first half 2017

https://www.digitalnewsasia.com/digital-economy/funding-societies-launch-p2p-platform-malaysia-1h-2017

For the Malaysian P2P operators, the rate of financing cannot be more than 18% per annum, and that there can be no concurrent hosting on more than one P2P platform for the same purpose. By placing a cap on the rate of financing, the concern now is whether such move will cap P2P’s growth potential. “Investors need to understand the implication of loan interest rates. Many investors are attracted to the potentially high interest returns quoted by P2P operators. However, high interest rates are not always good for investors. Rates must be high enough, but not too high. Overly high interest rates encourage adverse selection. Only risky SMEs who do not have a choice would accept overly high interest rates, increasing default risk.

So, from all the online article that i study on P2P, it seem that it do have huge potential growth and this could be a ball changing game for Mpay. It this workout well, then year 2017 could be the year of Mpay. Risk control for P2P is very important and this can ruin the company image if this turn out to be sour for investors who invest into P2P.

Overall, to conclude the business is that it require huge capital for this transition period and definitely they are on the right trend on doing the business. The issue is the business acceptance and it take time to see as Malaysia population is relatively small if compare to CHINA. People alway say stock price is alway ahead of our economy performance 6 months ahead. So, i guess investors and traders also taking early view for the financial turnaround to be happen by the third quarter 2017. Especially when people on the street keep on complaint business is tough, not enough money. So, with this P2P coming in, people has the option if they can't obtain loan from the bank.They could get it from P2P which the capping of interest rate per annum is 18% rather than those ah long which stick those stick on the treet, putting flyer on the shop lot door and letterbox which showing 2-3% interest per month. If could be more than that, if not you see those people who seek for MCA help when ah long disturb their family members and appear in newspaper.

Let look into technical point of view. If we look at the chart, we do notice it was hovering at the area 0.15 to 0.185 for quite some time and then early this year it breakout this 0.185 and the momentum start to kicking in. As of Monday closing, the last done price was 0.24. So, people may wonder how far will it go up. Will it retrace or will it be another IFCAMSC to have such miracle from 0.10 to near to 2.00 in a year time. God only can tell what will happen. Not me.

If i adopt Fibonacci retracement, 50% fibo level will fall at 0.255 follow by 61.8% at 0.28 then 71.6% at 0.315. If you use weekly chart, you will notice currently candlestick is hanging at the upper bollinger band and this upward momentum should be continue. From the weekly chart, it show that currently it is charging with the bullish momentum.

Mpay

Last Done price : 0.24

Support : 0.215 (-10.42%) ; 0.23 (-4.17%)

Resistance : 0.255 (+6.25%) ; 0.28 (+16.67%) ; 0.315 (+31.25%) ; 0.335 ( +39.5%)

Disclaimer: Above information obtain at the best available source of information. Any inaccurate information, writer should not held any responsibility due to investment losses arise from above article. It does not solicit buy or sell call on the stock, it merely for educational sharing purpose. Kindly consult your investment broker pertaining any investment decision.