10 in 10 With Cordlife Group - Being the One Choice for Parents

MQ Trader

Publish date: Tue, 15 Jun 2021, 04:43 PM

10 Questions for Cordlife Group Limited

Company Overview

Established in May 2001, Cordlife Group is a leading company dedicated to safeguarding the well-being of mother and child. The Group is listed on the Mainboard of the Singapore Exchange since 2012 and is a pioneer in private cord blood banking in Asia.

Link to StockFacts Company Page

1. Could you elaborate on Cordlife’s business segments and each of its focus?

- We are a pioneer in private cord blood banking and own the largest network of cord blood banks in Asia with full stem cell banking facilities in 6 key markets – Singapore, Hong Kong, Indonesia, India, Malaysia, and the Philippines. All our facilities are accredited by AABB (formerly known as American Association of Blood Banks), with several also accredited by other leading standards organisations, such as Foundation for the Accreditation of Cellular Therapy (FACT) and College of American Pathologists (CAP).

- Beyond cord blood, cord lining and cord tissue banking, we have extended our cryopreservation expertise to expanded stem cells in the Philippines and lenticules in Singapore, offering a comprehensive suite of diagnostics services for families including non-invasive prenatal testing, paediatric vision screening, newborn metabolic screening and family genetic screening services.

- We recently introduced the digital healthcare business segment and developed Moms Up, a mobile app, to provide health-related information and resources for Asian women who are expecting or planning to conceive, and women who have young children. Moms Up is available in the Philippines, Indonesia and Malaysia and will be made available soon in all our markets.

2. Cordlife operates in 6 key markets, are there plans to expand the Group’s geographical reach?

- In Singapore, Hong Kong, the Philippines and Indonesia, Cordlife operates the largest private cord blood banks and we are amongst the top 3 market leaders in India and Malaysia. Through our majority-owned subsidiary in Malaysia, Stemlife Berhad, we own an indirect stake in Thailand’s largest private cord blood bank, Thai Stemlife. Cordlife has also established a presence in Myanmar, Vietnam, Macau, Brunei and Bangladesh.

- While we have managed to establish our position in Asia, we are also looking to strengthen our market position and expand our footprint beyond the current markets. We aim to deepen the penetration of our banking services in each market and increase revenue contribution from the diagnostic and digital healthcare business segments.

3. How do you plan to expand your customer base?

- We believe in expanding our reach to potential clients while increasing touchpoints with existing clients. Before COVID-19, we have been active at trade fairs, baby expos and antenatal seminars in various countries. We have continued to increase our digital initiatives to better serve and empower clients, reach a wider audience of new clients and maintain our competitiveness in the industry.

- With COVID-19, we ramped up our digital marketing campaigns to capture business opportunities and held webinars to create awareness of our product and service offerings among consumers. Through social media platforms, we provide weekly and quarterly updates on cord blood, and cord lining related news, along with developments on stem cell utility and relevant industry news.

- In addition, we engage healthcare professionals regularly to keep them abreast on the latest developments relating to stem cell related topics, stem cell utility or related Cordlife services for doctors. We believe that such partnerships with hospital caregivers and medical institutions will increase the interest in stem cell therapy and the applications of stem cells.

4. Describe Cordlife’s financial performance over the past few years.

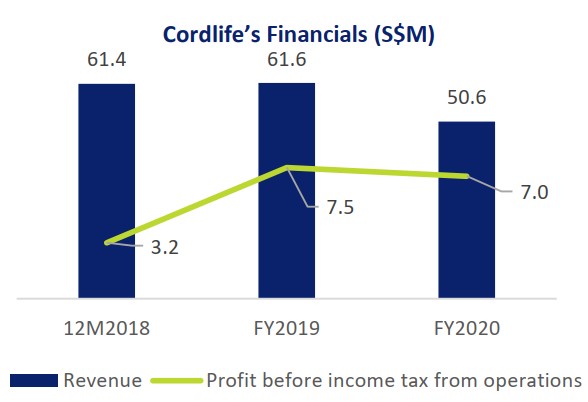

- The Group's total revenue remained relatively stable from 12M2018 to FY2019, mainly contributed by our banking and diagnostics segments. While banking revenue decreased in FY2020 as a result of COVID-19, while diagnostics revenue grew at a CAGR of 69% from S$0.9 million to S$2.7 million between 12M2018 and FY2020, mainly attributable to the increase in prenatal testing services.

Profit before income tax from operations grew at a CAGR of 49% between 12M2018 and FY2020. It increased 138.1% from 12M2018 to FY2019 partly due to a decrease in operating expenses contributed by improved efficiencies. FY2020’s profit before income tax from operations declined 6.7% as a result of the decrease in revenue and gross profit, offset by lower operating expenses and government grants mainly in Singapore of c.S$2.1 million. Advertising and promotion, travel and transportation expenses decreased during the year due to movement restrictions imposed on physical trade fairs and travelling.

5. How has COVID-19 impacted business and what measures were put in place to mitigate this?

COVID-19 has affected the demand for banking services and reduced the number of client sign-ups due to tightened consumer spending. The implementation of social distancing measures and closed borders also limited our delivery of services. However, we re-configured our business processes and implemented an electronic enrolment platform to engage with potential clients.

- We intend to leverage on our digital platform Moms Up to expand our reach to potential clients and increase touchpoints with existing clients. These online initiatives will allow us to reach a wider audience for awareness building, as well as reduce inefficiencies and costs in service delivery.

- With our staff, the Group will continue to observe necessary hygiene protocols and take precautions to ensure the safety of our staff and viability of operations

6. What are the key focus areas for Cordlife in the next 2-3 years?

We will continue to focus on increasing our product and service offerings in our key markets, especially under the diagnostic segment, to increase customer lifetime value. In order to remain agile and cater to a technologically-savvy market, we will continue to deepen our digital capabilities to improve our online customer experience, increase operational efficiency and reduce the costs of service delivery. As we continue building up the content base and the capabilities of Moms Up, we are confident that it can potentially generate new revenue streams for the Group in the future.

- Aside from driving organic growth, we are also constantly on the lookout for suitable merger and acquisition opportunities. We seek prospects that can return a synergistic effect, such as increasing our footprint and customer base in Asia, attain competitive advantages, achieve economies of scale or increase the scope of our services.

7. What are some growth drivers for a business like Cordlife?

Although the banking segment remains our main revenue driver, the contribution from the diagnostics segment has increased over the past three years from 1.52% in 12M2018 to 5.27% in FY2020. We believe that the diagnostics segment has significant growth opportunities, as we seek to increase product and service offerings.

- We have begun providing diagnostics services like non-invasive prenatal testing (NIPT), paediatric vision screening, newborn metabolic screening, and family genetic screening services. We believe that there is great potential in the market for NIPT. Fortune Business Insights forecasts that NIPT will grow at a CAGR of 17.8% from 2020-2027 to reach US$10.9 billion by 2027 from US$3.0 billion in 2019.

- Under the banking segment, penetration rates in countries like Indonesia, India and the Philippines are still relatively low. Therefore, we see huge potential for growth in these countries as healthcare spending by middle and affluent classes is on the rise. With increased utilisation and interest in stem cell therapy, we believe that the demand and value of our accredited banking services will continue to grow.

8. What are some of the risks for the business and how do you manage them?

- We noticed the trend of middle to upper class professionals living in the urban areas having fewer babies. Thus, we have increased our service and product portfolio to increase customer lifetime value. In particular, we enhanced our suite of services under the diagnostics segment and increased the product and service bundles offered to our clients.

- We have also been affected by economic trends such as the COVID-19 pandemic in early 2020, which brought about a global recessionary impact, tightening business and consumer spending. The implementation of social distancing measures reduced our ability to interact physically with potential clients. Nonetheless, we were able to pivot into conducting webinars and accelerated our implementation of an electronic enrollment platform.

9. What are some of the key ESG factors that are material to the Group? How do you address these factors?

- At Cordlife, we believe considerations for ESG risks and opportunities will enable us to create value for our stakeholders in the long run. Guided by ESG factors that are most relevant to our business and stakeholders, we have formulated four key pillars that are imperative to our business sustainability:

- Being the one right choice – Our business is rooted on governance excellence to be the one right choice for our customers. We uphold the utmost standards of integrity in our business and proactively monitor key risks to ensure business continuity.

- Caring for our customers – Our business is built on the trust of our customers and we endeavour to meet

- their needs. We do so by safeguarding their privacy, by ensuring excellence in quality and by proactively engaging them through various channels and initiatives.

- Caring for our employees – Our employees are instrumental to the success of our business. We work to safeguard our employees’ health and safety by providing a safe working environment.

- Caring for the environment – We pay attention to the resources our operations require, and aim to do our part to minimise the environmental impact our operations may cause.

10. What is Cordlife’s value proposition to its shareholders and potential investors and what do you think investors may have overlooked about it?

- The Group has been in operations since May 2001 and has built up a sizable customer base where we focus on adding more products and services to increase the customer lifetime value. We have established an extensive network of hospitals, clinics and doctors across our 11 markets which would allow us to cross sell our products and services, particularly diagnostic products through these networks.

- Furthermore, with penetration rates still relatively low in some of the countries that we operate in, we believe that there is still a huge potential for growth supported by increased healthcare spending from the progressive and rising middle and affluent classes. We will continue with our efforts to step up the awareness of our products and services in these markets.

- Cordlife is financially healthy with a strong balance sheet. As at 31 December 2020, the Group was in a net cash position of S$71.2 million. We will leverage on our strong cash position to prudently explore new opportunities that will add to our revenue and earnings growth.

10 in 10 – 10 Questions in 10 Minutes with SGX-listed companies

Designed to be a short read, 10 in 10 provides insights into SGX-listed companies through a series of 10 Q&As with management. Through these Q&As, management will discuss current business objectives, key revenue drivers as well as the industry landscape. Expect to find wide-ranging topics that go beyond usual company financials.

This report contains factual commentary from the company’s management and is based on publicly announced information from the company.

For more, visit sgx.com/research.

For company information, visit https://www.cordlife.com/sg/

Click here for Q1 FY2021 Business Updates

More articles on SG Market Dialogues

Created by MQ Trader | Aug 13, 2024

Created by MQ Trader | Aug 07, 2024

Created by MQ Trader | Jul 31, 2024

Created by MQ Trader | Jul 30, 2024

Created by MQ Trader | Jul 17, 2024

Created by MQ Trader | Jul 09, 2024

Created by MQ Trader | Jun 26, 2024

.png)

.png)