THE MOST UNDERVALUED DATA CENTRE AND SOLAR BENEFICIARY THAT HAS A POTENTIAL UPSIDE OF 400-500%! (UPDATED)

csan

Publish date: Wed, 28 Feb 2024, 12:00 AM

One company released their results 2 days ago which was extraordinary, showing record high profits, stunning cashflow generation and declared a surprisingly large dividend payout. From their results commentary and past guidance, it can also be seen that the company has delivered on their promises and the shift in strategy to penetrate certain industries have also started to bear fruit. These industries are also industries that are about to boom.

The name of the company is Powerwell.

What does Powerwell do?

Powerwell is the largest manufacturer of electric switchboards in Malaysia. What is a switchboard? In Powerwell's words, they describe the switchboard as an equipment that distributes and directs electricity from a main source to several circuits as well as protects power systems. In layman terms, the switchboard is like a 2-in-1 router and fuse.

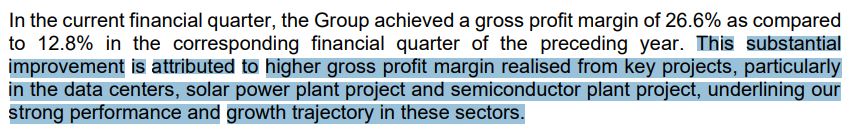

From the description above, it can be seen that switchboards are needed for any building or infrastructure that requires electricity. But why is Powerwell special? This is because they have shifted their focus from manufacturing and selling switchboards for normal factories/buildings to data centres and solar plants. Powerwell's management realised that these are the 2 industries that are booming and is going to get more explosive in the future, especially for solar power. Powerwell also mentioned that these 2 industries are high-value, high-margin businesses for them and they have proved it.

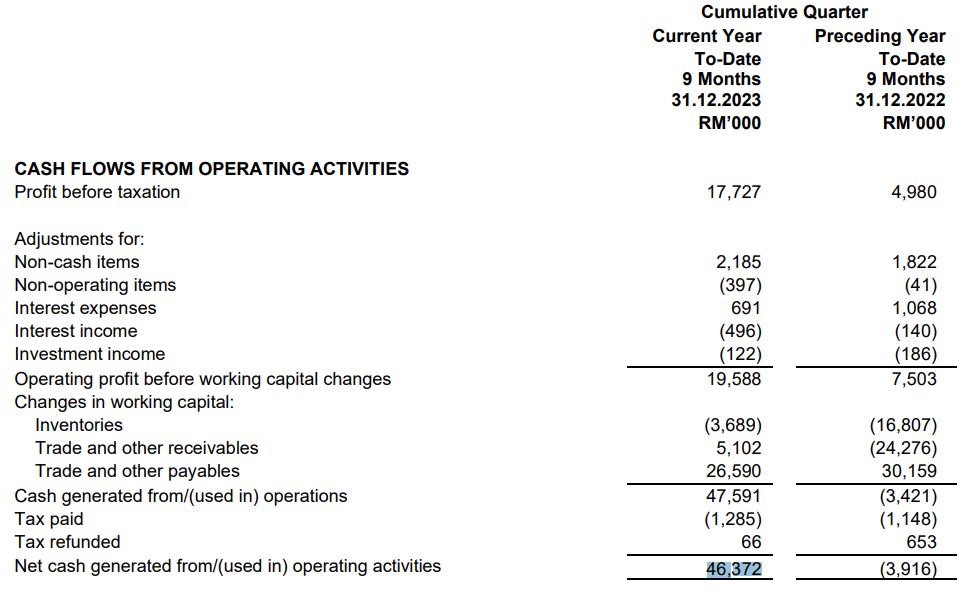

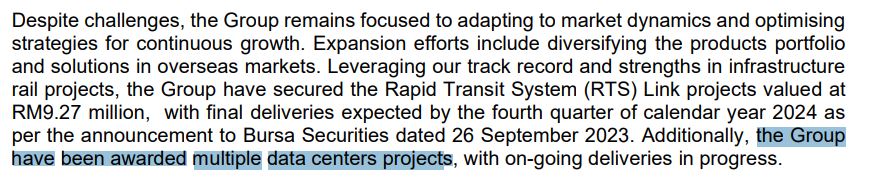

Powerwell released their quarterly results 2 days ago and they reported numbers which stunned the market. As seen below, their profit was at an all time high and they also recorded a mind-blowing operating cash flow of RM46 million for the 9-month period! In the commentary section, Powerwell also guided that they have been awarded multiple data centre projects and will have stronger financial performance with continued high-value project deliveries.

What is also special about Powerwell is that the management has delivered on their promises. It is very rare for companies in Malaysia or developing Asia to guide the market honestly. One year ago, the executive director of Powerwell, Catherine Wong (Wong Yoke Yen), gave an interview to The Edge. Among other things, she guided that:

1. They want to venture into Pakistan and Bangladesh, two markets where they are bidding for a lot of jobs.

2. They are going to penetrate into the data centre and chipmaking industries.

3. They are going to get business from the EV charging and solar power industries.

4. Expand into Indonesia with a new assembly plant.

5. They intend to transfer to the Main Market of Bursa Malaysia.

One year later, Powerwell has achieved the first 4 and it is almost certain that they can qualify for transfer to Main Market when they report their 4th quarter results in 3 months time as their cumulative net profit for the past 3 years is at RM17 million (RM20 million needed to qualify for a transfer).

The link to the article:

https://www.optionstheedge.com/topic/people/executive-director-powerwell-catherine-wong-played-key-role-listing-company-bursa

How to value Powerwell?

It is very difficult as there are no peers which manufacture switchboards. The closest is ACO Group Berhad but they are a just distributor of switchboards and command lower profit margins compared to Powerwell which manufactures them. Another comparable that we can take is UMS Neiken, the famous switch manufacturer. How are both ACO and UMS Neiken valued? They are valued at 18-28x PE. Applying these PE multiples to Powerwell's annualised quarterly profit (RM9 million x 4), Powerwell should be valued at RM1.12-1.74. If we were to be conservative and ignore the higher PE multiple of 28x, Powerwell will still have an upside of 473% from today's share price of RM0.30.

A valuation of 18x is also easily achieved due to Powerwell's stunning cashflow generation and generous dividend payout. At a payout of 2sen for the 9-month period, this is almost 90% of net profits. With the 2 sen dividend declared, Powerwell will have a dividend yield of 6.7% at today's share price of 30sen. This is higher than nearly every company in the E&E space.

By next quarter, Powerwell is almost certain to be able to announce an application to transfer to the Main Board. It is a matter of time before the share price of Powerwell increases significantly to properly reflect their fundamentals, explosive prospects and a likely transfer to the Main Board in 3 months.

UPDATE: To all that sent me kind messages after reading my blog post and profited handsomely, i'm very happy for you. If you had bought at 30sen, you're sitting on gains of 37% now at 41sen. Powerwell may experience some share price weakness after dividend ex-date. Always remember to take money off the table every now and then and allocate money for the next gem or treat your loved ones to a nice meal.

More articles on Art of Investments

Created by csan | May 23, 2024

Created by csan | Apr 01, 2024

Created by csan | Nov 18, 2023

Created by csan | Mar 06, 2023

.png)