HUME is superior to MCEMENT

csan

Publish date: Thu, 24 Aug 2023, 10:19 PM

There it is. Hume released their quarterly results today. So did Mcement.

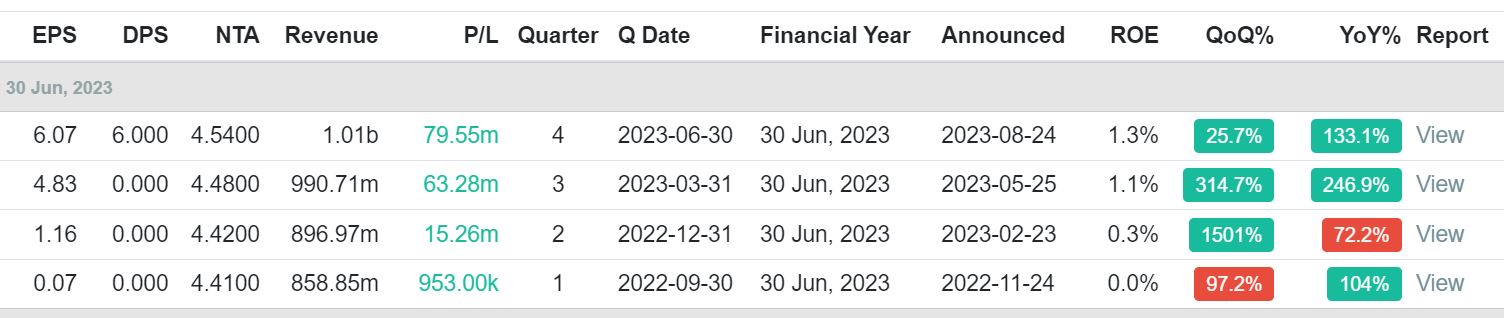

We can see that Hume achieved net profit margin of 15% this quarter. 3 months ago, they achieved 9%. Hume's performance below:

We can also see that Mcement achieved net profit margin of 8% this quarter and 6% in the last quarter 3 months ago. Mcement's performance below:

Why is this the case?

This is because many do not know that most of Mcement's sales are tied to fixed long-term contracts which only allow them to achieve a cost-plus margin. In other words, their selling prices will move together with cost. Their slight improvement in margins this quarter is because of higher sales volume which led to greater economies of scale. Mcement does not benefit much from the higher market prices of cement. Their fixed term contracts are mostly sold to the China contractor building ECRL and also to YTL's construction arm.

We can see that Hume's margins are almost double this quarter compared to Mcement. Hume's market share for cement is much less than Mcement but their performance is far superior because their sales are mostly sold to construction players with prices sold at near market rates.

Annualising the most recent quarterly earnings for both companies, we can see that Hume is trading at 6x PE while Mcement is trading at 16x PE. Hume is very much like Kerjaya Prospek in the construction space - small player but consistently higher margins than peers. This valuation gap will surely narrow and it is a matter of time before investors correct Hume's undervaluation.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Art of Investments

Created by csan | Apr 01, 2024

Created by csan | Nov 18, 2023