EXTREMELY UNDERVALUED GEM THAT COULD BE A TRIPLE BAGGER! (UPDATED)

csan

Publish date: Thu, 18 May 2023, 12:32 AM

I was writing on the final gem from the February results season when one company reported results 2 days ago which was so stunning that I almost fell off my seat. If I wait any longer to post on this company, I may be too late, so I will release my post on the February gem later and write about this company immediately.

The company that stunned everyone 2 days ago is Hume Industries.

What does Hume do?

Simple. They are one of the largest cement manufacturers in Malaysia. However, there are many young or new investors who are not familiar with the history of the cement industry in Malaysia. Many years back, there were 3 main cement manufacturers in Peninsula Malaysia - Hume, YTL Cement, Lafarge. When this was the case back then, they were killing each other with price wars. Only in 2015 and 2016, all of them made large profits because of strong demand for those 2 years. From 2017 onwards, the price wars intensified and all of them started making huge losses. In 2019, things started to change when YTL Cement bought Lafarge. The 2 combined companies is now known as Malayan Cement. Since then, things started to change as there were now only 2 main players instead of 3. Price wars ended and all of them started to make profits again. In fact, there were complaints from the construction industry in 2019 when both players started to raise selling prices because the 2 players started to control the supply in the market.

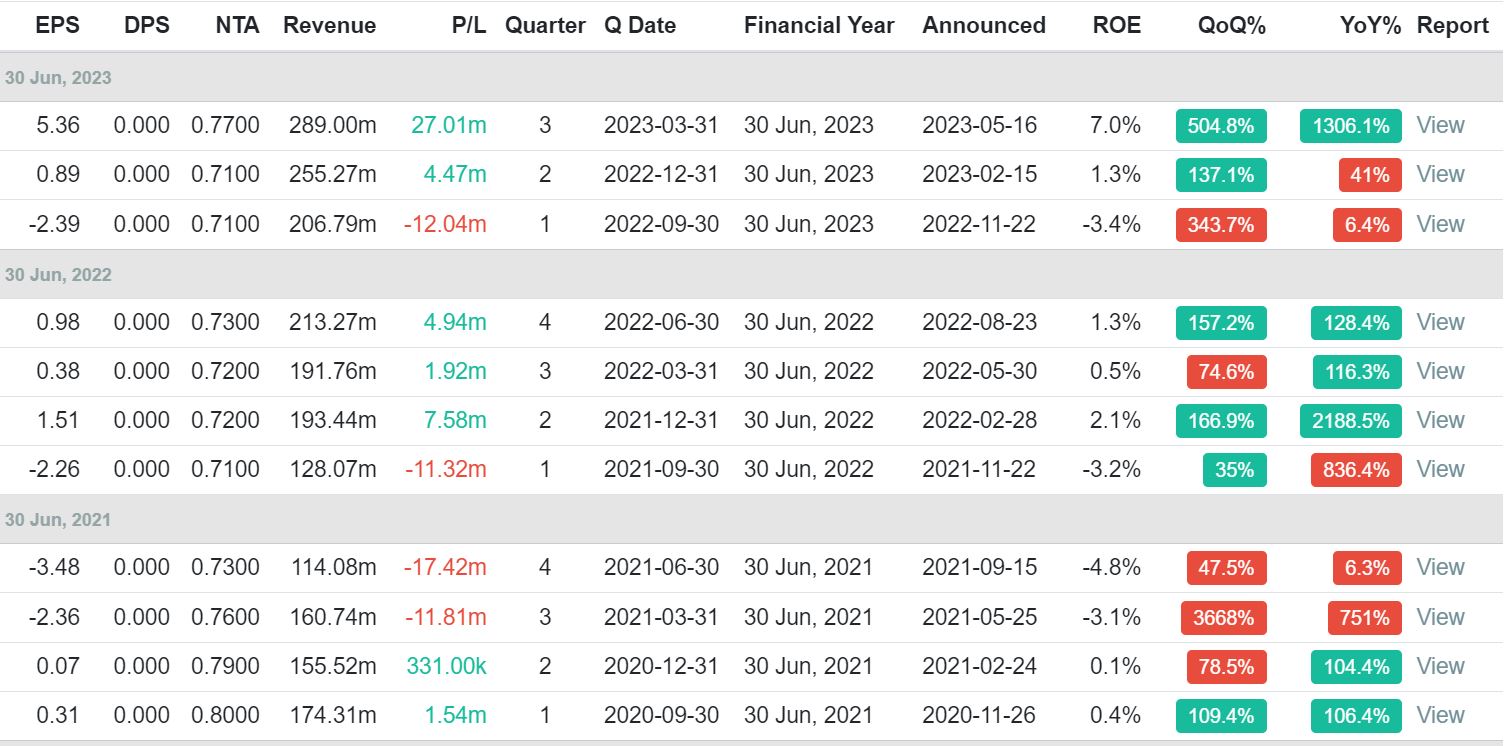

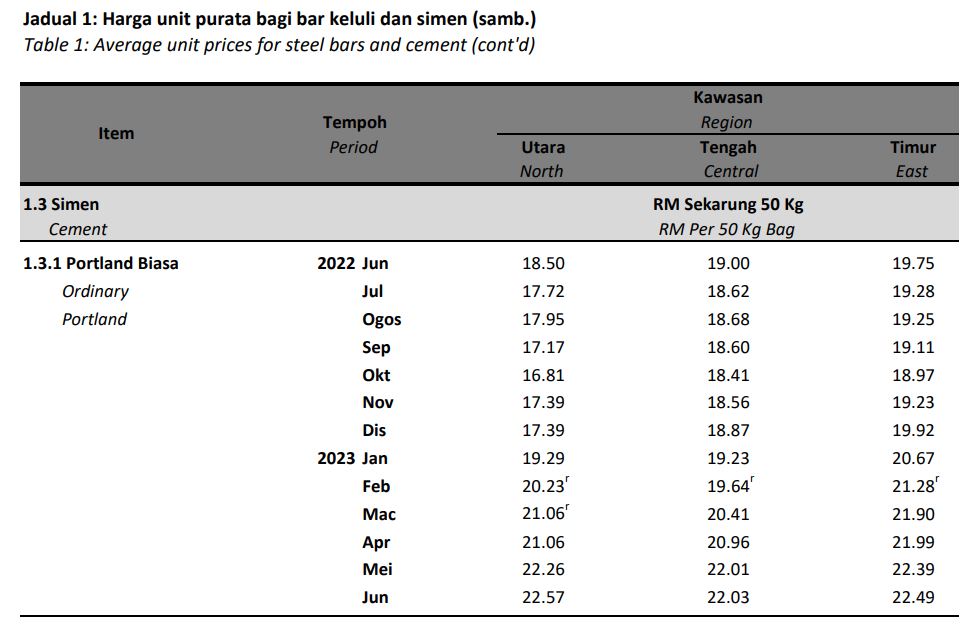

Unfortunately, Covid hit and the demand for cement fell as the construction industry suffered. In 2023, the economy has picked up again and the property and construction industry has started to heat up. With the significant increase in demand, the 2 players raised the selling prices for cement and this was reflected in the quarterly results released by Hume 2 days ago:

Can this profit sustain?

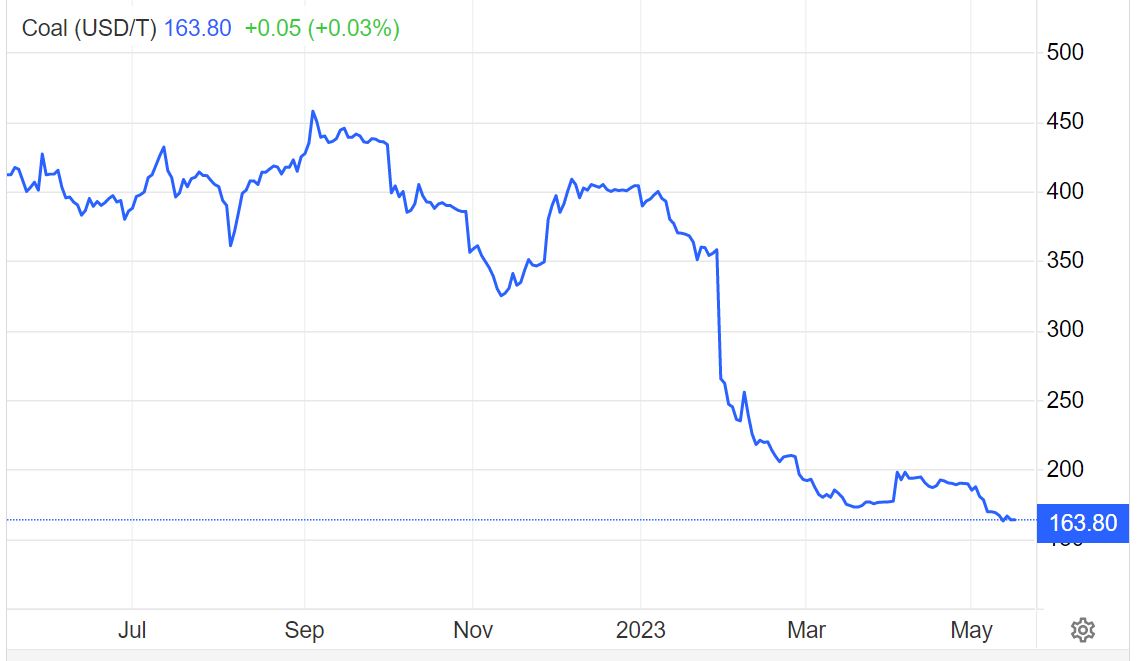

The answer is it will get even stronger. Cement prices have been increasing for 6 months in a row from October 2022 to April 2023. The results released by Hume reflected selling prices for Jan-Mar 2023. What many people don't realise is that April 2023 selling prices are even higher than March 2023. Not only that, the price of coal (one of the biggest cost components of cement players), have actually plunged. In short, selling prices are still increasing while cost of raw materials are plunging. Imagine what profits Hume and the other cement player will report next quarter and beyond! There are also hardly any mega projects going on right now. Imagine what will happen to the demand for cement and cement selling prices when mega projects like MRT3, RTS and Penang Transport Master Plan starts!

How to value Hume?

Usually, I would look at comparables. But this time, it is not advisable to do so because the other player, Malayan Cement, is trading at 54x PE! This just shows how undervalued Hume is. To value Hume, I would look at how Hume was valued back in 2015-2016 when the cement industry was doing very well. Back then, Hume was trading as high as RM3.92 when it was making RM20million profits. Back then, the cement stocks were the darlings of institutional investors and they were consistently trading at 20-25x PE. Using the lower end PE of 20x and annualising the latest quarterly profit, Hume should trade at RM4.28. This ignores the fact that Hume's profit should be even stronger than the RM27million that they posted 2 days ago. At the current share price of RM1.26, Hume is valued at an extremely low forward PE of 5.9x compared to the 20-25x in 2015 and 2016 when it earned lower profits and when there were 3 main players. In fact, I had been expecting a double limit up and it was very surprising that the share price retreated yesterday after opening at limit up, but it rebounded back strongly to close back at the limit up price. It was clear that some institutional investors have started pouring money back in to the 2 cement stocks. It is a matter of time before institutional investors realise that these 2 cement players are controlling the market supply and will once again be the darlings of the stock market just like Press Metal.

UPDATE: (17 November 2023) At today's price of RM1.95, those who bought 6 months ago would be making a handsome gain of 55%. Looking at cement prices, next quarter's profit should be similar or slightly higher than this quarter's RM48 million. I would suggest to take profit and look to invest elsewhere as cement prices seem to have stagnated and Hume doesn't look like they are willing to pay better dividends.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Art of Investments

Created by csan | Apr 01, 2024

Created by csan | Nov 18, 2023