ICON: This is why Yinson's boss bought the company. He bought it at a steal!

csan

Publish date: Mon, 01 Apr 2024, 02:20 PM

Last week, Ekuinas announced that they had sold a 50.2% stake in Icon Offshore to Liannex Maritime at 63.5sen/share. Liannex is owned by Yinson's boss Lim Han Weng. This deal valued Icon at RM344 million.

Many people would have asked why he wanted to buy Icon given that their profits currently are bad. However, if you were to look closely at their financial numbers, you will realise why he bought Icon. And you would also realise that he bought it at a crazy low valuation.

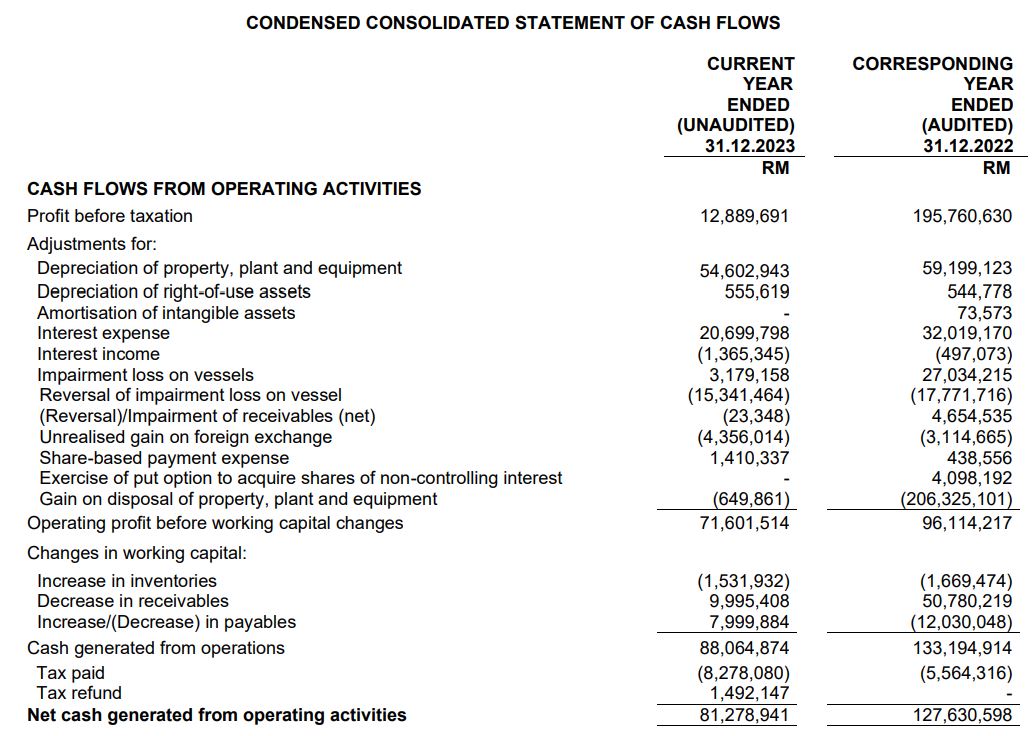

In the latest quarterly results, we can see that Icon posted a core loss of RM14 million (net profit minus reversal of impairment and unrealised gains). However, many did not realise their stunning cashflow generation as seen below:

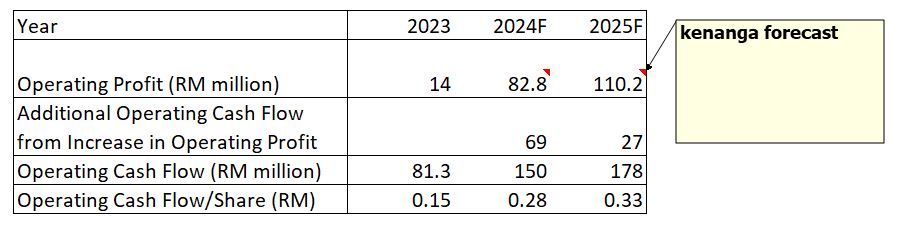

According to Kenanga's initiation report (https://klse.i3investor.com/web/staticfile/view/533751), Icon and the other OSV players are still reporting low profits because their vessels are tied to long-term contracts with Petronas that were signed many years ago during Petronas' austerity period when oil prices crashed in 2015. This is all about to change in the 2nd half of 2024 when their contracts expire and will be renewed at current market rates which are significantly higher than the rates in the old long-term contract. From the 2nd half of 2024, which is just 3 months away, Icon's profits are expected to surge.

In 2023, Icon generated RM80 million in operating cashflow. If we were to follow Kenanga's forecast, which i think is actually too conservative because Icon was making RM20 million profits per quarter in 2014, Icon's operating cash flow for 2024 and 2025 should reach RM150 million and RM178 million respectively. Now we can see why Yinson's boss bought into Icon. Within 2 years, he can already recover almost all his initial cost!

How to value Icon?

If we were to follow Kenanga's 2025 net profit forecast of RM44 million and take the 15-20x PE multiple which the OSV players traded at during the boom years in 2013 and 2014, Icon should be valued at RM1.22 - 1.62 per share. At today's share price of RM0.80, Icon has an upside of 53-103%.

Icon-WA is actually what investors should be targeting. It has 3 more years to expiry and at Icon's valuation of RM1.22 - 1.62, Icon-WA should be valued at RM0.395 - 0.795. At today's warrant price of RM0.20, Icon-WA has an upside of 98-298%.

Kenanga's profit forecast is likely too low given the severe shortage of OSVs in the market. But even if we take those forecasts, the upside is significant and the biggest winner will be Yinson's boss. Icon also pays out hefty dividends. They paid 5sen/year for the last 2 years and this is more than any other public-listed OSV player in Malaysia. It is a matter of time before the share price and warrant price of Icon increases significantly to properly reflect the explosive earnings growth of the company and industry which we will start to see in the 2nd half of this year.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Art of Investments

Created by csan | May 23, 2024

Created by csan | Nov 18, 2023

Created by csan | Mar 06, 2023