EXTREMELY UNDERVALUED OIL & GAS GEM THAT SHOULD EASILY DOUBLE!

csan

Publish date: Tue, 13 Dec 2022, 07:55 AM

After the November results season, there were 2-3 companies that posted extremely strong results and has become massively undervalued.

One company that posted extremely strong results is Perdana Petroleum.

What many investors did not realise is that the actual profit, or what the investment banks call as core profit, is actually almost double what was posted. More explanation will be provided below.

What does Perdana do? Perdana is a Sarawak government-linked OSV player. They charter Offshore Service Vessels (OSV) to upstream oil and gas players. Their main end-client is Petronas but their OSVs are mainly chartered to Dayang. During the oil and gas boom in 2014, OSV players all over the world over-invested in OSVs, causing a massive oversupply. This is why Perdana had been losing money over the last 7 years. With many OSV players around the world going bankrupt, the industry has downsized. At current oil prices, oil and gas players around the world like Petronas have been ramping up production and this has led to a shortage again in the OSV market. Read the article below on OSV charter rates and utilisation rates:

https://www.rivieramm.com/news-content-hub/rising-day-rates-utilisation-drive-rosier-outlook-for-osvs-73472

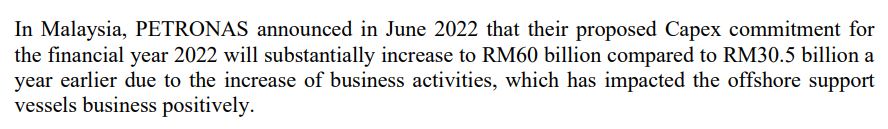

Also see what Perdana had written in their prospects section about Petronas' CAPEX:

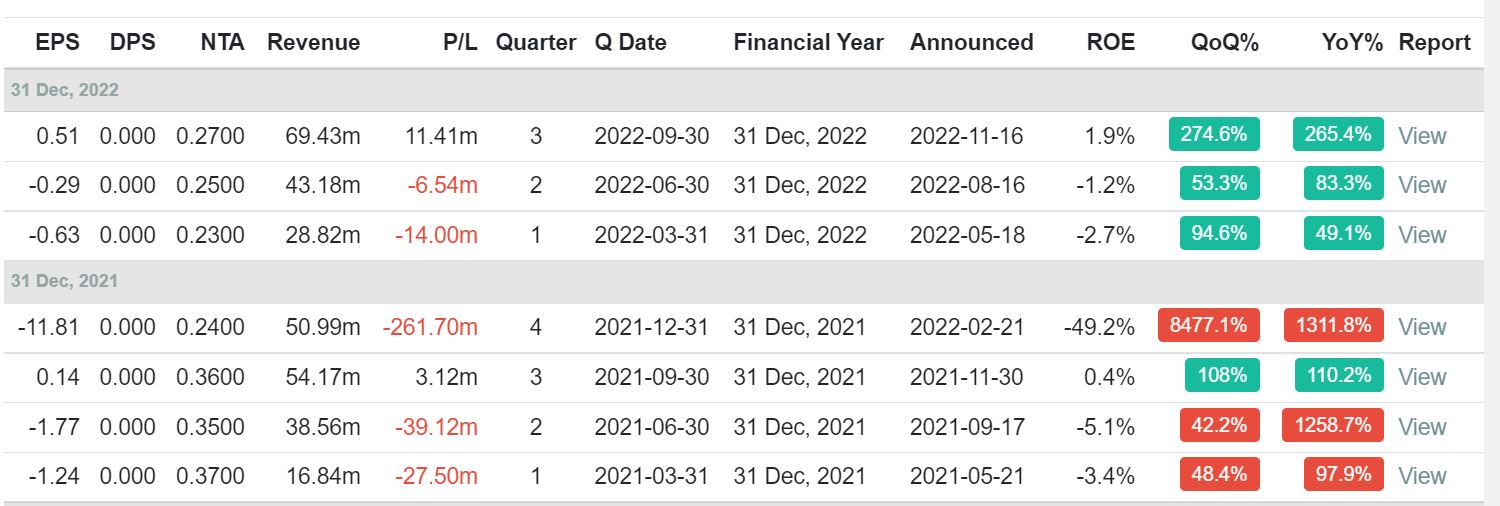

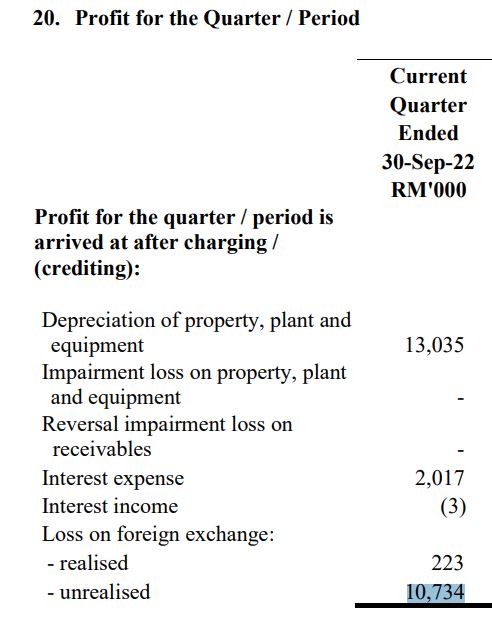

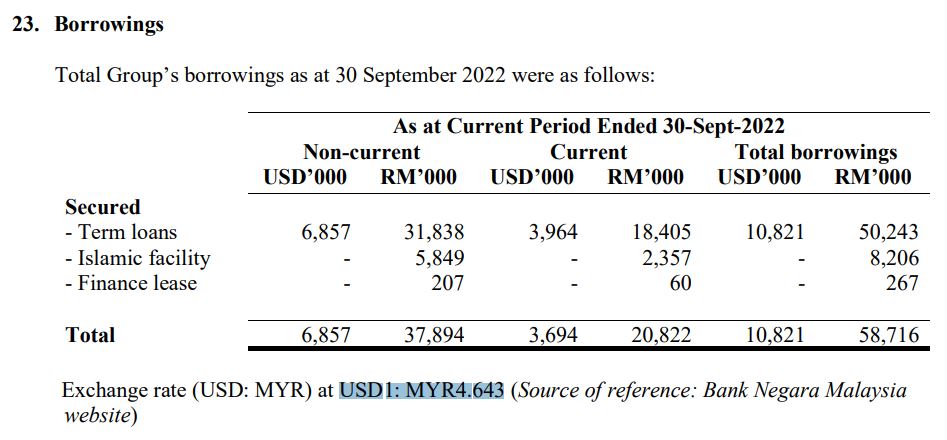

In the most recent quarter, Perdana reported a net profit of RM11.4 million or an EPS of 0.51sen. But is this their actual profit/core profit? It is not. Core profit excludes profits or losses that are one-off or unrealised. This is why it is called core profit, that is, the profit that is sustainable going forward. In the latest quarterly results report, it was disclosed that Perdana incurred an unrealised FOREX loss of RM10.7 million. Excluding this unrealised loss, Perdana's core profit would be RM22.1 million or EPS of 0.99sen!

How to value Perdana?

Since Perdana is now expected to return to its glory days with higher charter rates and higher utilisation rates, we should look at how Perdana was valued during its glory days in 2014. In 2014, we can see that Perdana was valued at around 12x PE. At a PE of 12x and an annualised EPS of 3.96sen (0.99sen x 4), Perdana is valued at RM0.475. Even if we try to be extreme and halve the PE multiple to 6x, Perdana will be valued at RM0.24. At the share price of RM0.13 now, Perdana should have a minimum upside of 85% but there is no way Perdana will be valued at 6x when they release their results next quarter showing a profit of more than RM20 million without any FOREX loss. At RM0.475, Perdana has an upside of 465%. It is a matter of time before the share price of Perdana reflects the significant increase in earnings and strengthening fundamentals of the industry.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Art of Investments

Created by csan | May 23, 2024

Created by csan | Apr 01, 2024

Created by csan | Nov 18, 2023

Created by csan | Mar 06, 2023