The Big Energy Crunch - Coal, Oil & Gas (Feat- $ARMADA, $HIBISCS, $YINSON, $DIALOG)

Shiba_Capital

Publish date: Wed, 06 Oct 2021, 05:44 PM

**Disclaimer: Everything posted here is for infomational purposes only and do not constitue any investment recommendations.**

Greetings from Shiba Capital again,

Due to heavy workload write-ups are delayed for a bit, hope everyone can understand.

Well, let’s jump right into the elephant in the room:

The Big Energy Crunch

**Intimidating intro**

It everywhere on the news where energy prices spike up in a crazy manner, the general public are scrambling for gas or petrol but does anyone really cares who’s the culprit behind ?

First of all, spring is coming and it only gets colder in the coming months as the world prepares for the coming winter season. Therefore, European countries like Russia, Germany, the Netherlands are cutting down supply and raising inventories.

On the same passage, cold weather has also bring effects to generation of electricity as India also faced their version of energy crunch, but not at a huge scale yet

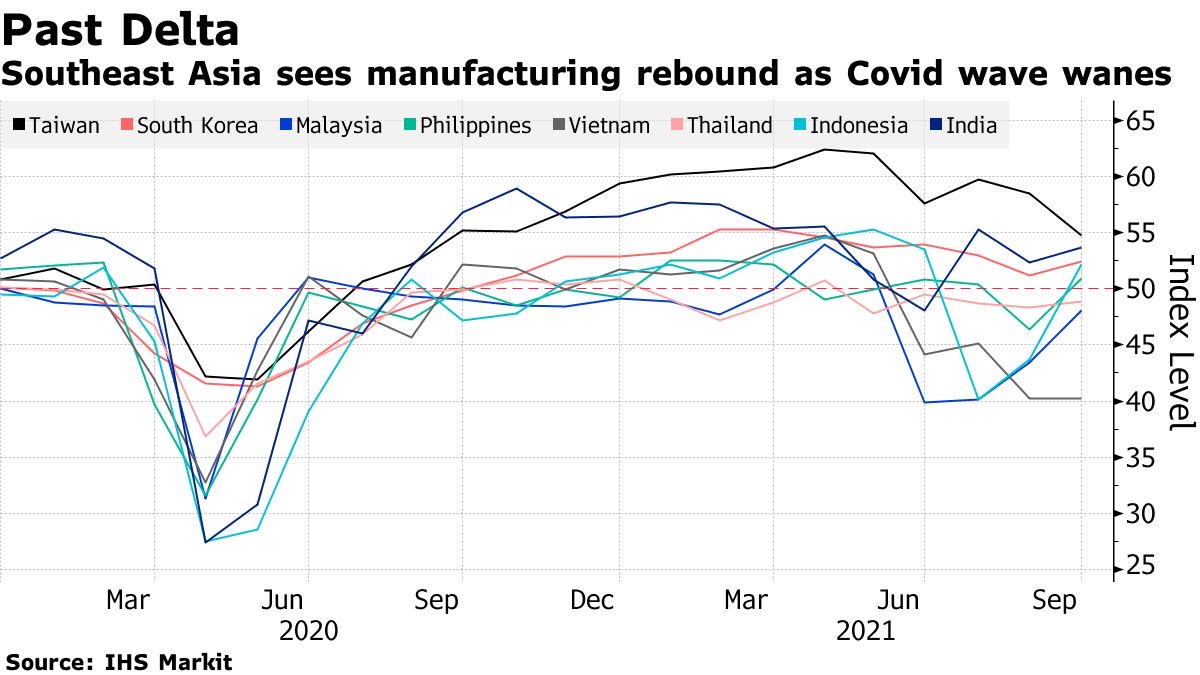

Second point, the recovery of the global manufacturing hub. Southeast Asia has been playing a huge role in the global supply chain, with recoveries from the Covid-19 impact in Malaysia, Vietnam, Indonesia etc. Power demand is off the charts with companies scrambling to complete their contracted work and proceed with the huge backlogs.

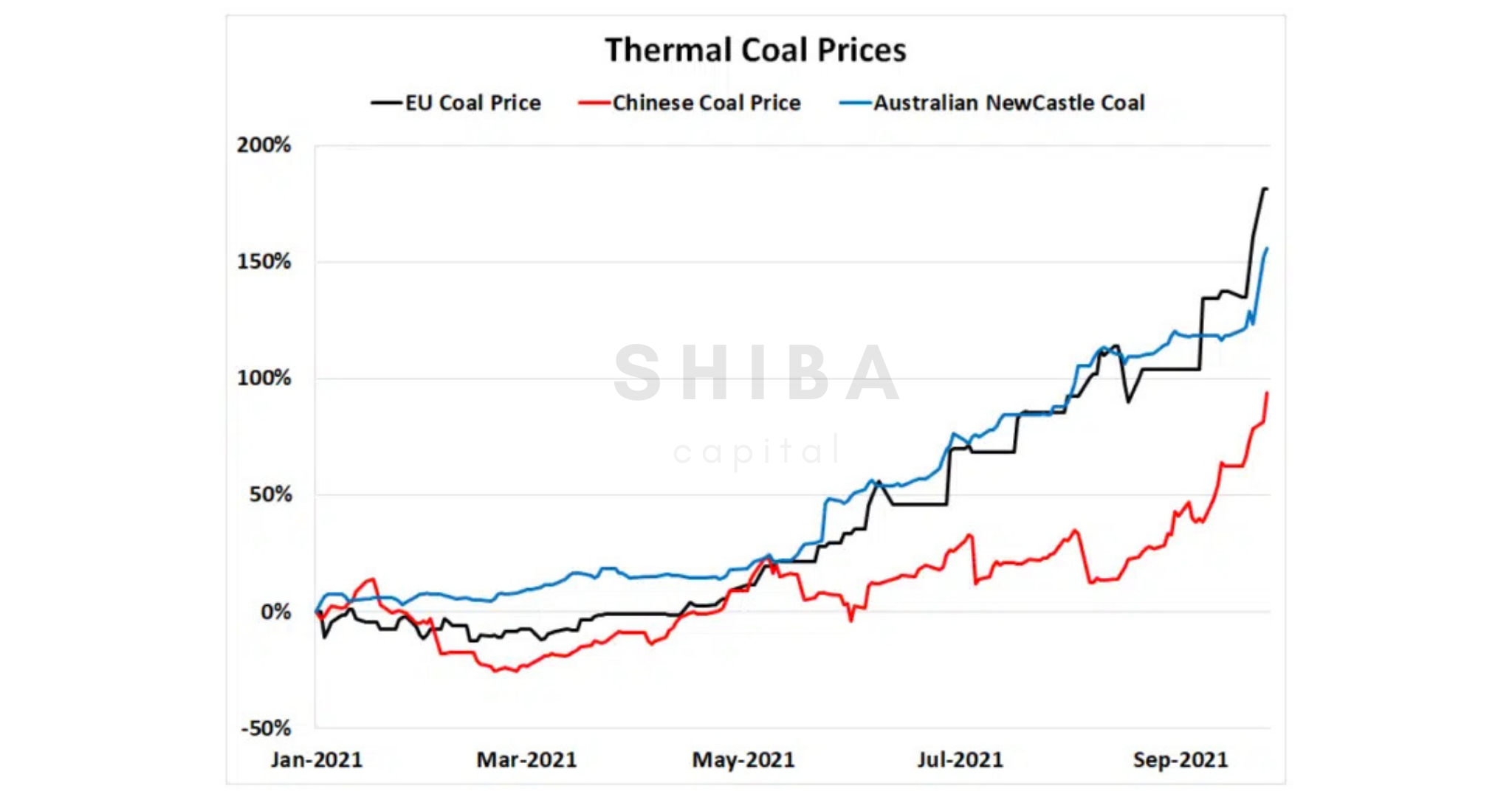

While China, the “dragon head” of manufacturing is also having a hard time. Shiba Capital previously covered China’s energy issues at: https://klse.i3investor.com/blogs/shiba_capital/2021-09-27-story-h1591781013-China_Indirectly_Hits_the_Tech_Giants_with_Energy_Crunch.jsp

As you may have known China still heavily relies on coal as their main source of power supply, therefore the prices are also skyrocketing:

Worldwide suppliers are now praying for the weather to be warmer this upcoming winter as it is too late to expand supplies. While the pressing issue is that the current largest shipment export country is the United States and countries with largest inventories are Russia and Iran. Well, the geopolitical stress will be intense.

Shiba readers knew that Shiba loves charts and how can we forget about them.

There are some interesting charts in the Energy industry which we are going to cover:

$YINSON

Firstly will be Yinson. The stock has been in a downtrend until only recently where you can see Bull Snorts coming in with huge volume bars. This is definitely a name to put on your watchlists if you have not. Great fundamentals and competent management. But looks extended at the moment, could probably present a lower risk entry point later.

$HIBISCS

The household name for oil stocks in Bursa. Broken out from a big base starting in early 2021, while we are interested to see whether the breakout holds. Personally, would like more volume to make it work.

$ARMADA

Poor man’s version of Yinson and Dialog due to its relatively lower stock price. Resembles Hibiscus’s chart quite a lot despite operating in different areas of the crude oil industry. Has yet to breakout at the moment, but more liquid and stronger compared to other energy stocks in Bursa.

WHY DOESN'T MY COUNTER FOLLOW THE OIL/STEEL/ALUM/FCPO (insert anything here*) PRICE?

Another topic Bursa investors have been raising is: How come oil prices, or any commodity prices are rocketing but our local linked or directly beneficial stocks are not as strong ?

Take note, one cannot expect the companies to trade exactly like what the underlying commodity is doing. A single company’s stock price incorporates all the possible factors like the management, company’s financials, local operating environment, government policies in place etc.

Of course, a certain degree of correlation between the two is definitely present and will drive stock prices, but not in a mirror image way.

(P.S. Weekly chart is used for a better presentation.)

As seen, Bursa’s energy stocks are way weaker than the crude oil price itself which Shiba believes is not new for fellow readers now.

Another example, the recently hot topic: palm oil. The chart says it all, will be divergence improve in the near future, we shall see.

Thanks all for reading. Hope everyone is having a great time and invest safely. Cheers.

Follow our Telegram for latest updates and infos @shibacapital.

can join our facebook too : Shiba Capital

More articles on Shiba Capital

Created by Shiba_Capital | Sep 26, 2021

Created by Shiba_Capital | Sep 20, 2021

Created by Shiba_Capital | Sep 19, 2021

Created by Shiba_Capital | Sep 15, 2021

Created by Shiba_Capital | Aug 01, 2021

.png)