[Logistic] Industry that sneakily performing well

Shiba_Capital

Publish date: Mon, 16 Aug 2021, 04:32 PM

**Disclaimer: Everything posted here is for infomational purposes only and do not constitue any investment recommendations.**

Container shipping, BDI thrives amid pandemic

As tech stocks are getting the spotlight, some logistic counters are still performing relatively well in recent QRs including $TASCO and $MAYBULK.

Container Shipping Rates

Globally, container shipping rates are blowing out to never before seen levels amid continued chaos due to supply-demand shortage. The cost of container freight has more than quadrupled from 2020 as market demand outstripe supplies and because of shortage of containers, owing to congestion in Europe and the US recently.

Not to mention, China recently closed a major container terminal at the Port of Ningbo-Zhoushan after a dock worker tested positive for COVID. This is the 3rd largest container in the world, and this shutdown makes an already bad situation much worse.

The consequences of the shutdown are already apparent.

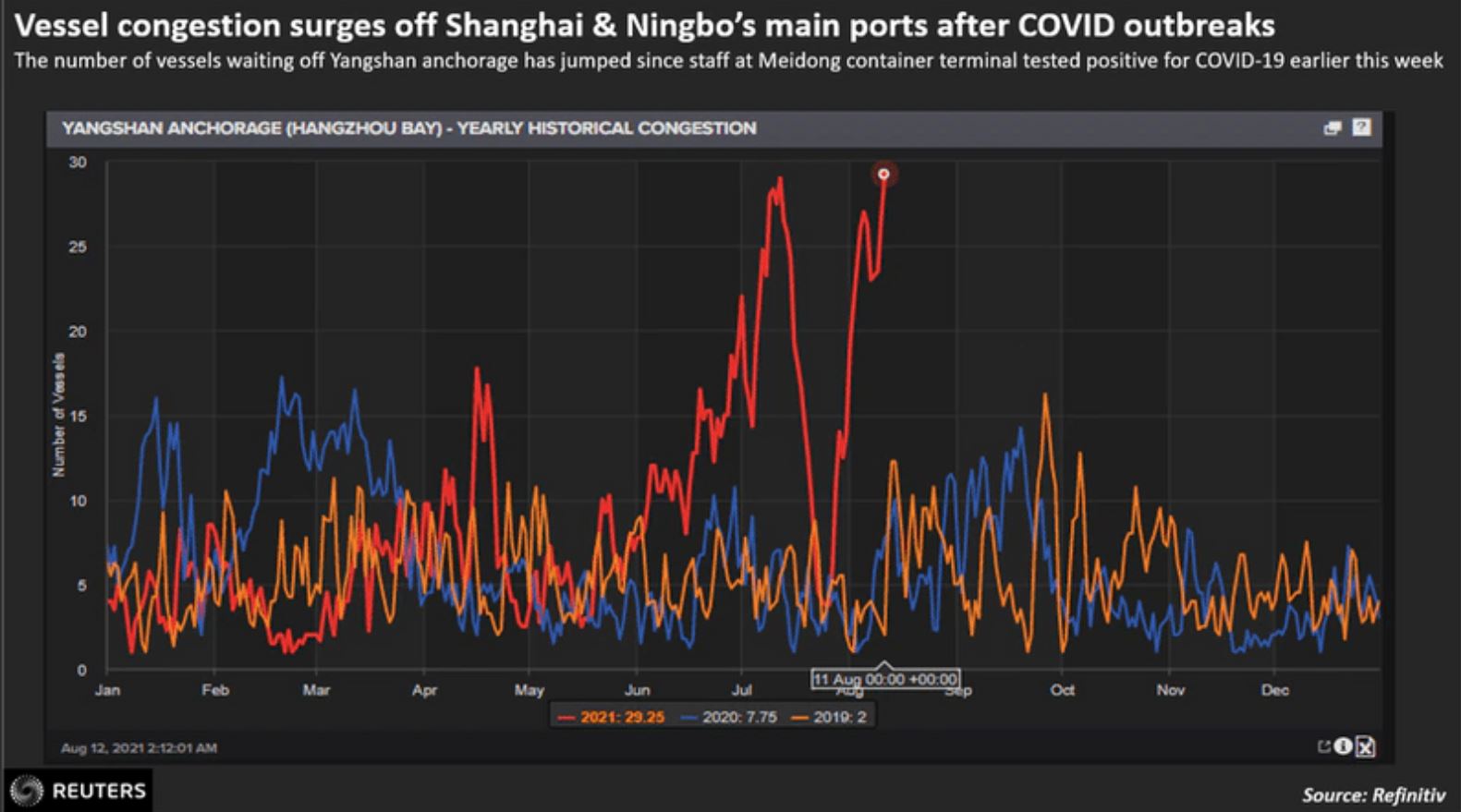

Don't be intimidated by the zippy zappy lines. This chart shows more vessels are waiting on anchor at the Yangshan port, a key container terminal in Shanghai, as vessels are being rerouted. Higher means more congestion.

“This will affect imports as well as exports. September is usually the peak month for exports, and the experience from Yantian port’s congestion tells us that clearing the ensuing freight congestion could take at least 4 weeks” said the regional head of research at ING.

“This could affect the delivery of goods for Black Friday shopping in the west”. Added Carnell.

Considering around 25% of capacity at China’s 3rd busiest port just closed down, just as Black Friday and Christmas are coming, things don't seem likely to be calming anytime soon.

Baltic Dry index

Meanwhile, BDI also hit a decade high on China port closure.

The port at Zhoushan is also important for imports of commodities like crude, gas and coal. Australia could be hit hard by this.

These disruptive developments pushed the BDI to its highest since June 2010 on Thursday. Another reason is that the dry bulk market continues to be tight.

In a recent interview with a dry bulk player in Malaysia, the CEO mentioned that the scrapping of older ships and the decline in new ship orders in the last 10 years had led to the current supply tightness. Traditionally, it takes about 2 years to build a ship.

In addition, steel prices have gone up so much that most shipowners will just wait and see how the situation evolves. If we were to order new vessels now, steel cost alone would result in 15% increase in vessel prices.

Shares of shipping companies across the world rose, with COSCO shipping in Hong Kong shares closing nearly 9% higher. Hamburg-based Hapag Lloyed jumped 5.8% and Nasdaq-listed shares of AP Moeller-Maersk rose 2.4% overnight on Thursday.

Although the hike in prices are most obvious from Asia to Europe and the US, rates for intra-Asia routes have gone up as well.

This will be beneficial for local local shipping companies including

$TASCO, $MAYBULK, $HARBOUR, $SYSCORP, $FREIGHT and many more.

Let us know which topic you want to learn more about and we might feature it soon.

Come join our telegram at : https://t.me/shibacapital

Come join our facebook at: Shiba Capital

More articles on Shiba Capital

Created by Shiba_Capital | Oct 06, 2021

Created by Shiba_Capital | Sep 26, 2021

Created by Shiba_Capital | Sep 20, 2021

Created by Shiba_Capital | Sep 19, 2021

Created by Shiba_Capital | Sep 15, 2021

Created by Shiba_Capital | Aug 01, 2021

Gongku

guess my lazada will be stucked at china ...

2021-08-16 20:28