Shiba Capital

Macro-roni of the week- Commodities (Alum & LNG), Semiconductor index SOXX

Shiba_Capital

Publish date: Wed, 15 Sep 2021, 02:38 AM

Covering some macros. Its more important than you think despite boring!

Commodities

1. Bloomberg Commodity Index closed at all time highs yesterday, gains mainly led by Aluminum and Natural Gas. Mainly due to supply concern issues, as we are heading towards to end of year, supply worries are more to come.

Semiconductor

2. SOXX also notched an all time high yesterday despite weakness in Nasdaq and FAANG names. Defintitely one to monitor as Malaysia's tech industry is highly reliant on semiconductors

Tax the rich!

3. US Democrats are planning to increase corporate tax rates (top bracket) to 26.5% which is lower than Biden's original proposal at 28%. For context, pre-Trump era has a 35% corporate tax rate.

Furthermore, top individual tax rates are proposed to hit 39.6%, while capital gains tax at 25%, up 5%.

Correction imminent?

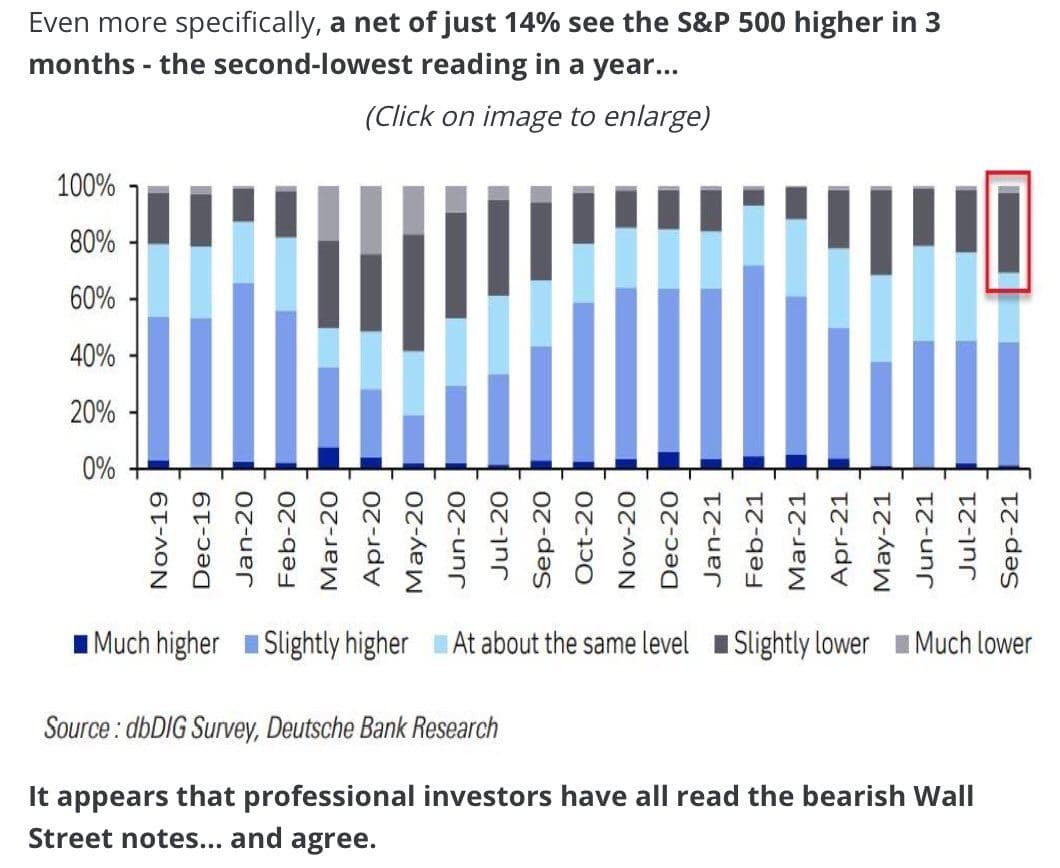

4. Deutsche Bank's survey found professional investors (68% of respondents) are expecting a correction larger than 5% in equity markets by year end. Does the major concensus materialise this time ?

Thats all for this week folks. Help us share if you liked it, more contents to come.

Cheers.

More articles on Shiba Capital

The Big Energy Crunch - Coal, Oil & Gas (Feat- $ARMADA, $HIBISCS, $YINSON, $DIALOG)

Created by Shiba_Capital | Oct 06, 2021

Quick recap of what happened this week! *Full of Volatility and excitements*

Created by Shiba_Capital | Sep 26, 2021

What happened to Evergrande and its impacts to the steel industry

Created by Shiba_Capital | Sep 20, 2021

Weekly Recap - $SCIENTEX, $JAKS, $KGB, $GREATEC, $QES, $TOPGLOV & 5G

Created by Shiba_Capital | Sep 19, 2021

JHM , D&O. [Educational] Lets understand JHM and difference between JHM and D&O.

Created by Shiba_Capital | Aug 01, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments