What happened to Evergrande and its impacts to the steel industry

Shiba_Capital

Publish date: Mon, 20 Sep 2021, 12:05 PM

**Disclaimer: Everything posted here is for infomational purposes only and do not constitue any investment recommendations.**

Quick recap of the Evergrande saga

(Everyone would have known this incident)

Who is Evergrande:

China’s number 2 real estate developer Evergrande, which is also number 122 in the Fortune Global 500 list has racked up 1.95 trillion in debt.

Trigger Point:

1st - GuangFa Bank (廣發銀行) froze Evergrande’s deposits of 132 million RMB.

2nd - Hang Seng Bank (恆生銀行) and Bank of East Asia (東亞銀行) suspended new mortgages for 2 new projects in Hong Kong.

Significance:

As Evergrande started to default its bond, investors are losing confidence in China’s high yield bond market.

KraneShares Asia Pacific High Yield Bond ETF (KHYB:PCQ:USD) is just inches away from the Covid lows back in March 2020. If this continues, the whole high yield market especially for cash-strapped China real estate developers will collapse.

At this point, you must be thinking how this can impact our local markets.

Remember earlier this year, everyone is talking about how local steel companies are being benefitted from the expansion and recovery in China’s economy post Covid. Things are quite worrying now.

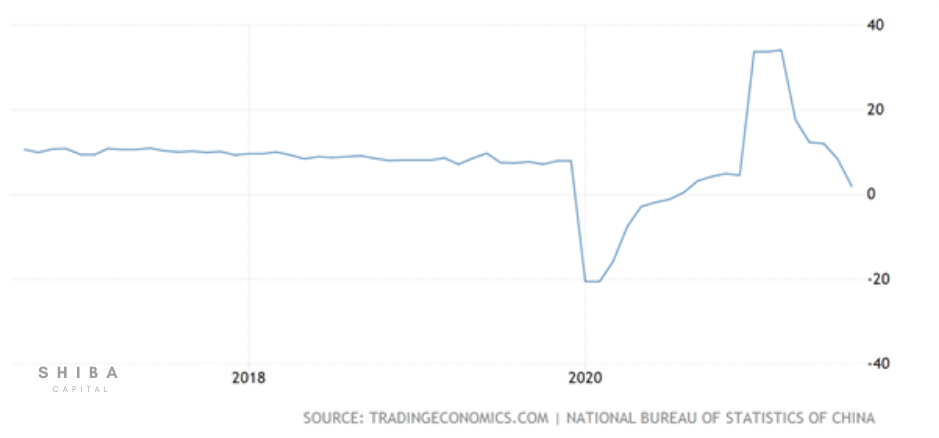

China’s retail sales shrank more than expected in August 2021, only up 2.5% YoY from August 2020. This means that despite China’s output level has returned to pre-Covid levels, but consumers are not able to take in all the supply and unwilling to spend as how they would previously.

This is something you should pay attention to if your invested companies have a meaningful business operations exposure in China.

The steel industry:

The real estate industry highly correlates with the steel industry as it serves as a necessity for building materials.

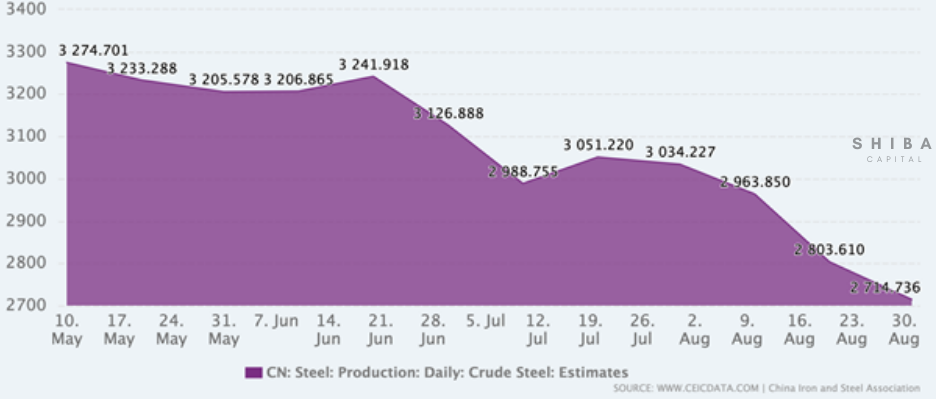

China’s daily steel production has decreased significantly as depicted above due to output cuts by the government. However, the price uptick might be limited due to easing of iron ore prices and impact from slowing property market. By mid September, the recovery of infrastructure construction has remained milder than a year earlier, some steel traders said.

The ripple effects are well observed in related:

Let’s first take a look at miners.

Rio Tinto. World’s second largest mining corporation.

Fortescue Metals Group

BHP Billiton

And now steel companies

United States Steel Corporation

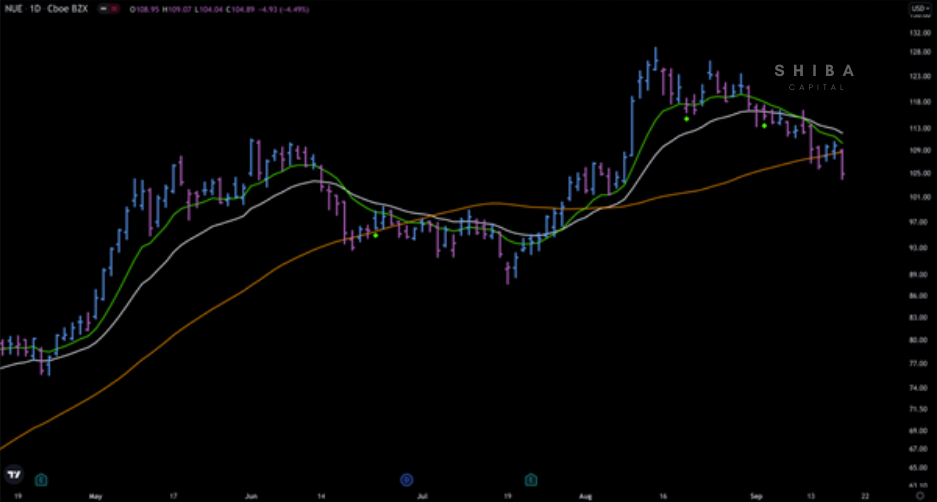

Nuecor Corporation

ArcelorMittal

In short, steel companies are not in a major downtrend per se, but they are definitely showing cracks in their charts and not trending as strong as few months ago.

In terms of the Malaysian peers, there are not much clues to be seen for now but definitely interesting to see developments in the next few weeks.

Hope everyone liked the short report above.

And always follow us at @shibacapital on Telegram.

can join our facebook too : Shiba Capital

More articles on Shiba Capital

Created by Shiba_Capital | Oct 06, 2021

Created by Shiba_Capital | Sep 26, 2021

Created by Shiba_Capital | Sep 19, 2021

Created by Shiba_Capital | Sep 15, 2021

Created by Shiba_Capital | Aug 01, 2021

Discussions

What a LOAD of $%#$#@#%@ . Evergrande is a BIG developer. It does NOT mean that THEY consume LOTS of Steel for Housing Construction. For your info... Houses in China are Reinforced Concrete Structure. With Infill Bricks. As such ONLY steel reinforcement (An expensive item)are for the Frame and Floor . A TYPICAL house of 1200ft2 consumes about 2.3 to 3.3 tonnes of steel. Assuming they have in construction 50,000 units per year. 50,000 x 2.8 t = 140,000t. Which is "Peanuts" of the Total steel production. Civil Works ( Highways, Railways. Power stations, etc ) are the Major Consumers of STEEL. NOT HOUSING !!!!!! There are People who are Professional QS who does such analysis. Info :- " Steel Production in China decreased to 86800 Thousand Tonnes in July from 93900 Thousand Tonnes in June of 2021" ... https://tradingeconomics.com/china/steel-production. ..... THUS ------ 140/ 86800 = 0.0016. Or 0.16% ( Peanuts !!! ) Wastage in Civil Works is already ~ 2 to 4% !!!!!!!!!!

2021-09-20 16:11

When I saw below fellow said 50k units, I laugh until I fall under the chair.

MuttsInvestor said "Assuming they have in construction 50,000 units per year"

Judging from his statement, he has little tiny brain, period.

Here more reliable, a report released by CICC said "13mn housing units completed in 2013"

Report presented at the International Symposium on Housing and Financial Stability in China. Hosted by the Chinese University of Hong Kong, Shenzhen

Shenzhen, China─December 18-19, 2015

2021-09-21 17:53

The reports are cooked up by IMF/WorldBank Chinese agents.

https://www.youtube.com/watch?v=10KrBjlpH_Q

2021-09-21 18:03

Don't believe US mainstream media! China is not US! Ccp will takeover if Evergrande indeed face trouble!

2021-09-21 18:05

DickMe3@ https://www.youtube.com/watch?v=10KrBjlpH_Q

21/09/2021 6:03 PM

WION is channel from India , due do conflicts of interest so India and China are in opposite direction most of the time .Therefore the information provided may not be true.

2021-09-21 19:00

When the report is ugly and presumably not in one's favor, then it's 'cooked up'. And the usual boogeymen are responsible.

2021-09-22 17:41

Gongku

Thanks for the sharing!

2021-09-20 14:45