Hektar REIT is trading at its 52-week low – Is it a Good Bargain?

James Yeo

Publish date: Fri, 23 Jun 2017, 12:07 AM

Since April 2017, Hektar REIT (KLSE: 5121) has undergone a 12.2% drop in its price. It is currently priced at MYR 1.44, as of 13 June 2017 – a 52-week low!

With such a huge drop, will it be a good time to buy into it?

Read on to find out our analysis!

Hektar REIT’s Profile

Hektar REIT’s portfolio consists of five well-established shopping centres in various states on the West Coast of Peninsular Malaysia.

The REIT is in the midst of acquiring another mall in Segamat, Johor, which is expected to complete in 2Q17. Upon completion, the enlarged portfolio will have approximately 2 million square feet of retail space.

The main bulk of its revenue comes from Subang Parade and Mahkota Parade. The two malls account for 42% and 30% of its net property income (NPI) respectively.

Profitability

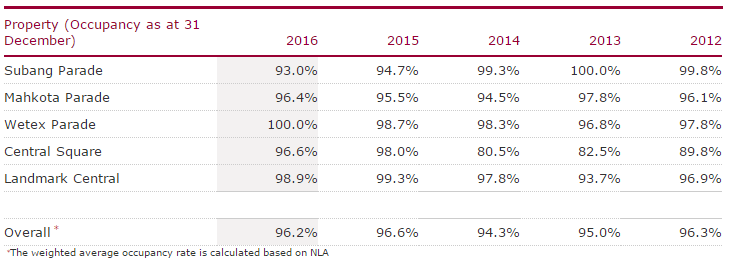

A quick look at its occupancy rate shows that 3 out of its 5 shopping malls have been losing its tenants from 2015 to 2016. As such, its overall occupancy rate has fallen slightly from 96.6% to 96.2%.

In 2016, Wetex Parade has achieved a remarkable feat – a 100% full occupancy rate! However, it is worth noting that the mall contributes to only 12% of the REIT’s gross revenue.

For its traffic flow, overall number of visits has also dropped by 1.6% from 30.6 million in 2015 to 30.1 million in 2016. Both Subang Parade and Landmark Central have faced a decrease in traffic. As such, the REIT aims to implement major asset enhancement for these two malls in 2017.

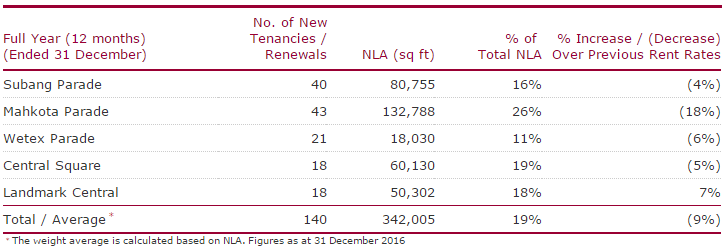

To add on to the challenges ahead, average rents for Hektar REIT decreased by 9% for the year ended 31 December 2016.

This will serve to be a huge blow for future income, which may impact unitholder’s distribution.

This can be seen in its latest 1Q17 results where net property income was down by 5.3% over the corresponding period due to higher operating expenses.

Chief Executive Officer, Dato’ Hisham bin Othman has this to say, “We have just received the approval from Bursa Malaysia on the proposed listing of Rights Issue to part finance the said acquisition, and we are working towards completing the proposed acquisition by September 2017.”

In our opinion, the Rights issue is probably what makes investors ‘run for their lives’.

REIT Distribution

The distribution policy of Hektar REIT is to distribute at least 90% of its net income for the full financial year to its unitholders.

As such, based on Malaysia’s tax system, the REIT is able to be exempted from the 25% income tax.

The distribution is declared and paid out on a quarterly basis, with the next distribution payment on 22 June 2017.

Its latest DPU stands at 2.30 sen, an 11.5% decrease from 2.60 sen the previous period. Annualized it and you get 9.2 sens, equivalent to 6.4% dividend yield.

Challenges Ahead

At its current price at its 52-week low, can Hektar REIT turn around in the coming future?

A look into the rest of 2017 reveals an imminent challenge. From the table below, 56% of its rental income is at risk as 207 of its tenancies will expire at the end of this year.

From its tenancy mix, the main bulk of rental income comes from fashion and footwear, followed by food and beverages. These two categories account for 22% and 21.6% of the REIT’s rental income.

In the upcoming future, its fashion and footwear segment is expected to face further pressure due to the proliferation of e-commerce. From this article in Reuters, Chinese e-commerce giant Alibaba will be launching new sales channels in Southeast Asia, including Malaysia. It states that “Alibaba will provide end-to-end solutions including logistics, payment, and localization support catering to each local market’s needs”.

This may potentially render retail spaces more obsolete in the few years to come. As such, this intervention by Alibaba will inevitably deliver a huge blow to the revenue of Hektar REIT, or all retail REITs in the region per se. Therefore, investors are advised not to jump in recklessly based on purely on the ‘cheap’ 52-week low price.

Fancy an Ebook that teaches you the hallmarks of multi-bagger stocks and how to find them? Simply click here to receive your copy of a brand-new FREEEbook titled – “100 BAGGERS” by Christopher W. Mayer here today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Small_Cap_Asia

Created by James Yeo | Aug 03, 2018

Discussions

Low can be lower. More malls can be even more malls. Only high quality malls stand out, unfortunately HEKTAR's malls aren't.

2017-06-23 21:12

Agreed on all the above~ I am usually wary of Reits that need to issue rights to acquire another property.. in the end you are not getting your so-called high yield cos it is negated by the share price losses...

2017-06-23 22:45

Agree. Sell Hektar buy OR right strategy.

Posted by smartly > Jun 23, 2017 08:36 AM | Report Abuse

wait till after ex-right

2017-06-24 11:50

.png)

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)

Jon Choivo

No its not. By every metric, KLCC is better.

2017-06-23 00:33