Don’t fall into the “Ponzi Schemes” Trap!

Spencer88

Publish date: Sat, 11 Mar 2017, 09:49 PM

First of all, I have to make a disclaimer that I am not promoting any form/kind of investment schemes here. All that is stated here is just my opinion and is up to you to judge.

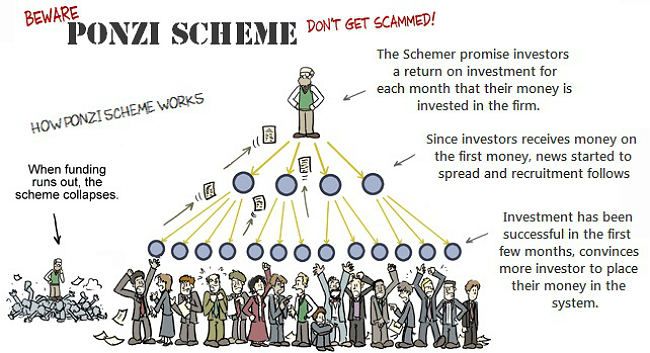

By definition, Ponzi scheme is a fraudulent investment plan. It takes a new investors money to pay off the old investors and telling them that this is the “return” on their investment. The first scheme ever ran was in 1919 and to date, there are a lot of such schemes selling like hot cakes and they go bust overnight. So what are the problem associated with it?

- Margin of safety

- The problem with all such schemes is that there is no margin of safety. You may argue that if it can last past X months and I can already breakeven, and the rest is just free money. The major flaw here is the sustainability of the scheme. There are some that ended before it even started (design problem, resulting in lesser attractiveness), and some that last for 5 – 10 years. Can you guarantee me how long will this scheme last? Or can you guarantee me with your life that this scheme can definitely last for another half a year? If you can’t give me a definite yes, then you know what the problem is.

- Time

- Time plays a big role in all investments, because it takes time to reflect the true value of investment due to difference in opinions, misinformation and biasness. But for such schemes, time is the ticking sound of a bomb, waiting for it to explode. This was due to the design of the scheme, as the scheme will go bust when there are insufficient funds to flow into it to pay off the old investors.

- Control

- Your money is not in your control. This is because you are not in a position that can decide if you can redeem back your money anytime you wanted to. Even investing in funds there are certain clause that delay the payment of your capital. They can still sell off their assets when liquidity is lacking, but for such schemes what can they sell to generate the liquidity to pay off investors?

- False Promises

- Guaranteed return is a false promise by nature. Let’s be realistic here, can you guarantee that the widely recognised as the safest investment: government bonds, that the rate will be the same for perpetuity? Even the longest bond goes for 30 years, and the highest rate once goes to more than 10%. What is the rate now?

- Psychology Trap

- What you consistently do reflects what you will become in the future. If you slack, you become a slacker. If you play Ponzi schemes and made money, you will think along the line of making easy money with no risk. This is the trap that most people had fallen into. What I seek in investment is to make money by taking into account measurable risk while safeguarding my own capital, and to be done for life.

Lastly, I have to mention that there are a lot of investment schemes out there are Ponzi scheme in disguise, because it is illegal to sell Ponzi scheme. If I still can’t convince you to avoid it, I wish that all my other articles will persuade you to pursue value investing, as I truly believe value investing is the way to get me out of the rat race.

More articles on Spencer88 blog

Discussions

Can talk how IW City shareholders make money if they the 1 who bought at RM 2.28?

2017-03-12 05:02

stockmanmy

Post removed.Why?

2017-03-11 22:36