(Spencer88) 为何“冷眼”前辈买入(SKH,0060)?

Spencer88

Publish date: Sat, 08 Apr 2017, 09:18 PM

相信有阅读Bursa Malaysia公告的股友们应该不难发现4月6日Bursa Malaysia的公告,“冷眼”前辈已经入股(SKH,0060)并持有三千万股成为该公司的第二大股东。而且股价也一度从原有的RM0.10飙升至今天闭市时的RM0.155,股价足足飙升了五十五巴仙!!为了满足大家的好奇心,笔者将在此简单的分析一下。

SKH CONSORTIUM BERHAD,0060(前身为MEDIA SHOPPE BERHAD)原先从事IT和ICT相关产品的交易业务,较后于2015下半年开始投身于建筑及产业发展的相关业务。由于IT和信息通信技术市场竞争激烈,所以SKH决定在业务上实行转型计划。因此,SKH开始进军建筑领域,因为管理层认为这个行业更加有利可图。而该集团的名称变化也是随着业务重心的转移而改变的。

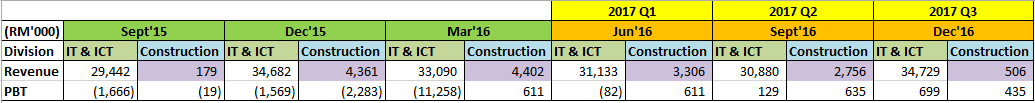

在2015年9月7日,SKH集团获得了一项价值一亿八千一百万令吉(RM181 Million)的建筑相关合约,并在登嘉楼的干马挽(Kemaman) 县发展一片土地。依据季度报告所发布的进展,载自2015年12月为止,SKH已经完成了部分土地的整治工作。但是,根据SKH的建筑部门(Construction Division) 的营业额来推算,该工程的进度看来有缓慢。【截至目前为止,建筑部门的营业额已经达到了一千五百五十万令吉(RM15.5 Million),但是,其中的四百万令吉(RM4 Million)是来自 Batu Pahat 的工程项目,另外还有三百五十万令吉左右(RM3.5 Million)的营业额是属于新山(Johor Bahru)的一个项目。这意味着单单是干马挽的工程就还有一亿七千三百万令吉(RM173 Million)的营业额还未进账,而且依据合约里表示SKH必须在2019年九月之前把该工程完成,因此笔者推测SKH的营业额将会在近期内爆发,而且一个季度将会有平均一千五百七十二万令吉的营业额来自于干马挽的工程(这还不包括Batu Pahat 和 Johor Bahru 的建筑营业额在内)】。干马挽的工程合约也有提到该工程将会为SKH带来一笔三千万令吉的毛利(Gross Profit),经过笔者与该公司目前还未进账的营业额来推算后,SKH应该会有两千八百万令吉的毛利有待进账,平均一个季度将会有两百六十万令吉的毛利来自该工程。

值得一提的是,目前SKH最新季度的毛利只有四百四十万令吉,而当中建筑部门的毛利应该不会超过五百千令吉因为建筑部门最新季度营业额只有区区的五百千令吉。试想看如果接下来的季度SKH的建筑部门可以为SKH带来额外的两百六十万令吉毛利(这还不包括Batu Pahat 和 Johor Bahru 的毛利在内),这将会把SKH最新三个季度的平均毛利(四百万令吉左右)提高整整五十巴仙!不过毛利归毛利,股票投资还是需要看盈利,所以要是毛利提高了,能不能把之转为盈利那就要看管理层对开销控制(Expenses Control)的本事了。

另外,IT和ICT相关产品的交易业务最近开始转亏为盈,笔者相信只要SKH能够继续保持着IT和ICT相关产品的交易业务目前的盈利,再加上SKH的建筑业务将会在近期内贡献的营业额来看,盈利要创新高应该不难!这就是笔者所看见SKH唯一的成长因素,而至于“冷眼”前辈入股的实际原因就不得而知了。希望这个简单分析可以帮助到大家,如果有任何相关资料不妨留言分享或是PM笔者的面子书吧。文章只仅作参考,买卖自负!

合约内容:

最后也请大家多多支持笔者的专业,笔者也会尽我所能提供大家第一手的消息!谢谢。

https://www.facebook.com/quantuminvestmentresearch/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Spencer88 blog

Discussions

Hi Spencer88, thank you for sharing this article.

I have a few questions. I hope you can share some insights on it

1) From the previous quarterly report, the revenue and profit from the construction division are contributed by Batu Pahat, JB and Kemaman projects. The management team did not specify in details how much of revenue and profits each project contributed? How did your figures come about?

2) From the excerpt of the contract that you provided above, the management team is expecting a gross profit RM 30 million from the Kemaman project? Can you share with us where did you find this piece of important information? I might have missed it somewhere.I couldn't find it anywhere as i was tracing all the bursa announcements from 7/9/2015 ( date of announcement of contract ) till present date

3) On 10/8/2015, Christopher Chan Hooi Guan ( founder and CEO ) of the company ceased to be the majority shareholder and sold off all his shareholdings. And on 14/8/2015, he announced his formal resignation.

On 17/8/2015, we saw the emergence of Mr Tan Tzu Pin and Dato Low Liong Kian as majority shareholders through Master knowledge Sdn Bhd. Both with construction background. On 7/9/2015, the announcement of Kemaman project was made. So, it is not hard to figure out that both these new shareholders with their construction background have secured the kemaman project for the company and going forward, construction division will be the main contributor to the company's revenue.

Ever since then,both the shareholders have been increasing their stakes from 21% to 29%. This is not a surprise ,taking into consideration the future earnings potential of the company.

But, on 28/3/2017, both the shareholders have completely disposed their stakes in Master Knowledge Sdn Bhd. Dato Low still has a small stake of 1 million shares through his spouse ' Ng Su Moi '.

Can you share some insight into this twist of events? I'm puzzled.

Awaiting your reply soon. Thank you :)

2017-04-09 09:28

cold eye will say thank you for promoting this stock for me and i bought it as its earning will increase 50% from previous year and prices has reached forecasted value thnks to punters chasing it. thank you again.

2017-04-09 09:33

Caely is a great company with great fundamental. The stagnant of share price in the light of no substantial gain on profit. Current price of 0.50 sen is so undervalued.

2017-04-10 13:05

@kkw812004

1.)You may refer to the QR of SKH starting from Dec'15, under the section of commentary on quarterly performance.

2.)You may refer to this link

http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=172960&name=EA_DS_ATTACHMENTS

3.)I did not go through the changes in shareholding composition of directors, we will never know what directors are trying to do, and they might have a lot of proxy acting on behalf of them.

thank you

2017-04-10 22:53

oldmanorangtua

thanks for sharing. Can u share to me how u get construction figures from johor baru n patu pahat . Thanks

2017-04-09 07:01