(StarBizWeek) Sunway Medical could be worth at least RM1.5bil

Stock Kingdom

Publish date: Sat, 17 Jun 2017, 08:18 AM

Profitable: Sunway’s healthcare division, namely Sunway Medical, reported a pre-tax profit of RM37.65mil in financial year 2016.

Sunway Group’s healthcare division, which is slated for a listing in two years, should carry a value of at least RM1.5bil when it goes public.

This is based on back-of-the-envelope calculations by ascribing a price to earnings multiple enjoyed by healthcare listings on Bursa Malaysia to this unit.

Sunway’s healthcare division, namely Sunway Medical, reported a pretax profit of RM37.65mil in the financial year 2016 (ended Dec 31) and ascribing a price to earnings (PE) multiple of around 40 times to this, it is worth about RM1.5bil.

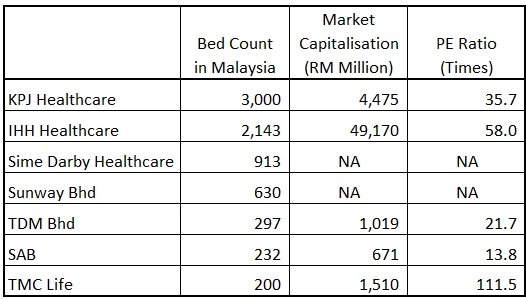

That PE multiple may seem high but not unreasonable when compared to what healthcare stocks are trading at present on Bursa Malaysia.

The main pure-play hospital groups listed on the Malaysia market are IHH Healthcare Bhd, KPJ Healthcare Bhd and TMC Life Sciences Bhd and they trade at lofty PE multiples of 58, 37 and 73 times respectively.

KPJ, which derives some 90% of its revenues from Malaysia is the largest private medical hospital operator locally with around 3,000 beds today.

IHH, the second largest public listed hospital operator the world and the largest in Asia has 2,143 beds in Malaysia at the moment.

Ramsay Sime Darby Healthcare, a 50:50 joint venture between Sime Darby and Australian-based Ramsay Healthcare owns three hospitals in the country at the moment.

“Sunway Medical should sit right in between the two big groups (of IHH and KPJ) in terms of earnings multiples.

“It has a better perception branding than KPJ hospitals but it is much smaller than IHH, which is globally the largest listed hospital group,” a banker points out, noting that TMC which is a much smaller operator, is valued more as a growth stock given their growth plans in the pipeline.

Notably, Sunway Medical could fetch an even higher value upon its listing in two years should profits, which have been steadily growing for this division in the past three years, grow further or if appetite for healthcare assets grows stronger.

This week, Sunway Group founder and chairman Tan Sri Jeffrey Cheah indicated that they have firm plans to list its healthcare business in two years’ time and that healthcare is the way forward for the group and it plans to build five more hospitals.

Sunway Medical is a wholly owned unit of Sunway Bhd.

When it goes public in two years, Sunway Medical will become the third largest publicly listed hospital entity on the Bursa Malaysia by bedcount.

The group has already announced several greenfield expansion plans that is poised to grow earnings further.

It will do so by pumping in some RM1bil in capital expenditures to open new hospitals in addition to its flagship Sunway Medical Centre located at Bandar Sunway presently.

The increased focus on the healthcare sector also comes at a time where the property market in Malaysia is still going through a tough time.

Sunway, now being a predominantly property and construction company will divert more of its attention and resources to the healthcare sector amid the still hazy outlook for the Malaysian property scene.

The group also derives some earnings from its circa 37% holdings in Sunway Real Estate Investment Trust (REIT) that sees mall dominance among consumers being challenged by the online retailers.

Analysts expect that Sunway will still hold on to a substantial majority stake in the soon to be listed healthcare entity, similar to what it had done with Sunway REIT.

The group’s planned capacity expansion of its flagship Sunway Medical Centre, Sunway Petaling Jaya would see it increase bed count to 1,000 in 2½ years from 630 beds at present.

This expansion would come onstream just shortly after its listing and would help pique increase interest in its initial public offering (IPO).

Sunway is planning another hospital at Sunway Velocity, Cheras with an initial bedcount of 240 that would be completed by end-2018.

More hospitals are also planned over five years through expansions in Sunway Damansara, Ipoh, Penang (two hospitals) and another one in Sunway Iskandar, Johor.

Bedcounts for these hospitals are not yet set as finer details have not yet been decided, according to the company.

Such a strong expansion would put Sunway just behind IHH Healthcare in Malaysia.

A company representative from Ramsay Sime Darby tells StarBizWeek it has no immediate plans to expand capacity at the moment and that bedcount will remain as it is in two years.

Meanwhile, the plan to monetise Sunway’s hospital assets have received a warm welcome from investors with its shares receiving a boost when the announcement was made on Thursday’s market open.

Sentiment was also boosted due to the announcement of a 4 for 3 bonus issuance and free warrants (3 for 10) exercise.

Kenanga Research notes in its report that Sunway’s management is also capitalising on aggressively promoting and capitalising on medical tourism as a strong contender to Singapore with similar medical care standards amid the weak ringgit scenario at present.

“We believe that growing their medical division would provide them a sustainable income stream in the future, which would further mitigate their risk in the property and construction business which are highly cyclical,” Kenanga says.

Source: http://www.thestar.com.my/business/business-news/2017/06/17/sunway-medical-could-be-worth-at-least-rm15bil/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-05

SUNWAY2024-07-05

SUNWAY2024-07-05

SUNWAY2024-07-05

SUNWAY2024-07-05

SUNWAY2024-07-04

SUNWAY2024-07-04

SUNWAY2024-07-04

SUNWAY2024-07-04

SUNWAY2024-07-04

SUNWAY2024-07-04

SUNWAY2024-07-03

SUNWAY2024-07-03

SUNWAY2024-07-03

SUNWAY2024-07-03

SUNWAY2024-07-03

SUNWAY2024-07-03

SUNWAY2024-07-03

SUNWAY2024-07-03

SUNWAY2024-07-02

SUNWAY2024-07-02

SUNWAY2024-07-02

SUNWAY2024-07-02

SUNWAY2024-07-02

SUNWAY2024-07-02

SUNWAY2024-07-01

SUNWAY2024-07-01

SUNWAY2024-07-01

SUNWAYMore articles on StockKingdom

Created by Stock Kingdom | Aug 23, 2017

Created by Stock Kingdom | Aug 23, 2017

Created by Stock Kingdom | Jun 15, 2017

Discussions

Using Sum of the parts analysis (SOTP), SAB can theoretically obtain higher valuation target

SAB healthcare division registered Profit before Tax of RM19.4mil.

Take 25% tax rate, the net profit will be RM14.55mil.

Applying 20 times PE, the healthcare division itself will be valued at RM291mil

2017-06-17 08:43

Current SAB market cap = 671mil

Healthcare division = 291mil

Oleochemical & Palm oil fruit/mill division = net profit 42.75mil

2017-06-17 08:44

Lk036, I think it's possible of Sunway share holder get the offer share of Sunway Medical, I am now accumulating Sunway shares cos the future prospects is bright.

2017-06-17 10:20

The options are all subject to the management's decision, we can only guess, hmmm....

2017-06-17 10:36

Logical thinking is:

chance of going down = slim

chance of going up = good

At least it won't make you broke :)

2017-06-17 10:39

Before Sunway Medical listed, we all should focus on TDM first.

Included the new hospital at Terengganu, TDM should have total 427 bed.

For a size of 427 bed, its market value should be at least RM400-RM500mil.

Many people are concern about TDM's PBT on its healthcare unit, because it is relatively low compare to other player. However, if you have monitor their corporate development for the past 3 years, you will know know TDM is expanding and upgrading its hospital (i.e. Taman Desa, Kelana Jaya, Terengganu). All these expansion and upgrading expenses has caused their PBT drop for the past 2 years.

However, all these will be ending soon, the Taman Desa medical centre has completed its expansion, from 27 beds to 80 beds, and the Kelana Jaya Medical also increase to 50 beds, plus the new Terengganu Hospital with 130 beds.

With the additional beds, I'm expected revenue will increase 15%-20%, while PBT will be increase to at least RM5mil per quarter.

Based on Rm5mil per quarter, 1 year is RM20mil. If we applied PE of 25 times, then its healthcare unit will be worth RM500mil.

If profit can increase to RM7 mil per quarter (which is very possible for the size of 427 beds), then 1 year will be RM28mil, times 25 PE, it will be worth RM700mil.

2017-06-18 10:42

Stock Kingdom

Sunway’s healthcare division, namely Sunway Medical, reported a pre-tax profit of RM37.65mil in financial year 2016.

SAB's Sri Kota Medical Centre, registered pre-tax profit of RM19.4mil in last 4Q

2017-06-17 08:42