(TapDance) Low Risk High Return (3) - Daiboichi

tapdance

Publish date: Fri, 15 May 2020, 10:26 PM

Summary

Daibochi is mistaken as ugly, unpredictable and expensive - market expectation low. Misperception to be remove in four months.

Nestle Procurement Vision 2020 is a major driving force for the company.

Resin (raw material) cost is on down cycle will widen profit margin – for an extended period of time.

Scientex – an excellent business operator and now Daibochi’s major shareholder – brings tremendous value.

MPP acquisition brings immediate earning accretion and clientele-mix enhancement (domestic vs. MNCs / big vs. small)

Indochina coming of from low base allows for huge potential for its existing Myanmar stronghold

Description

Market misperception – hence expectation low

In today’s Bursa investment world, investors are quick in forming their first impression on a company by merely peeping at the result snapshot and the accompanying prospect commentary.

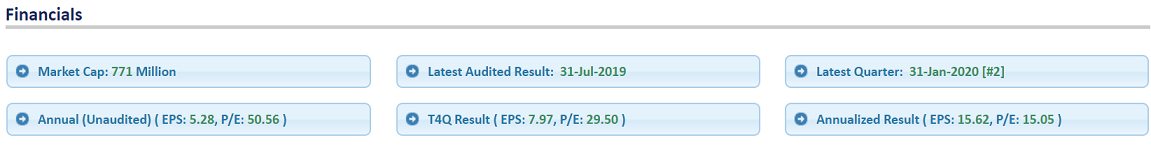

Does the snapshot below disgust anyone?

I thought the discontinuation-and-change of financial year is extremely confusing and the lumpy performance is utterly frightening. The valuation appears mind boggling too!

The financial year change is the result of the co.’s merger i.e. Scientex took over Daibochi in 2018/2019. Because Scientex’s financial year ends in July 31st and to align the group’s financial reporting, hence explains the change.

Still, just why did the very successful Scientex acquire Daibochi (~62%)? And why did numerous successful investors build their position into Daibochi’s substantial shareholder list?

I might have a few clues.

First, the below snapshot presents business performance prior to the financial year change. It shows Daibochi’s growth consistency and resiliency. Another clue is about Nestle – I’ll explain later.

Judging by its pre-merger result, it is acceptable to gauge its 12m performance by annualizing a single quarter result. Daibochi is only trading at ~12x PE (not the headline 50x).

Daibochi is a lot sturdier, easy to understand and undervalued than the market thinks. Market will eradicate the negative perception in four months after two more quarterly results announcement.

Nestle Procurement Vision 2020 a mega driver for Daibochi/Malaysia

One of Daibochi’s main client – Nestle announced that Malaysia is one of the three Global Procurement Hub to cater for the need of over 100 countries globally for its manufacturing operations.

Scientex decided to take over Daibochi not long after Nestle’s announcement. Is that a coincidence?

The other two hubs are located in Switzerland and Panama – safe to assume that Malaysia will be responsible for Nestle's Asia business.

Structural change

-

Management Caliber

Scientex as an excellent operator will bring tremendous value to Daibochi. It is an open secret that Scientex’s management is exceptionally driven. Scientex as a global packaging player grew its Revenue/PBT by 6x/12x since FY06 i.e. ~20% CAGR.

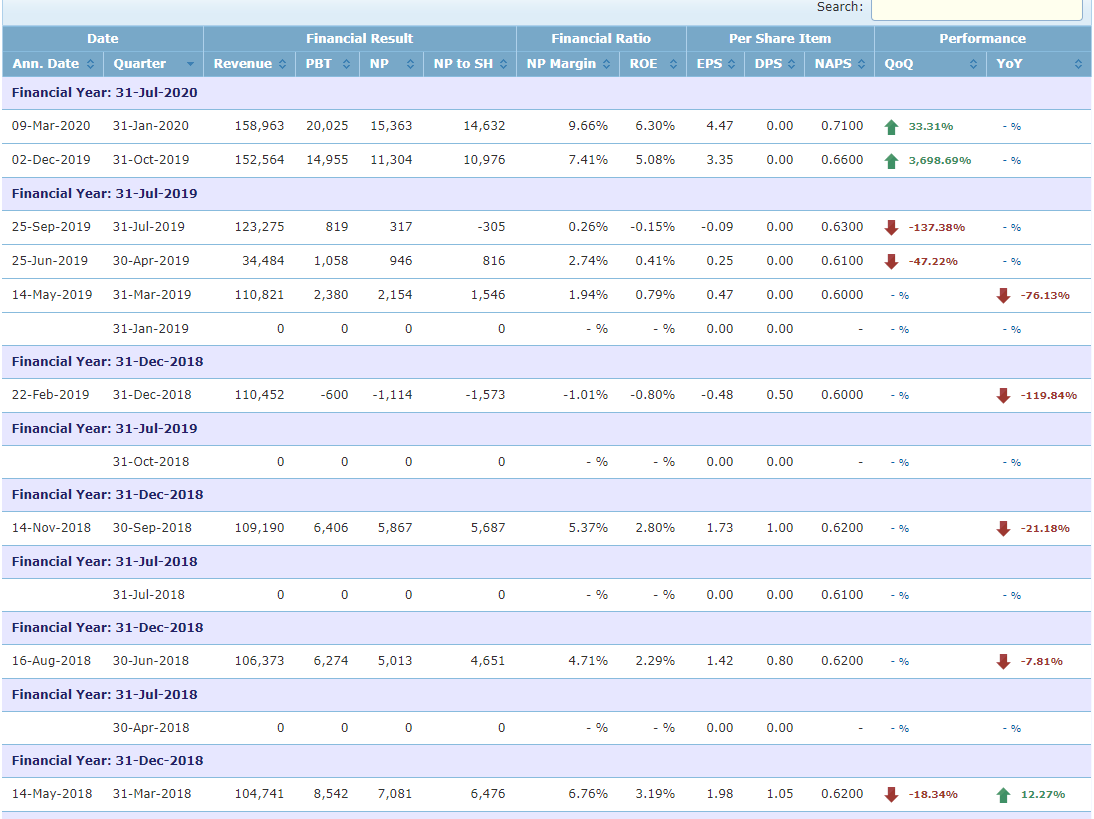

Excerpt below from latest AR (mind the choice of word):

Right after the conclusion of the takeover, Daibochi adjusted its dividend policy and was out acquiring a competitor – Mega Printing (“MPP”). MPP’s clientele are mainly local Malaysian F&B operators hence an immediate complement to Daibochi’s MNC clients.

The investment brings immediate value. It is the standard Scientex playbook. On top of earnings accretion, these bolt-on acquisitions will-be-given and bring synergies in many forms.

-

Raw material cost and product synergies

Scientex as a global packaging player has huge clout in raw material procurement especially in the local scene. Daibochi will be a net beneficiary from raw material cost savings standpoint leveraging on the ‘Daibochi + Scientex + MPP’ scale.

The group is able to centralized corporate services and collaborate in various technology and R&D initiatives for packaging solution. For instance, Scientex’s 100% recyclable packaging material will be an easy sell for Daibochi’s MNC clients.

Growth potential – Asean and Indochina

Daibochi has a plant in Myanmar and is already contributing ~30% of the group’s profit. Daibochi stands a good chance to ride on the region’s huge population potential and affluence growth of which is just coming off from a very low base.

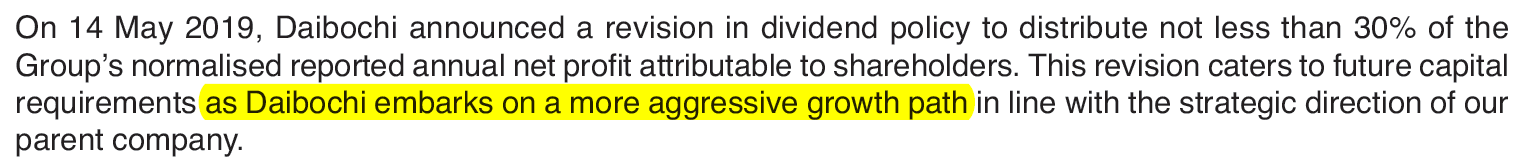

Resin raw material cost in down cycle and multi-year low

Daibochi’s profit margin will expand for an extended period of time. The ultra-low oil price environment couples with significant investment in the petrochemical industry results in massive resin supply glut. Plastic product manufacturers will benefit from the down cycle.

MCO impact limited

The sell down since March-2020 is unjustifiable. Daibochi’s products are essential for the food & beverage industry – where people consume more during the lockdown period.

Production is carried out as normal despite the 50% capacity condition – by altering the administrative workforce for allowing full factory production.

Catalyst

- Market expectation is low - negative perception eradicates in two more quarters

- Malaysia as procurement hub in Nestle’s procurement vision 2020

- Resin supply glut and down cycle

- Scientex effect – mgmt. caliber, raw material cost, clientele and innovation collaboration

- MPP’s earning accretion

- Indochina affluence growth

Voila! you have yourself a low-risk-high-return investment idea.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)

tapdance

Consumers are spending more/less on packaged food (& beverages) during lockdown? ..snacks?

2020-05-17 09:34