QL what is the value?

teoct

Publish date: Fri, 04 Jan 2019, 11:24 PM

Interesting conversation going on in the QL i3 forum (10154899906070843, Ricky Yeo, Jon Choivo, and many others) on whether QL is overvalue or not.

It is a most illuminating conversation about the use of PE to judge the value of a company versus the fundamental study of the company business, especially with the introduction of Family Mart (FM).

I did make a comment in the same forum when FM was announced; this is what I said back in 2016:

teoct From a business point of view, the FamilyMart should be complementary to current business. That is, it is additional outlets for QL's products. Secondly on logistic, QL already is a master as they are distributing their product to the many supermarkets, etc around the country. So maybe with the convenience store, the current distributing fleet maybe better utilize, thus lowering overall operating cost.

With adoption of IT (which I am sure they will, especially FamilyMart system), the inventory holding cost should be low and there should be minimal dead products.

Management of pilferage and cash flow should be the key focus and this could easily add to the overall margin.

Yes, return for this investment will only become visible in 5 to 10 years. Some figures:

Propose 300 stores in 5 years, each cost 250k, investment of 75 million.

Each store expected to have revenue of 800k, i.e. overall revenue of 240 million.

Say, margin of 5% only, give profit of 12 million, that is 16% return on investment, not bad.

Yes, this is a simple back of the envelop calculation, but think, out of the 240 million revenue, maybe about 40% (i.e. 96 million) of this goes directly back to QL for eggs, fish products, etc. This is about 3% of overall QL revenue. Now, when they hit 1000 stores, that would contribute about 320 million, no small change this.

Of course, one could argue that this may cannibalize it's traditional market, a bit yes. The targeted market is different from traditional supermarkets. Execution risk is there.

My family hold QL shares and will continue to hold.

14/04/2016 09:51

Now, two years later and with QL trading at PE of 50, surely it is overvalue said some, no said others, it is growing and there is more to come. What / which exactly is it.

Like the saying goes, a picture paints a thousand words, as most readers know, I like graphs / charts.

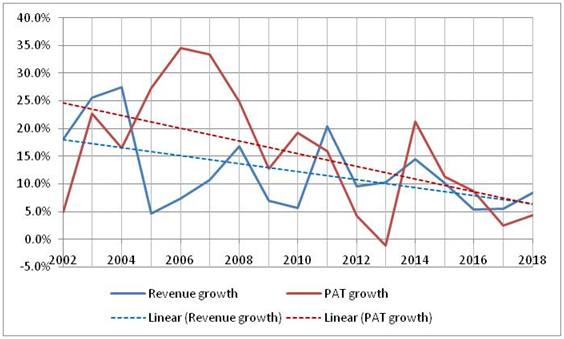

As one can see, the Revenue growth rate and the Profit after tax (PAT) growth rate have both come down and I think approaching a terminal value of about 5%.

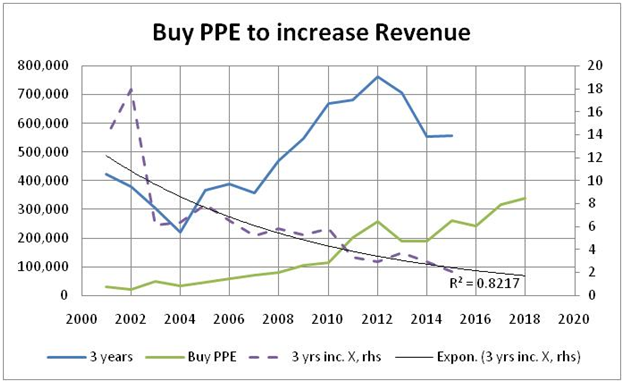

Yes, QL has been “investing” in properties, plant and equipment (PPE). My data goes back to 2001.

Here is shown the gain in revenue on invested PPE three years before, that is, I have shifted the 3 years (blue) line so that one can have a feel for the “benefit” invested three years ago. Example, in year 2015, QL invested 262m in PPE and this shows up as a gain in Revenue on year 2018 less revenue of 2015 i.e. 3,263m-2,708m=555m. Again, the return on the investment is reducing and an exponential trend gives the best fit. Going forward, the return from future investment would give lower return (<2).

Obviously, not all the increase in revenue (from 3 years ago) can be attributed to the investment done in PPE. There would be maybe price increases of products sold, etc. But suffice to say, for all purpose and intent, it is sufficient for this thesis, that all increase is due to the investment of PPE.

Why 3 years, there is a lag as it takes about 3 years to build a plant, get equipment in, test and commission the production. Of course, it can be shorter or longer, let’s not split hair here.

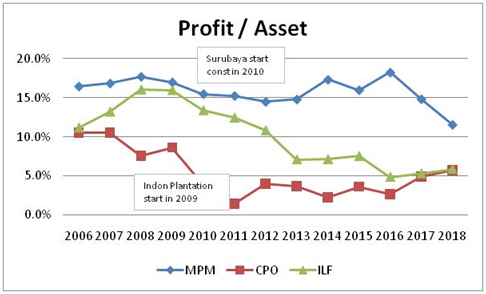

Throwing more money will eventually lead to diminishing return. So have to “invest” on new line that can have potentially higher return than current business lines – MLM, CPO & ILP (terms adopted from QL annual reports). That possibility is Family Mart, a “tender” step with mutual benefit, i.e. buys QL products. There may be other projects (in the pipeline) other than MLM, CPO & ILP as these are all reaching a diminishing return as shown in the next few charts.

The various segments are also approaching a terminal profit margin, maybe 7%.

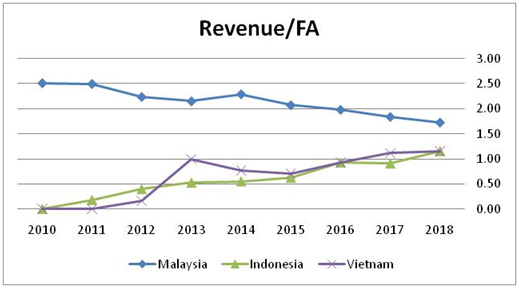

And investment in Vietnam and Indonesia is also reaching a plateau in generating revenue. As can be seen in the chart below, investment in Indonesia and Vietnam is not giving the type of return like in Malaysia - home ground advantages. Nonetheless, it appears to converge at 1.5.

All these data are from QL annual reports.

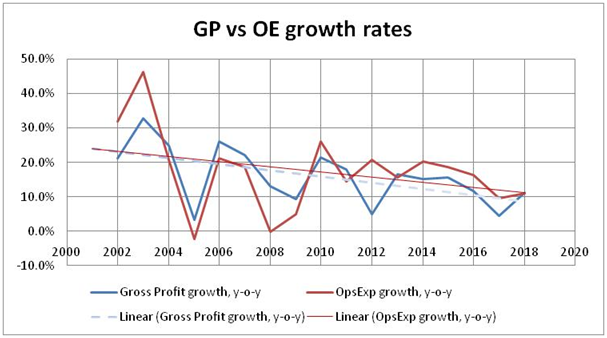

And the gross profit growth rate is slowing as well as the operating expenditure growth rate. However, the operating expenditure growth rate is higher than gross profit growth rate. This means that the PAT will stagnant. This can be seen in the next graph.

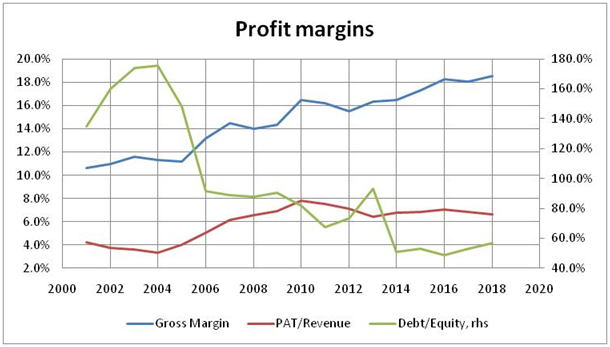

The gross margin is going up while the net margin is stagnating. As one of the contributors said, the operating expense is growing faster than the growing gross profit.

Debt to equity has come down a lot but appear to be increasing slightly in the last 2 years.

Of course, there will be up and down but averaging up, the (revenue, profit margin growth rates) trend is all down.

So is QL worth RM 10.75b (PE50), i.e. PATxPE=215mx50=10.75 billion?

That is earnings (PAT) of 10.75 billion.

PE means price to earnings, and here earnings is PAT.

PAT of 10b, definately not in my lifetime.

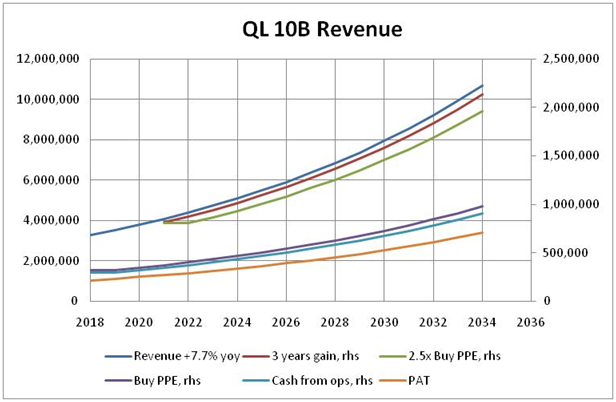

But with the above information, one can extrapolate just to find when REVENUE will hit RM 10.75b.

Yes, there are so many assumptions that this can be shredded immediately, but just for illustration purposes, it will take at least 16 years (give and take a few years) to reach 10.75 billion, REVENUE only. And PAT, well say 6.6%, will give 708 m, not even close to 1b, not to say 10b EARNINGS.

Yes, PAT has grown 3.3x (708/215) in 16 years, a 7.7% CAGR (compounded annual growth rate).

For those technically interested

Cash generated from operation is estimated at 8.5% of revenue and investing PPE is about 1.08 x cash generated. This will mean debt to equity will increase, never mind, let’s assume this is OK. And being very optimistic, the return for every ringgit invested gives 2.5 ringgits three years later.

Only with revenue growing at about 7.7% pa (the red line) matches the 2.5x revenue gain (green line) (OK, close enough). As you can see this will give a circular iteration in EXCEL, but if one manually try with the growth rate of the revenue, the 3 years gain can be estimated.

So is the PER of 50 too high? If yes, then the next step is equally if not more onerous, Sell or Keep?

This is a dilemma, if one sell now, will there be another company with such track record? For more of this, refer to Philip A Fisher “Common Stocks and Uncommon Profits”, Chapter 6: When to Sell – third reason, if one can find a company that can do higher growth rate than QL current estimated 8%, it will be worthwhile to switch.

OK, sell and buy back later, according to Philip A Fisher same book as above, page 236, Stay or Sell in anticipation of possible market downturns. I urge you to read the book as it explains better than I can.

In investing, there is always the emotional aspect, and here lies also the irrational / exuberant Mr. Market.

Both sides have decent points and faced with the above, I am in real dilemma.

Have a good 2019 investing all, PEACE.

E&OE

Disclosure: I and my family own QL shares.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Buy / sell at your own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-21

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QLMore articles on TeoCT

Created by teoct | Jul 23, 2020

Discussions

The market is taking QL in the league of UBER, Grab, Twitter, alibaba with exceptional growth etc....they are not valuing based on traditional PE matrix mah....!!

Posted by Choivo Capital > Jan 4, 2019 11:33 PM | Report Abuse

Mr teo,

Well, to answer your dilemma, do you think you cannot find a better investment?

Berkshire is selling at 16 times operating earnings now. Which is 3 times cheaper (just a rough estimate i think its probably 4-5 times cheaper).

Do you think QL is better than berkshire hathaway? When QL cannot even grow earnings and revenue faster than berkshire hathaway?

Don't take this to be me being argumentative. Just asking a question. If you say yes, hold. If you say no, go buy Berkshire Hathaway better.

Good luck with your journey. I wish you all the best.

2019-01-04 23:41

Raider bro,

When people get stupid, they start using stupid valuations.

At the end of the day, the value of the ivnestment is all the cash generated over the lifetime discounted to present value.

Uber lose 1bil a quarter. They need to pay for electricity etc, you think they can lose 1 bil per quarter to eternity?

No mah.

I am willing to bet with you, whatever value UBER IPO at, within 2 years, it will be 60% or less of that.

2019-01-04 23:44

QL historical single digit CAGR EPS growth is not impressive to justify its hefty valuation. Even if the wet dream of exceptional growth in future is materialized, the current price already priced it all. What do investor expect by paying the future jack up price on something that is still uncertain ??

stockraider The market is taking QL in the league of UBER, Grab, Twitter, alibaba with exceptional growth etc....they are not valuing based on traditional PE matrix mah..

2019-01-05 00:11

By looking at the details QL maybe overrated, i think fairer indication of QL valuation should be in the region of rm 4.50 loh....!!

This co do not really pays div and damn stingy in sharing with shareholders loh...!

Its Family Mart but certainty not worth Rm 2 billion, the most maybe around Rm 600m factoring growth loh...!!

Overall QL should command PE around 23x...of course should not exceed Nestle and Dutch Lady mah...!!

2019-01-05 00:13

Wow, congratulate the author for doing such a good analysis! Especially you did it without copy and paste. Really really good.

However, that was history. You'll get 100 marks but still you're totally wrong.

One, the killer has came to livestock farming, much worse than CP opening their mega farm next to QL (CP is in Malaysia though, small scale. Probably Malaysia's market is too small for CP). And most likely QL management doesn't know how to solve the problem. Two, Oil palm's low price may prolong for a few years (and our government continue to hurt oil palm, probably we will have a lost decade for oil palm). Otherwise, why did the major shareholders sell?

When QL was listed, I look at the receivables and decided this is a risky co. I was very wrong. So I could be wrong again.

You will start to see what i mean in the next quarterly result. Good luck!

2019-01-05 00:24

Choivo Capital, thank you for dropping by and appreciated the tip. Thank you for thinking so highly of me, that is, my capability to buy BH.

I had a peek at BH (A) during 2008/2009 crisis, the lowest then was USD 78,600 per share! Exchange was about 3.7; i.e. RM291k for ONE share, not 1 lot (1000) or 1 small lot (100), JUST ONE SHARE. But of course should I have such bread then, today, BH is selling for USD 292,500 per share (RM 4.14 gives RM1.2m), a 17% CAGR, yes some of those gains is exchange rate (~1.3%).

Some suggestion on Malaysian stocks would be very much appreciated.

Nevertheless thank you.

supersaiyan3, thank you for the kind words, 100 marks, you are too kind. I did some crystal-ball gazing, you think this is totally wrong? How can it be improved?

Flintstones, thank you, most kind.

i3lurker, thank you for dropping by.

Sslee, thank you for the like.

stockraider & shpg22, thank you for both your views.

To the rest who read, appreciated your time, I hope it is of value and improve ones understanding of the issue at hand.

Have a nice weekend.

2019-01-05 10:14

Mr Teo,

There is Class B shares, USD 195 per share, or RM800.

Its basically class A split 1/1500. The downside is it has less voting rights, prorated.

https://www.investopedia.com/ask/answers/021615/what-difference-between-berkshire-hathaways-class-and-class-b-shares.asp

2019-01-05 10:18

i think the more we all talk on QL...the more the price will start dropping...some will start shorting i guess

2019-01-05 16:35

Choivo Capital, thanks.

supersaiyan3, thanks.

probability, hmmmm. I was wondering before I posted this along the same line as you. Then I think, if my posting can move the market, wow, to @#*$ with it.

Not too long ago, someone was illustrating some writers are pumping the market, or something along that line (if I understood it correctly) and impoverishing "investors".

I thought long and hard on this. My take is primarily SHARING (it also help crystallized my thinking). It is the reader's that need to separate the wheat from the chaff.

Ralph Waldo Emerson said "Nothing is at last sacred but the integrity of your own mind".

Paul Samuelson (won 1970 Nobel Prize in economics) said "Well when events change, I change my mind. What do you do?"

Then there are those that ----- "I have already made up my mind, don't confuse me with facts" (This is from Philip A Fisher, I bought the book in 20/2/1997 and re-reading for the umpteen time now).

Let this (forum) be not an "echo chamber", diverse views is important to provide the path to informed decision.

So readers, please exercise due care.

Have a good week ahead.

2019-01-06 10:12

I have not critically evaluated QL but judging roughly from the 10 years financials it seems to be an average company, although it could have a slight chance of growing faster than previously. Assuming that the company can grow in real terms faster than inflation + long term gov yield, I have trouble assuming such a long growth period in my calculations. Yes, the company is good, it sells things that consumer will always need and recurrent(something Buffett would like), but the risk as Buffett said: the final risk is the risk of inadequate return over time, euphemism for you paid too much. Some might argue: have a longer time horizon, let the company compound. Even Munger has said eventually, over a very long period, ROE is the return investors ultimately get. But the caveat is you must be sure this is the best return you are going to get over that period, if not your opportunity cost would outweight your gain. And this is the point, where I believe the divergence of ideas begins in this forum. Each person opportunity cost is different, that is why QL could be good to some but inferior to others. For an investor who did not encounter better opportunities than QL, ipso facto QL is the best; while others will pursue better opportunities. The only way to get better returns is to widen your universe, as Buffett once comment on how to start finding good companies: start from A and work to Z.

2019-01-08 14:27

And personally I think investor's focus on reported earnings could potentially affect adversely on their decision making. Owner earnings is a better concept and should be adopted widely. Of course one needs to know the meanings of the figures he uses to calcuate owner earnings, lest he come out with an even more erroneous earnings picture.

2019-01-08 14:38

VenFx thanks.

Winner, appreciate very much the "like".

GrahamNewman, thank you for your comments, appreciate it very much.

2019-01-09 09:51

Philip ( Random Walk Theorist)

Revisiting this article 1 year on, I hope you held the stock over the covid crisis period.

While many individuals have commented on the viability of holding QL, one thing you would have noticed was how much it has held its value over the past year and even over the crisis period.

From the lowly price of RM6.50, it has gone up to 8.60 on one year, while the revenues and earnings have hit all time highs in a quarter.

On top of that, during the crisis, while every stock in the market dropped by 30% or more, QL has remained relatively stable.

For me, the value has been far more excellent, as it has provided me with margin collateral that I was able to use to purchase a lot of other wonderful stocks selling at 10 year lows.

Buying and holding QL was one of the best decisions I have ever made.

I hope you didn't crack under pressure and got out of this wonderful investment vehicle.

Mr. Long numbers :)

2020-04-21 12:25

Philip ( Random Walk Theorist)

As for which company performed better over the past year?

QL or BRK? You have only to look at the financial and stock results to know.

So many detractors, but who sleeps well at night in the end?

The owners and shareholders of QL.

>>>>>>>

probability i think the more we all talk on QL...the more the price will start dropping...some will start shorting i guess

05/01/2019 4:35 PM

Choivo Capital Mr teo,

Well, to answer your dilemma, do you think you cannot find a better investment?

Berkshire is selling at 16 times operating earnings now. Which is 3 times cheaper (just a rough estimate i think its probably 4-5 times cheaper).

Do you think QL is better than berkshire hathaway? When QL cannot even grow earnings and revenue faster than berkshire hathaway?

Don't take this to be me being argumentative. Just asking a question. If you say yes, hold. If you say no, go buy Berkshire Hathaway better.

Good luck with your journey. I wish you all the best.

04/01/2019 11:33 PM

supersaiyan3 Wow, congratulate the author for doing such a good analysis! Especially you did it without copy and paste. Really really good.

However, that was history. You'll get 100 marks but still you're totally wrong.

One, the killer has came to livestock farming, much worse than CP opening their mega farm next to QL (CP is in Malaysia though, small scale. Probably Malaysia's market is too small for CP). And most likely QL management doesn't know how to solve the problem. Two, Oil palm's low price may prolong for a few years (and our government continue to hurt oil palm, probably we will have a lost decade for oil palm). Otherwise, why did the major shareholders sell?

When QL was listed, I look at the receivables and decided this is a risky co. I was very wrong. So I could be wrong again.

You will start to see what i mean in the next quarterly result. Good luck!

05/01/2019 12:24 AM

stockraider By looking at the details QL maybe overrated, i think fairer indication of QL valuation should be in the region of rm 4.50 loh....!!

This co do not really pays div and damn stingy in sharing with shareholders loh...!

Its Family Mart but certainty not worth Rm 2 billion, the most maybe around Rm 600m factoring growth loh...!!

Overall QL should command PE around 23x...of course should not exceed Nestle and Dutch Lady mah...!!

05/01/2019 12:13 AM

GrahamNewman I have not critically evaluated QL but judging roughly from the 10 years financials it seems to be an average company, although it could have a slight chance of growing faster than previously. Assuming that the company can grow in real terms faster than inflation + long term gov yield, I have trouble assuming such a long growth period in my calculations. Yes, the company is good, it sells things that consumer will always need and recurrent(something Buffett would like), but the risk as Buffett said: the final risk is the risk of inadequate return over time, euphemism for you paid too much. Some might argue: have a longer time horizon, let the company compound. Even Munger has said eventually, over a very long period, ROE is the return investors ultimately get. But the caveat is you must be sure this is the best return you are going to get over that period, if not your opportunity cost would outweight your gain. And this is the point, where I believe the divergence of ideas begins in this forum. Each person opportunity cost is different, that is why QL could be good to some but inferior to others. For an investor who did not encounter better opportunities than QL, ipso facto QL is the best; while others will pursue better opportunities. The only way to get better returns is to widen your universe, as Buffett once comment on how to start finding good companies: start from A and work to Z.

08/01/2019 2:27 PM

2020-04-21 12:32

Mr Long numbers, good to hear from you with your usual gusto.

Yes it has been one year 3 months since I wrote this article.

I have divested mine and our family holding out of QL since then and invested outside of Malaysia (Not Berkshire).

The counter (consumer sphere) has provided me with about +17% annualized, even under Covid 19 condition. Lucky, I presumed despite the analysis carried out.

But of course, QL is a good counter (within Malaysia context) for years to come.

Like you, I have also invested overseas as the companies have that much more potential. This is because the market the companies is in is that much more bigger (the world vs Malaysia only).

But there is one area I have not mastered like you, low number of counters. I aim to reduce my portfolio to below ten if possible within 12 months.

Nevertheless, thank you for all the learning and happy investing.

Stay safe and physical (not social) distancing and all.

2020-04-21 13:24

Choivo Capital

Mr teo,

Well, to answer your dilemma, do you think you cannot find a better investment?

Berkshire is selling at 16 times operating earnings now. Which is 3 times cheaper (just a rough estimate i think its probably 4-5 times cheaper).

Do you think QL is better than berkshire hathaway? When QL cannot even grow earnings and revenue faster than berkshire hathaway?

Don't take this to be me being argumentative. Just asking a question. If you say yes, hold. If you say no, go buy Berkshire Hathaway better.

Good luck with your journey. I wish you all the best.

2019-01-04 23:33