TEK SENG HOLDINGS BHD (7200) -A VERY GOOD “MEAN REVERSION” TRADE SETUP

TheAlphaTrader

Publish date: Fri, 26 Nov 2021, 10:37 AM

Today we will examine a mean reversion trade setup, which I have identified in Tek Seng Holdings Bhd (Tek Seng). This trade is quite different from the other posts that i have shared recently. The premise of previous trades presented so far have come with a good fundamental story, accompanied by a good price chart structure.

In a mean reversion trade setup, we argue that the price chart may not be pretty now but is probably overdone on the downside/upside in relation to the underlying fundamentals.

FUNDAMENTALS

Tek Seng is an investment holding company with its subsidiaries principally involved in the manufacturing and trading of PVC related and non-woven related products, trading of solar cell products, generation and supply of renewable energy as well as property rentals.

Tekseng was incorporated in 2002 and listed on the KLSE Second Board in Nov 2004. In Sept 2006, Tekseng successfully transferred its listing to the Main Board of the KLSE.

Tekseng trades at a very undemanding trailing PE ratio of only 7 times and below its NTA of RM0.61. It is also a NET CASH company of RM25 million. What is even more attractive about this stock is that, in the current low interest rate environment, Tekseng offers a dividend yield of 8% (the latest dividend of RM0.01 ex date is on 3 Dec 2021)

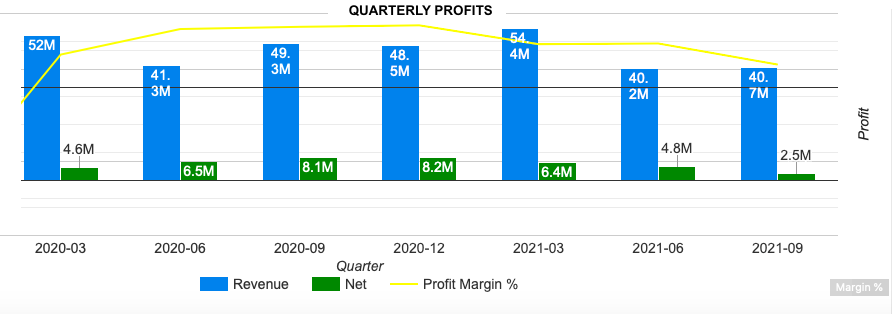

Tekseng was a huge beneficiary from the “Covid-related stocks” theme as it is involved in the manufacture of non-woven related products that are used in the manufacture of face mask and protective gowns. It was a blockbuster FYE 2020 for Tekseng where its profits soared to an astounding RM27.41 million. Thanks to the Covid-related stocks frenzy, the price of Tekseng rallied to an ALL-TIME HIGH of RM1.44 on 6 Aug 2020. At the highs for the year, Tekseng was trading at a PE of almost 19 times for FYE 2020.

When the bubble burst on Covid-related stocks, Tekseng was not also spared and dropped precipitously to close at RM0.66 on 21 Dec 2020. Tekseng continued its slide in 2021 and recently touched its year low of RM0.395 on 19 Nov 2021.

It is clear that the profit for 2021 has been downtrending as the ASP for face mask and protective gowns have been on the decline since the beginning of 2021. However, even with the nationwide lockdowns affecting all companies Tekseng was still able to turn in a commendable cumulative profit of RM 13.7 million for the first 3 quarters of 2021!

The reopening of the economy, both locally and globally, will benefit the PVC sheeting segment, which has traditionally been Tekseng’s major revenue contributor for the last 30 years.

TECHNICALS

From the daily chart we can observe that the price is attempting to break the downtrendline, which held since Oct 2020. As a guide for possible targets for the mean reversion trade, we can utilise fibonacci (FIB) retracement levels.

As measured from the pandemic lows of RM0.12 in Mar 2020 to the Covid theme-induced high of RM1.44, we get the 61.8% FIB level of RM0.63, while 50% FIB level would be RM0.78. Further up, the next FIB level would be RM0.94, which is the 38.2% level.

INTERESTING OBSERVATIONS

1. The price has overshot on both the upside and downside.

Prices tend to overreact on the upside when the sentiment goes in mania overdrive and likewise, overshoots on the downside when slipping into despair mode. If I am making a calculated guess, we are pretty much at the tail end of the latter!

2. Price reaction was positive after the latest Quarterly Report

Post-pandemic, although there has been a massive de-rating of Covid-related stocks, one should not forget that Tekseng remains a profitable company. As reported in the latest quarterly report (released on 19 Nov 2021), Tekseng clocked in a noteworthy Net Profit of RM2.5 million!

The latest quarter was impressive since the country was still in lockdown mode and the demand as well as ASP for personal protective equipment (PPE) had already been on the decline.

Interesting to note that Tekseng hit a year low of RM0.395 on the day the latest quarterly results were released. The price action has been positive since then, signalling that the smart money have a view that the worst is probably priced in.

SCENARIOS GOING FORWARD

1. Current Profit Levels Remains or Improve

We will assume that the PPE demand and prices have stabilised and the company will go back to relying on its traditional income stream in manufacturing and trading of PVC sheets. Therefore, in our worse case scenario of RM2.5 million per quarter would translate to a prospective PE ratio of 12 times (if we take into account the net cash position of RM25 million)

2. Dividend Payout Policy Remains

Tekseng has declared a dividend of RM0.01 for the last 3 Quarters of 2021! So, if we add the RM0.005 declared in Q4 2020 we get a total dividend of RM0.035 for the last 4 quarters, which translates to a yield of 8.3%!

If the company maintains this exceptional dividend payout policy, I see many investors flocking to Tekseng as a dividend stock investment.

A simple check on the Insage software for the top dividend stocks on KLSE you will find only 9 stocks that pay over 7% dividend. Amongs the other popular dividend stocks like Topglove, Kossan and TAANN, you will find that Tekseng is the only small cap stock (below RM200 million market cap) on that list!

CONCLUSION

Prices always get overdone on the upside frenzy and similarly, overshoots on the downside when it falls into panic mode. More often than not, picking bottoms in stocks can be hazardous to your wealth. However, with this mean reversion trade setup in Tekseng, the risk to reward profile is well defined and could be very financially rewarding. We also have the high dividend yield element as a strong buffer.

A stop loss can be placed at RM0.38, below the RM0.40 pivotal support, while the 1st target could be set at RM0.63 to RM0.78 range. At RM0.63 Tekseng would trade at at reasonable trailing PE ratio of only 10 times!

Have a good weekend and happy trading!

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks.Consult your financial consultant before making any financial investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Alpha Trader

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Created by TheAlphaTrader | May 31, 2024

Created by TheAlphaTrader | Mar 06, 2024

Axcapital

Excellent article and well argued

2021-11-26 10:51