KARYON INDUSTRIES BERHAD (0054) - A CONSISTENTLY PROFITABLE SMALL CAP COMPANY

TheAlphaTrader

Publish date: Mon, 27 Dec 2021, 10:26 AM

Karyon Industries Bhd (KIB) is an investment holding company founded in 1989. It was listed on the MESDAQ Market in September 2004 and was successfully transferred to the Main Board in May 2014.

KIB has two major wholly owned subsidiaries, Hsin Lung Sdn Bhd (HLSB) and Albright Industries (M) Sdn Bhd (AISB), which are involved in the manufacturing polymeric products.

HLSB is one of the largest manufacturers of Polyvinyl Chloride Compound (PVC) in Malaysia with a production capacity of 30,000 metric tonnes per annum. PVC is used in various applications including wire and cable coverings, footwear linings, gaskets and many more. HLSB also produces various types of PVC hoses for household and industrial purposes.

AISB is mainly involved in the manufacturing and trading of metallic stearates, PVC stabilisers and additives.

POINTS OF INTEREST

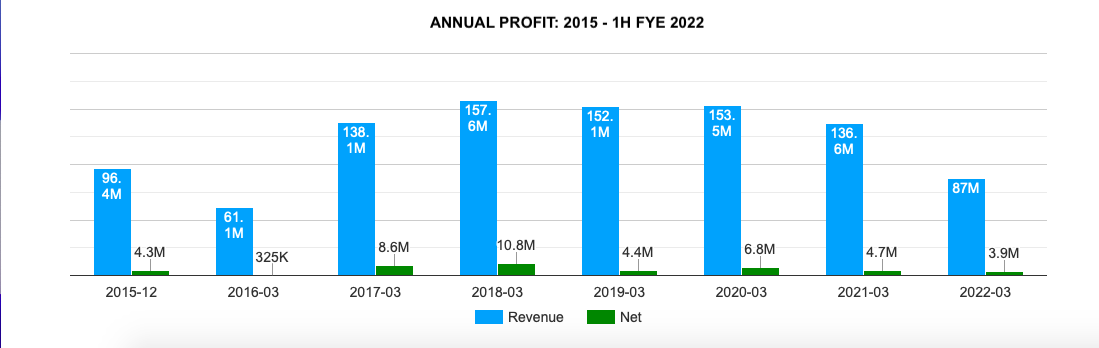

1) NEVER FAILED TO TURN IN A PROFIT ANNUALLY

KIB has reported annual profits consistently for the last 17 years since its listing! KIB currently trades at a trailing PE ratio of 16 times and has an NTA of RM0.23 per share. It has a net cash position of RM25.3 milliion vs a market capitalisation of only RM114 million. It has also adopted a consistent dividend payout policy with the current divident yield at 4.16%.

Although the most recent financial quarter showed a decrease in profit due to the MCO period, which limited the workforce operations to 60 percent capacity. Despite the challenging period, KIB was still able to turn in a profit of RM829,000. I expect the next quarterly results to improve with the production capacity returning to normal operating levels.

2) KEY EXECUTIVES ARE ALSO SUBSTANTIAL SHAREHOLDERS

KIB was founded by Dr Chua Kee Lam, a very well respected chemist back in 1989. He is also currently the second largest shareholder in KIB. His son, Mr. Chua Ling Hong, is the current CEO of the company (helming the positon since 2016), and also the fourth biggest shareholder with a 4% stake. The younger Chua has already demonstrated his calibre by delivering the best profit results (RM10.8 million) in the company’s history in FYE 2018!

Another major shareholder is Mr. Yeoh Chin Kiang, who has recently assumed the position of Executive Deputy Chairman. He was previously the Executive Director at Ta Win Holdings Bhd. His son Mr.Yeoh Eng How is also the Executive Director of KIB.

3) INSIDER BUYING

Both executive families of KIB have been consistently purchasing shares of the company. Since May 2021, both the Chua and Yeoh families have collectively purchased over 7 milion shares at prices ranging from RM0.225 to RM0.30. The most recent purchase was just made on 21 Dec 2021 for 350,000 shares at RM0.225.

As an illustration of how markets can be irrational, in April 2014, the NTA of KIB was at RM0.20 per share when the stock hit an all-time high of RM0.385. The surge in price then was premise on the excitement of KIB’s transfer to the Main Board. Fast forward 7 years later, the company’s balance sheet is now stronger, with NTA at RM0.22 per share. This is after taking into account dividends paid out almost yearly, yet the share price is only RM0.24! Maybe that is why the insiders are buying so many shares at current prices!

So, if the insiders who know their company so well, see value at the current prices, it is definitely a good buying indicator for the fundamental investor!

4) SMALL CAP STOCKS SEASONALITY

Small cap and penny stocks tend to have seasonal rallies near Chinese New Year. At the current price, KIB offers a good entry point to capture any seasonal rallies, if it materializes.

TECHNICALS

From the daily chart, a nice trading range is clearly defined with the support zone at RM0.20 to RM0.22 zone, while the resistance zone is at RM0.31 to RM0.33. A break above resistance zone would see a test of the 2020 year high of RM0.355, and then the all-time high price of RM0.385 set back in 2014.

CONCLUSION

At the current level, KIB offers an excellent value proposition. Downside seems limited, both from a fundamental and technical perspective. As one of the largest PVC manufacturers in Malaysia and backed by a strong management team, I am confident of the long-term growth and prospect of this company.

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Alpha Trader

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Created by TheAlphaTrader | May 31, 2024

Created by TheAlphaTrader | Mar 06, 2024