HEITECH PADU BHD (5028) ENTERING THE DATA CENTRE BUSINESS IN A BIG WAY

TheAlphaTrader

Publish date: Mon, 17 Jan 2022, 02:22 PM

COMPANY BACKGROUND

HeiTech Padu Berhad (Heitech) is engaged in the provision of information technolgy (IT) systems, specialising in the development of Information and Communication Technology (ICT) systems and infrastructure solutions for the public and private sectors. Apart from ICT, the Group also ventured into other areas such as engineering works, mailing and document processing activities and renewable energy.

POINTS OF INTEREST

1. JOINT VENTURE (JV) WITH REGAL ORION BHD AS A CATALYST

- Background of Regal Orion (RO)

RO is a company incorporated on 19 October 2017 and is owned by Japanese IT specialists investors. The principal activities of RO are the engineering, construction and project management specificaly in the data centre development sector.

RO’s maiden project is located at Techpark @Enstek, Labu, Negeri Sembilan which it bought back in March 2018.

- The JV between Heitech and RO

Heitech and RO entered into an unincorporated joint venture agreement on 5 March 2021 for the construction of a Tier IV data centre on a piece of land owned by Heitech in Shah Alam, Selangor. The JV project includes the construction, commissioning and testing of the Tier IV data centre, which comprises a five storey building with racks to be tenanted upon completion by international or multinational tenants.

Heitech currently operates another data centre on the Shah Alam land and the new JV project will be built on the undeveloped portion of the land. Under the agreement, Heitech will grant RO the right to develop the land in exchange for a 20% cut of the profit after tax of the project. The project is expected to be completed by Sept 2024.

- RM350 million contract from RO for the design, engineering, procurement, construction, installation and commissioning (DEPCIC) of a data centre in Negeri Sembilan

Further to the JV in March 2021, on 16 Aug 2021 Heitech also secured a RM350 million contract from RO for the DEPCIC of the data centre in Negeri Sembilan, which it acquired back in 2018. RO aims to turn the facility into a premium Tier IV next generation green mega data centre, which will have a total of 120,000 sq feet of Net Hosting Space Area.

The execution and successful completion of the DEPCIC will contribute positively to the revenue and earnings of Heitech in the years to come.

- Private Placement of 10 million new shares to RO

A Private Placement of 10 million new ordinary shares to RO was proposed on 24 June 2021 and was subsequently approved by Bursa Malaysia on 17 July 2021. As at the time of writing (15 Jan 2022) the placement has not been completed nor has the price been fixed.

Typically, Private Placements are completed within 6 months of the regulatory approval date. So could the recent strength in price be linked to the price fixing for the Private Placement?

2. GOOD CHART STRUCTURE

Heitech broke the downtrend line (in place since 16 Feb 2021) on 13 Dec 2021 by closing at the day high of RM1.30. It has successfully retested the new uptrendline on 7Jan 2022 at RM1.25 and has managed to close above RM1.30 for the next 5 conseutive days despite the current challenging market environment for tech stocks.

1st resistance zone can be pegged at RM1.55 to RM1.70 while the next resistance stands at RM1.80, which if broken would represent a new 52 week high. The support zone is at RM1.03 to RM1.13 levels.

Interesting to note that when the JV with Regal Orion was announced on 5 March 2021, the price of Heitech was at RM1.60.

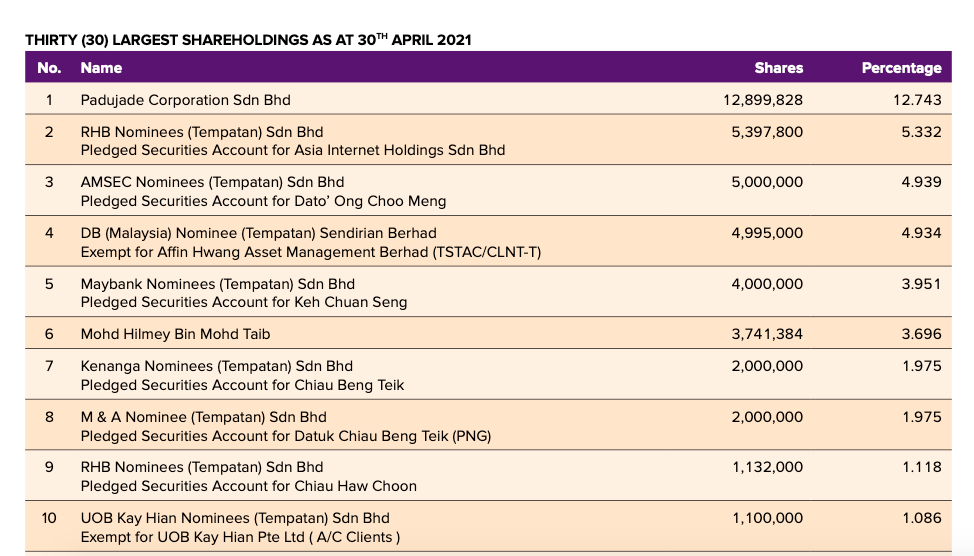

3. INTERESTING LIST OF SUBSTANTIAL SHAREHOLDERS

Looking at the list of the top 30 shareholders from the latest Annual Report, we find 2 new prominent investors who bought into Heitech somewhere between 30 April 2020 and 3 April 2021.

Dato Eddie Ong Choo Meng( Dato Eddie) is the third biggest shareholder with 5 million shares (4.9% of the company) while Datuk Chiau Beng Teik (Datuk Chiau) and his son collectively own 5.1 million shares.

Dato Eddie Ong is the owner of the Hextar Group of companies and also has substantial holdings in a string of other public listed companies. Based on historical evidence, there is always a lot of price action in the companies that Dato Eddie has investments in, the most recent being in Complete Logistics Bhd which has just made a new all-time high of RM2.92 on 14 Jan 2022. Hextar Global Bhd was up a whopping 193% in 2021 making it one of the best performing stocks of the year.

Datuk Chiau is no stranger to stock market punters, being the boss at Chin Hin Group of companies. Chin Hin Group Bhd was also one of the darlings of the stock market in 2021 rising from RM0.90 in Jan 2021 to close at RM2.55 on 31 Dec 2021, for an astounding gain of 280%!

Some may remember back in 2020 when Regal Orion was considering a reverse takeover (RTO) into GPA Holdings Bhd (now renamed Joe Bhd). Coincidentally, Dato Eddie was also in the running to acquire the stake in GPA from Tan Sri Tan Hua Choon. Could it be a sheer coincidence that both Regal Orion and Dato Eddie also made presence in Heitech?

4. STILL OBTAINING NEW AWARDS OF CONTRACT WORK

Heitech was recently awarded a contract on 17 Dec 2021 for the supply, installation and management of the network infrastructure for Permodalan Nasional Berhad (PNB)’s new office at Merdeka 118. The contract is valued at RM21.7 million and is for a period of 42 months.

Heitech also has an ongoing contract worth RM36.2 million with JPJ Malaysia for Infrastructure ICT work and the mySIKAP project. This project duration is for 1 year starting in September 2021 and will contribute positively to the the bottomline for Heitech’s FYE 2022.

CONCLUSION

Valued at only RM133 million market cap coupled with the right catalyst and good technical chart setup, Heitech could be a stock to look out for in 2022 and beyond! Although tech stocks may not be in vouge at the moment, Heitech has its own fundamental reasons for getting a rerating.

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

More articles on The Alpha Trader

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Created by TheAlphaTrader | May 31, 2024

Created by TheAlphaTrader | Mar 06, 2024