FOOD FOR THOUGHT: SOMETHING IS BREWING AT CWG HOLDINGS BHD (9423)?

TheAlphaTrader

Publish date: Fri, 18 Feb 2022, 11:35 AM

BACKGROUND

CWG Holdings Bhd (CWG) is primarily involved in the manufacture and sale of stationery and printing materials. The company has been around since 1959 and was listed on the KLSE in 1994 as Chee Wah Corporation Bhd. In 2017, the company underwent an intrernal reorganization and share exchange exercise, as well as renaming the company to CWG Holdings Bhd. Their premium brand, “CAMPAP” is very well known and as a consumer, I have been using their stationery products for many years. The brand has received multiple accolades, both locally and abroad,including the Superbrands Malaysia Award in 2005 and the BrandLaureate BestBrands Award 2018-2019.

CWG derives a whopping 75% of its revenue from exports. The strong USD augurs well for the company’s earnings, and that is good news for CWG since the Federal Reserve is on the bias of raising interest rates for the rest of this year. In fact, CWG had quite a good run in 2015 as a proxy to the weak RM play when it went up almost 400% in a span of 6 months!

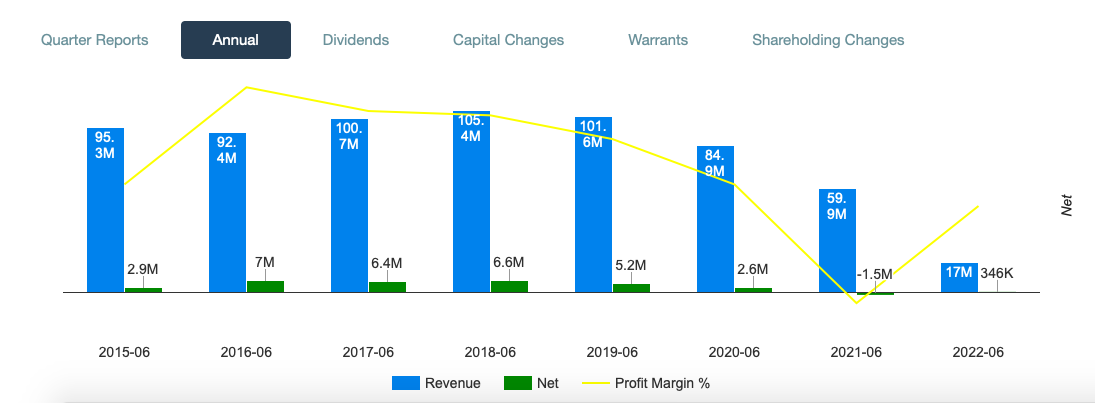

Just like many other companies, the pandemic had a negative impact on CMG’s performance in FYE 2021, with the company registering a loss of RM1.5 million. Having said that, it is worth to note that CWG had been consistently making profits for the prior 6 years preceding Covid-19, with profits ranging from RM2.6 million to RM7.0 million. Going forward, things should be perking up with the worse of the pandemic behind us. Most recently, CWG registered a Q1 FYE2022 profit of RM346,000. The next quarterly financial report is expected to be released by end of February 2022.

Going beyond financials, what is exciting for CWG is actually the emergence of a new subsatntial shareholder on 28th January 2022 and the bonus issue of free warrants.

INTERESTING CORPORATE DEVELOPMENTS

1) Private placement

A Private Placement of 20% of the total number of issued shares or 25.2 million new shares were placed out to Datuk Hong Choon Hau at RM0.40 while another 10% new shares were placed out to unidentified new investors at RM0.405. Datuk Hong has also been made Executive Director of CWG effective from 16 Feb 2022.

So, who is Datuk Hong Choon Hau?

Datuk Hong bought a substantial stake into the biotech company Sunzen Bhd back in June 2014. From the Bursa Malaysia announcements, he aquired 41 million shares or 27.5% of the company at RM0.26 per share. He has since exited the company in Jan 2021.

Interesting to note from the price chart of Sunzen, in the span of 12 months after Datuk Hong’s entry into Sunzen in June 2014, the price of the company went up 80% from RM0.26 RM0.47! Will the same magic happen with CWG?

2) Bonus Issue of Warrants

As a way to reward existing and new shareholders, CWG will also issue bonus free warrants on the basis of 2 warrants for every 1 existing share. The ex date for these free warrants are on the 25 Feb 2022. What this mean is that shares have to be purchased by 24 Feb 2022 in order to be entiltled for the free warrants. The exercise price of the warrants are fixed at only RM0.36 with a tenure of 5 years.

From our observation of late, there have been many profitable corporate exercises that resulted in good returns for investors by purchasing the mother share and participating in the bonus warrants/bonus shares exercise.

TECHNICAL PICTURE

From the weekly chart, we can see a that until July 2021 the volume traded on CWG was very light. However, for reasons that were not driven by any newsflow at that time. volumes saw a huge spike in July 2021, leading to big jump in price from the RM0.40 level to a high of RM0.70.

Since the past 6 months, the volume traded has been way above the daily average while the stock has been slowly trending up from the RM0.40 level to the current RM0.50 level.

From the rising uptrend channel that started in June 2020, the levels to be tested on the upside rests at RM0.70, while the support sits firmly at the RM0.43 level.

CONCLUSION

It will be interesting to see what Datuk Hong’s plans are for CWG in the coming months. The best way to benefit from any potential upside fo CWG’s price is to buy the shares before it goes ex bonus as the leverage from the upside of the warrants will be amplified.

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Alpha Trader

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Created by TheAlphaTrader | May 31, 2024

Created by TheAlphaTrader | Mar 06, 2024

Dkk08

Wow.. hoot9e.. Huat ar.. Must thanks this writer for sharing a few good writeup recently

2022-02-18 11:47