DANCOMECH HOLDINGS BERHAD (5276)- RECENT SELLDOWN PRESENTS A GOOD BUY OPPORTUNITY?

TheAlphaTrader

Publish date: Wed, 23 Mar 2022, 11:19 AM

BUSINESS BACKGROUND

Dancomech Holdings Berhad (Danco) was listed on the Main Market of Bursa Malaysia Securities Berhad on 21 July 2016. The company is principally involved in the trading and distribution of process control equipment, measurement instruments and industrial pumps. They also provide material handling system solutions and are involved in the production of metal stamping parts and components, and design and manufacture of tools and dies.

The trading division which accounts for the main operations, is involved in 3rd party products purchasing from suppliers based in countries such as Germany, United Kingdom, China, Taiwan, South Korea, Spain, Italy, etc. The company offer its products to palm oil and oleochemicals, oil & gas and petrochemical, and water treatment & sewerage industries.

REASONS FOR THE RECENT SELLDOWN

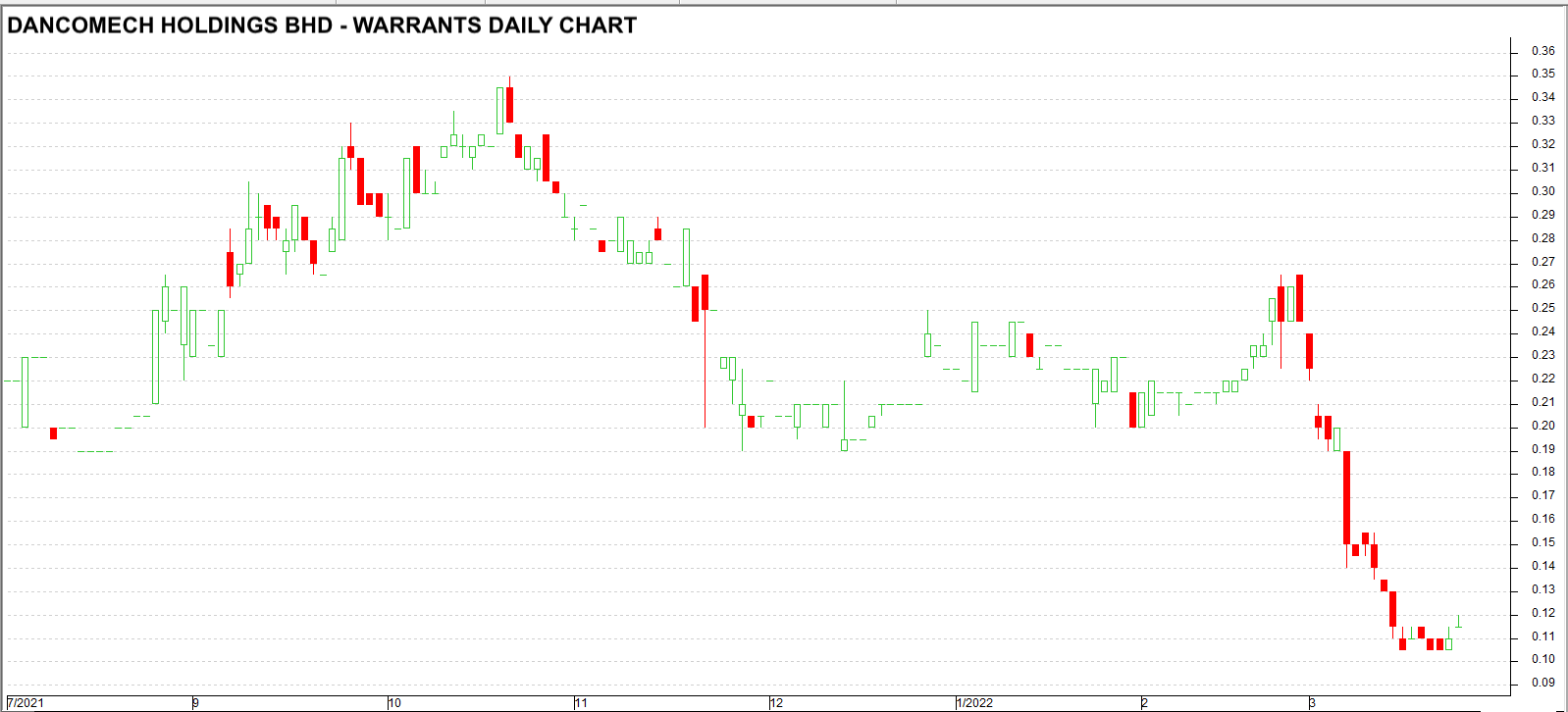

The impending expiry of Danco warrants (expiring on 22 May 2022) has resulted some irrational selling of the Danco mother share. Danco shares hit a year high of RM0.60 on 25 February 2022 after reporting a strong set of quarterly results. It has since shed 25% of its value with the warrants dropping about 60% in the last month.

This could be the result of many minority warrant holders deciding to sell the warrants instead of converting them at a cost of RM0.30 per warrant. This is understandable given the fact that the warrants were offered as free bonus warrants back in 2017 on the basis of 1 warrant for every 2 shares. Retail shareholders also often view the conversion process as cumbersome.

The constant 4% to 7% discount of the warrant price had also presented an arbitrage opportunity for existing shareholders to sell the mother shares and buy the warrants to go through the conversion process. This has also place further pressure on the mother share price.

It should be noted from the Bursa Malaysia announcements that there has been heavy conversion of warrants into ordinary shares by the major shareholders. This is viewed positively as this reinforces their commitment and confidence in the future of the company.

SOLID FUNDAMENTALS

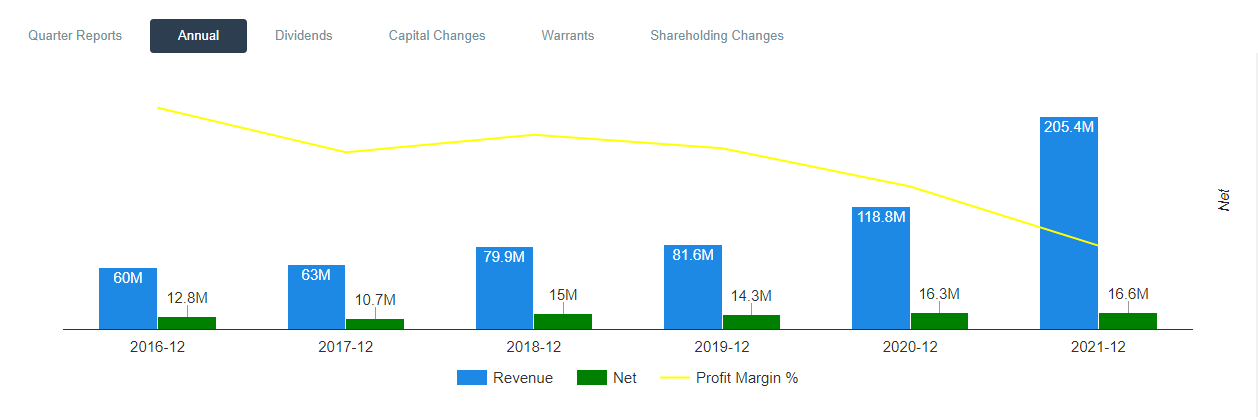

Danco has the strong distinction of NEVER failing to report a profit since its listing in 2016! It recently reported its best ever annual profit in 2021, since its listing debut on Bursa Malaysia. Since it has a 40% profit distribution policy, it pays a good dividend yield of 4.55%.

From the latest Balance Sheet, we can see that the company has a net cash position of RM61.65 million. Assuming the full conversion of the warrants, the net cash position would be raised to RM86 million or 19.23sen per share with the fully dilluted PER of 12 times on the enlarged share base. However, based on the Ex cash PER, Danco is trading at a prospective PER of only 7 times!

The closest comparison of a company with similar business operations on Bursa Malaysia would be Unimech Bhd, which trades at a PER of 10 times. Other internationally listed companies in the same industry like KITZ Corp (listed in Japan), Emerson and Flowserv (listed in the USA) trades at over 20 times PER.

MULTIPLE ACCOLADES

i) FORBES ASIA’S 2021 BEST UNDER A BILLION LIST

Danco was one of the eleven Malaysian companies recognised under Forbes Asia’s 2021 Best Under A Billion list, which highlighted the resilience of 200 public listed small and mid-sized companies in the Asia Pacific region, with sales under US1 billion. Also included in the list of eleven companies in Malaysia, are the likes of Scientex Bhd, Thong Guan Bhd and Frontken Bhd.

This is quite an achievement as the top 200 companies are selected from a universe of 20,000 public traded companies in the Asia-Pacific region. The matrix used in compiling the lists include debt, sales and EPS growth over both the most recent one and three year period.

ii) “TOP MALAYSIA SMALL CAP COMPANIES 20 JEWELS 2019”

Danco also was selected as one of the top 20 small cap companies in 2019 by RHB Investment Bank Bhd to invest in from South East Asian Markets. This was pretty impressive given that only 5 Malaysian companies made it to the list from the total of 757 companies listed on Bursa Malaysia with a market cap of below RM1 billion.

CONCLUSION

The best buying opportunities present themselves in the most unusual and unexpected ways. In the case of Danco, after reporting blockbuster quarterly results, the share price was trading at 2022 high of RM0.60. The valuations were already considered very attractive at RM0.60, but due to the selldown of the warrants, a fantastic opportunity to get into the stock at a deeply discounted price has presented itself.

When fundamentally good stocks are sold down for the WRONG reasons, history has shown that capitalising on the short term anomaly generally pays off handsomely in the long run!

Disclaimer: This blog is created for sharing of trading ideas only. It is not in any way or form meant to be an inducement or recommendation to buy or sell any stocks. Consult your financial consultant before making any financial investments.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Alpha Trader

Created by TheAlphaTrader | Aug 16, 2024

Created by TheAlphaTrader | Jul 27, 2024

Created by TheAlphaTrader | Jun 21, 2024

Created by TheAlphaTrader | Jun 07, 2024

Created by TheAlphaTrader | May 31, 2024

Discussions

At this price, Danco presents a great buying opportunity. Should be a good buy.

2022-03-23 13:13

.png)

Lsly88

noted this writer articles quite good..follow few times can get some some free drinks

2022-03-23 12:09