KLSE Top 3 Oil & Gas Stocks You Must Know Before Investing & Why Investor/Traders must have these related stocks in their portfolio ?

TradeVSA

Publish date: Wed, 18 Dec 2019, 11:13 AM

Malaysia’s oil and gas industry is witnessing active transformation during 2019 mild bull rally driven by local and global industry dynamics. And as such oil and gas counter have been dominated the KLSE stock exchange. Analyzing all the recent developments, emerging strategies and trends in the Malaysia oil and gas counters in the KLSE, we are looking at 3 possible good candidates to study for our oil and gas counters.

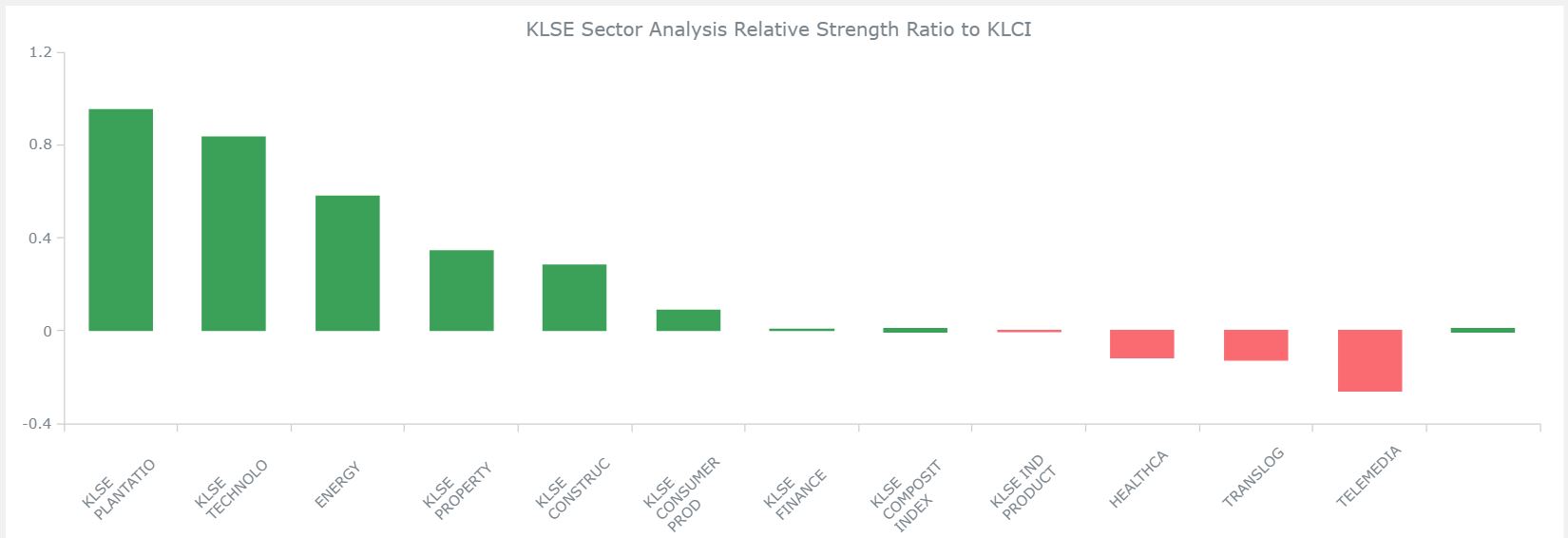

However, before we discuss the 3 good oil and gas counters, we need to look at the entire KLSE sectorial analysis to see why Energy sector @ Bursa, aka oil and gas. Firstly, we have Energy sector being the most dominant over other like technology and plantations.

As such, let’s look at them now.

TradeVSA Sector Analysis

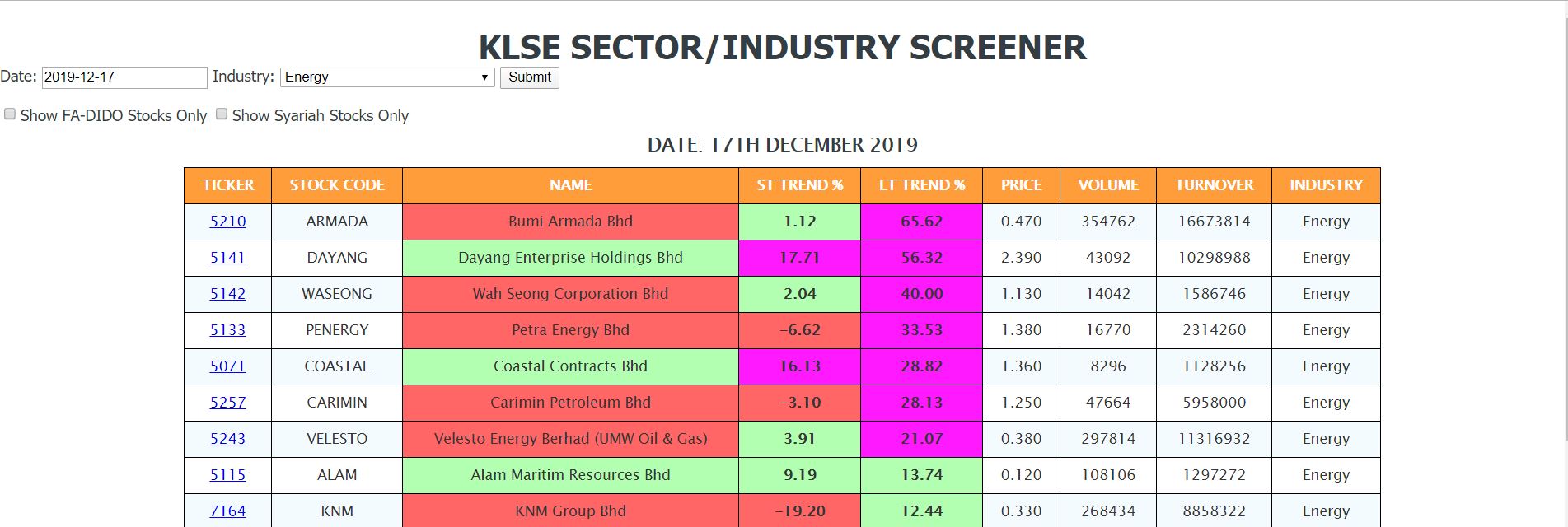

In our TradeVSA KLSE Sector screener, we can easily select top three counter doing fairly well from the technical aspects of Volume Spread Analysis (TradeVSA method). In addition, with our toolkit colour coded for ease of stock selection,(eg. Green with Purple cells is preferred), we have them “bubbled to the top” for quick investor/trader reference.

TradeVSA KLSE Sector Screener – Oil & Gas

Based on the KLSE screener, we notice 3 counters in Oil & Gas are having a nice uptrend. We will discuss the 3 counters below and look for opportunities to trade based on the chart. Below are the 3 counters:

- Bumi Armada

- Wah Seong Corporation

- Dayang Enterprise

Bumi Armada (5210.KL)

Background

Bumi Armada (ARMADA) was formed in 1995 with two main business units, Bumi Armada Navigation and Haven, with a predominantly domestic focus. Bumi Armada Navigation, which was established in 1977, focused on the provision of vessel chartering services whilst Haven, which was set up in 1987, was an offshore construction, installation and maintenance services company. Listed in 1997 on the Main Board of the Kuala Lumpur Stock Exchange and subsequently delisted on April 2003. In 2011, ARMADA was once again listed on Bursa Malaysia, in an IPO which was the largest in the country for that year.

Today, ARMADA is a Malaysia based fully integrated offshore solutions provider that operates across the globe. ARMADA provides offshore services via two business units: (i) Floating Production and Operation (FPO) of oil and gas solutions and (ii) Offshore Marine Services (OMS) which comprises of Offshore Support Vessel (OSV) and Subsea Construction (SC) services.

Known Major Shareholder(s) (As at 29th Mar 2019)

8.56 % Amanah Saham Bumiputera

7.10 % Employees Provident Fund Board

34.89 % Objektif Bersatu Sdn Bhd+

Note: + Ananda Krishnan & family have interest in this.

A Quick Fundamental View for Bumi Armada:

FA Ratings : 1/8*

- PE = -2.88

- ROE = -27.95 %

- DIY = 0.00 %

- Mkt Cap: 2,791.4M (RM) in Large Cap, Energy, Main Market.

Note: [s] = Syariah, ** = Good.

@ Trading at Overpriced (relative).

*Intrinsic Valuation Desk*

Intrinsic Value cannot be calculated as EPS is negative! This company is loss-making currently! Please check other indicators too.

Profitability Analysis

TradeVSA Weekly & Daily Chart

TradeVSA weekly chart show the change of trend with a climatic sell-off bar at the end of November 2018. Price started to mark-up with high volume Line Change after the Buy Signal. Based on the currently chart setup, Bumi Armada likely to form a pullback pattern soon. We are looking for signal of strength to confirm the pullback is complete

Red Pentagon appeared once again in the daily TradeVSA chart. However, we notice the volume still low to average with a Spring bar as the current support. We will look for opportunity to trade once Green Pentagon Buy signal appear again to confirm the pullback.

Wah Seong Corporation (5142.KL)

Background

Wah Seong Corporation Berhad is a Malaysia-based company. The Company's segments include Oil & gas division, which is engaged in pipe coating, pipe manufacturing for the oil and gas industry, building and operating offshore/onshore field development facilities, and the provision of equipment and services to the power generation, oleochemical and petrochemical industries; Renewable energy division, which is a supplier and manufacturer of specialized equipment for biomass power plants; Industrial trading & services division, which is engaged in the trading and distribution of building materials, and the manufacturing and trading of industrial pipes; Plantation division, which is engaged in agricultural development, cultivation of oil palm and other crops, and trading of oil palm products and agriculture based products, and Others, which includes all other units within the Company.

Known Major Shareholder(s) (As at 29th Mar 2019)

32.99 % Wah Seong (Malaya) Trading Co. Sdn Bhd

6.98 % Tan Kim Yeow Sdn Bhd

5.38 % Midvest Asia Sdn Bhd

4.50 % Lembaga Tabung Angkatan Tentera

4.41 % Amanahraya Trustees Bhd Amanah Saham Bumiputera

A Quick Fundamental View for Wah Seong Corporation:

FA Ratings : 1/8*

- PE = 20.95

- ROE = 4.41 %

- DIY = 0.00 %

- Mkt Cap: 937.6M (RM) in Mid Cap, Energy, Main Market.

(3-Yrs CAGR: +16.2% p.a.)

Note: [s] = Syariah, ** = Good.

@ Trading at Overpriced (relative).

*Intrinsic Valuation Desk*

Intrinsic Value @ 10% disc rate =0.25, IV @ 3.6% = 1.97, IV @ 7.5% = 0.45, IV @ 12% = 0.18,

Share is *OverValued *, Safety Margin @ 10% disc rate = -79 % (Sell !).

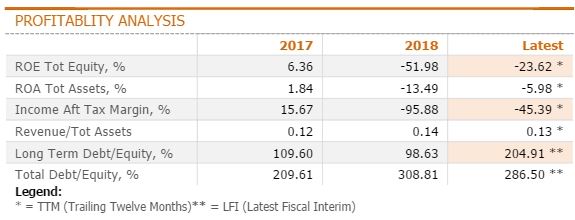

Profitability Analysis

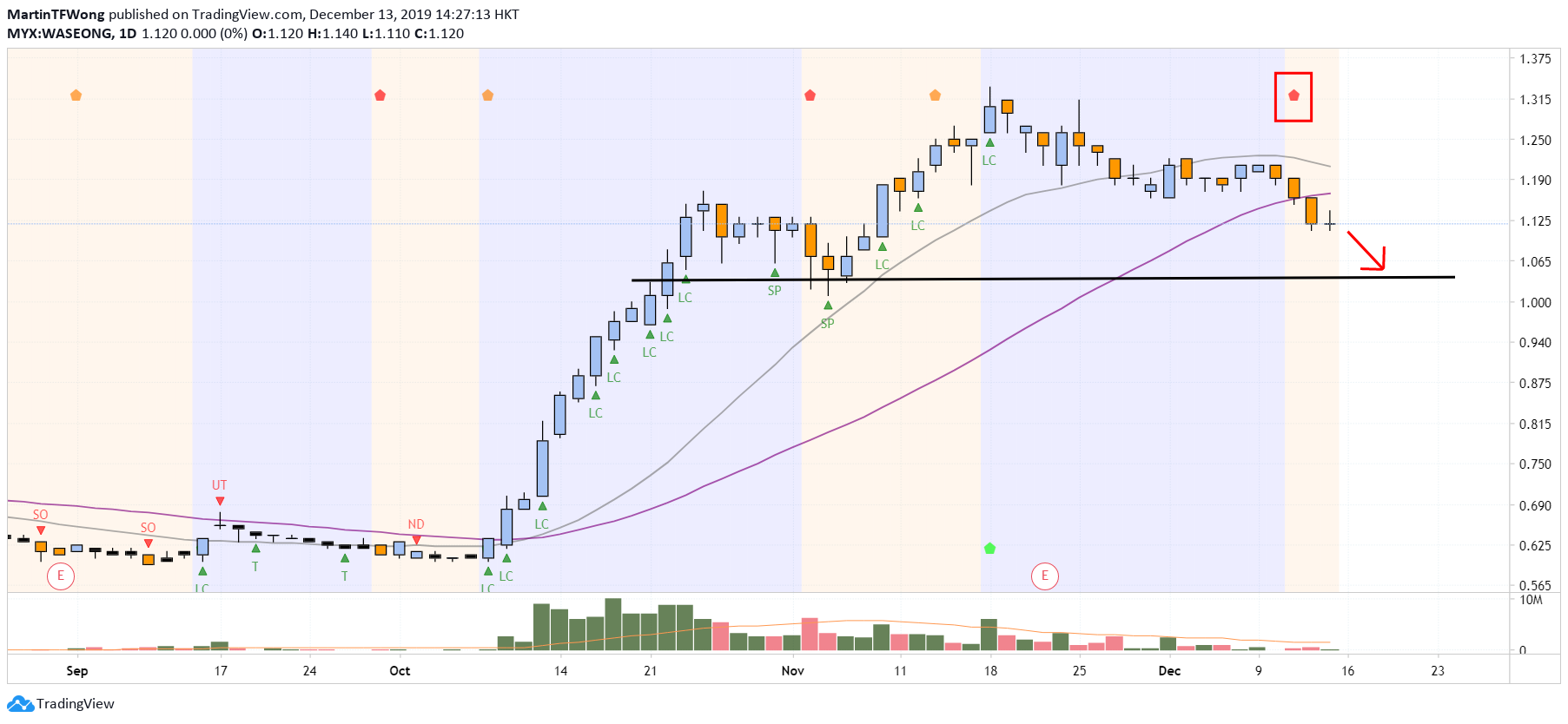

TradeVSA Weekly & Daily Chart

Strong volume breaks the resistance in the weekly show price likely to test at RM1.70 soon. Currently price is pulling back to retest the temporary support however we yet to see any sign of strength. We will look for trading opportunities if there any strength.

Daily chart showing a similar setup where Wah Seong continue to pullback to the support with Spring. We notice red pentagon appeared indicate pullback is not complete yet. We will wait for green pentagon to appear to confirm the pullback.

Dayang Enterprise Holdings

Background

DAYANG is considered to be one of the largest providers of offshore platform services in Malaysia. It is principally involved in the provision of offshore topside maintenance services, minor fabrication operations, offshore hook-up and commissioning, and charter of marine vessels relating to the oil and gas industry. It owns a fleet of 8 offshore support vessels. As at the end of Sept 2019, its total orderbook stood at approximately RM2.5 bn; which are call out contracts to last at least until 2023.

Known Major Shareholder(s) (As at 29th Mar 2019)

26.42 % Naim Holdings Bhd

6.83 % Tengku Dato' Yusof Bin Tengku Ahmad Shahruddin

7.92 % Urusharta Jammah Sdn Bhd

6.35 % Vogue Empire Sdn Bhd

A Quick Fundamental View for Dayang:

FA Ratings : 6/8*

- PE = 9.29 **

- ROE = 17.99 % **

- DIY = 0.00 %

- Mkt Cap: 2,377.3M (RM) in Large Cap, Energy, Main Market.

(3-Yrs CAGR: +60.0% p.a.)

Note: [s] = Syariah, ** = Good.

@ Trading Underpriced (relative).

*Intrinsic Valuation Desk*

Intrinsic Value @ 10% disc rate =4.34, IV @ 3.6% = 33.45, IV @ 7.5% = 7.71, IV @ 12% = 3.01,

Share is *Undervalued *, Safety Margin @ 10% disc rate = 94 % (Buy Now !).

Target Price: 2.53 @ P/PE@ 10.5x, potential +12.9 %.

Profitability Analysis

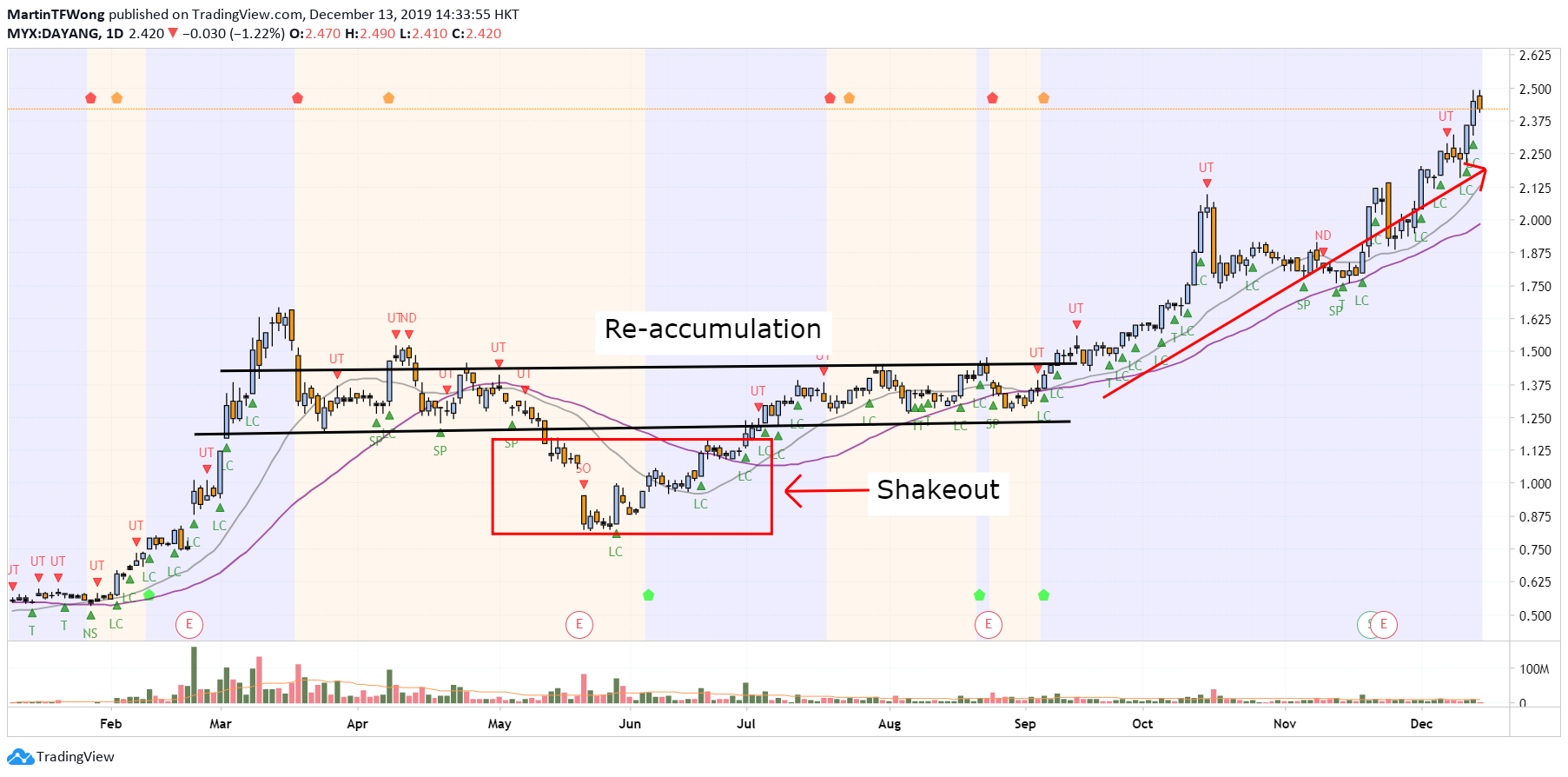

TradeVSA Weekly & Daily Chart

Strength can be easily spotted in the re-accumulation for Dayang. During the re-accumulation, we notice there is a shakeout with buy signal pushes the price back to re-accumulation. Another buy signal appeared on 6 September 2019 to push the price above resistance and change the trend to Mark-Up stage.

Price continue to mark-up with several pullback. Looks for the next pullback to trade with low risk.

Summary

After considering all the fundamental and technical aspect, we preferred Dayang over Bumi Armada and Wah Seong. With a fundamental target price @ RM2.53, we see a potential of +6.5% for Dayang. However, if you are trading on a technical aspect of TradeVSA, medium target profit @ RM2.70.

|

Bumi Armada |

Wah Seong [s] |

Dayang [s] |

|

FA Ratings : 1/8*

Note: [s] = Syariah, ** = Good. @ Trading at Overpriced (relative).

*Intrinsic Valuation Desk*

Intrinsic Value cannot be calculated as EPS is negative! This company is loss-making currently! Please check other indicators too. |

FA Ratings : 1/8*

(3-Yrs CAGR: +16.2% p.a.) Note: [s] = Syariah, ** = Good. @ Trading at Overpriced (relative).

*Intrinsic Valuation Desk*

Intrinsic Value @ 10% disc rate =0.25, IV @ 3.6% = 1.97, IV @ 7.5% = 0.45, IV @ 12% = 0.18, Share is *OverValued *, Safety Margin @ 10% disc rate = -79 % (Sell !).

|

FA Ratings : 6/8*

(3-Yrs CAGR: +60.0% p.a.) Note: [s] = Syariah, ** = Good. @ Trading Underpriced (relative).

*Intrinsic Valuation Desk*

Intrinsic Value @ 10% disc rate =4.34, IV @ 3.6% = 33.45, IV @ 7.5% = 7.71, IV @ 12% = 3.01, Share is *Undervalued *, Safety Margin @ 10% disc rate = 94 % (Buy Now !). Target Price: 2.53 @ P/PE@ 10.5x, potential +6.3 %.

|

|

Think to buy ARMADA only if it break about Short Term Resistance level @ 0.550 or Pullback @ 0.5-0.51.

Medium Target Profit = 0.597. |

Think to buy WASEONG only if it break about Short Term Resistance level @ 1.330 or Pullback @ 1.22-1.242.

Medium Target Profit = 1.443. |

Think to buy DAYANG only if it break about Short Term Resistance level @ 2.490 or Pullback @ 2.175-2.238.

Medium Target Profit = 2.702. |

Do you know how to create these fundamental and technical like above automatically ? You can do it now for FREE using our free tools.

We will cover for Plantation sector next week. Let us know what sector you wish us to cover in the next article in the comment below.

Contact us via: email at support@tradevsa.com or Call/WhatsApp at +6010 266 9761 if you have any queries.

Join our FREE Education via Telegram Channel: https://t.me/tradevsatradingideas

Facebook: www.facebook.com/MartinTFWong

Youtube: https://www.youtube.com/channel/UCKiafbxoa-DtTF5YP0v-HYg

Follow in the Telegram, Facebook and Youtube for daily update

More articles on TradeVSA - Case Study

Created by TradeVSA | Nov 01, 2021

Created by TradeVSA | Oct 15, 2021

Created by TradeVSA | Oct 06, 2021

Discussions

Armada An Quantum Leap Stock In 2019/2020

Like your sharing for Armada / Waseong & Dayang .

TQ !

2019-12-19 14:22

Thank you for highlighting. Will correct the syariah compliant for Bumi Armada

2019-12-20 11:18

speakup

stating the obvious. where was this sifu when it was near lows?

2019-12-18 17:31