Step by Step Guide to Spot Pullback using Volume Spread Analysis

TradeVSA

Publish date: Fri, 08 May 2020, 01:30 AM

A pullback is a temporary retracement in a stock pricing during mark-up stage / uptrend. Pullbacks are widely seen as buying opportunities after a stock has experienced a large upward price movement. Pullback strategy give us the advantage of buying at a lower price in an uptrend to reduce risk and the opportunity to ride the primary trend to increase profit.

As Volume Spread Analysis trader, we tend to combine Sign of Strength signals into the Pullback setup to ensure we buy at the right price with lower risk. In this article, we will focus Pullback with No Supply signal.

No Supply (NS) signal simply mean lack of sellers at the particular price range. No Supply signal can be spotted mostly in a support level. Once No Supply signal appeared, these indicating sellers have been removed from the market and Smart Money ready to mark the price higher!

Below are the case study and recent pullback setup with No Supply signal

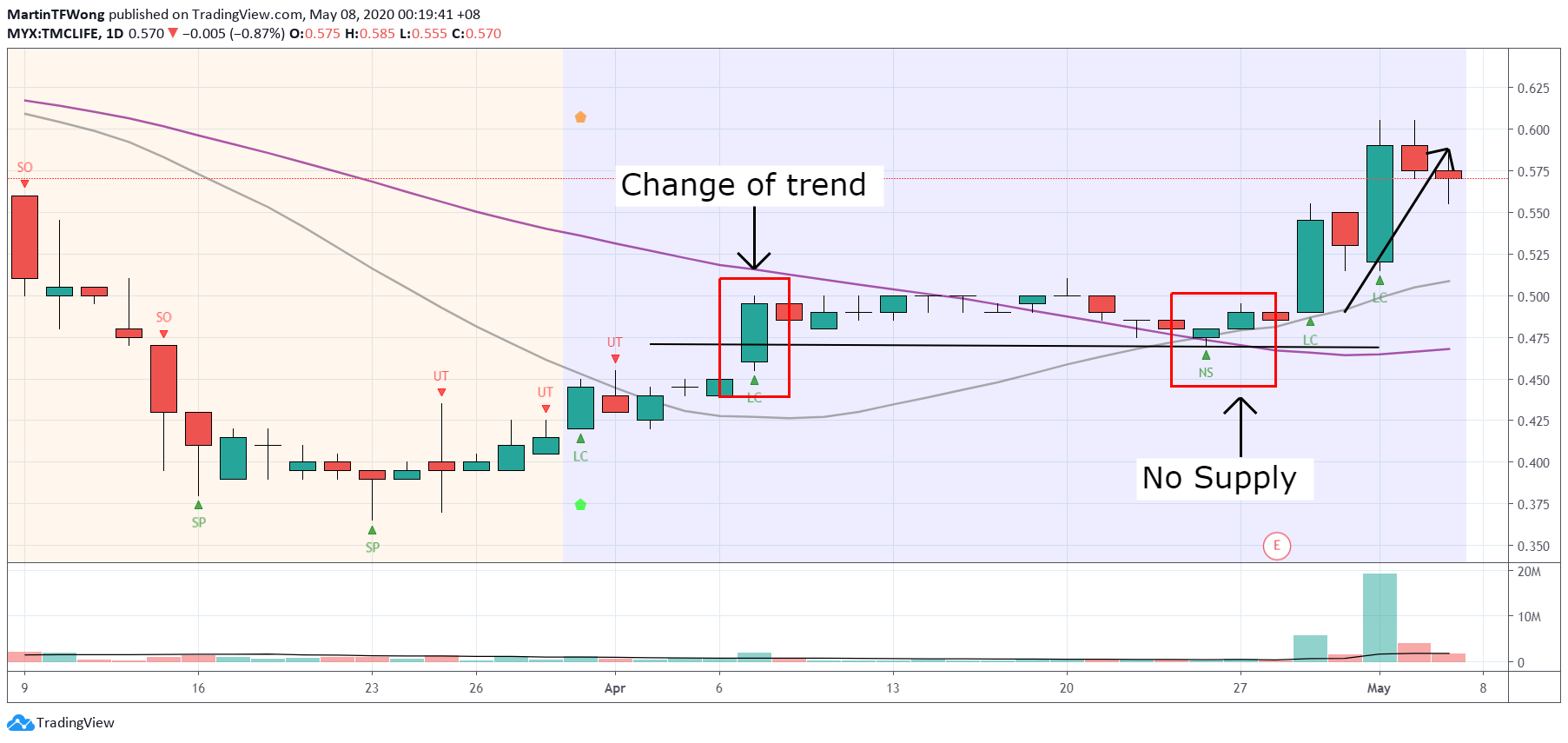

Case Study 1

Signal in the daily chart above:

- Change in trend with Line Change (LC)

- Price pullback

- No Supply indicate no sellers before Smart Money mark the price up

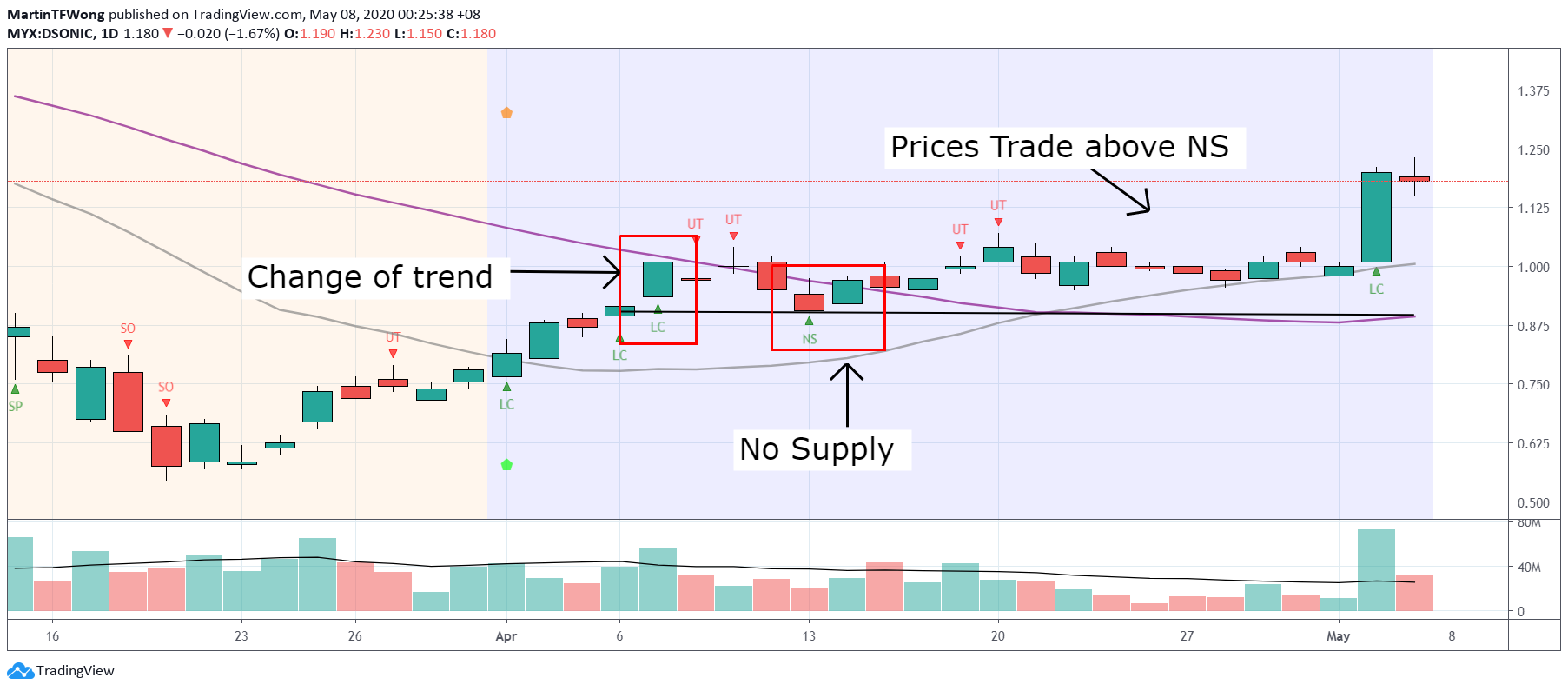

Case Study 2

Signal in the daily chart:

- Line Change with change of trend

- No Supply signal marked the lowest in the new support level

- Prices trading above NS signal indicate strong support from Smart Money

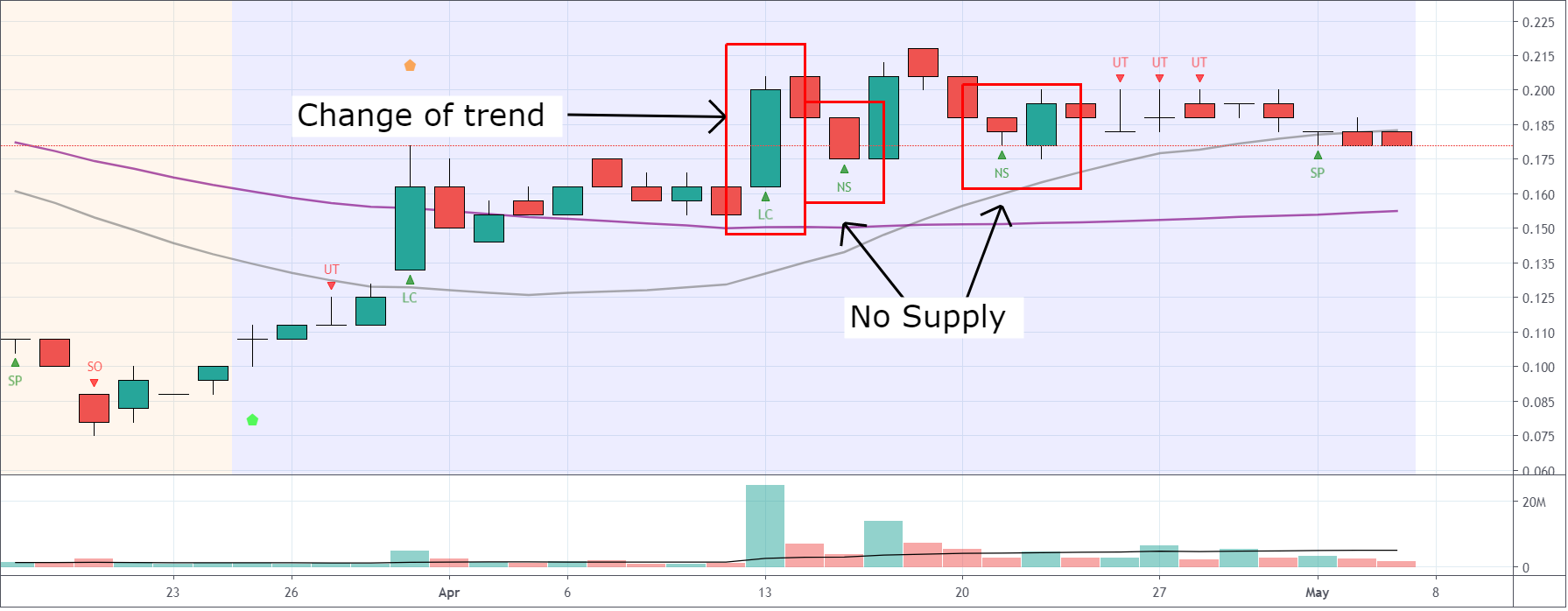

Case Study 3

Signal in the daily chart:

Signal in the daily chart:

- No Supply marked the lowest of new support

- Continuation of Mark-Up after Pullback

- Lack of sellers detected by Smart Money

Current Pullback Setup 1

Strength signal in the chart:

- Line Change high volume

- Price pullback with No Supply signal

- Prices trading above / near No Supply signal

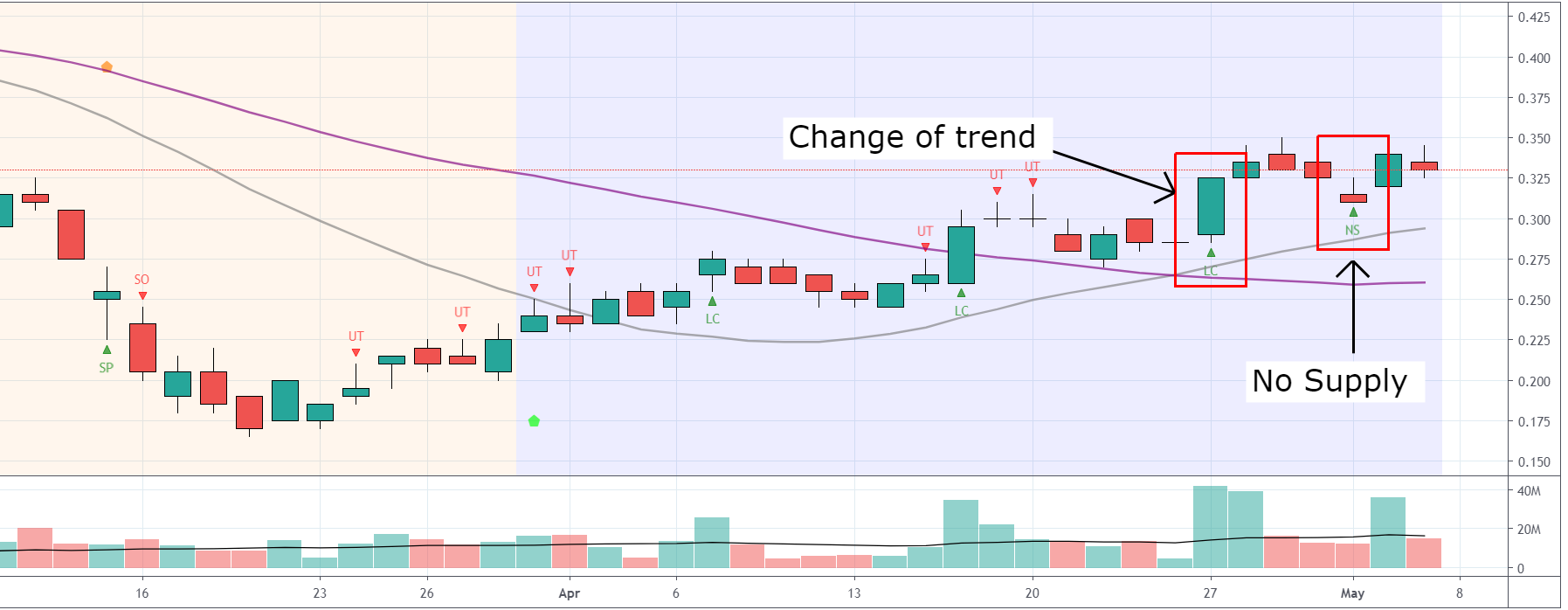

Current Pullback Setup 2

Strength in the chart:

- High volume Line Change

- Price tested Line Change with No Supply signal

Current Pullback Setup 3

Strength in the chart:

- Price continue to mark-up with Line Change

- No Supply marked the complete of the pullback

- Price trading above No Supply

All example above shown how can a Volume Spread Analysis trader improve his entry during pullback using COMBO Setup (Green Pentagon + Line Change + No Supply). Below are the previous pullback review with different Strength setup:

- Sedania – 3 May 2020

https://www.tradingview.com/chart/SEDANIA/EGGKUyJO-TradeVSA-Pullback-Completed-with-Spring-Sedania/

- Elsoft, DUFU, Supermax – 1 May 2020

https://www.tradingview.com/chart/SUPERMX/ylnDrbo4-TradeVSA-The-Best-Risk-to-Reward-Trade-Setup/

- Damansara Realty BHD – 19 April 2020

https://www.tradingview.com/chart/DBHD/37ZIq478-TradeVSA-DBHD-Pullback-Completed/

Contact us via: email at support@tradevsa.com or Call/WhatsApp at +6010 266 9761 if you have any queries.

Join our FREE Education via Telegram Channel: https://t.me/tradevsatradingideas

Facebook: www.facebook.com/MartinTFWong

Youtube: https://www.youtube.com/channel/UCKiafbxoa-DtTF5YP0v-HYg

Follow in the Telegram, Facebook and Youtube for daily update

More articles on TradeVSA - Case Study

Created by TradeVSA | Nov 01, 2021

Created by TradeVSA | Oct 15, 2021

Created by TradeVSA | Oct 06, 2021

Taehyung

Look complicated, but useless analysis !

simply can't make money using this type of flipflop trading method !

2020-05-08 08:56