PENTAMASTER CORP - Next gem in the making

intelligentinvesting

Publish date: Sun, 10 Jul 2016, 09:05 AM

1. Company Background

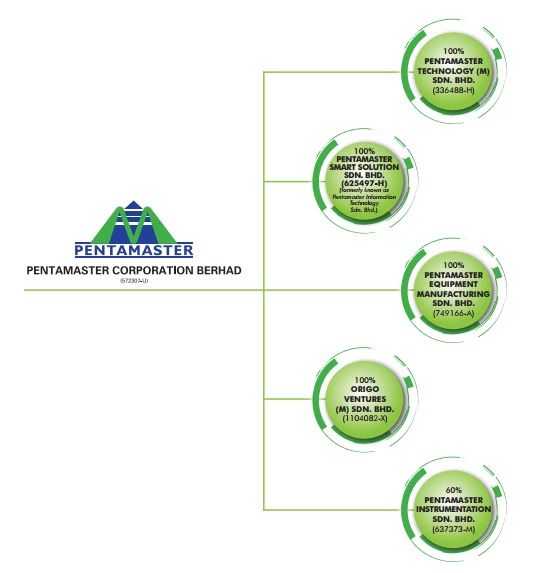

Pentamaster Corporation Berhad is a Malaysia-based company engaged in investment holding and provision of management services.

Through its subsidiaries, the Company operates in five segments: designing and installation of automation systems and contract manufacturing; manufacturing of automated and semi-automated machinery and equipment; designing and manufacturing of precision machinery components; development and implementation of information technology system, and designing and manufacturing of automated testing equipment and test and measurement system.manufacturing.

2. Financial Performance

In term of net profit, PENTA was able to turn from net loss in year 2012 to net profit of MYR4.65m in year 2014. If we look at recent few quarter result, there is significant growth of EPS. Coming quarter is expected to be good judging from track record from last few year.

For latest quarter report, the group recorded higher revenue at RM28.6 million in the current quarter as compared to RM19.3 million registered in the corresponding quarter last year.

The higher revenue recorded was mainly due to increase in sales from automated equipment operating segment and revenue contribution from smart control solution system which was partially offset by the lower revenue from automated manufacturing solution operating segment.

Due to the higher revenue achieved and better product mix secured, the Group recorded a higher profit before tax of RM4.2 million in the current quarter as compared to the pre-tax profit of RM1.4 million in the previous corresponding quarter.

3. Basic FA

Basically, Penta had improved its fundamental in this recent years, by implementing below actions:

- Disposal of its loss making subsidiaries

- Acquisition of Origo to diversify into property project management

- Acquisition of land to build a new plant for expansion

EPS : 9.96

NTA :0.576

PE : 7.8

ROE :16.28

Net income margin: 14.4%

M.Capitalization: RM107M

EBIT : 17.5M

Deposit/cash : 16.9M

Short term bank borrowing: RM175K

T.Asset : RM105.7M

T.Liability: RM21.6M

T. Equity :RM84.1M

EY: 17%

4. Basic TA

After good quarter earning, we can see that buying volume is increasing with Volume EMA above average volume. Currently, for moving average, Penta is above 20d EMA, 70d sma and 200d sma which shows bullish sign.

For above chart, the trading price for Penta is close to upper band which shows buyer's interest is relatively strong. Parabolic indicator also shows Penta on uptrending trend with strong Force Index to reinforce bullish trend. Stochastic indicator is currently neutral, no overbought or no oversold.

In conclusion, it is pretty obvious that Penta is on strong uptrend at the moment.

5. Ownership Summary

For ownership summary, we can note that insider & public made up of around 96% of total share. One may wonder on why not much funds are interested in investing in Pentamaster? Small cap with low liquidity or erratic earning?

Based on projected PE 10.5 : 0.974 x 10.5= RM1.03

(PE 10.5 is derived from 30% discount from sector PE at 15 judging from Penta smaller market cap)

Based on EV/EBIT=8 projection: FV= RM1.05

(Projection is based on 10% minimum growth)

|

(22.5*EPS*Book value per share)^0.5 :RM1.12 |

7. Strategy

Based on current price (7July 2016),

Entry :RM0.78

TP :RM1.1

Breakout: RM0.82, RM0.90

Stop loss: < RM0.73

Short term TP: RM0.90

Potential gain : 41%

Potential loss : 6.8%

Related Article

Pentamaster gets RM45mil orders, for delivery in H1

Disclaimer: This is a personal weblog, reflecting my personal views and not the views of anyone or any organization, which I may be affiliated to. All information provided here, including recommendations (if any), should be treated for informational purposes only. The author should not be held liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Intelligent Investing 88

Discussions

Semicon support firms upbeat

Strong sales seen for second quarter after a slow first quarter

http://www.thestar.com.my/business/business-news/2016/04/23/semicon-support-firms-upbeat/

2016-07-10 21:25

(22.5*EPS*Book value per share)^0.5 :RM1.12

Can you pls explain how this derived?

2016-07-10 23:31

No pump n dump, but profit taking already....what do you expect from small retailers.

2016-07-11 10:27

Hhahahaha..

I dunno la.. May be I'm wrong.. OK.. I watch first. Diam diam watch lo..

2016-07-11 10:28

Bizfuneng, that's Benjamin Graham's formula to calculate Graham Number, his version of intrinsic value

2016-07-11 14:45

icn88

Thanks for sharing~

2016-07-10 10:45