Dear Friends of i3 Forum,

On December 16th 2014 I called for a buy on Jaks at 40 sen

See

Posted by calvintaneng > Dec 16, 2014 03:00 PM | Report Abuse ![]() X

X

Whoa!

Top boss bought at 44 cents and above, millions of them. Anything below 40 cents is a bargain!

So don't wait or else Jaks jump Jump JUMP Up And Away!

As of now Jaks is Rm1.48. Up more than Rm1.00 or or up 270% in 4 years.

NOW CALVIN TELLS YOU WHY YOU MUST SELL JAKS BEFORE IT CRASHES BACK BELOW RM1.00

THESE ARE THE REASONS

1) At Rm1.48 with NTA of Rm1.43 Jaks is now selling above NTA. (Last time Jaks was 40 sen with NTA over Rm1.00)

So Jaks is now fully valued & in fact overvalued.

2) Insiders are now Selling as They Know at this price Jaks is not worth keeping

See

| MR ANG LAM AIK | 22-Mar-2018 | Disposed | 549,000 | 1.452 |

|

| MR ANG LAM AIK | 20-Mar-2018 | Disposed | 201,000 | 1.480 |

|

So any price above Rm1.452 is now too dangerous to chase. The sell down shows trouble ahead! A Red Flag!

See further

Particulars of Director

| Name | MR ANG LAM AIK |

| Descriptions(Class) | Ordinary Shares |

Details of changes

| No |

Date of change

|

No of securities

|

Type of transaction

|

Nature of Interest

|

| 1 |

20/03/2018

|

201,000

|

Disposed

|

Direct Interest

|

| Name of registered holder | Ang Lam Aik | |||

| Description of "Others" Type of Transaction | ||||

| Consideration (if any) | RM297,480.00 | |||

| 2 |

22/03/2018

|

549,000

|

Disposed

|

Direct Interest

|

| Name of registered holder | Ang Lam Aik | |||

| Description of "Others" Type of Transaction | ||||

| Consideration (if any) | RM797,148.00 | |||

| Circumstances by reason of which change has occurred |

Disposal in open market. |

| Nature of interest |

Direct Interest |

Total no of securities after change |

|

| Direct (units) | 0 |

| Direct (%) | 0.000 |

| Indirect/deemed interest (units) | 0 |

| Indirect/deemed interest (%) | 0.000 (SOLD OFF 100% COMPLETELY!!) |

| Date of notice | 26/03/2018 |

| Date notice received by Listed Issuer | 26/03/2018 |

This is not just selling some for necessities. This complete SOLD OUT Is 100%

3) JAKS being expert in Water Business should keep to its knitting & not venture into IPP. See how even UMW (Car Business) made a Big Blunder going into O & G?

Now Star Media is suing Jaks for Rm50 Millions for Delayed Job Work in PJ.

That's why Jaks is placing out more shares to raise capital to prepare for this Rm50 Millions Cash call.

4) With Litigation in Malaysia - how could Jaks concentrate on Its Power Plants in Vietnam?

After all Jaks office is only a very short 10 to 15 minutes drive from Subang Jaya to PJ Section 13

See

Where to find us:

JAKS Resources Berhad (585648-T)

LOT 541, Jalan Subang 2

Sungai Penaga Industrial Park, USJ 1

47600 Subang Jaya

Selangor Darul Ehsan, Malaysia

10 Km - Distance from usj 15 subang jaya to section 13 petaling jaya

The driving distance from usj 15 subang jaya to section 13 petaling jaya is 10 km. Your Travel Starts at usj 15 subang jaya . It Ends at section 13 petaling jaya. Can'

NOW IF JAKS COULD NOT COMPLETE THIS SECTION 13 JOB ON TIME YOU THINK JAKS WILL BE ABLE TO COMPLETE VIET POWER PLANT ON TIME?

5) THERE ARE MANY POWER PRODUCERS IN VIETNAM APART FROM JAKS

See

List of power stations in Vietnam

The following page lists some of the power stations in Vietnam.

Contents

[hide]

Coal[edit]

| Station | Capacity (MW) | Total (MW) | Community | Coordinates | Status | plant/owner/operator | Ref |

|---|---|---|---|---|---|---|---|

| Cam Pha Power Station | 2 x 300 | 600 | Operational | ||||

| Quang Ninh Power Station | 4 x 300 | 1200 | Hakan Ward | Operational | |||

| Ninh Binh Power Station | 4 x 25 | 100 | Operational | ||||

| Hai Dng Thermal Power Plantuo | 2 x 600 | 1200 | Phuc Thanh/Quang Trung communes | 21°02′00.6″N 106°24′43.9″E | On-going project | JAKS Resources and China Power Engineering Consulting Group (CPECC) | [2][3] |

Gas Turbines[edit]

[4] Ca Mau 1500 Can Tho

Hydroelectric[edit]

| Station | Capacity (MW) | Total (MW) | Community | Coordinates | Status | Ref |

|---|---|---|---|---|---|---|

| Hàm Thuận – Đa Mi hydroelectric power stations | 2x150+2x88 | 476 | Operational | |||

| Lai Châu Dam | 4x300 | 1200 | Under Construction | |||

| Hòa Bình Dam | 8x240 | 1920 | Hòa Bình | 20°48′30″N 105°19′26″E | Operational | [5][6] |

| Trị An Hydro | 400 | 400 | Trị An | Operational | ||

| Tuyên Quang Hydro | 3x114 | 342 | Tuyên Quang | Operational | ||

| Thac Ba | 3x36 | 108 | Operational | |||

| A Vuong | 2x105 | 210 | Operational | |||

| Đa Nhim Hydro | 4x40 | 160 | Operational | |||

| Dai Ninh | 2x150 | 300 | Operational | |||

| Quảng Trị Hydro | 2x32 | 64 | Quảng Trị | Operational | ||

| Yali Falls Dam | 4x180 | 720 | Operational | |||

| Thác Mơ Hydro | 2x75 | 150 | Operational | |||

| Can Don | 2x38 | 76 | Operational | |||

| Srok Phu Mieng | 2x25.5 | 51 | Operational | |||

| Se San 3 | 2x130 | 260 | Operational | |||

| Se San 3a | 2x54 | 108 | Operational | |||

| Se San 4 | 3x120 | 360 | 1 unit Operational | |||

| Buôn Kuốp | 2x140 | 280 | Operational | |||

| Buon Tuasrah | 2x43 | 86 | Operational | |||

| Song Ba Ha | 2x110 | 220 | Operational | |||

| Binh Dien | 2x22 | 44 | Operational | |||

| Ban Ve | 2x160 | 320 | 1 unit Operational | |||

| Vinh Son | 2x33 | 66 | Operational | |||

| Sông Hinh Hydro | 2x32 | 64 | Sông Hinh | Operational | ||

| Pleikrong | 2x50 | 100 | 1 unit Operational | |||

| ZaHung | 2x15 | 30 | Operational | |||

| Song Con | 3x20 | 60 | Operational | |||

| KrongHNang | 2x32 | 64 | On-going project | |||

| Sơn La Dam | 6x400 | 2400 | Mường La | 21°29′47″N 103°59′42″E | Operational | |

| Srepok3 | 2x110 | 220 | On-going project | |||

| Srepok4 | 2x40 | 80 | On-going project | |||

| Khao Mang | 2x15 | 30 | On-going project |

See also[edit]

References[edit]

- ^ "Coal-Fired Power Plants in Thailand & Vietnam". Gallery. Power Plants Around The World. Archived from the original on 19 July 2009. Retrieved 23 February 2014.

- ^ [1]

- ^ [2]

- ^ "CCGT Power Plants in Vietnam". Gallery. Power Plants Around The World. Archived from the original on 18 July 2009. Retrieved 23 February 2014.

- ^ Hydroelectric power stations in Vietnam Archived 2009-07-19 at the Portuguese Web Archive

- ^ Hòa Bình Dam Archived 2010-08-20 at the Wayback Machine.

6) SO WILL JAKS BE EXPECTED TO MAKE MONEY AS EVEN ONE POWER PRODUCER IN USA ALREADY GONE BANKRUPT?

Power company files for bankruptcy

FirstEnergy Solutions Corp., a power generator that pleaded for the Trump administration’s help in bailing out struggling coal and nuclear plants, has filed for bankruptcy.

The company, its subsidiaries and FirstEnergy Nuclear Operating Co. listed $550 million in cash to continue operations and meet obligations to employees in a Chapter 11 filing in Federal Court in Akron, according to a statement issued Saturday night, March 31. Parent FirstEnergy Corp. of Akron is not part of the filing, the company said in a separate statement.

The move comes after the FirstEnergy unit on March 29 called on Energy Secretary Rick Perry to declare a grid emergency and guarantee profit for ailing coal and nuclear generators, including its own. Perry had drafted an earlier plan to compensate reactors and coal units more for their power, but federal regulators shot that down in January.

“The Chapter 11 filing represents our best path forward as we continue to pursue opportunities for restructuring, asset sales and legislative and regulatory relief,” said Donald R. Schneider, president of FirstEnergy Solutions, in the bankruptcy statement. “We believe that this decision will best serve our customers, employees and business partners."

Electricity generators across the U.S. have been pummeled by low power prices as stagnant demand, cheap natural gas and surging development of wind and solar have squeezed profits. Few have embodied the struggle as much as FirstEnergy Solutions, which owns a fleet of coal and nuclear plants in Ohio and Pennsylvania.

Warning of a “power crisis,” Akron-based FirstEnergy Solutions had asked Perry for an order that would force PJM Interconnection LLC, the largest U.S. power grid operator, to pay nuclear and coal plants a guaranteed profit if they’re capable of storing 25 days worth of fuel on-site.

The company had already announced plans to shut three nuclear plants in the PJM region and has closed several coal-fired generators since 2012.

FirstEnergy Corp., which owns utilities from New Jersey to Ohio, had warned investors as far back as 2016 that it was considering bankruptcy for the unit. In January, a group including Elliott Management Corp. announced a $2.5 billion investment in the parent company that included an agreement to explore how to exit the unregulated power business as soon as possible. The company said it planned to sever ties with the unit by March 31.

FirstEnergy Solutions has around $3.6 billion of debt, about 60% of which is in municipal issues, according to data compiled by Bloomberg.

The bankruptcy could be a setback for Robert Murray, an outspoken U.S. coal mogul whose mines supply FirstEnergy Solutions plants. His company, Murray Energy Corp., urged the Trump administration last year to take emergency steps to keep the plants open.

FirstEnergy Solutions reported a $5.46 billion loss from the unit in 2016 and a $2.39 billion loss last year.

Akin Gump Strauss Hauer & Feld LLP is serving as legal counsel to FirstEnergy Solutions in the bankruptcy filing. Lazard Freres & Co. is serving as investment banker, Alvarez & Marsal North America LLC is serving as restructuring advisor and Charles Moore has been appointed as chief restructuring officer.

WITH SHALE OIL HAMMERING CRUDE OIL & FALLING GAS PRICES CUM ALTERNATE WIND AND HYDRO POWER NOT ALL IPP CAN SURVIVIE

7) LIKE MUDAJAYA (MUDAJAYA CRASHED FROM Rm2.70 to less than 90 Sen) FACING RED TAPE IN INDIA JAKS IS ALSO FACING POSSIBLE RED TAPE IN VIETNAM

Red tape hindering power plant projects

Red tape hindering power plant projects

LEAVE A COMMENTViet Nam News HÀ NỘI – Substandard investment procedures and regulations hinder investors in major power plant projects,baodautu.vn reported. Ngô Quốc Hội, Director of An Khánh Thermal Power Company told the investment e-newspaper that investment procedures and policies for power plant investors overlapped. For example, some projects were submitted with detailed information as part of the adjusted National Power Development Plan VII from 2011-2020, which was approved along with the projects in 2016. However, once the projects were launched, investors were required to re-submit the project’s feasibility study, ask for assessments from ministries and agencies and then ask for Government approval. “It takes an additional six to eight months for a duplicate process before the project is approved again,” Hội said. Domestic investors also complained about unequal treatment between independent power producer (IPP) projects and foreign-invested projects under Build-Operate-Transfer (BOT) contracts. An IPP or non-utility generator is an entity, which is not a public utility, but which owns facilities to generate electric power for sale. Foreign-funded BOT projects are given incentives in foreign currency exchange and power sale guarantees but domestic IPP projects are not. If investors of IPP projects want to exchange currency to pay loans, they have to register with the State Bank and are at risk of changing exchange rates. Hội added that domestic power investors faced difficulties in borrowing money from local banks. The company’s Bắc Giang Thermal Power Plant Project is set to be completed in 2022 with a capacity of 650 MW. This required… [Read full story]

See the Story of Mudajaya which ended with disappointment

Mudajaya: Indian Power Project Completion - Koon Yew Yin

Author: Koon Yew Yin | Publish date:

Koon Yew Yin

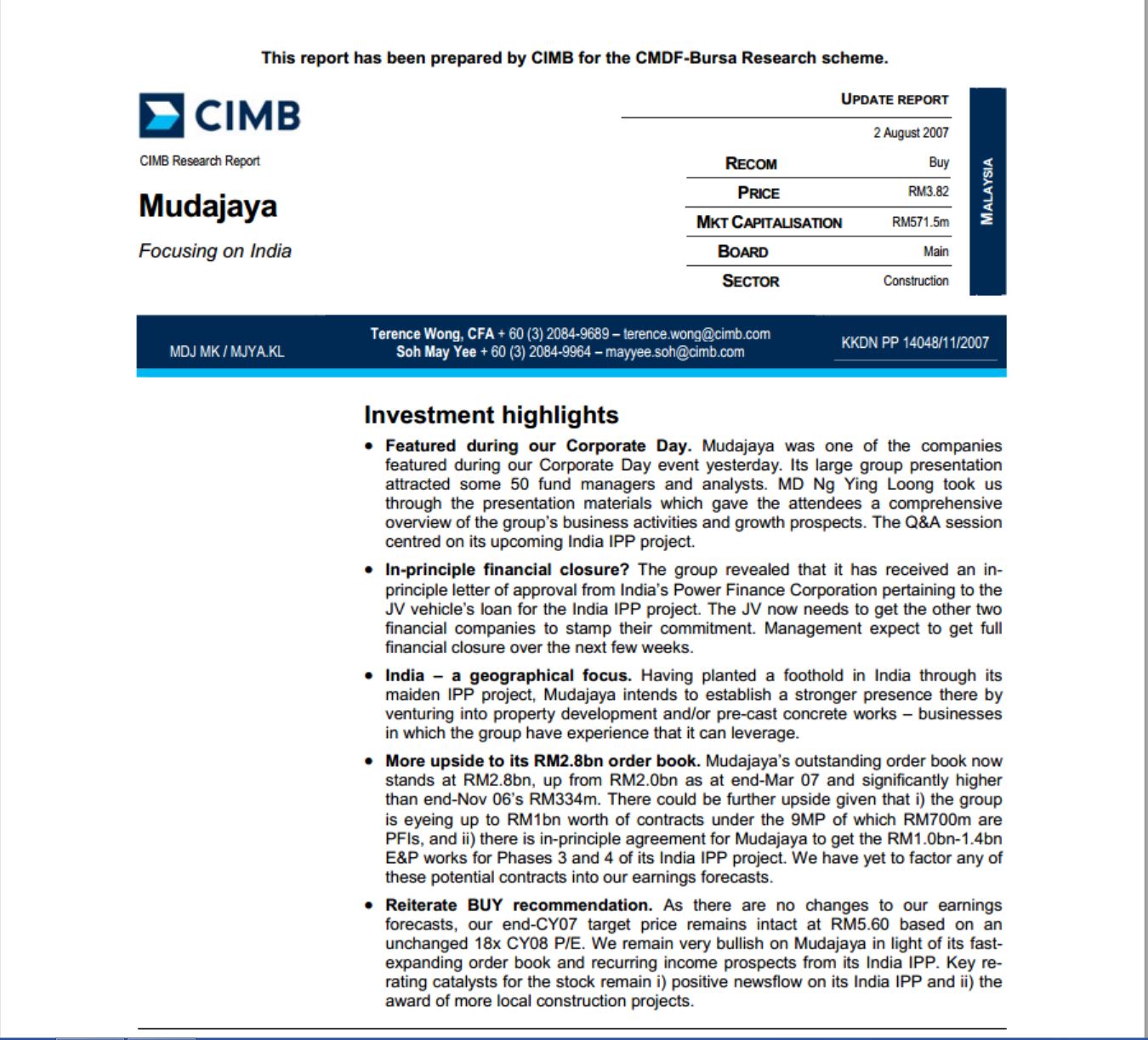

About 7 years ago, CIMB research had a buy recommendation for Mudajaya because of the Indian power project as shown in the report below. Investors have waited for 7 years and all of them are tired and disappointed in waiting for the completion of the Indian power project. Finally the 1st unit of 360 mw will start firing in a few weeks and most likely all the 4 units of 360 mw will be operational by year end. How will this benefit investors?

What is this Indian power project?

About 40 years ago, when I was the CEO, Mudajaya built the 1st power plant called Tungku Jaffaar Poer Station, Port Dickson, Negri Sembilan, Malaysia. Subsequently Mudajaya completed 18 more power plants in Malaysia as a construction contractor. Mudajaya is a specialist in power plant construction.

But in India, Mudajaya holds 26% in an independent power producer (IPP) joint venture with an Indian partner to undertake the construction of 4 units of 360 mw coal power plant and the sale of electricity to the Indian Government.

Perhaps if I tell you some brief details of the Indian project, investors can imagine the difficulty of completing such a large project and forgive Mudajaya for the long delay.

The size: 4 units of 360 mw, totaling 1440 mw.

Cost: The total construction cost is about 1440 mw X US $ 1.5 million X 3.20 = RM 6,912 million.

Coal consumption: 1440 mw X 4,500 ton = 6,480,000 ton per year

Coal consumption cost at US $ 30 per ton = 6,480,000 X 30 X Rm 3.20 = Rm 622 million per year.

Power line construction cost: Rm 2 million per kilometer, total length required ??

Mudajaya holds 26% in this joint venture and its estimated profit is about Rm 70 million per year for 25 years which all investors have been waiting for.

The price chart shows Mudajaya share price has been depressed for many years. I believe it is due for re rating when the company makes the announcement of the completion of the Indian power project.

Mudajaya is one of my major investment holdings. I am not asking you to buy it but if you buy, you are doing at your own risk.

Mudajaya’s Wild Card

My wife and one of my closest friends told me that it is unethical to publish articles regarding the shares that I own because some readers who do not know me well would doubt my good intention. However, at my age and my financial standing I am not afraid to post this article as long as my intention is noble and altruistic. I want to teach you how to fish!

Since I wrote about Jaya Tiasa, many readers wanted to know about my other holdings. Mudajaya is my second largest holding. I also have some Xingquan, Success Transformer, Kulim, MFCB and smaller holdings of a few other counters.

As you know, many financial institutions are covering this stock and despite their frequent recommendations Mudajaya’s share price has been trading around this current level of Rm 2.70 in the last 3 or 4 years. Why should it be selling cheaper than its peers in terms of P/E ratio?

Mudajaya Price Chart

As you can see from the price chart, average price for the last few years is about Rm 2.70 and the downside risk is very small. For the share price to break out of this price range it needs a powerful catalyst which should be the announcement of its profit from its 26% share of the Independent Power Producer (IPP) concession in India. Let me give you a brief description of this project.

I was one of the original founders of Mudajaya and during my tenure, I constructed the 1st phase of the Tungku Jaffa power Station in Port Dickson about 40 years ago. Since then the company has completed 19 power plants as a construction contractor. The company specializes in power plant construction.

But in India, Mudajaya has taken a different role. Mudajaya holds 26% of a consortium to construct, own and operate 4 units of 360 Mega Watts coal fired power plant to generate electricity for sale to the Indian Government.

The total power is 4 units X 360 = 1440 mega watt. One mega watt can light up about 1,000 homes.

The estimated construction cost is about USD 4X360 MWX 1.3 million = USD 1.87 billion

The annual coal consumption is about 4,500 ton X 4X360 = 6,480,000 ton per year.

Assuming the coal price is USD 50 per ton, the annual cost of coal used = USD 324 million.

All these figures are mind boggling, hard to imagine any company has the financial ability to undertake this large concession for 25 years.

In India, a consortium of financial institutions finance the construction cost basing on the Power Purchase Agreement signed by the Indian Government. The banks must make sure that the power purchase agreement (the selling price of electricity) is profitable to Mudajaya and its partners otherwise the bank will not get back their money. The power purchase agreement is for 25 years and the power tariff will be adjusted to cover cost of coal, inflation, foreign exchange etc.

The first unit of 360 mw will be operational by end of March and the second unit will be operational by end of the 2nd quarter. By the end of the year all the 4 units will be in full operation.

The completion date has been postponed a few times until investors are fed up. As a result the share price remains depressed for so long. I believe the announcement of the additional profit spread over 25 years will be the catalyst to propel the price upward.

Today while I was writing this article, a big fund was buying aggressively to push the price up by 12 sens to close at Rm 2.80. The total volume traded was 2.972 million shares. It looks like the long delayed announcement of the additional profit from the Indian IPP concession will be out soon.

I am obliged to tell you that Mudajaya is my 2nd largest holding and I am not asking you to buy it. But if you do, I am not responsible for your losses.

Calvin warned Uncle KYY to sell both JTiasa & Mudajaya at Rm2.60 & Rm2.70. After Uncle KYY disposed both fell 60% to 70% & Uncle Koon disappeared from i3 Forum for 7 months & then reappeared again with the new fangled peril called Jaks?

How many poor i3 Forumers have been cleaned wiped off when Jtiasa & Mudajaya crashed 60% to 70%?

So this is not the time to still go play play. Uncle Koon is already rich beyond all. And now enjoying a second childhood playing modern day Robin Hood?

8) OF COURSE IN THE GAME OF GREATER FOOL SOME LESSER FOOL MIGHT STILL MAKE MONEY FROM GREATER FOOL.

AND WHY NOT? GREATER FOOL CAN ALSO MAKE SOME FROM GREATEST FOOL

THE SMART MONIES THAT BOUGHT HENGYUAN AT RM2.00 SOLD TO THE LESSER FOOL WHO CHASED IT TO RM10.00

AND THE LESSER FOOL WHO SOLD HENGYUAN TO GREATER FOOL AT RM17.00 ALSO MADE GOOD MONEY

AND THE GREATER FOOL WHO SOLD HENGYUAN AT THE PEAK PRICE OF RM19 AND ESCAPED BY THE SKIN OF THEIR TEETH ALSO MADE SOME FRIGHTFUL GAIN ?

AND THE GREATEST OF THE GREATEST FOOL HOLDING HENGYAN ABOVE RM19.00?

GOOD LUCK

CALVIN ALWAYS WARN ALL NOT TO CHASE HOT HOT STOCKS AT HIGH HIGH PRICES!

SO THOSE WHO STILL WANT TO CHASE JAKS WITH THE HOPE OF WHAT?

SELL CHUN CHUN AT TOP TOP TO THE GREATEST SORCHAI?

SO MANY SORCHAI AND MANY MORE SORCHAI AH?

WILL YOU BE THE ONE HOLDING SOMEDAY?

WARM REGARDS

Calvin Tan

Singapore

Uncle KYY is our modern day Robinhood. Rob all Sorchai Greedy Suckers by all means!! Thumbs Up!! And go help poor poor students!

Long Live Uncle Koon!!

qqq3

I bot this morning.....

I think I will make money. I like to buy on pivotal moment.

2018-07-31 12:01