NYLEX (4944) & ANCOM (4758). Time to buy on these Two Cyclical Stocks for 2 STRONG CATALYSTS, Calvin Tan Research

calvintaneng

Publish date: Fri, 15 May 2020, 10:18 AM

Hi guys, PLEASE READ TO THE END AS WE TYPE NOW

Yesterday both Nylex & Ancom posted a poorer sets of results. That is for sure. Why?

Because these results were until Febtuary 29, 2020

See

SUMMARY OF KEY FINANCIAL INFORMATION

|

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

|

||||

|

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD |

||

|

29 Feb 2020

|

28 Feb 2019

|

29 Feb 2020

|

28 Feb 2019

|

||

|

$$'000

|

$$'000

|

$$'000

|

$$'000

|

||

| 1 | Revenue |

360,502

|

433,730

|

1,162,837

|

1,506,799

|

| 2 | Profit/(loss) before tax |

473

|

-5,786

|

9,338

|

13,785

|

| 3 | Profit/(loss) for the period |

-1,893

|

-11,579

|

-1,764

|

-2,243

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

165

|

-3,867

|

2,103

|

4,953

|

| 5 | Basic earnings/(loss) per share (Subunit) |

0.07

|

0.84

|

0.93

|

2.32

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

|

||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

1.3800

|

1.5700

|

||

See the date again

SUMMARY OF KEY FINANCIAL INFORMATION

29 Feb 2020

Results were until Feb 29 2020

Things were bleak then

Now in March 2020 Two BIG CATALYSTS APPEARED

1) COLLAPSE OF CRUDE OIL PRICE

IN JUST 2 MONTHS CRUDE OIL ALMOST USD60 PLUMMETED TO NEAR USD20 IN APRIL FOR ALMOST 70%

WHY IS IT GOOD FOR NYLEX AND ANCOM?

BECAUSE BOTH NYLEX & ANCOM USE LOTS AND LOTS OF CRUDE OIL TO CONVERT INTO INDUSTRIAL CHEMICAL FOR THOUSANDS OF PRODUCTS

THIS 70% REDUCTION OF FEED COST WILL EXPLODE UPWARD THE PROFITS OF BOTH NYLEX & ANCOM

SEE SOME PRODUCTS THEY MAKE

THESE ARE WIDELY USED BY POLICE IN MCO RECENTLY

NOW ANCOM & NYLEX COST OF PRODUCTION CHEAPER BY UP TP 70%

HOW MUCH EXTRA PROFIT AFTER FEB 29 2020 WHEN OIL PRICE CRASHED BY 70!!!

2) CATALYST NUMBER TWO

FERMPRO OF NYLEX NOW IN FULL PRODUCTION AGAIN

BIGGEST SUGAR CANE PLANTATION IN CHUPING, PERLIS

SEE

FERMPRO SDN BHD Fermpro Sdn Bhd is Malaysia's leading manufacturer of high quality ethanol using cane sugar molasses and advanced US distillation technology. Its ethanol conforms to British Pharmacopoeia Standards and is widely used in cosmetics, toiletries, personal care products, Pharmaceuticals, health tonics, food flavours, paints, printing inks, as sterilising and cleaning solutions, and for other electronic and industrial uses. Its products include: Ethanol 96% B.P. Absolute Ethanol B.P. Denatured Ethanol Specially Denatured Ethanol Liquified Carbon Dioxide CONTACT DETAILS: Address: 202, Block A, Phileo Damansara 1 No. 9, Jalan 16/11 Off Jalan Damansara 46350 Petaling Jaya Selangor Darul Ehsan Malaysia Tel : (603) 7660 0033 Fax : (603) 7660 0133 Contact Person: Tan Wee Lian Email: enquiry@fermpro.com.my

IN NYLEX ANNUAR REPORT IT IS STATED THAT REVENUE FROM ETHANOL IS RM29 MILLIONS & A PROFIT OF RM2.8 MILLIONS (BUT FACTORY SHUT DOWN FOR UPGRADE AND EXPANSION TILL JUNE 2019)

SO THE NEED FOR GLOVES STARTED IN EARLY FEBRUARY AND BY MARCH WORLD GOVERNEMENTS IN SHOCK RUSH TO BUY GLOVES. AFTER GLOVES FACE MASKS CAME INTO VOGUE

AND NOW IS SANITIZERS!!!

WHY THE UPSURGE OF DEMAND FOR EHANOL?

BECAUSE ONLY SANITIZER WITH AT LEAST 65% OR MORE ETHANOL IS EFFECTIVE AGAINST COVID 19

REST ARE INEFFECTIVE

SO THERE IS A RUSH FOR ETHANOL WORLD WIDE FOR MANUFATURES OF SANITIZERS!!!

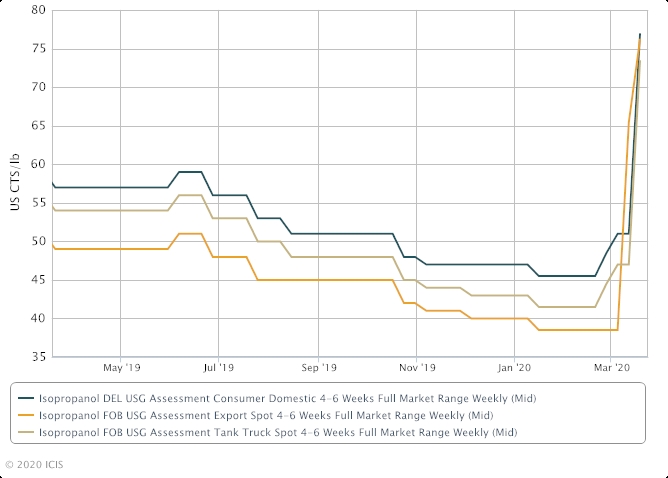

SEE THE PRICE UPSURGE FOR ALCOHOL USED IN SANITIZERS!!

AT THIS NEWS FIRST TO GO LIMIT UP IS HEXZA!!

WHAT ABOUT NYLEX?

NYLEX FACTORY IN CHUPING PERLIS IS 11 ACRES

HEXZA'S FACTORY IN TASEK IS 10 ACRES

CHUPING IS ALSO WHERE THE BIGGEST SUGAR CANE PLANTATION IS LOCATED = RAW MATERIAL FOR ETHANOL

YES! SUGAR IS CONVERTED TO ETHANAL

OTHERS ARE MAIZE, GRAPES, BEETROOTS AND OTHERS

SUGAR CANE IS 7 TIMES MORE POTENT THAN MAISE

SUGAR CANE GROWS ALL YEAR ROUND IN SUNNY AND HIGH RAINFALL COUNTRIES LIKE MALAYSIA IN THE TROPICS

BEET ROOTS AND GRAPES ONLY HARVESTED ONCE A YEAR AND MORE COSTLY

SO SUGAR CANE FOR ETHANOL IS THE VERY BEST

THAT MEANS VERY GOOD FOR NYLEX ON 2 COUNTS

SURGE IN DEMAND AND RISING PRICES DUE TO SCARCITY!!

SO NOW WE KNOW

ANCOM AND NYLEX ARE VERY GOOD CYCLICAL UPTURN STOCKS

CYCLICALS?

YES! GREAT CHAMPION SIFU DR. NEON SOON KEAN OF DYNQUEST BOUGHT NYLEX IN YEAR 2015 & 2016 FOR 1.1 MILLION SHARES TO BE TOP HOLDER OF NYLEX

HE CHUN CHUN BOUGHT AROUND 50 SEN (WHEN CRUDE OIL COLLAPSED TO USD27) AND SOLD BEFORE 2017 WHEN CRUDE OIL STARTED TO RISE AGAIN. HIS DYNAQUEST FUND MADE 100% IN 2 YEARS OR 50% PER YEAR FOR TWO YEARS OF 2015 & 2016

GRAND MASTER CHAMPION SIFU ATTRIBUTED CYCLCAL TYPE OF INVESTMENT LEGENDARY SIFU PETER LYNCH WHOSE MAGELLAN FUND EVEN BEATEN WARREN BUFFET BERKSHIRE FOR 9 STRAIGHT YEARS!! AT 29% COMPARED TO BERKSHIRE BELOW 25%

SO HOW NOW?

IS NYLEX AND ANCOM AT THE CREST OF CYCLICAL UPTURN?

IS THAT WHY ANCOM IS PLACING OUT PP SHARES WITH ONE FREE WARRANT FOR 4 SHARES TO RAISE CAPITAL AS TIME FOR EXPANSION IS NOW RIPE

BEST REGARDS

Calvin Tan Research

Singapore

Please buy/sell after doing your own due diigence

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Jul 24, 2024

Created by calvintaneng | Jul 15, 2024

Created by calvintaneng | Jul 12, 2024

Discussions

ALL STREETS OF WHOLE WORLD NEED DISINFECTING BY SANITIZER

SEE

https://www.google.com/search?source=univ&tbm=isch&q=disinfecting+entire+cities+photo&sa=X&ved=2ahUKEwjM_M3m8rTpAhVRWysKHeHiDgAQsAR6BAgKEAE&biw=962&bih=345

WHERE GOT ENOUGH ETHANOL??

2020-05-15 11:13

LISTEN LISTEN LISTEN

YOU CAN GET FRESH LATEST FROM RUBBER TREES EVERY MORNING FOR RUBBER GLOVES

BUT SUGAR CANE FOR SANITIZER ONLY HARVESTED FROM 9 MONTHS TO 24 MONTHS ONCE

SEE

https://www.google.com/search?q=sugar+cane+grows+in+9+months&oq=sugar+cane+grows+in+9+months&aqs=chrome..69i57.8879j0j7&sourceid=chrome&ie=UTF-8

MANY GLOVE COMPANIES IN MALAYSIA

BUY ONLY HEXZA & NYLEX GOT SUGAR CANE FOR ETHANOL CONVERTING INTO SANITIZER!!

2020-05-15 11:18

Do you know?

Gloves protect your hands from Covid 19?

Only sanitizer ATTACK!!

I never use any gloves so far

But i see hand sanitizer at home & everywhere

2020-05-15 11:21

Isolation gown protects doctor's bodies from Covid 19

Few of us use it

BUT ALL USE SANITIZER THAT "ATTACKS" COVID 19

2020-05-15 11:23

Face Masks protect our throat & lung from Covid 19

We wear them when we leave our homes

But we Use Sanitizers at home & every where to "ATTACK" & "DESTROY" invisible covid 19!

2020-05-15 11:24

So Gloves, Isolation gown & face masks are defensive weapon

we wear to protect ourselves

Only "SANITIZER" is an offensive weapon that ATTACK & DESTROYS COVID 19

The best defense is an offense or ATTACK!!

2020-05-15 11:27

Testerday Rakunten did a write up on Ancom

And we quote

We are positive on Ancom Bhd (“Ancom”) prospects and growth trajectory of their agrichemical business. This division contributes over 70% of group’s profit with decent gross margins of over 15%. Its 4-year CAGR is solid of over 25% in revenue and profits. As such, we believe Ancom will see better days in FY21 when its restructuring gains traction. BUY with target price of RM0.90 premised on 12.5x PER FY21 being 2-year average PER and comparable to its peers.

Ancom’s key driver and hidden jewel is their agrichemical business under Ancom Crop Care Sdn Bhd. The other major asset being its 48.95% stake in Nylex Bhd which is in the industrial chemical business that has hit a sweet spot amidst the Covid-19 pandemic. It is experiencing surge in demand for their ethanol production, an active ingredient in sanitisers. Its business of manufacturing hand sanitisers and hygiene and sanitisation services is the new normal in the wake of gradual opening of most business post CMCO. Ancom’s foray into sanitiser production is complementary to their existing business as the margins are fairly lucrative with gross margins ranging between 25-40%.

Core business and hidden jewel lies in their subsidiary Ancom Crop Care Sdn Bhd which contributes over 70% of the profit to Ancom Bhd. Agriculture chemicals which are part of the food supply chain are predominantly used in sugar cane plantation, palm oil plantations. It has reported FY19 net profit of RM35m and is expected to maintain is profitability for FY20 and FY21. This value however is trapped at group level which is undergoing restructuring as their other business has been a drag such as media that realised over RM12m loss for FY19.

Nevertheless, we still expect Ancom Bhd to remain profitable with agribusiness to be the key driver delivering earnings growth via expansion of capacities and new products for the agribusiness coming onstream by FY21. This would catapult group’s earnings and expect growth momentum to continue with EPS to chart double digit growth for FY21 and beyond.

And these are some good points

1) ANCOM 4-Year CAGR is solid of over 25%

2) Seeing better days ahead Rakunten gave a PER12.5 Target Price for Ancom at 90 sen

That is too modest. The Surge in NYLEX will lift up Ancom past Rm1,00 to Rm1.20 possible

3) Ancom owns 48.95% of NYLEX

The other major asset being its 48.95% stake in Nylex Bhd which is in the industrial chemical business that has hit a sweet spot amidst the Covid-19 pandemic. It is experiencing surge in demand for their ethanol production, an active ingredient in sanitisers.

Nylex has Hit a SWEET SPOT in Covid 19 pandemic!

Nylex is experiencing SURGE IN DEMAND for their ethanol production, an active ingredient in sanitizers

So Both Nylex & Ancom will benefit tremendously from the Upward Surge of Demand for Sanitizers

Gloves, face masks & isolation gowns are defensive

Only sanitizer is Offensive

Glove, face mask & isolation gown protect from Covid 19

Only SANITIZER ATTACK AND KILL CONONAVIRUS

2020-05-15 12:14

IN NYLEX ANNUAR REPORT IT IS STATED THAT REVENUE FROM ETHANOL IS RM29 MILLIONS & A PROFIT OF RM2.8 MILLIONS (BUT FACTORY SHUT DOWN FOR UPGRADE AND EXPANSION TILL JUNE 2019)....

=> Only 29 Million the revenue from ethanol...the question is how much it can contribute to the earning of Nylex?

2020-05-17 23:58

Already got Rm2. 8 millions from last time profit guidance

So when production fully resume plus high demand and increase in prices

Maybe Rm3. 5 millions to Rm4 Millons in profit or more

If crazy like glove then profit explode to Rm5 or Rm6 millions possible

2020-05-18 12:15

calvintaneng

7 BILLION PAIRS OF HANDS MIGHT NOT NEED GLOVES

BUT 7 BILLION PEOPLE ON EARTH NEED HAND SANITIZER

2020-05-15 11:10