ADVANTAGES OF PALM OIL: CAN OPERATE UNDER MCO; CLEAN, GREEN ENERGY; END OF LIFE ASSET VALUE, Calvin Tan Research

calvintaneng

Publish date: Sat, 24 Jul 2021, 01:35 PM

Dear Friends. Investors & Traders of i3 Forum,

Investing in Palm Oil got many Advantages

1) PALM OIL LISTED UNDER ESSENTIAL FOODS CAN OPERATE UNDER MCO LOCK-DOWN

While many INDUSTRIAL, Airlines, Hotels, Tours, Cinemas are Shut Palm Oil Estate Workers operate as usual to harvest Fresh Fruit Bunches & Process them into Cooking Oil & a thousand other products like Biscuit (all 100% Biscuit Companies got palm oil in their lable as well as Bread, Ice-cream, Cakes, Chocolates & others in Malaysia)

And then HYPERMARKETS, SUPERMARKETS, MINI MARKETS ALSO NOT AFFECTED BY MCO. And 50% of ALL SUPERMARKET PRODUCTS CONTAIN PALM OIL!!

So while others ceased production Palm Oil continues....non stop!

2) CLIMATE CHANGE TO BIODISEL WILL BE GREAT FOR PALM OIL AS WORLD PIVOTS FROM POLLUTION OF FOSSIL FUEL TO BIOFUEL

See

Graph of UK figures for the Carbon Intensity of Biodiesels and fossil fuels. It assumes biodiesel is transported to the UK to be burnt.[1]

NOTE: KPOWER IS ALSO OPEN UNDER MCO AS IT IS UNDER ESSENTIAL UTILITY SERVICES AS IT PIVOTS TO GREEN ENERGY OF HYDRO & BIODISEL, WIND AND SOLAR

Right Now in USA PHILLIPS 66 IS CONVERTING FOSSIL FUEL REFINERY TO BIODISEL

Phillips 66 completed its initial renewable diesel project at its Rodeo, California, refinery as it moves forward with its Rodeo Renewed project – the complete conversion of the 120,200 b/d hydrocarbon facility into a 50,000 biodisel renewable fuel plant by early 2024, CEO Greg Garland said on April 30

"In April, the company completed its diesel hydrotreater conversion, which will ramp up to 8,000 b/d (120 million gallons per year) of renewable diesel production by the third quarter of 2021," he said on the first quarter results call.

he initial 8,000 b/d renewable diesel hydrotreater, known as Unit 250, started up in early April and is ramping up and running soybean oil, according to Robert Herman, head of Phillip 66's refining segment.

"It came up the first time and has run well," he said, about the diesel hydrotreater conversion from hydrocarbon to soybean oil feed.

Herman said it's been a "good learning curve" around getting the smaller unit in operation as the company works towards full conversion of the refinery. This included testing its logistics supply chain to get soybean oil to Rodeo. The converted hydrotreater unit will ramp up to 9,000 b/d of soybean oil feed in the third quarter with the completion of some of the logistics projects.

THERE IS NOW A STRUCTURAL SHIFT INTO BIODISEL USAGE AND WILL ELEVATE SOYBEAN PRICES WHICH WILL IN TURN SUPPORT PALM OIL AS THEIR OIL PRICES GO CO-RELATION ON WORLD MARKETS.

3) END OF LIFE VALUE FOR ALL PALM OIL ASSETS

Now think very very long term

Ships & Planes operate on Depreciating Assets. From Day One Any Plane, Ship, Car, Van, Jeep, Bike left the Showroom they start to deprectiate - why? Because they get rusty through age and the end of life is a heap of Rusty Steel

So are Steel Plants, Car Plants, Oil Rigs & ALL INDUSTRIAL ASSETS Which End of Life Mean Depreciation to Zero EXCEPT LANDS

AS LANDS ARE FOREVER!

PALM OIL IS PLANTED ON LANDS. END OF LIFE THESE LANDS ARE GETTING MORE AND MORE VALUABLE AS THEY ARE RE PURPOSED INTO SHOPPING MALLS LIKE IOI MALL PUCHONG (It Was Once Rubber Estate), BANDAR UTAMA HOUSES (Also dotted with rubber trees long ago), JOHOR PREMIUM OUTLET (Was Palm Oil Estate) & Many others like Factories, Shopping Malls, Condos, Offices and Houses.

That was why JCORP Took Kulim Private and converted Palm Oil Lands in Pengerang into Two Thriving Housing Enclaves

So Investing in Palm Oil is also a Type of Long Term Land Banking

Walton property invested in TSH RESOURCES and now with 38 Million shares is Top number 11 holders of TSH. Why?

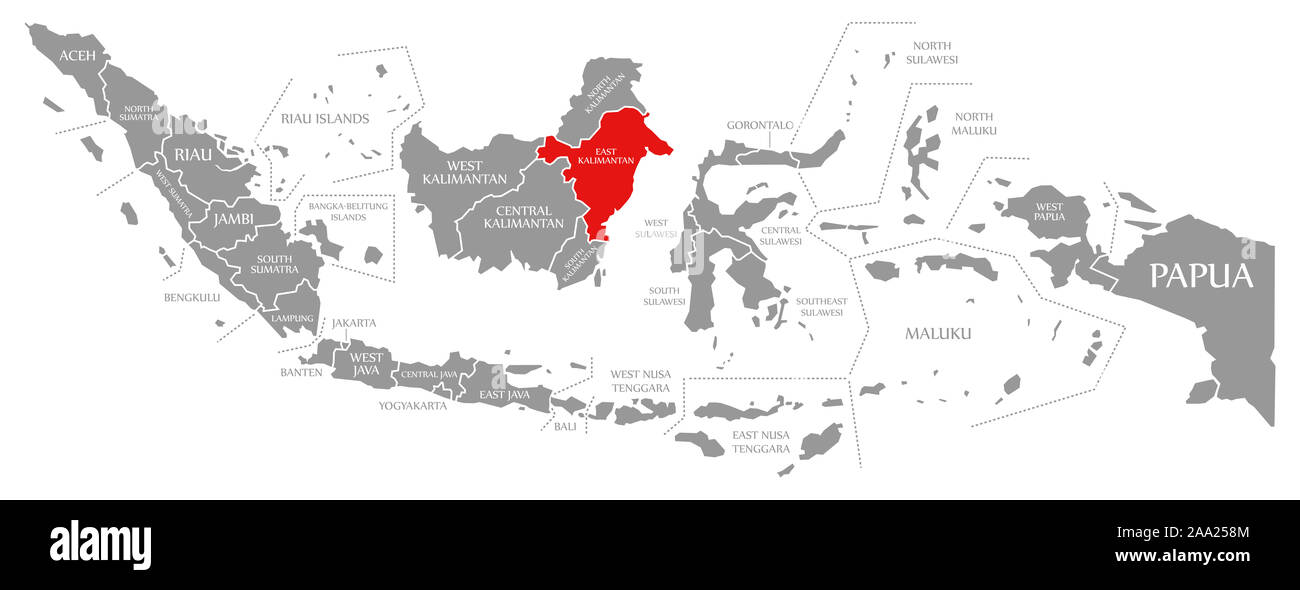

Did Walton know that TSH got prime lands in Kutai West and Kutai North of Balikpapan - the New Capital of Indonesia?

See lands in Kutai turned Hot Hot

New Indonesia capital: Land prices set to soar but not all locals thrilled

SEPAKU, East Kalimantan: Since Indonesian President Joko Widodo announced the relocation of the country’s capital from Jakarta to East Kalimantan in late August, Mr Sikbukdin has received at least five calls from strangers asking whether he is interested to sell his land.

“I told them no, I am not selling my land. The land is for my children,” the 56-year-old head of the Paser Balik tribe said.

The locals said land value in Penajam Paser Utara and Kutai Kertanegara districts – the two districts set to house the new capital – has surged immediately following Mr Widodo’s announcement.

Business-minded agents wasted no time to spring into action, actively approaching the locals to broach the possibility of them putting up their land for sale.

“Agents from Berau, Tarakan, Tenggarong (in Kalimantan), and even Surabaya and Jakarta have contacted me. They are really aggressive,” Mr Sikbukdin, who goes by one name, told CNA.

The Indonesian government is determined to relocate the nation’s capital because Jakarta, which is heavily polluted, is one of the fastest sinking cities in the world.

Jakarta is currently home to more than 10 million people, with another 30 million living in surrounding satellite cities, resulting in severe traffic congestion that cost S$7 billion in losses a year.

By comparison, East Kalimantan – which is largely free from natural disasters, unlike Jakarta and most parts of Indonesia – only has a population of 3.5 million people.

The government hopes the relocation could take pressure off Jakarta. It also believes that with the relocation, the country’s development will spread out as it is currently Java-centric.

Should the parliament give the greenlight to Mr Widodo’s proposal, the government will begin constructing the new capital next year on an initial plot of 40,000ha land and transfer its administration here by 2024.

Some 1.5 million civil servants will move here as well.

NOTE: TSH RESOURCES GOT THE MOST PLANTATION LANDS LOCATED IN KUTAI EAST AND KUTAI NORTH (See TSH Top 10 Properties from Annual Report)

This was what happened to Lands in Sepang & Putrajaya before KL shifted the Government Offices from KL to Putrajaya

LAND Prices Skyrocketed in Putrajaya and so Land Prices will also go up in KUTAI When Indonesia shifts their Capital to East Kalimantan one day

Incidentally, KLK failed to take over TSH lands in East Kutai but bought IjmPlant (IJMPLANT Also got lands north of Balikpapan)

KLK already built a Jetty in Balikpapan the purported New Capital of Indonesia. But TSH Lands are much nearer than IJMPLANT Lands

BEST REGARDS

Calvin Tan Research

Please buy or sell after doing your own due diligence or consult your own Remisier or Fund Manager

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Jul 24, 2024

Created by calvintaneng | Jul 15, 2024

Created by calvintaneng | Jul 12, 2024

Discussions

Land prices rise

https://www.asiapropertyawards.com/en/land-prices-rising-in-indonesias-purported-new-capital/

2021-07-24 13:46

like this article sifu calvin. but then, didnt buy TSH =(

bought TAAN instead. lol

2021-07-26 08:48

Thomas

I rank Taann in Top 3 for Mid Size Palm oil plantations

Rank like these

1st is Ijmplant. klk offers Rm3.10 takeover

2nd is Tsh resources

3rd is Taann

Tsh owns Innoprise while Taann owns SWKPlant

All three above got good Management

2021-07-26 13:47

calvintaneng

A look at East Kalimantan

https://www.youtube.com/watch?v=F85nXuUXs8Y

2021-07-24 13:44