A LOOK AT JTIASA AND IB BANK PAST FORECAST, JTIASA FUNDAMENTAL THEN & NOW, Calvin Tan

calvintaneng

Publish date: Thu, 08 Feb 2024, 02:21 PM

Dear friends,

Please read this

IN YEAR 2013 RHB IB GAVE THIS BUY CALL FOR JTIASA

Jaya Tiasa (JT MK) Buy (from Neutral)

Industrial - Building Materials Target Price: MYR2.56

Market Cap: USD677m Price: MYR2.25

See the link

https://cdn1.i3investor.com/my/files/st88k/4383_JTIASA/pt/RHB/4383_JTIASA_RHB_2013-12-13_BUY_2.56_Jaya%20Tiasa%20-%20CPO%20Price%20Assumptions%20Raised_475679008.pdf

(if cannot open then please read this under comment section)

At that time Cpo was around Rm2600

See

Upgrading CPO price assumptions. We have upgraded our in-house

CPO price assumptions for CY14 and CY15 to MYR2,700 and

MYR2,900 per tonne respectively from MYR2,600 previously. We

maintain our price assumption for CY13 at MYR2,400/tonne.

Four main factors driving the upgrade. These are: i) a stronger global

economy, which means food demand will continue to grow, ii)

Indonesia’s lacklustre production growth on the double impact of dry

weather in 2012 and 2013, iii) mandatory biodiesel implementation in the

world’s two biggest palm oil producing countries, and iv) production cost

to remain flattish-to-lower on significantly cheaper fertilisers following the

potash cartel breakup in mid-2013.

Raising forecasts. We have raised our forecasts for JT following the

10.2% price hike for FY06/14 and 14.6% for FY06/15. Our CPO price

assumptions are: MYR2,550/tonne for FY14 (from MYR2,375) and

MYR2,800/tonne for FY14 (from MYR2,600).

So 10 years ago RHB IB was bullish when Cpo was Rm2600

And gave a target price for Jtiasa at Rm2.56

Now after 10 years the Fundamental of Jtiasa has improved tremendously

See

10 year chart of CPO

A look at Chart Above can See PALM OIL PRICES NOW ABOUT THE SAME IN YEAR 2014

But look further and deeper

CPO is priced in USD

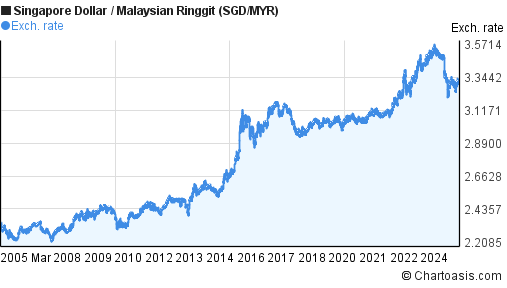

See USD to Ringgit Chart

SEE VERY VERY VERY CAREFULLY

IN YEAR 2014 ONE USD IS EQUAL TO AROUND RM3.00

TODAY ONE USD IS MORE THAN RM4.70

So in USD term Ringgit has fallen by 36.1%

So Jtiasa is seeing CPO at Rm3898 (No more Rm2600)

See

CRUDE PALM OIL FUTURES

From Rm2600 to Rm3898 is up 49.9% increase in CPO price.

Even though Fertilizer & Labour Cost have also increased they have now softened to a rise of 20% to 25%

So there is a lot more profit for Jaya Tiasa now compared to year 2014

Moreover in year 2014 Jtiasa total net borrowings was

Current Interest bearing loans and borrowings Rm455,536,000

Non Current: Interest bearing loans and borrowings Rm411,208,000

Total debt Rm866.744 Millions

Less cash

Cash and bank balances Rm81.037 Millions

Less Investment securities

Investment securities Rm124.741 Millions

= Net debt Rm660.9 Millions

Jtiasa current Net Debt has been pared down to Rm93 Millions only

SO THERE IS VAST IMPROVEMENTS

NOW SEE JTIASA VERY STRONG EANINGS IN TWO SETS OF RESULTS

Feb 2014 (refer Bursa)

SUMMARY OF KEY FINANCIAL INFORMATION31/12/2013 |

INDIVIDUAL PERIOD | CUMULATIVE PERIOD | ||||

CURRENT YEAR QUARTER | PRECEDING YEAR CORRESPONDING QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR CORRESPONDING PERIOD | ||

31/12/2013 | 31/12/2012 | 31/12/2013 | 31/12/2012 | ||

$$'000 | $$'000 | $$'000 | $$'000 | ||

1 | Revenue | 271,950 | 286,222 | 517,418 | 560,562 |

2 | Profit/(loss) before tax | 29,689 | 2,219 | 55,698 | 20,367 |

3 | Profit/(loss) for the period | 20,456 | 3,172 | 39,930 | 17,928 |

4 | Profit/(loss) attributable to ordinary equity holders of the parent | 19,840 | 2,888 | 38,943 | 17,425 |

5 | Basic earnings/(loss) per share (Subunit) | 2.05 | 0.30 | 4.02 | 1.80 |

6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | ||||

7 | Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.8000 | 1.760 | ||

Earning per share was 2.05 sen

Latest result

SUMMARY OF KEY FINANCIAL INFORMATION30 Sep 2023 |

INDIVIDUAL PERIOD | CUMULATIVE PERIOD | ||||

CURRENT YEAR QUARTER | PRECEDING YEAR CORRESPONDING QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR CORRESPONDING PERIOD | ||

30 Sep 2023 | 30 Sep 2022 | 30 Sep 2023 | 30 Sep 2022 | ||

$$'000 | $$'000 | $$'000 | $$'000 | ||

1 | Revenue | 248,003 | 207,807 | 248,003 | 207,807 |

2 | Profit/(loss) before tax | 93,035 | 46,472 | 93,035 | 46,472 |

3 | Profit/(loss) for the period | 66,835 | 33,948 | 66,835 | 33,948 |

4 | Profit/(loss) attributable to ordinary equity holders of the parent | 66,833 | 33,985 | 66,833 | 33,985 |

5 | Basic earnings/(loss) per share (Subunit) | 6.90 | 3.51 | 6.90 | 3.51 |

6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | ||||

7 | Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5100 | 1.4200 | ||

Latest result is 6.9 sen

so from 2.05 sen to 6.9 sen is up 236%

To sum it up

Rhb IB gave buy call in year 2014 & target price for Jtiasa at Rm2.56

At that time Cpo Rm2600 considered GOOD

Now CPO IS A HIGH OF RM3,898 )Up almost 50%

At that time Jtiasa Net Debt was Rm660 Millions

Now only Rm93 Millions

Or only 14% left of those high debt years

Last time EPS was 2.05 sen

Now 6.9 sen

At that Time Uncle KYY promoted JTIASA at Rm2.40

And IB BANKS BULLISH

Now Jtiasa is Rm1.13 (Less than half price)

And IB Bank gave neutral call?

IT IS VERY CLEARLY DEMONTRATED BY FACTS AND FIGURES

IB BANKERS SHOULD RERATE JTIASA HIGHER

Best regards

Calvin Tan

Please buy or sell after doing your own due diligence or consult your Remisier/Fund Manager

More articles on THE INVESTMENT APPROACH OF CALVIN TAN

Created by calvintaneng | Jul 24, 2024

Created by calvintaneng | Jul 15, 2024

Created by calvintaneng | Jul 12, 2024

Discussions

After Utd Plt announce bumper profit, J Tiasa may catch up. CNY is wood Dragon. JTiasa has a large Forest Concession. As Calvin said, when CPO price low, RHB gave TP of RM 2.56, now with Cost of Production at RM 2400, and CPO around 3800, eps will be higher than last Quarter. Dont forget, all its large 100k over acres, are Prime growing trees, i.e. yielding maximum production per acre. May go up slowly to touch RM 1.48.

2024-02-08 16:17

THE 4 PROSPERITY PALM OIL STOCKS OF 2024 (HAPPY CHINESE NEW YEAR 2024), Calvin Tan

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-02-13-story-h-188510438-THE_4_PROSPERITY_PALM_OIL_STOCKS_OF_2024_HAPPY_CHINESE_NEW_YEAR_2024_Ca

0 seconds ago

2024-02-13 06:54

Fantastic Fertilizer News!

Natural Gas (Nitrogen Fertilizer) has dropped from US10.00 to US1.58

A Drop of almost 85% from year 2022 Peak

Tremendous Savings on Fertilizer For Oil Palm esp those with Growth Stage of Palm Fronts

This will translate to lower Cost of Cpo production

Best to Stay Safe in Palm Oil Stocks

https://tradingeconomics.com/commodity/natural-gas

(Click on 10 year price chart button)

2024-02-16 00:56

calvintaneng

https://cdn1.i3investor.com/my/files/st88k/4383_JTIASA/pt/RHB/4383_JTIASA_RHB_2014-03-21_BUY_2.95_Jaya%20Tiasa%20-%20Set%20To%20Thrive%20On%20Myanmar%20Export%20Ban_829376291.pdf

2024-02-08 14:25