长钢四侠 之 长钢三叠浪 【ANNJOO SSTEEL MASTEEL LIONIND】

zefftan

Publish date: Tue, 14 Feb 2017, 01:06 AM

灵感来源 【风景画 : 位于中国重庆的 长江三峡, 风景优美】

本文论及的股项 长钢四侠【ANNJOO SSTEEL MASTEEL LIONIND】

今天2月13日, CSCSTEL 中钢发布了业绩,结果是很多高位买入的朋友都失望了,很多人都在斟酌明天是否要抛售手上的股票。

值得安慰的是, 如预期一般宣布了超高诱人股息 14 cent , 对目前股价,周息率 6%++ ,还是起到了一定的防护作用。

(声明: 本人手上已无中钢股票)

这时很多人的心中都掀起了涟漪,钢潮是否已退? 钢铁股要 gap down 了 ?

我看未必,很多人都并不是很了解整个钢铁领域,很多人以为后面有个STEEL 或者 METAL的都从事同样的生意,其实不然。以下这个图表分析了市场上的一些钢铁股项。

(摘自网络)

一小部分的宏观大马钢铁领域

最基本的,我们应该知道,马来西亚钢铁领域普遍上则分为 长钢 (REBAR / WIRE ROD) , 扁钢 ( C.R COIL) ,成品钢

长钢 (REBAR / WIRE ROD) 公司 比如 :ANNJOO , SSTEEL, LIONIND , MASTEEL

扁钢 ( C.R COIL) 公司 比如 :CSCSTEL , MYCRON , YKGI ,EMETALL(少量)

这二者看似相同,实为不同.

我的看法,中钢margin的忽退无法与长钢公司的盈利挂上等号。

这是因为如果要制作 扁钢, 原料(热轧钢HRC) 必须尤外国进口,在去年Q4特朗普竞选期间马币兑美元狂泻 导致这些扁钢制造者必须承担一次性的外汇亏损,进而导致margin 被拉低,因为原料贵了。

据我的观察,本地扁钢制造者过去几年所面对的大问题是LIONCOR售卖的HRC价钱昂贵,所以导致扁钢业者没有margin,现在好不容易LIONCOR倒闭了,以为可以进口到便宜的HRC, 哪里知道外汇因素和HRC涨价因素,而造成进口的HRC无法像以往般便宜。

LIONCOR的倒闭事件导致有些公司原料短缺,(注明:LIONCOR是马来西亚唯一的HRC提供者,在9月-10月期间宣布打包),所以如果一些原料储备不够的公司在不得已的情况下必须利用高汇率来购买昂贵原料。

鉴于此,MYCRON YKGI 有可能会步CSCSTEL 后尘, 交出令人 O_O 的业绩.。

可是,长钢业者就不同了,长钢业者这几年面对的问题是来自于中国的廉价长钢。2016年9月尾,政府对进口长钢实施了进口税 (ANTI DUMPING POLICY),导致进口的长钢更贵了,无法媲美本地价钱,而很多长钢使用者比如建筑公司就迫不及待吨多一些货,这个举动助长了需求,而本地长钢业者也得到进一步调高产品的机会,单单是Q4,长钢价格就涨了大约20%左右。(传统上Q4需求比较少,所以钢铁价格都会回调)。 这意味着长钢业者必然得到很好的profit margin,所以即将来临的业绩报告都值得我们期待。

领域催化剂:各项大型基建工程, 比如捷运2线 (KVMRT2), 东海岸铁路(ECRW),西海岸高速公路(WCE)

来看个股 长钢四侠

ANNJOO 安裕 - 位于北马,拥有国内最先进领先的生产线,profit margin 最高 , 库存量最高 , 带头大哥

SSTEEL 南钢 - 位于北马,据说生产出来的产品素质堪称一绝,价格也比较贵,生意也做得比ANNJOO大

MASTEEL 马钢 - 位于中马,四个里面最小规模

LIONIND 金狮 - 位于中马,生意量最大,政治裙带强

无可否认,ANNJOO,SSTEEL, 和 MASTEEL 都是大可能性持续获利的公司,而且即将来临的业绩有机会是爆炸性的,毕竟Q4产品平均涨价了10-20% 不等。如果这三个股都持续获利,那么所谓的 re-rating 就有可能降临了。

至于LIONIND 我对它的业绩还比较保守因为它的库存量Q3的时候貌似不多,但是此股具备黑马本色,毕竟LIONCOR的苏州屎已经告一段落,该impair的loss也都已经报销了。相信FY2017 LIONIND 应该有机会背水一战,反败为胜,毕竟也是钟廷森爷子的最后堡垒。

值得关注的是,ECRW 是一项亟需耗铁的一项工程,工程大机会由强国公司包办了,但是原料方面应该不会千里迢迢运过来,所以本地钢厂应该有得分一杯。纵观东海岸钢铁厂,比如PERWAJA 和 KINSTEL 应该无法竞争,所以剩下的机会应该是中马那两间。

结论

综合以上观点,我觉得长钢个股不应该被扁钢个股行情所拖累,反之有机会坂下一城。

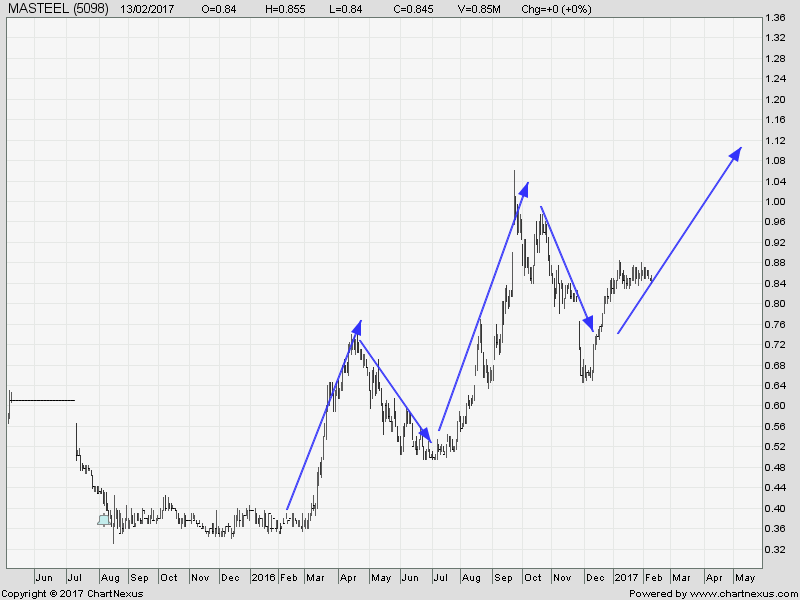

何谓长钢三叠浪 ?

请看下图

有没有看到共同点?

参考:

共勉之

ZEFF TAN

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on 笔随意走

Discussions

I also worry china will direct import steel with tax free(or discount) privileges.

2017-02-14 15:03

A lot of peoples worry of China cheap dumping, but where you can source the cheap supply like 2015-2016. No more such cheap supply and now all expensive.

2017-02-14 16:10

100percent: i apologize for that copyright, i got it from telegram, thanks for it

2017-02-14 23:26

My view is, that's exactly one of the key point.

When you look at those have "cheap" inventory, you can still take advantage of cheap inventory you have and sell at higher price now.

When cheap inventory depleted (depends on individual company), you need to replenish with "expensive" inventory, then margin will drop significantly.

Latest result of SS Steel clearly shows that. When the COGS remain flat, but higher revenue registered, they are using cheap old stock.

Once the old stock depleted, the profit margin should squeezed.

We do not have data of actual inventory in "tonnage". All are showing figures only.

This is something need to be very careful to consider.

Posted by leoting > Feb 14, 2017 04:10 PM | Report Abuse

A lot of peoples worry of China cheap dumping, but where you can source the cheap supply like 2015-2016. No more such cheap supply and now all expensive.

2017-02-15 09:14

zefftan 100percent: i apologize for that copyright, i got it from telegram, thanks for it

14/02/2017 23:26

Haha, don't worry. I was just poking at you. Great article! (had to use google translate)

2017-02-15 10:39

Also I completely agree.

Rebar prices have been high for the month ending Dec 2016.

Annjoo is likely to benefit the most as they are in the upstream business.

SSteel has already posted strong profits due to higher rebar prices due to China's increasing rebar prices and the safeguard measures

2017-02-15 12:34

Hi Zeff. What is your view on coming announcement of Prestar's result? Since its raw material is HRC, will its profit dropping due to higher cost for raw material?

2017-02-15 21:50

Maybe their effect is not so teruk like csc because of their product mix , but somehow I think will get affected

2017-02-16 12:01

moneySIFU

Big like, I like to read articles written by Jefftan, meaningful

2017-02-14 01:13