炼钢原料篇 之 石墨电极 GRAPHITE ELECTRODE 【ANNJOO LIONIND SSTEEL MASTEEL】

zefftan

Publish date: Mon, 25 Sep 2017, 06:10 PM

此文主要针对长钢个股 [ ANNJOO LIONIND SSTEEL MASTEEL ]

由于最近钢铁商品和股项都面临了一个礼拜的盘整,导致市场上传出了很多质疑的声音。

关于石墨电极graphite electrode 的文章 陆陆续续在各专页/chat group 里转发,一些对钢铁领域比较不熟悉的朋友们难免会有些担

心,不知道它会如何影响钢铁股的盈利。 reference1 , reference2

graphite electrode 一词最初显露于ANNJOO出炉的季报里。

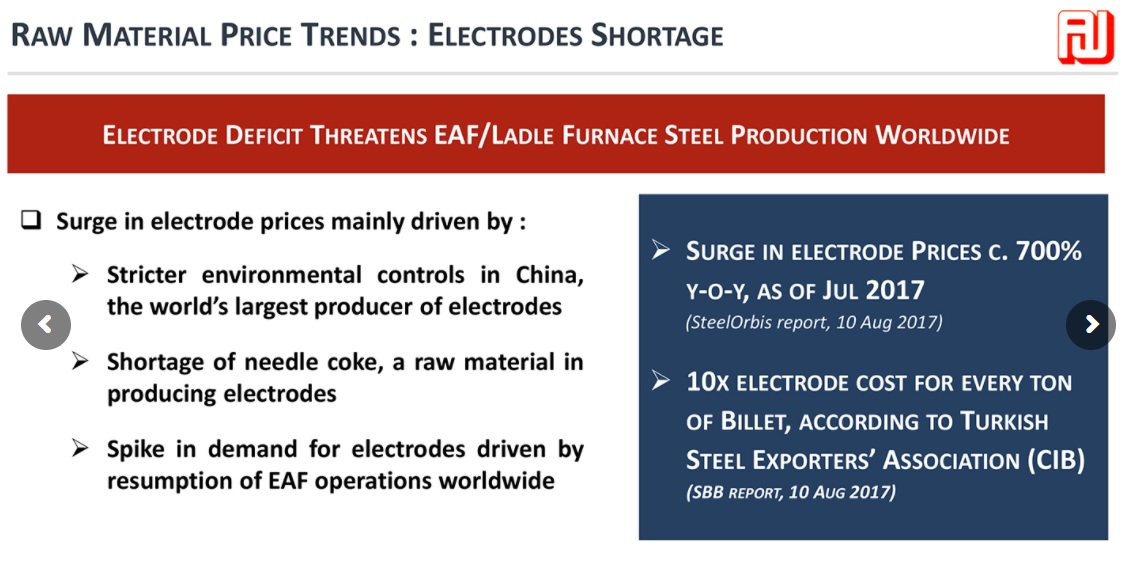

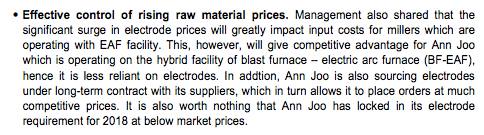

(摘自ANNJOO corporate briefing ppt)

本文的目的在于为各位读者揭开 石墨电极 的神秘面纱, 以及它对炼钢领域所带来的影响,希望各位投资钢铁领域的股友们看完后更了解炼钢的cost structure 以便安心持有。

相信在座各位都对 碳 (carbon) 这个词不陌生,但是虽不陌生,却又略带朦胧。

碳(CARBON), 顾名思义,就是跟燃烧有关系的东西, 碳是自然界里最为普遍的化学元素之一。

在我们日常生活中,经常听到的/看到的/食用的 与碳有关的东西如下:

碳水化合物 CARBOHYDRATE - 我们身体细胞主要依靠它来制造能量,比如:米饭,面粉,面包,糖,薯粉

二氧化碳 CARBON DIOXIDE - 我们呼吸所排除的气体

煤炭 COAL - 用来燃烧的原料

钻石 DIAMOND - 世界上最硬的物质 , 拿来求婚的饰物 (纯碳的一种天然形态)

至于石墨graphite , 由于我们都不是行内人,所以对它都颇为陌生。

石墨也是碳的其中一个天然形态, 但是由于需求强劲,现有科技也可以人工制造,主要制造的原料为焦(COKE),或者是沥青(TAR).

*沥青来自于石油

对于 石墨电极 涨价的新闻,其实早在六月尾/七月头, platts.com 就已经有提出了关于石墨电极的涨价/短缺对炼钢领域所会产生的变化。

电炉的运作与石墨电极的定位

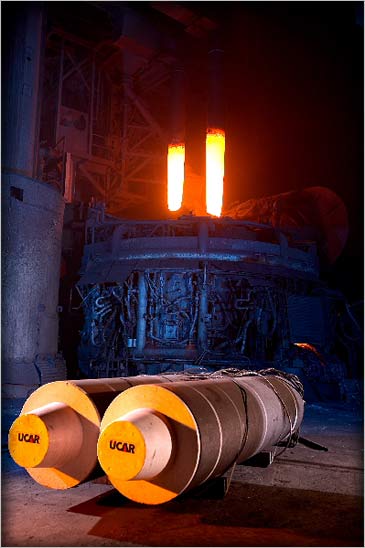

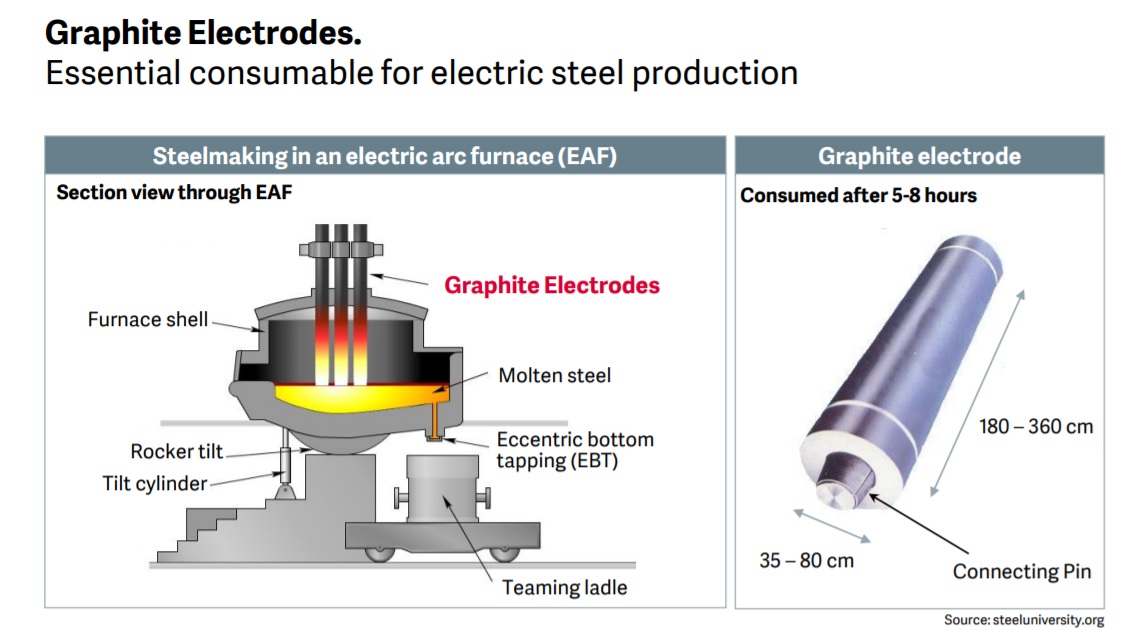

(图里两支火红色的擎天柱 为石墨电极)

石墨电极graphite electrode 是电弧炉的核心导电体,之所以会选择石墨是因为在这世上也只有它可以立足于摄氏3000 °的温度下 依然不受损,可以继续发挥导电功能。

在一个电弧炉的熔铁过程中,一堆废铁被放进了一个炉,然后接着两支电极植入盖顶,再以超高电压进行熔铁过程,将炉里的温度提高到3000° (相等于太阳表面温度的一半),而达到将废铁化为铁浆的效果。

这熔铁的过程同时相等于 50,000户人家使用的基本电流。

石墨电极的种类 以及 它的超音速价格走势

石墨电极普遍分为3种, 依据电炉本身的耗电量以及直径宽度 (300-750mm) *一把长尺的长度相等于 300mm

1)普通功率 NORMAL PERFORMANCE

2)高功率 HIGH PERFORMANCE

3)超高功率 ULTRA HIGH PERFORMANCE

以下为三个等级的电极10年走势 -这个应该是今天走势最牛b 的大宗商品

价格走势总结:

普通功率:12,000 to 67,000 人民币 (5.5 倍)

高功率:19,000 to 120,000 人民币 (6.3 倍)

超高功率:30,000 to 191,000 人民币 (6.36 倍)

下图为亚洲最大 石墨电极 供应商, 股价从石墨电极暴起开始至今短短三个月涨了大约3倍

截至目前为止的公开资料,我并不了解四家所使用的电极为哪一个种类,但是以它们的电炉的性能,暂定为高功率石墨电极。

不同的石墨电极可以 参考这里

但是一点可以肯定的就是 ANNJOO SSTEEL 和 LIONIND (Amsteel 1) 所使用的电炉 均来自同样的品牌,就是来自德国的BSE (Badische-Stahl Engineering),而且他们的电炉setting 都是 80-85MVA,所以应该都理应使用同样的电极。

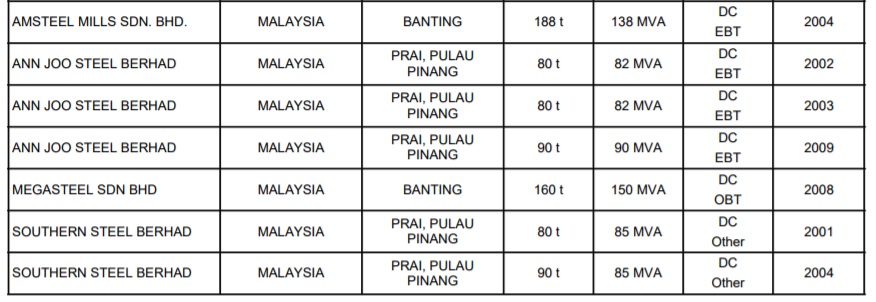

各厂电弧炉的Specification

石墨电极在炼钢里的使用量

根据Wikipedia 以及一些石墨电极供应商的数据, 平均每 1000kg 的成品 , 石墨电极的使用量为 3-4 kg, 也就是 0.3-0.4%

然而,根据LIONIND 十年前的资料 http://www.lion.com.my/WebCorp/Newsletter.nsf/0/DB65C1683BD7CCBB48257419000D98F8?opendocument 里面说AMSTEEL 平均每1000kg 使用大约 1.67kg 的石墨电极

演算和大胆推进 (算术不好童鞋的莫看,你会头晕)

假设用今年 4月至6月来做例子,假设平均销售价RM 2050 / MT(四月至六月期间,rebar 最高价为 RM2200+,最低为RM1950+)

LIONIND :

钢铁营业额 RM653,351,000

等于大约 320,000 MT (320,000,000 kg)的销售量

那个时候的每MT 生产成本大约是 RM2000 ,(这也解释了为什么LION和SSTEEL的业绩比较鸡肋的原因), 那么320,000 MT就相等于 RM 640,000,000 的总生产成本。

如果每MT (每个MT也就是等于1000kg)使用 3kg 的电极, 也就是说 320,000,000kg 总共消耗了960 MT 的石墨电极

2017年4-6月 ,高功率石墨电极平均价19,000人民币/MT,以当时的平均汇率, 相等于马币RM12,000

所以,RM12,000/MT x 960 MT = RM 11,500,000

RM11,500,000 占了生产成本 RM640,000,000 的 1.8 % (如果以每MT 4kg 来算的话,则是 2.3%)

既然每MT的生产成本 是 RM2000 , 那么 1.8-2.3%的石墨电极 等于 RM36-46

以目前的情况来看,截至9月25日,倘若假设高功率石墨电极的价格起了6倍(从19,000 到 110,000) ,这笔额外数目将会是RM180-RM230(从RM36 - RM216, or RM46 - 276)

再看废铁市场,根据知情人士,废铁市场 RM1.1 - RM 1.3 per kilo (相对于1-3月的时候价格是没差多少的,如果他们要起价,必须提前1个月向该钢厂propose)

所以,生产成本就从原来的 RM2000 + RM200 石墨电极额外费用 + RM100 假设废铁增5% = RM 2300

目前的销售价 RM 2620 - RM 2650, LIONIND/SSTEEL/MASTEEL 依然可以录得 每MT RM300- RM350 的盈利, gross profit margin 12- 13%

如果是ANNJOO的话,应该以成本优势可以录得 每MT RM400- RM500 的盈利 (或更多), gross profit margin 19% - 2x%

(摘自UOBKayHian 的report)

市场消息

本地的石墨电极供应商为来自德国的 SGL Group,工厂在Banting,不确定本地长钢商是否有跟他们进货,毕竟中国的价格好贵

目前也没传出本地石墨电极有短缺的问题

总结

根据演算的结果,销售价抵消了石墨电极的影响,希望大家不要被类似标题"石墨电极狂涨 700%"的主题影响,而觉得心里长刺。

"An investment in knowledge pays the best interest." - Benjamin Franklin

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on 笔随意走

Discussions

320,000 MT = 320,000,000 kg

Since every 1000 kg consumes 3kg

Hence, 320,000,000 kg / 1000 kg x 3kg

= 960,000 kg

= 960 MT

IF 960,000 MT, the cost wll be very high

Which means electrode alone also costing RM8billion orefi

2017-09-25 19:21

very good info, thank you very much.

good news for those long masteel, ssteel & lionind

2017-09-25 21:18

thanks for your info.

Just write some comments:

Electrodes got 3 types, normal, high and ultra high. Normal performance electodes is made from petroleum coke, high performance electrodes made from needle coke. For steel casting and making, normally at least need to use high performance electrodes that made from needle coke.

Electrodes price increased by about 7-10 fold, if by %, up to 700% since July price hike depend on diameter width.

If normal electrodes, this is about 150-220 or about 8% of the price.

But for steel industry (this need to use for high performance electrodes as for building construction purpose), so cost will be double to 300-440, about 16% of the price.

So if selling price is 2,600, cost will be 2,000 + 400 + 100 = 2,500, the margin will become 100. Please note that China steel price had been dropped a lot recently, so if steel price dropped to below 2,500, profit margin might be affected. Anyway, all need to follow Malaysia market price and individual company structure including finance cost, utility costs and others.

Anyway, just sharing and discussion purpose. If wrong, please rectify me.

2017-09-26 00:22

Windloud, I think you calculation are incorrect.

As mentioned by Zefftan, the consumption of graphite electrodes is around 3kg per tonnes (actually the real consumption should be lower than 3kg, as most of EAF claim that their consumption of Graphite Electrodes is between 1.5kg - 2.1kg only).

That mean, 1 tonnes of graphite electrodes can produce minimum 333 tonnes and maximum 666 tonnes of steel.

Assume the current price of ultra high performance graphite electrodes is RMB110,000, so it will equivalent to RM70,000. Based on Zefftan calculation, the average Graphite Electrodes price for previous quarter was approximately RM12,000, that mean there is an increase of RM58,000 for current quarter.

If we take RM58,000 divided into 333 tonnes, then maximum impact to the cost is only RM175 per tonnes.

If we take RM58,000 divided into 666 tonnes, then maximum impact to the cost is only RM87 per tonnes.

So your assumption of cost will increase by RM300-440 is incorrect, it should be maximum RM175 only.

Please correct me if my basis of calculation is wrong.

2017-09-26 01:52

Albukhary, username is windcloud, not windloud.

Normally consumption is around 2kg to 3kg for high performance electrodes.

If 2.5 kg, then 1 tonnes will produce 400 tonnes steel.

High performance granite price let's say RMB120,000 (let's say included tax/duty) x 0.64 = MYR 76,800, divided by MYR 192, is about 7-8% of the current price.

For 666 tonnes, the consumption will be 1.5kg of electrodes, but I wont use this, maybe Annjoo can achieve this but dont know is because of grades of electrodes and any other reason.

You are right, should not simply multiply by 2. Thanks for correct me.

2017-09-26 02:29

Albukhary

Very good information, thank you very much.

2017-09-25 18:25