|

| |

OverviewFinancial Highlight

Headlines

Business Background TSH Resources Bhd owns oil palm plantations, mills, and forest areas in Southeast Asia. Crude palm oil and palm kernel are extracted from the oil palm plantations. The products are transferred to a mill and processed into ready-to-sell products. Additionally, one branch of the business focuses on generating and supplying electricity from a biomass plant. The forest areas are cultivated to manufacture and trade wood products. Reforestation becomes an integral part of the process to safeguard against shortages. Furthermore, the company will manufacture, sell, and trade cocoa products. Its processing facility primarily produces cocoa butter.

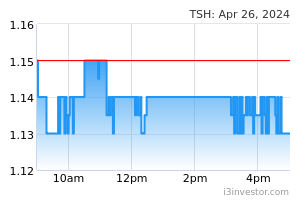

calvintaneng Yes Sales Jtiasa buy call was onjy 63 sen when many doubted had even said management lousy We loaded up Jtiasa kaw kaw then True enough Jtiasa has given us more than 100% profit This most spammed and hated Tsh is now what Jtiasa was So we just load up kaw kaw Success begets success Cheers! 23/04/2024 4:45 PM 9sunbeam hi new here why some seller put big quantity q at sell? how Malaysia stock can grow? this going on for years dy? 24/04/2024 10:38 AM calvintaneng no problem at all last time Ijmplant buy call Rm1.86 IB banks doing RSS short sell Ijmplant to kill Ijmplant call warrant but Klk offered to take Ijmplant private at Rm3.10 shorties all kena kaw kaw Then we gave buy call for Bplant at 57 sen RSS shorties also tried suppressing Bplant Then Ltat offered Rm1.55 to takeover Bplant all shorties again kena kaw kaw then we gave buy call for Jtiasa at 63 sen 5 IB banks now try doing RSS shorting Jtiasa But buyers overwhelms all and Jtiasa jumps up So Shorties now at Tsh? Just continue buy cheaply from them One day no more scripts to short All shares will be taken up by Funds and Value Investors So just buy and keep Keep longer the better 24/04/2024 3:42 PM calvintaneng IF MKHOP IPO IS WORTH 62 SEN WITH P/E 20.3: THEN TSH RESOURCES WITH P/E 16.56 SHOULD BE RERATED FROM RM1.14 TO FAIR PRICE OF RM1.40, Calvin Tan https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-04-24-story-h-182879779-IF_MKHOP_IPO_IS_WORTH_62_SEN_WITH_P_E_20_3_THEN_TSH_RESOURCES_WITH_P_E_ 24/04/2024 6:26 PM calvintaneng TSH RESOURCES (9059) 2023 ANNUAL REPORT: SHOWS A WONDERFUL COMPANY WITH AMAZING CHANGES, By Calvin Tan https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-04-25-story-h-182876873-TSH_RESOURCES_9059_2023_ANNUAL_REPORT_SHOWS_A_WONDERFUL_COMPANY_WITH_AM 25/04/2024 6:57 AM calvintaneng https://www.youtube.com/watch?v=tiKV3nGTpH4 this is Tanah Kuning, Bulugan Regency Where TSH got 13,338 Acres Prime Lands 25/04/2024 7:22 AM calvintaneng IB banks have very little scripts to do RSS as Chairman has transferred his 250 millions Tsh shares to Spore Depository also in Spore DBS Bank and other Funds have GOBBLED UP CHUNKS OF TSH OVER THERE SO VERY LITTLE SCRIPTS LEFT IN SPORE THESE PALM OIL SHARES WILMAR FIRST RESOURCES GOLDEN AGRI BUMITAMA AGRI 92% TO 98% SCRIPTS ARE IN THE HANDS OF JUST 20 TOP HOLDERS YOU GUYS SHOULD NOT WAIT TO BUY TSH YOU SHOULD JUST BUY SOME TSH AND THEN WAIT ONCE FREE FLOATS ALL TAKEN UP IT WILL BE VERY HARD TO GET 25/04/2024 10:20 AM calvintaneng SGX (SGD): TSH Resources (TSH) DBS BANK Appeared in Top 10 with 38 Million TSH RESOURCES Shares Speak Volume, Calvin Tan https://sgx.i3investor.com/blogs/Jbhouseforsale/2024-04-26-story-h49624695-SGX_SGD_TSH_Resources_TSH_DBS_BANK_Appeared_in_Top_10_with_38_Million_TSH.jsp 26/04/2024 8:57 AM calvintaneng IKN NUSANTARA In year 2005 (Almost 2 decades ago) TSH Resources bought 94,700 Acres land near here for as low as Rm4,500 an acre. Today it is worth from Rm200,000 to Rm4.2 Millions per acre https://www.youtube.com/watch?v=mG-l5pnoNYw 26/04/2024 9:05 AM AdCool Still talking about land after more than 3 years? TSH cant be forever selling land. TSH needs to sell its palm products and wood products. That wood products and forest planting isnt giving any profit for years... 26/04/2024 2:53 PM calvintaneng Sure can we also talked about Bplant lands since 2021 After Ltat took Bplant private it later sold lands in Kulim to Kedah Govt to be converted to Industrial park the sale price was Rm7.50 to Rm7.80 which translates to about Rm330,000 an acre A check with Bplant it has 2 plots of lands in Kulim one got price of Rm31,000 per acre and another is Rm33,000 per acre book value So Ltat made 10 X (times ) more selling Bplant lands And since we got the figures if we calculate backwards then Bplant privatisation at Rm1.55 was dirt cheap and it's real time market value now should be at least Rm8 a share 26/04/2024 3:12 PM calvintaneng One fine day when time is ripe and should Tsh sells its lands in Bongan, West Kutai then The wealth generated can last for 3 generations no problem Until then just quietly collect as many Tsh shares as you can afford to buy and hold tight 26/04/2024 3:15 PM Plantermen Land ownership in Indonesia is complicated. Forest land is strictly reserve and no cultivation is allowed. Ownership of agricultural land is split into HAK MILIK, HGB, HAK pakai { lease}, HGU { right to cultivate or plant}, HMA rumah susun { building units}. Only Indonesian citizens is allowed to own freehold land { HAK MILIK} Foreigner's is not allowed to own or buy freehold or HAK MILIK titles. In addition any agricultural land development 20% of land use is reserved for local community or adat{ forest land rights} akin to our Felda scheme 27/04/2024 11:31 AM Jonathan Keung Now you can understand why Tabung Haji and Boustead exit their Indonesian estates. Same goes for Singapore companies unless you paid a third party to undergo the transaction. Lease must be renew after expiry between 30 -33 years. If there is not development within 5 years after acquiring the said land. The local governor has the right to take back the said land under general orders .it's a land mine 27/04/2024 12:39 PM calvintaneng All above land matters we have discussed in Eagle Group for years 2022/2023 until now So we know them on finger tips 27/04/2024 12:56 PM calvintaneng For Lands in Ikn Nusantara There is a change to as long as 190 years Read this Investors in Nusantara Capital City (IKN) will be granted a right to cultivate (HGU) of up to 190 years as the House of Representatives (DPR) have decided to ratify the IKN Bill to be a law. DPR Deputy Speaker Sufmi Dasco Ahmad was the star at the 7th plenary session that was held on Tuesday (3/10). The DPR leader from Partai Gerakan Indonesia Raya (Gerindra) chaired the level II discussion that determined the Bill on the Amendment to Law No. 3/2022 on IKN to be passed as a law. After Sufmi Dasco has affirmed his approval for the IKN Bill to be a law twice, the meeting participants agreed. Read in Full IKN Bill ratification: The way is paved for investment in Nusantara https://www.pwc.com/id/en/media-centre/infrastructure-news/october-2023/ikn-bill-ratification-the-way-is-paved-for-investment-in-nusantara.html 27/04/2024 1:00 PM calvintaneng For IKN NUSANTARA Not only they allow land use to go up to 190 years from 35 years THEY ALSO INSTANTLY CHANGE 54 VILLAGES TO "NEW TOWNSHIPS" See Villages in IKN Nusantara to gain town status: OIKN https://en.antaranews.com/news/310635/villages-in-ikn-nusantara-to-gain-town-status-oikn It took Seremban, Melaka, Kampar and others quite some time to become "Townships" IN IKN INDONESIA THEY BUILT IKN NUSATANTARA (NEW CAPITAL) IN JUST 2 YEARS By August 17 It will be launched Officially Concurrently These will be launched 1. New Connecting Highway from Balik Papan to IKN NUSANTARA 2. NEW 5 Star HOTEL 3. New Hospital 4. New International Airport 5. New Presidential Palace with New Govt Servant Qtrs Many more Apple Tim Cook invited to build Smart Connection Elon Musk invited as well THE MOST EXCITING BOOM WILL BE HERE!! 27/04/2024 1:07 PM Plantermen Without disrespect to any sifu or experts on land matters. The planned city development of Nusantara is split into 5 phases. The targeted date of completion for the new capital city is set betw 2045 - 2050 27/04/2024 1:10 PM calvintaneng As for TSH it has an outstanding Indonesia Partner BILLIONAIRE GARIBALDI THOHIR Garibaldi Thohir has 10% share TSH 90% share of Tanah Kuning Lands in IKN NUSANTARA Also got 10% shares of lands in West Kutai & East Kutai See PT Andalas Agro Industri PT Andalas Agro Industri , is a company established through a joint venture collaboration between TSH Resources Berhad and Bapak Garibaldi Thohir of Indonesia. We were invited by the West Sumatera government to invest in palm oil milling as well as planting of oil palm . Palm Oil Mill The 60-tonne per hour palm oil mill is in the course of construction and is expected to be commissioned in early March 2005. It is located at Pasaman Barat , West Sumatera, about 145 km from the capital city of Padang. LONG AGO TSH ALREADY FOUND INDON PARTNER GARIBALDI THOHIR Later they went to buy Bulugan lands, West & East Kutai lands Billionaire Garibaldi Thohir owns 10% & TSH 90% Who knows? Today BILLIONAIRE GARIBALDI ROSE UP IN INFLUENCE & PROMINENT! This augurs well for TSH https://landmatrix.org/media/uploads/ekowoodcomimagesnews31dec05pdf.pdf 27/04/2024 1:31 PM calvintaneng “We are small in number, yes,” coal billionaire Garibaldi Thohir told the room in a widely publicized video of the event. But “in this room maybe one third of Indonesia’s economy is here.” SIGN UP FOR THE ENERGY DIGEST Their support is a big change from five years ago, when Thohir’s brother — sitting cabinet minister Erick Thohir — led President Joko Widodo’s campaign to beat Prabowo for a second time. Jokowi, as the incumbent is popularly known, can’t run for a third term and has implicitly backed Prabowo by having his 36-year-old son join the ticket as vice president. Yet the band of American-educated businessmen gathered in the cafe are just as key to victory when 205 million Indonesians elect Jokowi’s successor on Feb. 14. Prabowo, a former son-in-law of the late dictator Suharto, sang along to Creedence Clearwater Revival during the meeting as he expressed his gratitude for their support. “I get it now why I lost the presidential election twice,” said Prabowo, who was once banned from entering the US over suspected rights abuses. “Back then, I was not invited here.” The remarks underscore the sway Indonesia’s ruling class of tycoons and politicians still have in choosing the country’s leaders, nearly three decades since the country embraced democracy https://www.mining.com/web/wealthy-indonesians-set-to-win-no-matter-who-becomes-president/ 27/04/2024 1:34 PM calvintaneng “We are small in number, yes,” coal billionaire Garibaldi Thohir told the room in a widely publicized video of the event. But “in this room maybe one third of Indonesia’s economy is here.” SIGN UP FOR THE ENERGY DIGEST Their support is a big change from five years ago, when Thohir’s brother — sitting cabinet minister Erick Thohir — led President Joko Widodo’s campaign to beat Prabowo for a second time. Jokowi, as the incumbent is popularly known, can’t run for a third term and has implicitly backed Prabowo by having his 36-year-old son join the ticket as vice president. Yet the band of American-educated businessmen gathered in the cafe are just as key to victory when 205 million Indonesians elect Jokowi’s successor on Feb. 14. Prabowo, a former son-in-law of the late dictator Suharto, sang along to Creedence Clearwater Revival during the meeting as he expressed his gratitude for their support. “I get it now why I lost the presidential election twice,” said Prabowo, who was once banned from entering the US over suspected rights abuses. “Back then, I was not invited here.” The remarks underscore the sway Indonesia’s ruling class of tycoons and politicians still have in choosing the country’s leaders, nearly three decades since the country embraced democracy https://www.mining.com/web/wealthy-indonesians-set-to-win-no-matter-who-becomes-president/ 27/04/2024 1:35 PM calvintaneng https://www.instagram.com/bahlillahadalia/p/CznshZUv-EU/?img_index=1 See photo carefully Standing front row 3rd from right Billionaire Garibaldi Thohir 5th from right Upcoming Indonesia New President Probowo 27/04/2024 1:39 PM calvintaneng His investments in IKN NUSANTARA & his JV with TSH will see Tremendous Growth https://www.cnnindonesia.com/ekonomi/20230922132434-92-1002419/profil-10-konglomerat-bantu-jokowi-garap-ikn-aguan-hingga-boy-thohir/2 27/04/2024 1:43 PM calvintaneng Enough Revelations for now Lots more Vital Info about Gusik, West Kutai Prominence later THIS WILL PROPEL TSH'S ASSETS INTO A SUPER BULL TIME 27/04/2024 1:45 PM calvintaneng Ok one more reminder Last time in Jaya Tiasa Forum Naysayers like Skoh888 and danny123 poured scord on Jtiasa at around 65 sen danny123 later left Jtiasa (giant treasure) and went into the landmine Wcehld & got stuck there Jtiasa jumped up 100% See https://klse.i3investor.com/web/cube/profile/danny123 scroll down to see his bodoh remarks on Jtiasa (and missed it) SO BETTER NOT MISS TSH! 27/04/2024 1:51 PM calvintaneng Extracted from TSH 2023 Annual Report Desa Penawai, Bekokong Makmur, Kecamatan Bongan Jempang & Desa Jambuk, Muara Gusik Penawai, Tanjung Sari, Kecamatan Bongan & Desa Jambuk Makmur, Kecamatan Bongan Desa Muara Siram, Siram Jaya, Resak Kampung, Kecamatan Bongan, Desa Resak, Kecamatan Bongan, Kabupaten Kutai Barat, Provinsi Kalimantan Timur Note: Muara Gusik This is where WEST KUTAI CONNECTS WITH IKN NUSANTARA! 1 second ago 27/04/2024 10:44 PM calvintaneng calvintaneng These three areas were chosen because they have potential resources and local culture which of course also consider the potential for regional development and new economic growth areas YES! WEST KUTAI (CHOSEN AS "NEW ECONOMIC GROWTH" AREAS!!! were chosen because they have potential resources and local culture which of course also consider the potential for regional development and new economic growth areas 27/04/2024 10:47 PM calvintaneng pagac22 What is the current valuation of TSH Resources' land in IKN Nusantara, and why is it considered undervalued compared to other companies in the market? Good question Answer: BECAUSE TSH OWNS 80,000 ACRES LAND IN BONGAN, WEST KUTAI And these are the asking prices of lands in Kalimantan 1. North Kalimantan (Tanjong Selor) Asking price: Rm180,000 per acre 2. EAST KUTAI Asking price Rm300,000 to Rm500,000 per acre 3. WEST KUTAI Rm3 Millions to Rm4.2 Millions per acre WHY BONGAN, WEST KUTAI LANDS GOT SUCH ASTRONOMICAL ASKING PRICES? Answer: BECAUSE IT IS VERY VERY NEAR TO IKN NUSANTARA TITIK NOL AND NOW PEOPLE KNOW GOT "ECONOMIC DEVELOPMENT POTENTIAL" See GUSIK (GUSIQ IN MALAY) IS ONE OF 3 CONNECTING ROAD TO WEST KUTAI https://www.researchgate.net/publication/377267277_Road_Network_Connectivity_in_Supporting_IKN_NUSANTARA_The_New_National_Capital_City_Development_in_East_Kalimantan_Indonesia 7 minutes ago calvintaneng Extracted from TSH 2023 Annual Report Desa Penawai, Bekokong Makmur, Kecamatan Bongan Jempang & Desa Jambuk, Muara Gusik Penawai, Tanjung Sari, Kecamatan Bongan & Desa Jambuk Makmur, Kecamatan Bongan Desa Muara Siram, Siram Jaya, Resak Kampung, Kecamatan Bongan, Desa Resak, Kecamatan Bongan, Kabupaten Kutai Barat, Provinsi Kalimantan Timur Note: Muara Gusik This is where WEST KUTAI CONNECTS WITH IKN NUSANTARA! 27/04/2024 10:49 PM calvintaneng Study this 3 times to "SEE" https://www.researchgate.net/publication/377267277_Road_Network_Connectivity_in_Supporting_IKN_NUSANTARA_The_New_National_Capital_City_Development_in_East_Kalimantan_Indonesia 27/04/2024 10:53 PM calvintaneng Thank you Xiaeh Gusig (or Gusik) is the short cut to Ikn if fact it is the shortest route just like JB CBD Ciq kastam to Woodland in Singapore 28/04/2024 7:46 PM calvintaneng EPF & i FAST Funds (Singapore) Are Now in Top 30 Holders of TSH Resources, Calvin Tan https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-04-29-story-h-182764553-EPF_i_FAST_Funds_Singapore_Are_Now_in_Top_30_Holders_of_TSH_Resources_C 29/04/2024 5:17 AM karencortinas48 I lost 1 million for trading scam, coinsrecoveryworldwide was able to come through and recover half of the payment A huge shoutout to coinsrecoveryworldwide for their incredible skills and dedication in recovering my bitcoin! What a fantastic achievement! If anyone needs help in a similar situation, don't hesitate to reach out to Wizesafetyrecovery @ Gmail com May this victory serve as a reminder of the importance of cybersecurity and the value of seeking professional assistance. Here's to your continued success and security in the world of cryptocurrency! #BitcoinRecovery 🚀🔒. 29/04/2024 7:29 AM OneOracle If top 20 shareholder want to gather 90% of float of TSH. TSH need to trade above RM2. Thats where majority of public float will let go. 29/04/2024 8:52 AM OneOracle Any bad news they will absorb. Ex dividend they absorb. Poor result they absorb. Negative analysis they absorb. Lackey bombasting they absorb. RSS and idss they aborb. Once all vested party got enough tickets of TSH. They will definitely use SGX as the rally point to push the share where their big fund is and the easiest to push. Malaysia side is to absorb as much tickets as possible. So pls sell ,RSS and idss more. Dual listing at SGX definitely got a bigger objective and not for wayang. 29/04/2024 9:37 AM calvintaneng Good morning Tsh's Upcoming news that might boost it 1. May 2024 should see Tsh finally Debt free and cash rich 30/04/2024 7:49 AM calvintaneng 2. July 4 2024 dateline for Bulugan land final payment Rm221 Millions if cash is in then it will be 16 sen (less 10% shares of Garibaldi Thohir it will be 14 sen cash 30/04/2024 7:51 AM calvintaneng 3. August 17th 2024 Official launch of Ikn Nusantara New Admin Capital of Indonesia (phase one) only 43.9 km away is where Tsh got prime lands 80,000 acres total in 3 plots 1. About Rm7,000 per acre 2. Two more plots about Rm4,500 per acres Tsh has the foresight to buy these assets long ago in years 2005/2008 Current prices have got up to as high as Rm4.2 Millions per acre asking price 30/04/2024 8:18 AM calvintaneng So big things are in store for Tsh 1. Tsh has 80,000 acres in Kutai West Asking prices as high as Rm4.2 Millions per acre as people here are aware of this "Chosen Economic Zone" of the future 2. Kutai East Tsh has about 14,000 acres asking price Rm300,000 to Rm500,000 per acre 3. Bulugan (north Kalimantan ) Tsh got 13,333 acres left awaiting payment per acre sold price Rm16,500 was Rm6,502 per acre book value(year 2022 AR) if sale aborted better still as current price in Tanjong Selor (90km from Tanah Kuning Bulugan ) is already Rm180,000 per acre ) So Tsh lands in Tanah Kuning should have risen to Rm300k range as Tanah Kuning is where THE WORLD'S BIGGEST GREENTECH PARK IS LOCATED (For comparison we see Ltat after taking Bplant private sold lands in Kulim Hi Tech park for Rm333k an acre (bplant book value was only Rm31k per acre ) so land prices are now rising with the Upcoming Boom in East Kalimantan 30/04/2024 8:35 AM Jonathan Keung MKH oil palm Kalimantan a big let down. IPO at 0.63 .today listing 0.64. prior to Bursa listing analyst calling 80 sen TP. Now debut at miserable 62-64 price range. Worst on record for a ipo 30/04/2024 10:55 AM calvintaneng Price is what you pay Value is what you get At least over a long term MkhOp lands in Ikn Nusantara will be there and price can only go higher with Ikn boom 30/04/2024 11:05 AM calvintaneng if forced to make a decision between MkhOp and Tech, property, construction, O&G I will chose MkhOp it is very safe longer term of course Tsh is superior 30/04/2024 11:08 AM OneOracle So difficult to get people to sell TSH as it is in strong hands now. Many buyers are waiting to grab at cheap price. Need to raise your buying price if boss want to get more share. TSH sell at below PB 0.7 while MKHOP above 1. How can MKHOP move higher if TSH still so cheap. How to get cheap TSH if MKHOP still strading above pb 1? 02/05/2024 10:16 AM OneOracle https://www.klsescreener.com/v2/news/view/1318177/investing-sustainable-forestry-now-an-asset-class Sustainable forestry now an asset class TSH have valuable sustainable foresty assets as well. https://www.tsh.com.my/sustainability/forest-management/ 02/05/2024 11:52 AM OneOracle New Forests now has over US$7 billion (RM33.44 billion) in assets under management, with over 1.3 million ha of sustainably managed forests and agricultural land. It has six offices in Australia, New Zealand, the US, Singapore and Kenya. TSH had over 100000 ha in forest management. 1.3 million ha = RM33.44 billion 100k ha = RM 2.5 billion? SGX Mainboard listing. In Sept 2023, SGX welcomed the secondary listing of TSH to its Mainboard. TSH’s primary listing remains on Bursa but sees wider opportunities with a SGX presence. Firstly, the bulk of TSH’s earnings are already from Indonesia; hence, an SGX listing could provide greater flexibility in terms of: (i) funding, (ii) regional growth, for example many Indonesian corporations are comfortable with Singaporean listing, and (iii) wider carbon-related opportunities in term of market or trading including renewable energy and sustainable forestry where TSH manages over 100,000 Ha in Sabah. 02/05/2024 12:49 PM calvintaneng PALM OIL COMPANIES GOT 2 INCOMES: THE ACTIVE INCOME & PASSIVE INCOME OF A PALM OIL COMPANY, Calvin Tan https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-05-03-story-h-182016934-PALM_OIL_COMPANIES_GOT_2_INCOMES_THE_ACTIVE_INCOME_PASSIVE_INCOME_OF_A_ 03/05/2024 9:43 AM calvintaneng Since Tsh net debt only Rm12 millions By this month May 2024 results will see Tsh finally debt free and cash positive 03/05/2024 10:16 AM calvintaneng Another favourable factor if before 4 July 2024 Cash of Rm221 Millions for final sale of Bulugan land in then Tsh will report a nice 14 sen to 16 sen profit Should sale be aborted then better still Tsh will see it's lands value jump from Rm16,500 an acre to over Rm200,000 an acre no need to do anything at all land prices all over East Kalimantan goes up effortlessly due to Ikn Nusantara boom 03/05/2024 10:20 AM | |