|

| |

Overview

Financial HighlightHeadlinesBusiness Background Taliworks Corp Bhd is a Malaysia based company, primarily involved in the activities of Water treatment, supply and distribution. It is also engaged in the business sectors of Construction and engineering, Highway toll concessionaire, and operations and maintenance operator, and Solid waste management. The group generates the majority of the revenue from the Water treatment, supply and distribution segment which involves management, operations, and maintenance of water treatment plants and water distribution systems. It operates in Malaysia and China, of which the key revenue is derived from Malaysia.

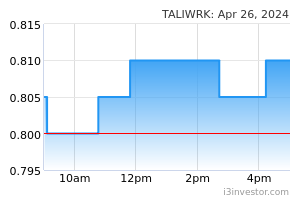

Pinky Oh no! The end of 1.65 sen per quarter! 😲 https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=227060&name=EA_FR_ATTACHMENTS The Board is pleased to declare a fourth interim single-tier dividend of 1.0 sen per share on 2,015,817,574 shares amounting to RM20,158,000 in respect of the financial year ended 31 December 2023, to be payable on 29 March 2024. 27/02/2024 6:20 PM Pinky 1. Higher repair and maintenance expenses 2. Previous quarter got toll compensation - current period tiada Looks like they finally exhausted their free cash, hard to sustain 1.65 sen per quarter already 😅 Continue monitor for another quarter 27/02/2024 8:32 PM cooledhawk123654 Last 2 years invesment in associate loss abt 20 over millions every year, what sort of the bisness the associate is doing? why keep losing money 27/02/2024 11:07 PM iscmob Any thought on HLB Research Rpt: Water. Revenue climbed higher by 6.0% driven by the increase in chemical and electricity rebates. There was a 2.4% hike in BWSR rates in FY23. Average MLDs came in lower by -2.8% which is within our range of expectations. At the operating profit level, there was a decline of -4.2% mainly due higher rehab & maintenance expenses. Profitability for the segment is expected to improve with a 14.3% tariff hike (effective 1-Jan-24). Tolls. ADT at the Grand Saga Highway and Grand Sepadu showed encouraging YoY growth at +7.3% and +2.8% respectively, benefitting from increased car usage vs FY22 which encompassed periods of pre-endemic conditions. Additionally, Grand Saga traffic was aided by the opening of SUKE highway. Despite the ADT growth in the period, profitability was lower on the back of higher rehab and maintenance charges. Construction. Revenue nearly doubled in FY23 due to the progress of the Package 2 and 3 of Rasau water scheme. We expect to see stronger performance from this division with projects showing signs of ramping up. There are also two water opportunities in the pipeline in Selangor which Taliworks could participate in. Forecast. Despite the results shortfall, we make no changes to forecasts as the construction segment is positively ramping up. Maintain HOLD, TP: RM0.81. Maintain HOLD with marginally lower SOP-driven TP of RM0.81 (from RM0.82) after rolling over valuation for is concession businesses. Uncertainty over its new level of dividends could weigh on share price in the near term. Nevertheless, we acknowledge the company’s highly cash generative business exposure. Upside risk: water project wins; Downside risk: lower dividends from current levels. 28/02/2024 11:08 AM Pinky I exited long ago around 83 or 84 sen. Been monitoring for re-entry for its tasty dividend yield. So now...since 1.0 sen je... 28/02/2024 11:29 AM cooledhawk123654 @cooledhawk123654 This: https://taliworks.com.my/waste-management/ thanks 28/02/2024 11:42 AM Lester Teow This is a dividend stock. If dividend is not attractive anymore, no reason to buy. 28/02/2024 1:45 PM Lester Teow RM27.60 million for budgeted capital expenditure for 2024, a significant portion of which is for solar panel replacement and other improvement works. 28/02/2024 1:52 PM Markv572421 melampauuuuuuu juga taliworks share dop ...what is the management doing ?????? 29/02/2024 12:00 PM Tanleechoo New MD hope can show a clear business directions…lack of focus as involved in too many business .. the core should be related to water 29/02/2024 12:20 PM Pinky Easy calculation. If 1.0 this quarter is indication of future dividends... RM0.01 x 4 / RM0.78 = 5.13% dividend yield I might as well buy REITs like IGBREIT and SUNREIT 🙄 29/02/2024 2:17 PM Xcalibre Construction to Fire on All Cylinders in FY24; BUY!! Under Budget 2024, MYR1.1bn was allocated for supply issues, especially in Kelantan, Sabah, and Labuan. This may include infrastructure like water treatment plants which Taliworks is currently constructing. Another rerating catalyst would be quicker-than-expected approvals for the tariff hike for its waste management associate. 05/03/2024 3:58 PM DividendGuy67 TALIWRK back above 80sen, closing at 0.815. Strong +3.16% gain. Thanks to TALIWRK recovery and 20 other green stocks to offset 12 red stocks, my portfolio made new all-time high again today. 02/04/2024 9:18 PM GroetjesuitNederland DividendGuy67 TALIWRK back above 80sen, closing at 0.815 Does anyone know why? The share price was punished because the dividend was reduced by about 39%. Something should be emerging for the share price to suddenly jump 2.5 sen with 6+ weeks to go to the next Quarterly Report. 03/04/2024 4:13 PM djrajan Taliworks starts 2024 on strong footing with 49% jump in earnings + Dividend is coming https://theedgemalaysia.com/node/711549 14/05/2024 8:19 PM Yippy68 for time being .I think it is fair for Tali to readjust the dividend payout. seem yearly 6.6 is too heavy for them to sustain. 15/05/2024 3:20 AM Yippy68 even 4 sen a year workout to a yield of 5 % if you buy at 80 sen. still better than FD. 15/05/2024 3:27 AM | | ||||||||||||||||||||||||||||||||||||