AHB - A SLEEPING BEAUTY AWAKENS !!!!!

BURSAMASTER

Publish date: Sat, 13 Apr 2019, 11:13 AM

AHB - A SLEEPING BEAUTY AWAKENS !!!!! (PERSONAL TP 0.25-

0.35),

AHB WB - PERSONAL TP 0.07-0.12

This week, BSKL has seen rising interest in the EXPORT based counters as the MYR had significantly weakened against the USD this week alone.

Recently I had spotted this small cap company; an investment grade, which have been underlooked and undercovered - AHB HOLDINGS BERHAD or AHB (Code 7315), listed on MAIN BOARD, CONSUMER PRODUCTS/SERVICES.

In summary, AHB is an international leading office interiors company, which has been recognised for design, innovation, and a range of products known as system MX that provides a fully integrated and highly flexible office interior solutions.

I noticed considerable interest starts to build in on Friday where the volume registered a sizeable increase to 8.8 million units which is the year 2019 highest volume registered so far.

This positive momentum should carry forward next week ( forbearing instances of the adversity/ negativity of the regional markets sentiment affecting Bursa Malaysia) since it was able to close Friday conclusively at 0.16. I forsee it trending to the next resistance of 0.20 before heading to my personal TP between 0.25 (short term) to 0.35 on the intermediate term.

WHY I THINK THIS STOCK IS UNDERLOOKED AND COULD HAVE GREAT POTENTIAL TO RISE FURTHER?

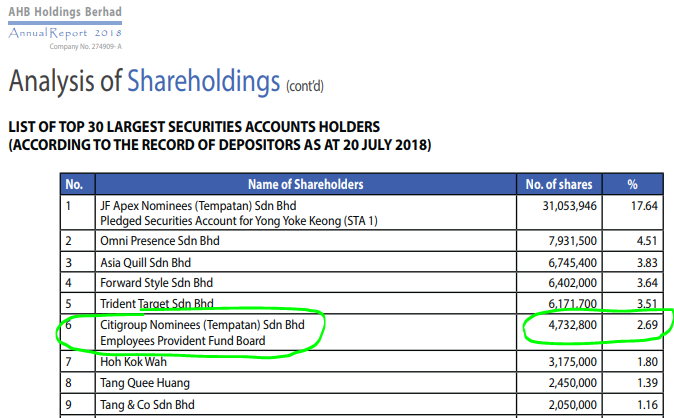

1. Lack of Coverage on Entry of EPF as Shareholder in FY 2018 (4,732,800 units, 2.69%)

I think the above factor has been widely missed by media/IBs/analysts as a whole. Check the below comparison of FY2017 and FY2018 Annual Reports (link below). You will find that in FY2017, EPF did not appear as a shareholder but in FY18 report, EPF is listed as number 6 major shareholder at 4,732,800 units (2.69%). As per procedure, a purchase above 5% has to be announced publicly, however since EPF acquired 2.69%, there was no need for public announcement on this matter.

I truly believe that this company has very big potential to grow, due to the fact that even EPF known for their strict investment choice, is also believing in the long term prospects of this company. EPF must have done their due diligence before buying into AHB, and possibly should the future look brighter, be adding more shares this year.

This is reflective of EPF recognition of the company's future direction.

FY2018 report: https://www.malaysiastock.biz/GetReport.aspx?file=AR/2017/7/31/7315%20-%201314381570795.pdf&name=AHB%20Annual%20Report%20FY2017.pdf

FY 2017 report: https://www.malaysiastock.biz/GetReport.aspx?file=AR/2018/7/31/7315%20-%201721153309238.pdf&name=AHB%20Annual%20Report%20FY2018.pdf

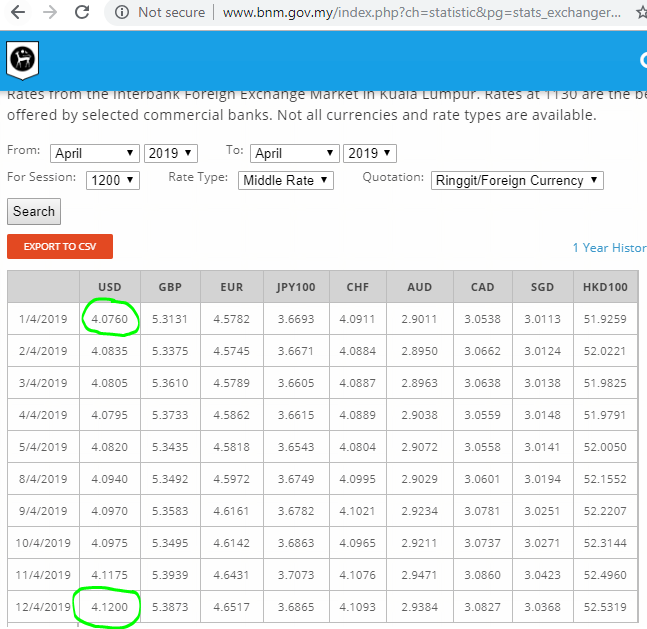

2. Weakening of MYR against USD - Good for Export Based Counters

Refer to below image on the exchange rates for USD/MYR taken directly from BNM website. We can see that MYR had started at 4.076 against the USD on 1st April, however started to weaken consistently until 12th April today which stood at 4.120, which is a significant weakening in the span of 2 weeks.

From recent quarter report, AHB clients are in the South Eastern Asia, South Central Asia and Middle East. Majority of dealings are international, therefore with the weakening of MYR against USD, AHB should benefit from gaining higher revenue and profit from the currency conversion.

http://www.bnm.gov.my/index.php?ch=statistic&pg=stats_exchangerates

3. Financial Analysis Point of View - A Potential Takeover Target

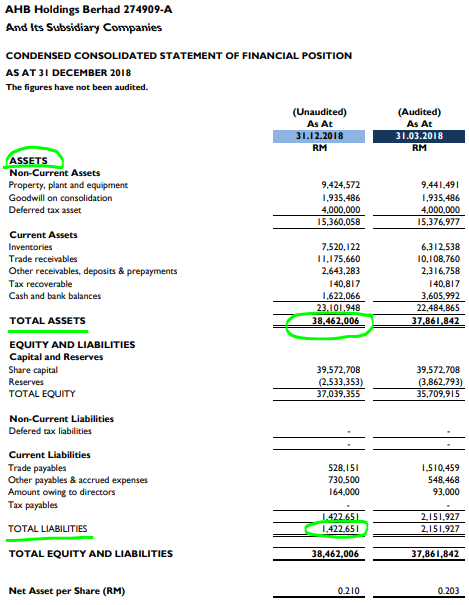

Refer to link below for latest AHB Quarter Report published on 22th Feb 2019. AHB had been making consistent revenue and profits for the last 3 quarters. However this is not the part which I want to highlight.

What I wish to highlight is that AHB is a debt free company (except small amount owing to directors). Section B7 of the latest QR mentions that "There were no outstanding borrowings and debt securities as at 31 December 2018.'.

We can refer below that the total assets of the company is RM 38.462 million (translating into NTA of 0.21) and liabilities stood at RM 1.422 million. Difference of assets and liabilities is a whopping RM 37.04 million ! From this alone, we can judge that AHB has very low gearing, and could be a potential target of a company wanting to list in BSKL.

Therefore, as long as the current stock price is under the NTA of 0.21, it could anytime be a potential takeover target by companies wanting to do Reverse Take Over (RTO).

http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=203762&name=EA_FR_ATTACHMENTS

4. Technical Analysis Point of View - Strong Bullish Bias

Refer below daily chart of AHB. A few indicators of strong bullish bias can be seen:

a. it had broken the downtrend since it had hit a peak of 0.435 in July 2017, with significant and conclusive volume demonstrated

b. currently trading above the ICHIMOKU Cloud, indicating activity in bullish region

c. MACD is seen crossing the signal upwards indicated by the green arrow

Should the price be able to breach 0.20 level, I foresee it testing the first resistance at 0.25 in the near term, and test 0.35 in the longer term.

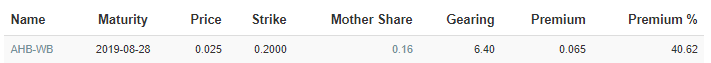

5. Alternative Entry Into AHB via AHB Warrant B (AHB WB)

Refer below AHB WB profile captured from KLSE SCREENER website (link given) for those looking at alternate cheaper entry, to consider the warrant due to below:

a. Considerably low total float of 71.1 million units

b. There is sufficient time for mother share to move above strike price of 0.20, as maturity is end August of 2019 which is about 5 months from now

c. Strike price of 0.20 is considerably reasonable and achieveable within short to mid term duration

Special Note: If you noticed recently EKOVEST WB had moved more than 100%, this was because EKOVEST mother share had started moving fast causing the premium of the warrant to be low (within 0-10%), hence causing the warrant to play fast catchup with the mother shares. Therefore for AHB WB, theoretically, as the mother share price rises above 0.20, the WB will move 1 bid in response to movement of 1 bid in mother share

https://www.klsescreener.com/v2/screener-warrants

I foresee that if AHB is able to break 0.20 conclusively, AHB WB should be trading at above 0.04 range. Should the mother share hit 0.25, AHB WB should be trading at 0.07-0.12.

CONCLUSION

Considering all the above, my personal TP for AHB is set between RM 0.25 - 0.35, and for AHB WB is set between 0.07-0.12

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

I WILL PLACE AHB INTO MY INVESTMENT PORTFOLIO BEFORE FUNDS START BUYING INTO IT.

I ANTICIPATE A GOOD RETURN ON THIS INVESTMENT.

Disclaimer : The above opinion is not a BUY CALL but only sharing my observations.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

Discussions

small cap investors vs big cap investors......

over a life term, over the long term.........it is more fruitful to invest in excellent companies, learn to say No to small cao opportunities..

for a trader, any thing also can trade, good bad ugly also can trade.

2019-04-14 12:41

Of course if you want dividend you can invest in linen or pohuat, but if you want use small Knife to sawing big tree then AHB is suitable for you with very low risk because of clean balance sheet and small number of share.

2019-04-14 12:41

nckcm > Apr 14, 2019 12:36 PM | Report Abuse

correct, when u see epf enter the stock, u better sell to them.

======

EPF do not enter stuffs with market cap < $ 1 billion....as a rule.

2019-04-14 12:42

Wong Yi Ming > Apr 14, 2019 12:41 PM | Report Abuse

small Knife to sawing big tree

==========

that is one way to get rich.....

another way is stay focus, concentrated portfolio and big trees grow bigger.

2019-04-14 12:51

Wong Yi Ming > Apr 14, 2019 12:41 PM | Report Abuse

small Knife to sawing big tree

==========

problem is losses mixed with winners, end of day, get what?

2019-04-14 12:52

there are investors who look for undervalued counters (capital growth) and long term stable income (dividend yields)

and then there are traders who trade based on charts (whether it be intraday, contra, or swing 1-2 weeks)

@qqq3 - it's easy for u to say to invest in long term for dividends..but in practicality, how many are really willing to buy and hold for long term let's say 5-10 years?

I appreciate the above sharing by BursaMaster as it provides opportunity for both investors (capital growth) and traders alike..if u feel it is not for u, then just go to other counter but no need to shot down people's opinion..

2019-04-14 13:18

Let discuss in a friendly & family atmosphere.. i welcome constructive comment...happy weekend

2019-04-14 13:30

I must confess that this is a koyak company & has been since it was listed. Even Mirzan long ago disposed his shares for 15 c or less.If the syndicate goreng next week, surely I will sell to them =)

2019-04-14 17:00

Coz my average cost, bought in batches over the last 4 months, is below 14.7c =)

2019-04-14 17:01

Pls goreng kuat2 tomorrow...I don't mind selling two lots by two lots throughout both trading sessions. After all, this is my full time job.

2019-04-14 17:06

Also, I just checked up on BursaMaster's previous recommendations : Danco, HoHup, Master - Surprised that they are still about the same price level as when they were recommended!

In fact, all three share one common feature : they all suffered profit -taking the DAY AFTER the blog date! Actually Danco dropped two days after the blog date, with no 'meat' to take intraday profits in between the blog date & the first black candlestick day.

Just thought you'd all like to know =)

2019-04-14 17:21

In fact, I remember taking profit on Master @ 90c the first trading day AFTER his post(on Saturday) on the counter. Since then...mostly peaked & down...

2019-04-14 17:25

Too many 孤魂野鬼stuck inside this counter le.. not easy to push up much.. somemore warrant expire soon.. every push i will recognise as trap..

Last time strong usd also cannot make good profit..

lowest point period director also no buy back share..

Up? Still possible geh.. purely goreng type penny stock for me..

2019-04-14 17:50

In fact, I posted the performance of his last 3 recommendations on my blog(see my profile for link) : Master, Danco & HoHup.

KYY, calvintan, bonescythe...all the same MO!

In fact, before the SC closed bonescythe's blog down for proven PUMP & DUMP activities, he always signed off with 'Have A Nice Day!'

Bursamaster : 'Happy Weekend' lol

2019-04-14 18:00

Pls la ppl...use yr brainzzz...who would bother taking the trouble to write a long blog just to help you put $$$ into yr pocket?

Isn't it more likely they're helping themselves put your $$$ into their pockets?

Sianzzzz...Genneva, JJPTR all the same...target naive newbies.

2019-04-14 18:05

Bursamaster has experience in KLSE since 1976..if he has done bad to others then he woild not have many followers and views on his blog

If you think you’re so great please writeup articles here for the public to see and evaluate (and lets see if your article can hit number 1) instead of just shooting down other people’ opinions =>

2019-04-14 18:26

lol bonescythe had plenty of followers from 2012-2017 too...but what happened to him? =)

2019-04-14 18:36

Do you know Bursamaster personally? He claim to be in KLSE since '76...you believe him even though you can't verify? Shows how naive you are...

2019-04-14 18:37

bonescythe..5 years

bursamaster..42 years..dun think its a correct comparison..counters recommended (danco, hohup, samchem, master and others) all possess good fundamentals and are on bullish bias

did he recommend any falling knives? nope..

did he recommend any pn17 or loss making companies? nope..

like i said..if you're so good..why not u write and let's see how you perform

2019-04-14 18:40

Hmmm...where shall we start? How about here on the Huaan thread :

dompeilee > Sep 26, 2016 12:36 PM

Bought 6 digit number of shares @ 3.5c

dompeilee This one will be one of the BIGGEST % gainers in the next couple of months...Catch it while it's still below 10c! :D

21/02/2017 09:57

I'm not in the habit of writing blogs on i3. But you can visit my personal blog to see how my recommendations did. And because I have a client base, I reserve my best material for their benefit, not any old tom dick & harry!

2019-04-14 18:46

A more recent call on the KKB thread:

dompeilee Bought 10,000 KKB @ 90c

17/08/2017 18:03

Bought more KKB @ 99c

14/02/2019 9:23 AM

dompeilee I expect a blowout profitable quarter! Stock up, ppl!

14/02/2019 9:33 AM

Btw, I'm just pointing how his recommendations performed(see the blog link in my profile) immediately after the blogs were posted. What you make of the data is all up to you, but I smell a scam.

2019-04-14 18:48

i have read your blog..you only post 1 article every 1-2 months..not consistent..

if you have a client base..then i only see your negative comment on other's articles as if you wanting to prove yourself better than them so that you may gain clients for your own benefits

so i would suggest that instead of you shooting down other people who are more established than you, you should do your writeups here and prove to the community on your track record..outside blogs don't mean anything because we can't see how well viewed your article is..

come on..take the challenge if you're as good as you say

2019-04-14 18:52

I invested in a stock(Huaan) that did better for me than BitCoin in 2017. I have nothing to prove to anybody, even though I have only been in the market for a quarter century =)

I share my view on so-called charitable stock recommendations. I called KYY out as a conman long before most ppl finally woke up to that fact...I also called bonescythe out as a scammer way back in 2012. SC only caught up to him recently.

If you put your own $ on the line, I can guarantee you I can write a blog about any stock I researched thoroughly that will rival any blogger on i3, or even exceed them!

2019-04-14 18:58

let's see you write the article then..walk the talk..i am willing to put my $ on the line for it..let's see it

2019-04-14 19:00

I have recommended AHB as a speculative play to my clients for some time already...in fact, I already knew the warrant expiry game was likely to be played many weeks back, proved by my post that I bought AHB-WB @ 1c.

If I were BOTHERED to write my own blog on AHB, I would point out things that Bursamaster MISSED:

-The co. undertook two share placements of 16.030 mil shares in Oct '17 @ 30c that probably explains how EPF became a shareholder

-Mirzan Mahathir was a longtime shareholder, until he sold out at the time of the last rights issue.

-The co. only benefits to the tune of 300,000+ to its bottomline for every 5% rise in the US$ vs the RM

-Its cash levels have more than halved in the last 9 months

etc etc

2019-04-14 19:07

now the readers of the forum can see that you only care about your own clients and not the public in general

if you really care about the public..then prove it by doing write ups here on this forum for people to see and benefit

stop shooting down other people as if you're the best if you don't have the guts to prove it here

2019-04-14 19:11

I never said I cared about the public! I only care that scammers fill their own pockets at the expense of naive gullible investors.

2019-04-14 19:13

i think until you prove in this forum that your article will be well viewed and received..i view you as a person who only cares about showing you're the best so that you can grow your client list..you don't really care about others or public losing..you are about your own pocket only..the way you talk

2019-04-14 19:17

Don't scam people with EPF name. EPF got burned with sasbadi so they did good due diligence?

2019-04-15 09:26

Investhor https://klse.i3investor.com/blogs/Bursa_Master/202081.jsp

checkout write-up below by BURSAMASTER on AHB

13/04/2019 11:56 AM

BURSAMASTER Thank you Investhor for sharing my article

13/04/2019 1:06 PM

See the above posted in AHB thread over the weekend? TWO CONMAN colluding to make $$$ off naive newbies...really pathethique HAHAHA!

2019-04-15 09:28

They prob bought a hundred or more lots @ 15.5c & 16c...wrote a flowery blog highlighting only the positive aspects & then sold all @ 17.5c today.

2019-04-15 09:32

Beware Investhor = bonescythe = Bursamaster lol Proven by Master, HoHup, Danco & now AHB

2019-04-15 09:36

market should beware of people like you..who do nothing but just attack others for your own benefit

you dont even have the balls to post an article on this forum because youre a nobody with no followers who wrote a loser blog with no views

please stop behaving like this..its pathetic to see a sad person like you in this market

2019-04-15 10:05

"Possible for bottom fishing in AHB, says PublicInvest Research

http://www.theedgemarkets.com/article/possible-bottom-fishing-ahb-says-publicinvest-research"

Article by PublicInvest on AHB..so you want to say PublicInvest also scammer ? cmon la..dont show your noobness on this forum please

2019-04-15 10:14

I already bought from 13.5-15c waaay before your wonderful blog came out...conveniently on Saturday after 8+ mil shares already traded & price already jumped up on Friday...suspicious timing, just like Master, Danco, HoHup...all of which are mostly down(one unchanged) since they were recommended.

2019-04-15 10:45

If you bother to read all the replies, not only me thinks this is a con job...your followers are all gonna get a free ticket to Holland? lol

2019-04-15 10:47

If you check my latest blog entry, I screencaptured the outline of the first time I recommended AHB to clients...back in Apr 2016...since then, we've made four/five rounds!

2019-04-15 10:56

its sad to see how youre trying so hard to prove yourself the best in your aim to gain more clients from this forum..

face it, you are just a sour grape who cant see other people succeed..the public here can see that you just care about yourself..nothing than that..

you dont even want to accept my dare to write an article here, because you know you dont have what it takes to take your article to number 1

2019-04-15 11:10

Yup...number 1 con article LOL!!!

640i...I only share my targets for my stockpicks with clients =)

2019-04-15 14:07

I can speak for myself as a newbie trader/investor that I have profited from this warrant over just 1 trading day. I’m just starting out as a day trader (after a series of unfortunate losing streaks last year). I read trends, so I came across this AHB warrant as its price was the most affordable to me given my limited funds, so I thought I could buy more lots and I’ll do a day trade since I know that this warrant is expiring soon.

I bought it at the price of 0.010 last Wednesday or Thursday and closely monitored it. I decided to sell it off the next day for 0.020. As a newbie, I’m blessed that I have found this counter because after a series of depressing losses, I was almost sure I was cursed by the stock market spirit. Now I’ve made my first realized profit so I’m very happy and feel that I still have hope.

I see a lot of tension on this thread so I’m just gonna share my two cents on this free, public forum. In my opinion: everyone has their own views, there is nothing wrong with that. But lets also learn to respect other people’s views as well alright? And if you have problems to raise, be sure you also walk in with solutions.

This platform is meant to enable users to share their own thoughts and opinions on their experience with the stock market in general, hopefully constructively too. The author has put a disclaimer at the bottom of the article, which I think is fair enough. I’ve profited from this even before this article was published, so I feel that I should share my experience too. I’m pretty sure there are many other newbie traders like me out there too. Peace out.

2019-04-15 14:14

the logical reason why it is active now is to save its warrants from being extinct....

2019-04-15 14:47

Btw KYY's articles always @ the top of i3....but...wait...how much did he say he lost in JAKS? lol

2019-04-15 14:50

HITnRUN

To pay decent dividend to holder, EPF has turned into trader rather than investor nowadays

2019-04-14 12:32