DYNACIA - CLOSELY LOOK OUT FOR THIS EXPLOSIVE STOCK !!!

BURSAMASTER

Publish date: Sun, 30 Aug 2020, 11:12 AM

DYNACIA - CLOSELY LOOK OUT FOR THIS EXPLOSIVE STOCK !!!

Hello to all readers out there. In the recent week, CONSTRUCTION stocks had started to show some momentum in BURSA. Some sector leaders moving were GAMUDA, IWCITY, EKOVEST, GADANG and many more.

Having said the above, the stock which I'd like to talk about today is DYNACITE GROUP BERHAD (DYNACIA - Stock Code 5178, MAIN Market, Industrial Products & Services)

BASIC INFORMATION ABOUT DYNACIA

DYNACIA was incorporated in May 2002 with core businesses in a few fields:

i) Construction, property development & property investment

ii) Steel

Market Capitalization : RM 64.91 million

Shares Float : 590.12 million

Website : https://dynaciate.com.my/

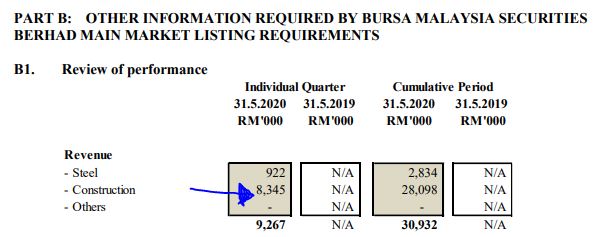

1. SHIFT FROM STEEL TO CONSTRUCTION BUSINESS

Refer latest summary of segmental information from QR. We can see that as of latest, nearly 90% of its revenue is derived from CONSTRUCTION segment. Therefore, I believe that DYNACIA should be recategorized into CONSTRUCTION sector instead of Industrial Products & Services.

On 9 November 2018, the emergence of Dynaciate Engineering Sdn. Bhd. (“DESB”) as a new major shareholder together with the appointment of Khoo Song Heng and Woon Kok Kee as executive Board members saw a change in the fortune and direction of the Group. DESB (together with its group of companies) is a well-known integrated service provider of engineering, procurement, construction management, maintenance and project management solutions for over 18 years in Malaysia as well as Singapore.

Their close association with DESB is cemented and they assumed the name of Dynaciate Group Berhad on 20 February 2019. Through this close association and injection of their wealth of experience and expertise, the Group has managed to secure two (2) projects for the construction of plants and facilities from two (2) reputable clients, namely, MIE Industrial Sdn. Bhd. and Oncogen Pharma (Malaysia) Sdn. Bhd..

The shareholders of the Company had approved the disposal of the Penang Land and properties for a total cash consideration of RM41.00 million at an EGM held on 21 January 2020 to Mgudang Sdn. Bhd., a wholly-owned subsidiary of MMAG Holdings Berhad. The disposal represents an opportunity for the Group to unlock and realise its value with the proceeds raised are earmarked for the construction segment which still requires substantial funding to complete ongoing and future projects.

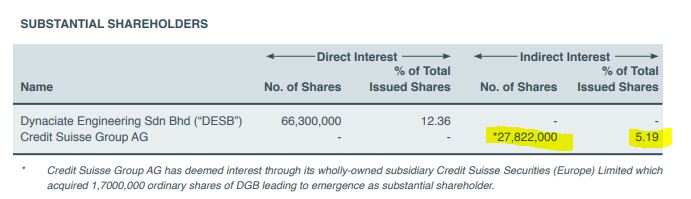

2. CREDIT SUISSE GROUP AG A MAJOR SHAREHOLDER WITH 5.19% STAKE

Refer below list of major shareholders as at latest 2019 Annual Report. Aside from DESB, which is the Construction arm of DYNACIA, we also see Credit Suisse Group AG with a major shareholding of 5.19%.

As such, there might be increased trading interest (local participant) in this stock with the confidence of foreign investors in the company business.

3. TECHNICAL ANALYSIS - BREAKOUT OF ACCUMULATION AREA WITH

STRONG VOLUME INTEREST, BREAKOUT OF ALL MAJOR EMAs

Refer below the basic price and volume chart with key EMAs for DYNACIA weekly chart :

A few observations on the weekly chart:

i. Refer Circle 1, there were very little weak holders selling during the COVID19 crash in March 2020, implying that the stock has more strong holders compared to weak holders

ii. Refer 2 & 3, DYNACIA had broken out above the accumulation area of between 8-9c, and also broken out above all major EMAs including long term EMA of EMA200 and EMA365

iii. Next resistances seen at R1 22-25c and R2 36-38c

CONCLUSION

Considering all the above, I opine that current price for DYNACIA is attractive due to below:

i) DYNACIA diversifying as a majority Construction company as compared to Steel

ii) Credit Suisse a major shareholder with 5.19% stake in the company

iii) Chart showing breakout of all key EMAs and accumulation zone, with significant volume interest

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Master

Created by BURSAMASTER | Sep 22, 2023

Created by BURSAMASTER | Aug 20, 2023

DISCLAIMER: This post serves as an educational analysis and is never meant/ intended to be a buy/sell call or recomendation, whatsoever.

Investors / punters must always do their own due deligence bef

Created by BURSAMASTER | Dec 25, 2022

Created by BURSAMASTER | Oct 23, 2021

greedy44444

Sailang until bankruptcy

2020-08-31 01:48