Disclaimer: This article is not tailored financial advice, but mere general stock sharing / observations. Please do further due diligence. The author disclaims all liabilities from readers. The author does not have interest in NFLX.

Learning Stock Investment from Squid Game?!

CynicalCyan

Publish date: Sun, 17 Oct 2021, 04:33 PM

Squid Game has to be the most popular drama right now.

Squid Game has a commendable cast, a gripping plot & some investment reminders to us. (all Squid Game intellectual property rights belong to its respective owner)

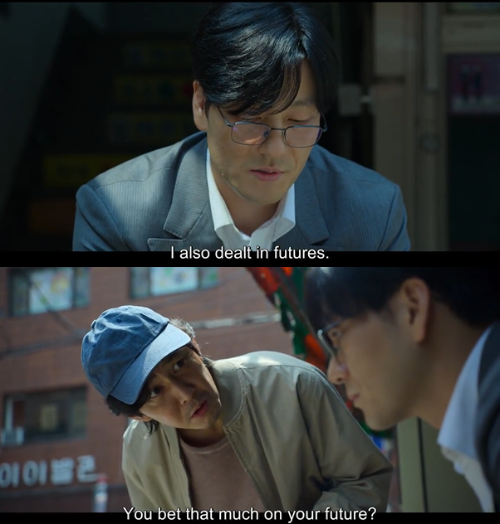

EPISODE 2

COMMENTS:

There are two main lessons here. One, don't invest in what you don't know. Two, don't overleverage.

If you invest in something you have completely no idea about, this is gambling. (Peter Lynch mentioned before). You're merely betting on your luck, which is akin to gambling.

You may buy some stock that goes limit up tomorrow, & feel like you are a genius stockpicker. But in reality, you are just lucky.

Even technical traders who know nothing about the stock's fundamentals, have to know its technical indicators and patterns.

Don't invest without knowing fundamental analysis or technical analysis.

On another front, using margin for stock investing is a double-edged sword. One mistake, and you might cause irreparable long term harm to yourself.

Suppose you borrow money to invest using your mother's property and lose it all like Sang-Woo. Besides not being able to repay the debt, your mum might even disown you!

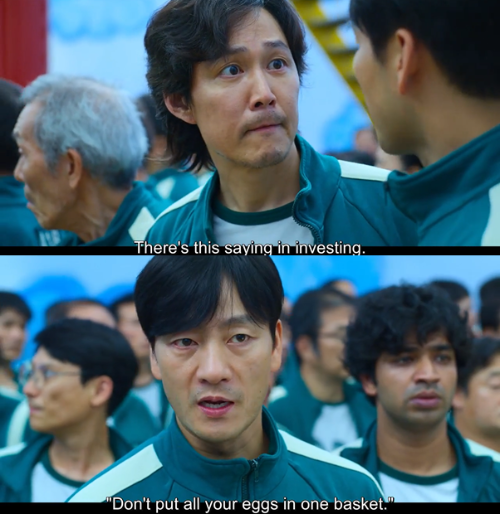

EPISODE 3

COMMENTS:

Despite Sang-Woo's self-preservation intentions here, we all should take heed of this advice.

It's not wrong to sailang your cash into a few stocks for better returns, provided you've done your research and you are right about it.

But it's very wrong to throw all cash into one stock, or one particular industry.

When the basket falls, you'd have no more eggs left.

When that sector's stocks plunge, you'd have little to no profitable stocks left.

CONCLUSION:

The above are some ways to avoid pitfalls of stock investment. What other investment advice can you identify from Squid Game?

More articles on Ultimate Stock Tips

Created by CynicalCyan | Nov 18, 2023

Created by CynicalCyan | Jul 08, 2023

Created by CynicalCyan | Jun 24, 2023

Created by CynicalCyan | Jun 18, 2023

Discussions

Whether great depression or great hyper inflation !

Always protect yourself with cheap highly profitable plantation business & its land mah!

Posted by calvintaneng > Oct 17, 2021 6:48 PM | Report Abuse

In money printing the Rich who hold cash will turn into beggars with rags

https://www.youtube.com/watch?v=mL8d91vdR9g

Posted by stockraider > Oct 17, 2021 6:51 PM | Report Abuse X

Why cheap plantation land & farm land leh ??

Bcos limited supply as they cannot manufacture plantation mah!

So it has deep value loh!

2021-10-17 18:55

Tobby

Good one! Yeah, maybe i should not put 70% of my cash into Genting! Should diversify soon!

2021-10-17 16:36