BUMI ARMADA BERHAD (5210) - PROFIT MAKING OIL & GAS COMPANY THAT CATCHES MY ATTENTION

ChloeTai

Publish date: Wed, 10 Jan 2018, 02:19 PM

At the time of writing, the price of Brent Oil is USD69.16 and the price of Crude Oil is USD63.47. With the Brent Oil nearing USD70, I have to own an O & G related counter which still have room of rising further with good fundamental. I glaced through the list of O & G counters and I choose to buy ARMADA-C35.

Introduction

Bumi Armada Berhad is a Malaysia-based international offshore energy facilities and services provider with a presence in over 17 countries spread across five continents.

Bumi Armada Berhad provides services throughout the oil and gas value chain – from exploration through to field development construction, production and operations – via four main business units and three support units:

Business Units

- Floating Production, Storage and Offloading (FPSO)

- Offshore Marine Services (OMS)

Floating Production and Operation (FPO)

The business unit is responsible for the offshore production facility and the overall integrity delivery of the infrastructure, processing equipment and operations.

Bumi Armada currently operates one Liquified Natural Gas (“LNG”) Floating Storage Unit (“FSU”) and nine FPSOs worldwide.

List of FPSO

Offshore Marine Services (OMS)

The main market for the SC units are in the Caspian Sea, where it executes installation of pipe lines and heavy lift operations.

The OMS business is responsible for the chartering, scope planning, logistics and full operations of the vessels in its fleet.

PROSPECTS FOR THE FINANCIAL YEAR ENDING 31 DECEMBER 2017

(Q1 May 2017)

Oil prices continued to be low over the first quarter of 2017, which could continue to dampen sentiment in the market, and oil companies are likely to remain cautious over the short-term. We have seen some positive signs in the FPO market as oil companies consider bringing new projects on stream. The outlook for exploration activities however remains more unclear, which will likely delay any recovery in the OSV market. Despite this uncertainty, the Group will continue to pursue new opportunities that would meet the internal criteria for balanced risk and returns, and it remains focused on improving efficiency and productivity in our business struture.

(Q2 August 2017)

As oil prices remain at depressed level, we are cautious in the short term. We believe this is likely to delay the recovery in new exploration activities, which in turn, will negatively impact the OMS business. With the completion of the four major conversion projects in 2017, we expect revenue to improve for the remaining period of the financial year.

(Q3 November 2017)

Over the remainder of 2017, we expect to see further developments in the current FPSO projects, which should be positive for the Group’s FPO business revenue in 2018. For the OMS business, we expect to see a decline inactivity in Q4 2017 due to winter in the Caspian region and the monsoon season in South-East Asia, which will likely result in lower earnings for this business during the last quarter of 2017.

|

Investment Bank |

Target price (RM) |

|

PublicInvest Research |

0.90 |

|

Affin Hwang Research |

0.95 |

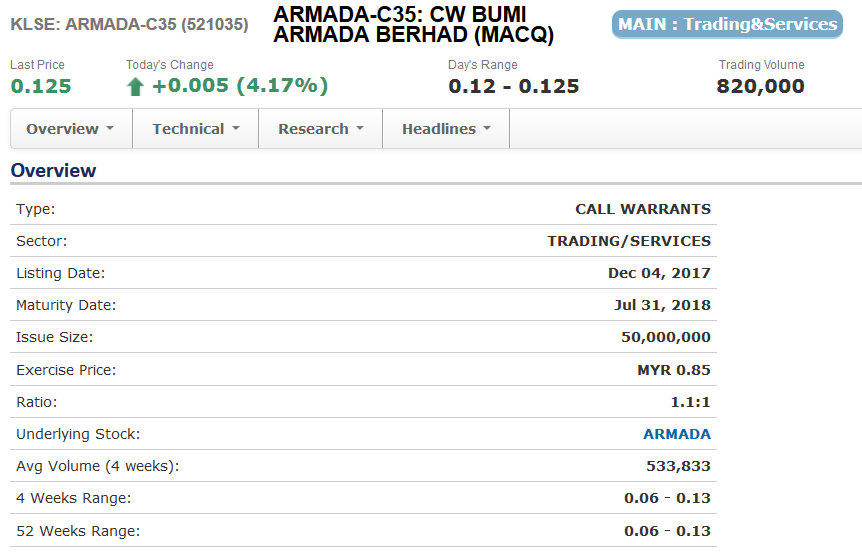

The advantages of Armada-C35 compared to the rest of the call-warrants are:

(1) It is offered by Macquarie which provide market makers such that the buy queue and sell queue will be adjusted according to the fluctuation in the price of the mother share.

(2) It only expires in July 2017

(3) Its ratio is small at only 1.1:1.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Chloe Tai Blog

Created by ChloeTai | May 30, 2024

Created by ChloeTai | May 22, 2024

Mah Sing export their plastic products to

More Than 50 Countries

around the world.

Created by ChloeTai | Apr 29, 2024

RHB Research - Going All Out; Keep BUY. New Target Price RM1.61.

Created by ChloeTai | Apr 25, 2024

Rakuten Research - Raised Synergy House Target Price to RM1.50

Created by ChloeTai | Apr 24, 2024

Estimated Q1 FY2024 will increase by 3 folds YoY.

Created by ChloeTai | Apr 21, 2024

Synergy delivering remarkable QoQ growth since their IPO. The company registered PAT of RM2.62 million, RM6.19 million, RM8.07 million and RM10.27 million. Immediate TP is RM1.48.

Created by ChloeTai | Dec 29, 2023

Kenanga Research give KGB an OUTPERFORM status with a target price of RM3.28 due to its record profit and high demand for ultra-high purity gases .

spiderman49

because of mac q only lo this c35 , other than that is not inside top 3 among the series of call warrant in armada lo , why not see c29 if u are aim for longer expiry date like c53 , diff by 1 month only n exciting exchange ratio 0.75 to 1

2018-01-14 11:48